Global Cancer Pain Market – Industry Trends & Outlook

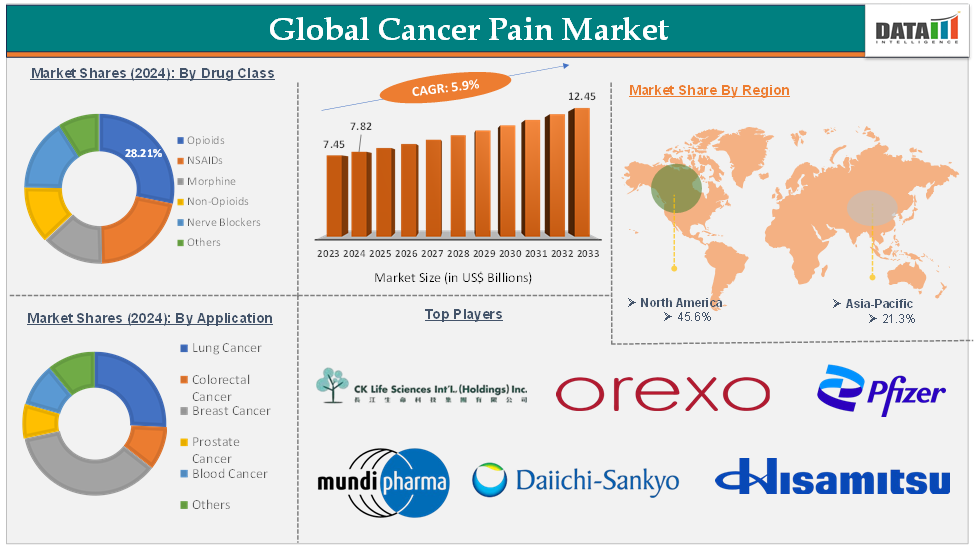

The global cancer pain market was valued at US$ 7.45 Billion in 2023. The market size reached US$ 7.82 Billion in 2024 and is expected to reach US$ 12.45 Billion by 2033, growing at a CAGR of 5.9% during the forecast period 2025-2033.

Drug Class (Opioids, NSAIDs, Morphine, Non-Opioids, Nerve Blockers, Others), By Application (Lung Cancer, Colorectal Cancer, Breast Cancer, Prostate Cancer, Blood Cancer, Others), By Route of Administration (Oral, Parenteral, Others), By End-User (Hospitals, Homecare, Specialty Clinics, Others), By Region (North America, Europe, Asia-Pacific, South America, and the Middle East & Africa)

The primary driver of the global cancer pain market is the rising prevalence of cancer worldwide, which directly increases the number of patients suffering from cancer-related pain. As cancer incidence continues to climb due to aging populations, lifestyle factors, and environmental influences, the burden of managing cancer pain becomes more significant. Improved cancer diagnosis and treatment are enabling more patients to survive longer, further increasing the need for effective, long-term pain management solutions.

A key trend shaping the cancer pain market is the advancement and diversification of pain management therapies. Innovations include the development of new opioid and non-opioid drugs, novel formulations, and the integration of alternative therapies such as cannabinoid-based treatments and neurostimulation devices. There is also a growing emphasis on personalized pain management and multidisciplinary approaches, combining pharmacological, psychological, and physical interventions to optimize patient outcomes.

The expansion of healthcare services in these regions is making advanced pain management therapies more accessible to a broader patient population. Additionally, the ongoing research and development of opioid alternatives and innovative pain relief technologies present opportunities for companies to introduce safer, more effective treatments.

Global Cancer Pain Market – Executive Summary

Global Cancer Pain Market Dynamics: Drivers

Rising cancer incidence

Rising cancer incidence is a major driver for the global cancer pain market because, as more people are diagnosed with cancer, the number of individuals experiencing cancer-related pain also increases. According to the World Health Organization, the global burden of cancer is growing rapidly, with over 20 million new cases in 2022 and projections indicating more than 35 million new cases by 2050, a 77% increase. This surge is attributed to factors such as population aging, growth, and increased exposure to risk factors like tobacco, alcohol, obesity, and air pollution.

In 2024, the United States is projected to see approximately 2,001,140 new cancer cases diagnosed and about 611,720 cancer-related deaths. These estimates exclude certain non-reportable skin cancers and noninvasive carcinomas, except for urinary bladder cancer. Cancer remains the second leading cause of death in the U.S., following heart disease, accounting for roughly 1,680 deaths per day.

