Clinical Laboratory Services Market Size & Industry Outlook

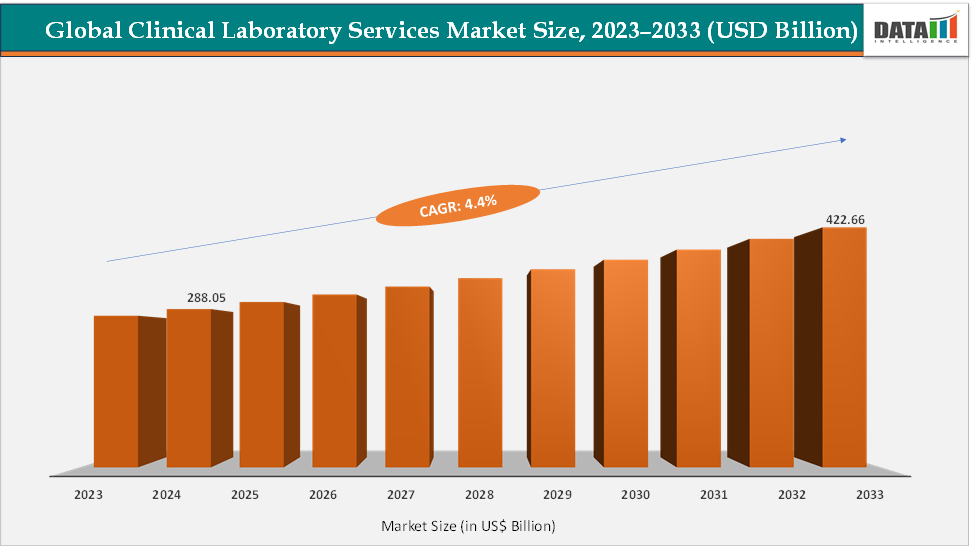

The global clinical laboratory services market size reached US$ 288.05 Billion in 2024 and is expected to reach US$ 422.66 Billion by 2033, growing at a CAGR of 4.4% during the forecast period 2025-2033. The market is driven by rapid technological innovation, shifting healthcare models, and evolving patient expectations. Advances in molecular diagnostics, next-generation sequencing (NGS), and automation are enabling faster, more precise, and personalized testing. The surge in point-of-care and at-home sample collection is decentralizing traditional lab workflows, bringing diagnostics closer to patients.

Integration of artificial intelligence, big data analytics, and lab informatics systems is enhancing decision-making, predictive healthcare, and operational efficiency. Rising demand from chronic disease management, precision oncology, and infectious disease monitoring is reshaping test portfolios. Additionally, new business models such as direct-to-consumer testing and digital health partnerships are expanding market reach. Together, these shifts are redefining the role of laboratories from passive test processors to proactive, data-driven healthcare partners with significant influence on patient outcomes.

Key Market Highlights

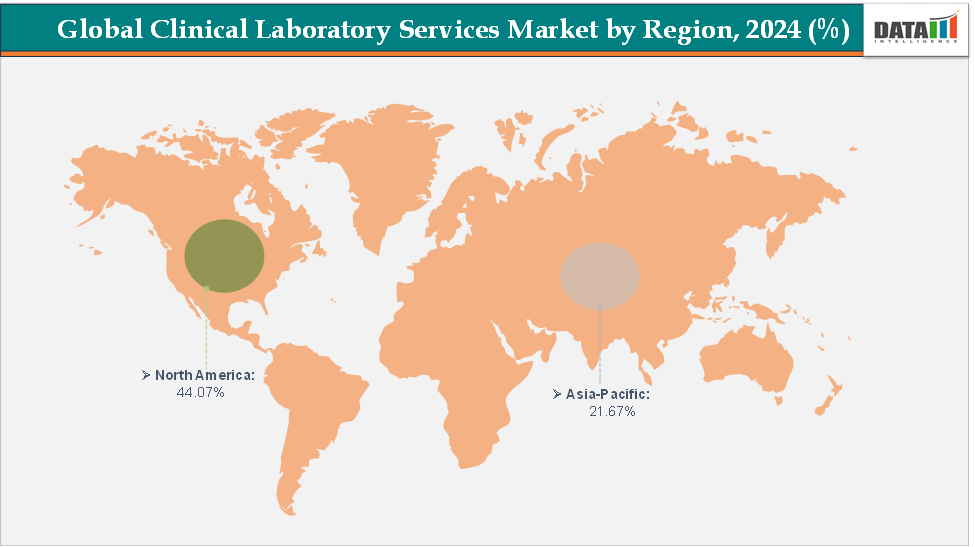

- North America dominates the clinical laboratory services market with the largest revenue share of 40.07% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 4.9% over the forecast period.

