Chemical Auxiliary Agents Market Size

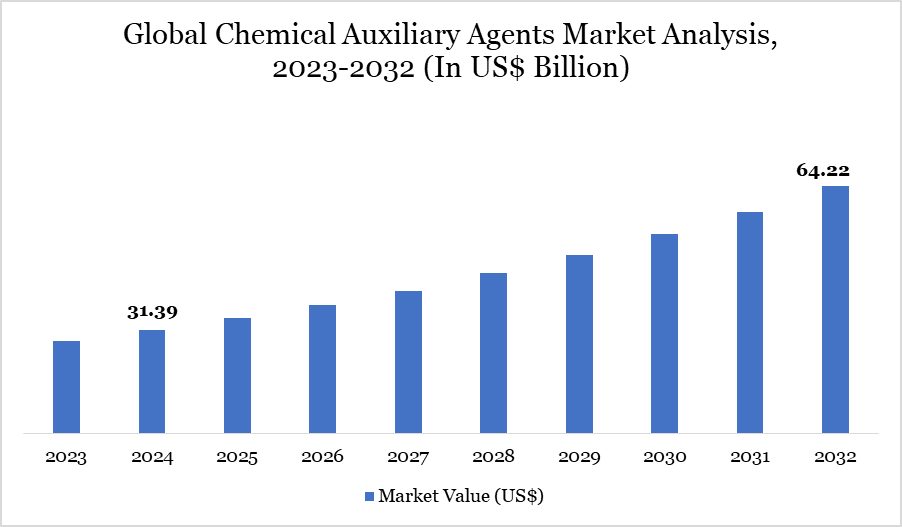

Global Chemical Auxiliary Agents market size reached US$ 31.39 billion in 2024 and is expected to reach US$ 64.22 billion by 2032, growing with a CAGR of 9.36% during the forecast period 2025-2032.

The global market for chemical auxiliary agents is undergoing significant growth driven by the rising industrial sector, especially in manufacturing and construction. The rising demand for water treatment chemicals and the globalization of chemical supply chains are crucial factors. The market is benefiting from increased agricultural activities and swift urbanization, particularly in emerging economies.

Industry participants are strategically prioritizing sustainability and product innovation to address various applications. Manufacturers are investing in sustainable alternatives, such as renewable and recyclable materials, to maintain competitiveness. Cosmo Specialty Chemicals (India) and Pulcra Chemicals (Germany) are augmenting their product portfolios and global presence via new launches and acquisitions.

Chemical Auxiliary Agents Market Trend

Several significant developments are influencing the chemical auxiliary agent’s industry. The primary factor is the increase in product innovation focused on environmental sustainability. Industry leaders are progressively prioritizing the development of bio-based, renewable, and recyclable chemical auxiliaries to comply with stringent environmental laws and reduce their carbon footprints. This has resulted in the development of eco-friendly product lines, shown by Rudolf Hub1922’s Offuel range for denim processing, which consists of 11 finishing auxiliaries composed of 90% renewable and recycled materials.

There is a significant impetus for the implementation of smart manufacturing methodologies and digital integration to optimize production and minimize waste. The market is witnessing an increase in demand for customized and specialized chemical solutions, designed to meet specific end-user needs. These developments highlight a significant industry shift focused on harmonizing performance with environmental effect, hence emphasizing the importance of innovation and sustainability in shaping the future direction of chemical auxiliary agents.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details |