As cancer cases rise, so does the demand for effective pain management, since about one in three cancer patients will experience chronic pain during their illness. This escalating need for pain relief, particularly in underserved regions where access to palliative care is limited, is fueling the expansion and innovation of the cancer pain market to address the mounting clinical and humanitarian challenge posed by cancer-related pain.

For instance, in May 2025, researchers at the National Institutes of Health (NIH) announced promising results from the first clinical trial in humans of resiniferatoxin (RTX), a non-addictive pain therapy derived from a cactus-like plant.

In this study, a single injection of RTX was administered into the lumbar cerebrospinal fluid of patients with advanced-stage cancer experiencing intractable pain. The results demonstrated that RTX safely reduced patients’ worst pain intensity by 38% and decreased their reliance on opioid pain medications by 57%. These findings highlight RTX’s potential as an effective and safer alternative for managing severe cancer pain. All these factors demand the global cancer pain market.

Global Cancer Pain Market Dynamics: Restraints

Regulatory challenges and opioid restrictions

Regulatory challenges and opioid restrictions represent significant restraints for the global cancer pain market, impacting both the development of new therapies and the accessibility of established treatments. Developing and bringing new cancer pain medications, especially those intended for advanced or chronic pain, faces intense regulatory scrutiny. Regulatory agencies like the FDA require extensive clinical trials to demonstrate both safety and efficacy, particularly because cancer patients are a vulnerable population often dealing with multiple comorbidities and complex medication regimens.

Opioids remain a cornerstone of cancer pain management, but increasing concerns about opioid misuse, addiction, and opioid-induced side effects have led to tighter regulations and prescribing guidelines. Many countries have implemented policies to restrict opioid prescriptions, require additional documentation, and mandate risk assessments before initiating opioid therapy.

These measures, while intended to curb misuse, can inadvertently limit patient access to adequate pain relief, especially in regions where alternative therapies are not widely available. Furthermore, regulatory agencies are increasingly cautious about approving new opioid formulations, given the ongoing opioid crisis and the risk of persistent opioid use and opioid-induced ventilatory impairment in cancer patients. Thus, the above factors could be limiting the global cancer pain market's potential growth.

Global Cancer Pain Market Dynamics: Opportunities

Emergence of breakthrough therapies

The emergence of breakthrough therapies represents a significant opportunity for the global cancer pain market, as these innovations address unmet needs and improve patient outcomes beyond what is possible with traditional pain management approaches. Breakthrough cancer pain (BTcP) is a specific, intense, and often unpredictable pain episode that occurs even when baseline cancer pain is otherwise well-controlled. Traditional long-acting opioids and non-opioid analgesics often fail to provide rapid and adequate relief for these episodes, leaving patients with persistent suffering and reduced quality of life.

Beyond opioids, novel non-opioid therapies and interventional techniques are expanding the treatment landscape. Innovations include nerve blocks, neuromodulation devices, radiopharmaceuticals, and even cannabinoid-based inhalation therapies, all offering alternatives for patients who cannot tolerate or do not respond to standard pharmacological options. These approaches are particularly valuable for patients with refractory pain or those at risk of opioid-related side effects and complications.

The introduction of these breakthrough therapies not only enhances the quality of life for cancer patients but also opens new commercial avenues for pharmaceutical and medical device companies. For instance, in May 2025, ZetaMet is an investigational (experimental) therapy being developed for patients with metastatic breast cancer, a form of breast cancer that has spread to other parts of the body, such as the bones. ZetaMet is designed to target and treat bone metastases, which are common and often cause pain and complications in advanced breast cancer.

For more details on this report, Request for Sample

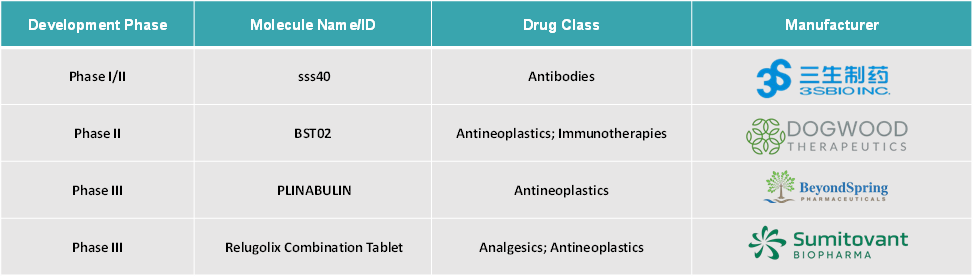

Global Cancer Pain Market – Pipeline Analysis

Global Cancer Pain Market - Segment Analysis

The global cancer pain market is segmented based on drug class, application, route of administration, end-user, and region.

Drug Class:

The opioid drug class segment in the cancer pain market was valued at US$ 2.21 Billion in 2024

Opioids are a class of prescription medications, also known as narcotics or opiates, that are specifically designed to relieve moderate to severe pain by binding to opioid receptors in the brain and other parts of the body, thereby blocking pain signals. Common opioids used in cancer care include morphine, oxycodone, hydrocodone, fentanyl, methadone, tramadol, and others.

In cancer pain management, opioids are primarily prescribed for patients experiencing moderate to severe pain, which is common in advanced or metastatic cancer. They are often a cornerstone of pain relief regimens, used either alone or in combination with other medications and supportive therapies. Opioids can be administered in multiple ways, including orally, intravenously, via skin patches, or even through spinal injections, depending on patient needs and the severity of pain.

The opioid drug class segment in the global cancer pain market is driven by the high prevalence of moderate to severe pain among cancer patients, especially those with late-stage disease or undergoing aggressive treatments. The proven efficacy of opioids in providing rapid and substantial pain relief, along with their adaptability in dosing and administration, makes them indispensable in oncology care. Additionally, clinical guidelines from organizations such as the World Health Organization and major cancer societies continue to endorse opioids as the standard of care for cancer pain, further supporting their widespread use.

For instance, in March 2025, the UK Medicines and Healthcare products Regulatory Agency (MHRA) removed the use of prolonged-release morphine sulphate and prolonged-release oxycodone for postoperative pain relief from their official licensed indications. This decision was made after a safety review that highlighted significant risks associated with using these medications after surgery. These factors have solidified the segment's position in the global cancer pain market.

Global Cancer Pain Market – Geographical Analysis

North America cancer pain market was valued at US$ 3.57 Billion in 2024

The increasing incidence of cancer in North America is a primary driver for the cancer pain market. The United States alone is projected to see over 2 million new cancer cases in 2025, with more than 618,000 cancer-related deaths. As cancer rates rise, so does the number of patients who experience cancer-related pain, whether from the disease itself, metastases, or as a side effect of treatments and diagnostic procedures. This growing patient population creates a sustained and expanding demand for effective cancer pain management solutions.

The US cancer pain market was valued at US$ 2.93 Billion in 2024

The rising geriatric population increases the overall burden of cancer pain, necessitating more advanced and accessible pain management therapies. Improvements in cancer diagnosis and treatment have led to longer survival rates for cancer patients. While this is a positive development, it also means more patients are living with cancer for extended periods, often requiring long-term pain management.

North America leads the global market due to high awareness among healthcare professionals and patients about cancer pain and the availability of innovative pain management options. The region benefits from advanced healthcare infrastructure, robust reimbursement policies, and ongoing research and development in pain therapeutics, all of which facilitate the adoption of new and effective pain relief modalities.

For instance, in January 2025, JOURNAVX (suzetrigine) is a newly FDA-approved oral medication developed by Vertex Pharmaceuticals for the treatment of moderate-to-severe acute pain in adults. Unlike traditional opioid painkillers, JOURNAVX is a non-opioid and works through a highly selective mechanism: it blocks the NaV1.8 sodium channel found on pain-sensing nerve cells in the peripheral nervous system.

By inhibiting this specific channel, JOURNAVX prevents pain signals from being transmitted from the nerves to the spinal cord and brain, effectively reducing the sensation of pain. Thus, the above factors are consolidating the region's position as a dominant force in the global cancer pain market.

Asia-Pacific cancer pain market was valued at US$ 1.67 Billion in 2024

The Asia-Pacific region is experiencing a significant increase in cancer incidence, which directly drives demand for cancer pain management solutions. As more individuals are diagnosed with cancer, a growing proportion experience acute or chronic pain due to tumor progression, metastases, or side effects of treatment.

The Japan cancer pain market was valued at US$ 0.31 Billion in 2024

Rapid improvements in healthcare infrastructure and greater access to medical services are enabling more patients in Asia-Pacific to receive timely cancer diagnoses and treatment. Countries like India, Vietnam, and Indonesia are investing in new hospitals, oncology centers, and palliative care units, which support the broader adoption of cancer pain therapies. This expansion ensures that more patients can benefit from advanced pain management options and supportive care products, further fueling market growth.

The increasing availability of generic drugs and biosimilars is making cancer pain management more affordable and accessible in the Asia-Pacific region. Governments across Asia-Pacific are implementing policies to improve access to cancer care, including pain management. These initiatives include expanding insurance coverage, subsidizing essential medicines, and integrating palliative care into national cancer control programs. Thus, the above factors are consolidating the region's position as a dominant force in the global cancer pain market.

Global Cancer Pain Market – Competitive Landscape

The major global players in the cancer pain market include CK Life Sciences (WEX Pharmaceuticals Inc.), Mundipharma International, Orexo AB, DAIICHI SANKYO COMPANY, LIMITED., Hisamitsu Pharmaceutical Co., Inc., Pfizer Inc., Grünenthal, Teva Pharmaceutical Industries Ltd., Galena Biopharma, Meda Pharmaceuticals, Vertex Pharmaceuticals Incorporated, and Dogwood Therapeutics, Inc., among others.

Global Cancer Pain Market – Key Developments

In May 2025, Autonomix Medical, Inc. reported compelling results from its first-in-human proof-of-concept (PoC 1) trial for a new interventional treatment targeting severe pain in pancreatic cancer patients. The company’s technology uses a minimally invasive procedure that delivers energy through blood vessels (transvascular nerve ablation) to disrupt pain-signaling nerves associated with pancreatic cancer pain.

In April 2025, the HOPE Clinic (Holistic Oncology Pain Evaluation Clinic) launched to provide specialized care for patients experiencing complex cancer pain. Spearheaded by Dr. Franchesca König and a multidisciplinary team at the CU School of Medicine, the clinic brings together experts in cancer rehabilitation, palliative care, interventional radiology, and oncology counseling to address the multifaceted nature of cancer-related pain.

In March 2025, Dogwood Therapeutics, Inc. is a biopharmaceutical company that develops innovative, non-opioid treatments for both chronic and acute pain. The company has just announced an important milestone: the first patient has been dosed in its Phase 2b clinical trial, called HALT-CINP. This clinical trial is designed to evaluate the effectiveness and safety of Halneuron, Dogwood’s lead drug candidate, in treating neuropathic pain that occurs as a side effect of chemotherapy.

In February 2025, the RM Partners Specialist Cancer Pain Network MDT is a newly launched, innovative program designed to improve care for cancer patients experiencing severe or complex pain in North West and South West London. MDT stands for Multidisciplinary Team, a network that brings together a range of specialists, including experts in palliative care, pain medicine, and functional neurosurgery, to collaboratively assess and manage cancer pain.

In February 2024, Radformation, a leading provider of radiation oncology software solutions, announced a strategic partnership with Icon Group. This collaboration brings together the expertise of both organizations to transform cancer care through innovative workflows and advanced software technologies.

In January 2024, Quibim, a company specializing in transforming imaging data into actionable insights for cancer diagnosis and treatment response, entered into a partnership with Merck KGaA. The goal of this collaboration is to develop advanced imaging-based diagnostics to enable precision medicine.

Global Cancer Pain Market Report Highlights

Metrics | Details | |

CAGR | 5.9% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Drug Class | Opioids, NSAIDs, Morphine, Non-Opioids, Nerve Blockers, Others |

Application | Lung Cancer, Colorectal Cancer, Breast Cancer, Prostate Cancer, Blood Cancer, Others | |

Route of Administration | Oral, Parenteral, Others | |

End-User | Hospitals, Homecare, Specialty Clinics, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

DMI Insights:

The global cancer pain market was valued at US$ 7.45 Billion in 2023. The market size reached US$ 7.82 Billion in 2024 and is expected to reach US$ 12.45 Billion by 2033, growing at a CAGR of 5.9% during the forecast period 2025-2033.

The primary drivers of the cancer pain market include the mounting global incidence of cancer, an aging population, and increased awareness and diagnosis of cancer-related pain. Advances in pain management therapies, such as the development of new opioid and non-opioid drugs, as well as innovative delivery systems like intrathecal pumps, are also propelling market expansion.

Key trends shaping the market include a shift towards non-opioid medications (e.g., NSAIDs, COX-2 inhibitors), the adoption of multidisciplinary pain management approaches, and the integration of mind-body interventions such as biofeedback and relaxation techniques. There is also a growing interest in personalized pain management and the use of advanced technologies, including neurostimulation devices and cannabinoid therapies, to improve patient outcomes.

Significant opportunities exist in the expansion of healthcare infrastructure in developing regions, the untapped potential of emerging markets, and the ongoing development of new and more effective pain management drugs. The rise of medical tourism in regions like the Middle East and Asia-Pacific, where cancer treatment is more affordable, is expected to further boost demand for cancer pain management solutions. Additionally, increasing R&D investments and a robust pipeline of novel therapies present avenues for future market growth.

The global cancer pain market report delivers a detailed analysis with 70 key tables, more than 71 visually impactful figures, and 173 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here