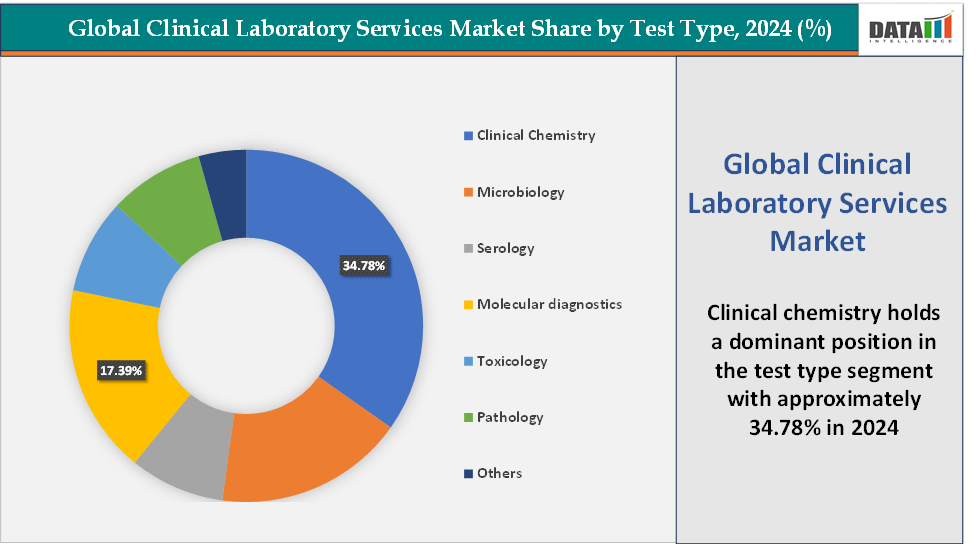

- Based on test type, the clinical chemistry segment led the market with the largest revenue share of 34.78% in 2024.

- The major market players in the clinical laboratory services market are Abbott, Labcorp, OPKO Health, Inc., Quest Diagnostics, NeoGenomics Laboratories, Myriad Genetics, Inc., QIAGEN, Eurofins Scientific, Siemens Healthcare Private Limited and ARUP Laboratories, among others

Market Dynamics

Drivers: AI-powered diagnostics & predictive analytics are significantly driving the clinical laboratory services market growth

AI-powered diagnostics and predictive analytics are profoundly accelerating the growth of the clinical laboratory services market by reshaping how tests are performed, interpreted, and integrated into clinical decision-making. Advanced AI algorithms now automate complex tasks such as digital pathology image analysis, genomic variant interpretation, and infectious-disease detection, enabling laboratories to deliver faster, more accurate results at scale.

Novel product launches, along with the regulatory approvals, are also further boosting the market growth. For instance, in March 2025, Beckman Coulter Diagnostics, a clinical diagnostics leader, announced that the new DxC 500i Clinical Analyzer, an integrated clinical chemistry and immunoassay analyzer, received 510(k) clearance from the U.S. Food and Drug Administration. The DxC 500i combines advanced technology with an intuitive user interface, ensuring that laboratories of all sizes can meet the growing demands of modern healthcare. With throughput of up to 800 clinical chemistry tests per hour and 100 immunoassay tests per hour, this analyzer delivers precise and reliable results critical for timely clinical decision-making.

Similarly, in May 2024, ConcertAI, a leader in oncology predictive and generative AI SaaS and real-world data (RWD) solutions for healthcare and life sciences, announced first-in-category predictive and generative AI solutions, expansions to its partner ecosystem, and a clinical oncology suite to enhance research capabilities and support for complex clinical study workflows. These solutions will provide researchers with enhanced data analysis tools for in-depth study, contributing to more informed care strategies that can improve patient outcomes.

Digital pathology platforms from companies like Philips and Paige.AI are transforming cancer diagnostics by providing high-resolution, AI-driven interpretation that boosts accuracy and consistency across labs. Meanwhile, leading diagnostic providers such as Quest Diagnostics and LabCorp are increasingly leveraging predictive analytics to forecast demand, optimize staffing, and automate pre-analytical processes enhancing efficiency in high-volume testing environments. With rising test volumes driven by precision medicine, chronic disease management, and clinical trial demand, AI and analytics are becoming indispensable tools that not only improve quality and speed but also expand the revenue potential of modern clinical laboratories.

Restraints: Data integration & interoperability challenges are hampering the growth of the market

Data integration and interoperability challenges are significantly restraining the growth of the clinical laboratory services market by creating gaps in communication, workflow inefficiencies, and barriers to digital transformation. Many laboratories still operate with fragmented information systems, where Laboratory Information Systems (LIS), Electronic Health Records (EHRs), and diagnostic instruments fail to communicate seamlessly due to incompatible data formats, outdated software, and lack of adherence to standards such as HL7 or FHIR.

This fragmentation leads to duplicated data entry, delayed result reporting, and higher error rates, ultimately impacting patient care and laboratory productivity. Furthermore, the inability to integrate lab data across hospitals, clinics, and public health systems slows efforts in infectious-disease surveillance and coordinated care. The cost of building and maintaining custom interfaces between disparate systems remains high, discouraging many labs from modernizing their IT ecosystems. As a result, despite growing test volumes and demand for rapid, data-driven diagnostics, interoperability bottlenecks continue to hinder scalability, innovation, and overall market growth.

For more details on this report – Request for Sample

Clinical Laboratory Services Market, Segmentation Analysis

The global clinical laboratory services market is segmented based on test type, application, therapeutic area, end-user, and region.

Test Type: The clinical chemistry segment is dominating the clinical laboratory services market with a 34.78% share in 2024

The clinical chemistry segment continues to dominate the clinical laboratory services market because it forms the backbone of routine diagnostics, chronic-disease monitoring, and large-scale health screening programs, making it the highest-volume and most indispensable testing category. This dominance is being reinforced through continuous advancements in automation, throughput, and reagent technologies. Recent developments underscore this momentum.

For instance, in July 2025, Diatron, a STRATEC brand, well-positioned in developing, manufacturing and marketing hematology and clinical chemistry analyzers and associated reagents for human medical and veterinary use, launched its new clinical chemistry analyzer, the P780. The system is designed to provide outstanding performance and maximum efficiency and safety, without compromising affordability, to meet the growing demands of modern laboratories.

Similarly, in March 2025, Beckman Coulter Diagnostics, a clinical diagnostics leader, announced that the new DxC 500i Clinical Analyzer, an integrated clinical chemistry and immunoassay analyzer, received 510(k) clearance from the U.S. Food and Drug Administration. The DxC 500i combines advanced technology with an intuitive user interface, ensuring that laboratories of all sizes can meet the growing demands of modern healthcare. With throughput of up to 800 clinical chemistry tests per hour and 100 immunoassay tests per hour, this analyzer delivers precise and reliable results critical for timely clinical decision-making.

Meanwhile, industry leaders such as Roche, Abbott, and Siemens have been expanding their automated clinical chemistry analyzer portfolios, integrating smart calibration, predictive maintenance, and cloud-based quality control features to enhance reliability and efficiency. Clinical chemistry’s dominance is also strengthened by its cost-effectiveness, tests are relatively inexpensive yet essential for nearly every patient encounter, which ensures consistent reimbursement and steady demand across hospitals, clinics, and diagnostic networks. Combined with its established infrastructure, high consumable usage, and central role in routine care pathways, these factors ensure that clinical chemistry remains the leading and most resilient segment in the clinical laboratory services market.

The molecular diagnostics segment is the fastest-growing in the clinical laboratory services market with a 17.39% share in 2024

The molecular diagnostics segment is the fastest-growing area within the clinical laboratory services market due to its expanding role in precision medicine, infectious-disease detection, oncology profiling, and personalized therapy selection applications that require far greater sensitivity and specificity than routine testing. Rising global infectious-disease surveillance needs, increased genetic disorder screening, and the shift toward personalized oncology are fueling test demand and driving laboratories to expand molecular capabilities.

Novel product launches and advancements further driving the market growth. For instance, in November 2025, Synthego, a leading provider of CRISPR solutions, announced a strategic expansion of its product offerings with the launch of a new portfolio of high-performance molecular reagents. Building on its established leadership in CRISPR gene editing, Synthego now delivers essential PCR enzymes, RNA synthesis tools, and advanced isothermal amplification kits designed to meet the stringent requirements of diagnostic laboratories as well as the evolving needs of molecular biology research. The launch addresses the growing demand for robust solutions designed to support the full spectrum of molecular biology and diagnostics workflows and accelerate the path from discovery to validation.

Clinical Laboratory Services Market, Geographical Analysis

North America is dominating the global clinical laboratory services market with a 40.07% in 2024

North America is expected to dominate the global clinical laboratory services market due to its highly advanced healthcare infrastructure, strong presence of leading diagnostic companies, and rapid adoption of cutting-edge technologies such as AI-driven analytics, automation, and molecular diagnostics. The region also benefits from high healthcare spending, a large insured population, and substantial test volumes driven by chronic disease prevalence and routine preventive screening. Additionally, supportive reimbursement frameworks and continuous investment in laboratory modernization further reinforce North America’s leadership position in the global market.