| By Agent | Dispersing Agents, Separation Agents, Solvents, Others |

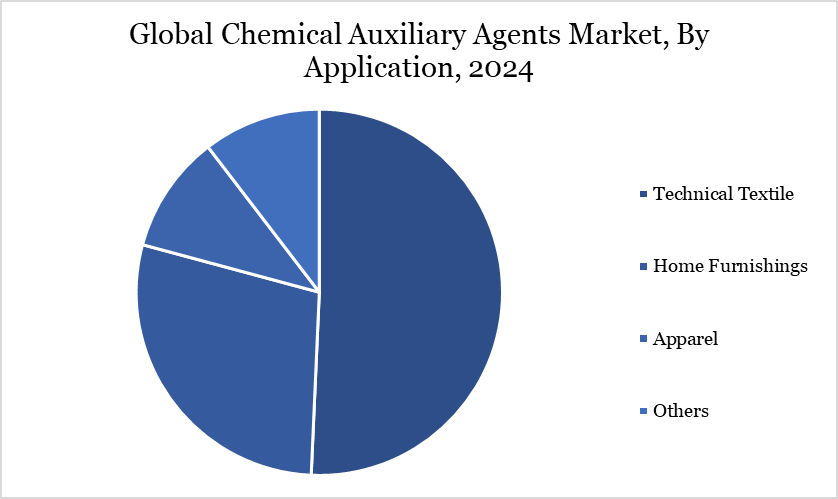

| By Application | Technical Textile, Home Furnishings, Apparel, Others |

| By End-user | Building & Construction, Personal Care, Textile Industry, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Chemical Auxiliary Agents Market Dynamics

Infrastructure and Agricultural Development

The market for chemical auxiliary agents is significantly propelled by extensive infrastructural development and the growth of the agriculture sector. The significance of auxiliary agents in improving the durability and workability of construction materials especially in concrete admixtures, waterproofing, and bonding agents, has gained heightened acknowledgment.

Data from the UK's Office for National Statistics indicates a 0.3% increase in building production in Q3 2022 and a 5.6% annual growth in 2022. Concurrently, worldwide agricultural expansion requires the application of chemical additives to enhance crop productivity and processing efficacy.

The increasing demand for sustainable and specialized chemicals in pharmaceutical and textile applications is a significant factor. The increase in manufacturing activities, along with strategic transitions towards sustainable product creation, guarantees robust market engagement. As nations industrialize and urbanize, the demand for sophisticated chemical auxiliaries will persistently increase, positioning the industry for substantial growth in both volume and value.

Regulatory Constraints and Raw Material Fluctuations

The increased global emphasis on emissions regulation, waste management, and chemical safety has led to more stringent compliance criteria. Chemical auxiliaries frequently comprise compounds that may negatively affect the environment, leading to heightened examination of their production and disposal processes.

Manufacturers now face increased expenses to adhere to these changing requirements, including liability for hazardous exposure. Furthermore, the market's dependence on petrochemical-derived raw materials renders it susceptible to price volatility caused by crude oil changes, supply chain disturbances, and geopolitical conflicts.

These price fluctuations might directly influence production expenses and diminish profit margins. This unpredictability may dissuade smaller entities from expanding operations and impede emerging technologies adoption. Consequently, enterprises must develop innovative, cost-effective, and compliant formulations to adhere to regulatory frameworks and diminish reliance on unstable inputs.

Chemical Auxiliary Agents Market Segment Analysis

The global Chemical Auxiliary Agents market is segmented based on agent, application, end-user and region.

Expanding Role of Chemical Auxiliaries in Shaping Global Apparel Manufacturing

Chemical auxiliary agents are vital in apparel manufacturing, facilitating both functional and aesthetic improvements in fabrics. This encompasses dyes, softeners, binders, stabilizers, leveling agents, and mercerizing agents, all of which enhance fabric attributes such as softness, colorfastness, and durability. Finishing auxiliaries are essential for tailoring textiles to fulfill certain end-use specifications, enhancing both functionality and wearer comfort.

The apparel industry continues to be a major global export sector, with more than 60 percent of exports originating from developing countries. The Asia Pacific region constitutes 32 percent of worldwide garment exports, underscoring its strategic significance. China had a 17.35 percent rise in garment export shipments during the initial seven months of 2022, amounting to US$ 189.35 billion. In 2025, despite only 20 percent of fashion executives anticipating enhanced consumer sentiment, growth is projected in nations such as Japan, Korea, and India, hence increasing the demand for sustainable chemical auxiliary agents in textile applications.