US Clinical Laboratory Services Market Trends

The United States dominates the global clinical laboratory services market due to its vast healthcare infrastructure, high diagnostic test utilization, and leadership in technological innovation, supported by strong financial capacity and large-scale national players. The US continues to expand at a solid pace, driven by rising chronic disease burdens, widespread preventive screening, and heavy adoption of advanced molecular and AI-powered diagnostics. Major US laboratory networks such as LabCorp and Quest Diagnostics perform millions of tests daily and continue to scale. Market dominance is further reinforced by strategic investments, such as Abbott’s USD 23 billion acquisition of Exact Sciences in 2025, aimed at expanding its leadership in cancer-screening and precision diagnostics.

The US also benefits from a strong regulatory and reimbursement environment, extensive clinical trial activity, and rapid deployment of next-generation technologies such as high-throughput molecular analyzers, digital pathology platforms, and automated laboratory workflows. Additionally, new business models like at-home testing expansions from digital health companies continue to push the US market forward. Combined, these factors ensure that the United States remains the global epicenter of clinical laboratory services, consistently shaping innovation, investment, and standards of care for the rest of the world.

The Asia Pacific region is the fastest-growing region in the global clinical laboratory services market, with a CAGR of 4.9% in 2024

The Asia Pacific region is the fastest-growing market in the global clinical laboratory services industry due to rapid healthcare expansion, rising diagnostic demand, and strong regional investments in advanced testing technologies. This surge is fueled by a rising burden of chronic and infectious diseases, large underserved populations, and accelerated adoption of molecular and digital diagnostics. Countries such as China, India, Japan, and South Korea are investing heavily in laboratory modernization; in 2025, Agilent Technologies launched a new biopharma and diagnostics experience center in Hyderabad, strengthening India’s testing ecosystem, while Chinese diagnostic reagent manufacturers gained share as hospitals shifted toward domestic suppliers amid higher import tariffs.

The region is also becoming a major hub for clinical trials and central laboratory services, with global leaders like LabCorp identifying the Asia Pacific as one of their fastest-expanding operational zones. Government-backed health programs such as national cancer screening initiatives in Japan, digital health expansion in Singapore, and large-scale NCD screening efforts in India are further boosting test volumes. Coupled with a rapidly growing middle class seeking preventive care and private diagnostic chains expanding aggressively, the Asia Pacific is cementing its position as the fastest-growing engine of the global clinical laboratory services market.

Europe Clinical Laboratory Services Market Trends

Europe’s clinical laboratory services market is experiencing steady growth driven by major healthcare reforms, rising diagnostic demand, and significant investment activity across the region. The market is expanding as countries modernize laboratory infrastructure and adopt advanced technologies such as automation, digital pathology, and molecular diagnostics to manage aging populations and increasing chronic disease burdens. A major boost came in 2025 with the rollout of the European Health Data Space (EHDS), which mandates improved interoperability and cross-border health data exchange, accelerating digital integration among laboratories and enabling more efficient diagnostic workflows.

At the same time, European health systems are increasingly outsourcing diagnostic services to private and specialized labs to improve efficiency and reduce costs, reflected in moves such as Poland’s largest diagnostic network, Diagnostyka, announcing an IPO in 2025 to expand its 1,100+ collection centers and 156 labs. Investment momentum is also growing, highlighted by private equity interest such as Warburg Pincus’s planned minority acquisition of French diagnostics leader Sebia, underscoring confidence in the region’s diagnostics expansion.

Technological adoption remains strong, with Germany, France and the UK implementing automation lines and AI-assisted cytology and microbiology tools to address workforce shortages and improve turnaround times. While clinical chemistry remains the dominant test category in Europe, the increasing uptake of precision medicine and infectious disease molecular testing is supporting diversified growth. Together, regulatory transformation, technological innovation, outsourcing trends, and strong capital flows are driving Europe’s clinical laboratory services market toward sustained and modernized growth.

Clinical Laboratory Services Market, Competitive Landscape

Top companies in the clinical laboratory services market include Abbott, Labcorp, OPKO Health, Inc., Quest Diagnostics, NeoGenomics Laboratories, Myriad Genetics, Inc., QIAGEN, Eurofins Scientific, Siemens Healthcare Private Limited and ARUP Laboratories, among others.

Market Scope

| Metrics | Details | |

| CAGR | 4.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Test Type | Clinical Chemistry, Hematology, Microbiology, Serology, Molecular Diagnostics, Toxicology, Pathology, and Others |

| Application | Preclinical & Clinical Trial-Related Services, Bioanalytical & Lab Chemistry Services, Drug Discovery & Development Related Services, and Others | |

| Therapeutic Area | Oncology, Cardiology, Infectious Diseases, Nephrology, Hepatology, Hematology, Neurology, Toxicology, and Others | |

| End-User | Hospital-Based Labs, Clinic-Based Labs, Central / Clinical Trial Labs, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global clinical laboratory services market report delivers a detailed analysis with 70 key tables, more than 75 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more clinical diagnostics-related reports, please click here