Chemical Auxiliary Agents Market Geographical Share

The Asia-Pacific region is at the forefront of significant growth in the textile and industrial sectors

The Asia-Pacific region remains the preeminent force in the global chemical auxiliary agents market, propelled chiefly by swift industrialization, expanding textile industries, and cost-effective manufacturing in nations such as China and India. The region possesses a developed downstream textile sector that requires high-value and performance-enhancing auxiliaries.

Consumer preferences have evolved towards economical and comfortable clothing, hence increasing the demand for chemical auxiliaries in textile production. China's Ministry of Industry and Information Technology (MIIT) reported a 3.1% year-on-year rise in the textile industry's operational income, totaling US$ 570 billion in the first nine months of 2022.

This consistent growth highlights the essential function of chemical auxiliaries in maintaining manufacturing efficiency and fostering innovation. Furthermore, the region's advantageous economic policies, availability of trained workers, and rising investments in research and development establish it as a worldwide industrial center. These factors jointly enhance the Asia-Pacific region's dominance in both the production capacity and consumption of chemical auxiliary agents across several sectors.

Sustainability Analysis

The market for chemical auxiliary agents is increasingly harmonizing with global sustainability objectives, demonstrating a heightened commitment to environmental stewardship. In response to the demands of regulatory agencies and consumers for environmentally friendly options, the industry is emphasizing green chemistry and the creation of sustainable formulations. Bio-based and recyclable chemical auxiliaries are increasingly being adopted, assisting industries in lowering carbon emissions and adhering to environmental requirements.

The future of the market is influenced by digital integration and intelligent manufacturing, which enhance resource efficiency and reduce operational waste. The increasing demand in the pharmaceutical and food processing industries for low-toxicity and biodegradable substances bolsters this trend. The integration of innovation and ecological responsibility is propelling the industry towards a circular production model, yielding enduring advantages in competitiveness, compliance, and environmental performance for chemical auxiliary agents.

Chemical Auxiliary Agents Market Major Players

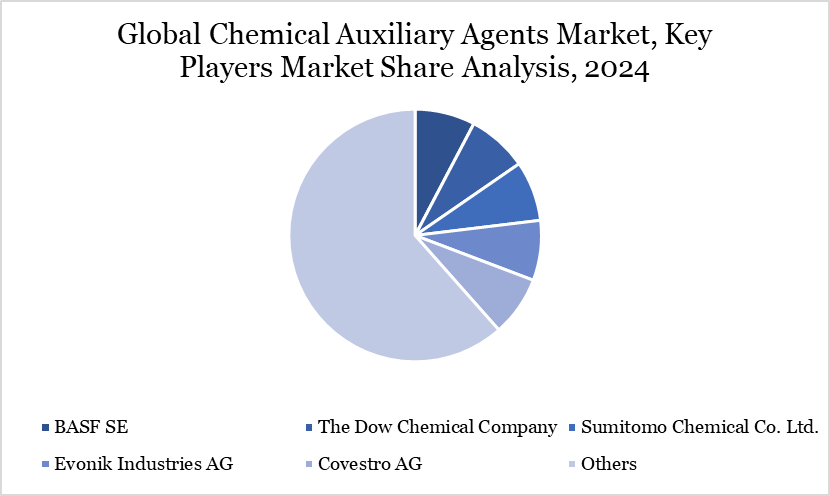

The major global players in the market include BASF SE, The Dow Chemical Company, Sumitomo Chemical Co. Ltd., Evonik Industries AG, Covestro AG, Solvay SA, Arkema SA, Akzo Nobel N.V., Kao Corporation and Eastman Chemical Company.

Key Developments

In August 2022, Archroma signed a binding deal with Huntsman Corporation to buy the latter's Textile Effect business. The acquisition is expected to help Archroma establish a comprehensive range of chemical solutions to cater to the textile business.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies