Global Biobanking Services Market: Industry Outlook

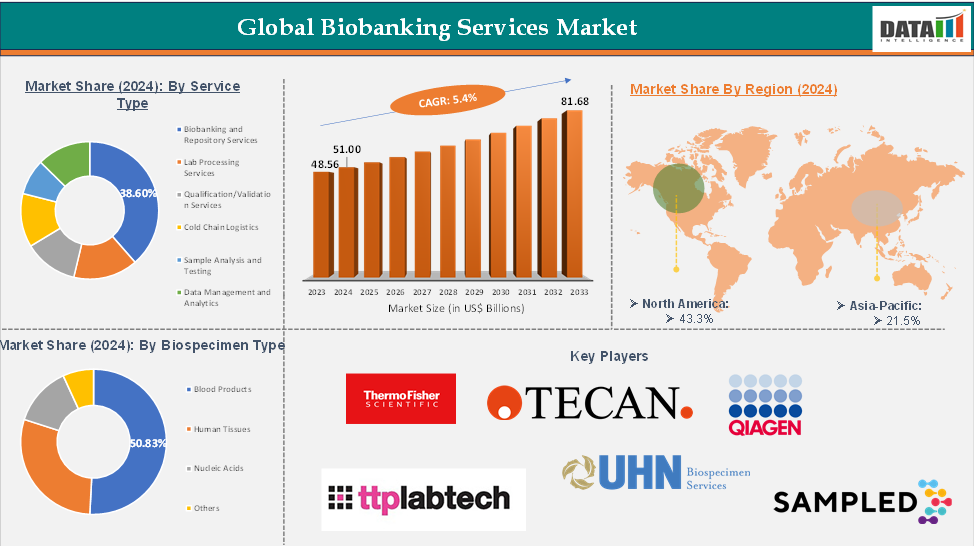

The global biobanking services market reached US$ 48.56 Billion in 2023, with a rise of US$ 51.00 Billion in 2024 and is expected to reach US$ 81.68 Billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025-2033.

The global biobanking services market is experiencing significant growth due to the demand for high-quality biospecimens for personalized medicine, drug discovery, and translational research. Biobanks are crucial for genomics, clinical trials, and epidemiological studies. The market is driven by rising investments from government and private organizations, the increasing prevalence of chronic and rare diseases, and the expansion of precision medicine programs.

Technological innovations like automated storage systems, AI-driven sample tracking, and virtual biobanking platforms are enhancing efficiency and accessibility. Strategic collaborations among academic institutions, pharmaceutical companies, and contract research organizations are accelerating biobank development across regions. The North America region is emerging as a significant growth hub due to its expanding healthcare ecosystem, government initiatives, and genetically diverse population base.

Global Biobanking Services Market: Executive Summary

Global Biobanking Services Market Dynamics: Drivers & Restraints

Driver: Growing demand for personalized medicine and precision healthcare

The global biobanking services market is expanding due to the increasing demand for personalized medicine and precision healthcare. Biobanks provide high-quality biospecimens for biomarker discovery, drug development, and diagnostics.

For instance, in January 2025, UK Biobank, the world's largest biomedical data source, released data on 3,000 circulating proteins from 54,000 participants in 2023. In 2024, Professor Claudia Langenberg and her team published a groundbreaking study using UK Biobank proteomic data to identify disease risk, one of a few studies to utilize this unique data.

As healthcare systems and pharmaceutical companies focus on patient-specific treatment strategies, the need for diverse biospecimen repositories has increased. This has led to increased investments in biobank infrastructure, sample storage technologies, and data integration platforms. The integration of genomic, proteomic, and metabolomic research into clinical practice further emphasizes the value of biobanks in enabling precise healthcare interventions. This trend is accelerating the growth of biobanking services worldwide, making them indispensable for modern, data-driven healthcare solutions.

Driver: Increasing government and private funding for biobanking initiatives

The global biobanking services market is growing due to increased government and private funding for biobanking initiatives. Governments are investing in national and regional programs to advance public health research, personalized medicine, and disease prevention strategies. Private sector entities, including pharmaceutical companies and biotechnology firms, are investing in biobanking infrastructure to accelerate drug discovery and development.

This funding is enabling the establishment of advanced biorepositories with automated systems, high-throughput storage solutions, and integrated data management platforms. It is also facilitating large-scale population-based biobank projects and encouraging public-private collaborations to improve sample diversity and quality.

Restraint: High cost of biobanking infrastructure and maintenance

The global biobanking services market faces significant challenges due to the high cost of infrastructure and maintenance. Setting up a biobank requires significant capital investment in advanced equipment, such as ultra-low temperature freezers, cryogenic storage tanks, liquid nitrogen systems, automated sample handling tools, and secure laboratory facilities.

These systems must comply with rigorous regulatory standards, adding complexity and expense to the initial setup. Maintaining these facilities requires continuous expenditure on electricity, calibration of instruments, backup systems, and consumable replacement.

Operational costs are further increased by the need for trained personnel, data security systems, and adherence to international standards like ISO 20387. These financial demands often limit the ability of small- and mid-sized institutions and biobanks in low- and middle-income countries to build or expand modern biorepositories.

The lack of stable funding models and limited revenue-generation opportunities further hinders the broader adoption of biobanking services globally, impacting biomedical research and personalized medicine advancements.

Opportunity: Advancements in automated and robotic biobanking systems

Advancements in automated and robotic biobanking systems are revolutionizing the global biobanking services market. Automation technologies enable precise, high-throughput handling of biological samples, minimizing human error and enhancing consistency.

These systems are particularly beneficial for large-scale biorepositories handling thousands to millions of biospecimens. Robotic systems integrate workflows, including labeling, inventory management, environmental control, and secure data linkage, leading to improved efficiency, reduced labor costs, and faster turnaround times. As the volume of clinical and research biospecimens grows, the integration of automated systems becomes essential for scalability and reliability.

For more details on this report, Request for Sample

Global Biobanking Services Market Segment Analysis

The global biobanking services market is segmented based on service type, biospecimen type, storage type, application, end user, and region.

Service Type:

The biobanking and repository services segment from the service type is expected to hold 38.60% of the biobanking services market

The biobanking and repository services segment is a significant contributor to the global biobanking services market due to the increasing demand for high-quality, long-term storage of biological specimens in clinical research, diagnostics, and drug development. This segment provides critical services like cryopreservation, inventory management, sample labeling, and quality control, ensuring sample integrity and traceability.

The growing number of clinical trials, especially in oncology and rare diseases, further increases the demand for centralized biobanking solutions. Government and private sector investments in biomedical research infrastructure and automated storage systems enhance the efficiency and scalability of repository services, positioning the segment as a fundamental growth engine.

For instance, in December 2024, the Indian Council of Medical Research (ICMR) and Madras Diabetes Research Foundation (MDRF) established the country's first diabetes biobank in Chennai. The biobank, which stores, processes, stores, and distributes population-based biological samples, supports scientific research on diabetes and related disorders, with permission from the ICMR. Hence, the above-mentioned factors help the segment to grow during the forecast period.

Global Biobanking Services Market - Geographical Analysis

The North America biobanking services were valued at US$ 19.28 Billion in 2024 and are estimated to reach US$ 30.85 Billion by 2033, growing at a CAGR of XX% during the forecast period from 2025-2033.

North America dominates the global biobanking services market due to its advanced healthcare and research infrastructure, strong funding mechanisms, public-private partnerships, and large-scale initiatives like population health studies and cancer genomics programs.

The region has also adopted advanced technologies like automated storage systems, AI-powered sample tracking, and cloud-based biobank management platforms, improving operational efficiency and scalability. Moreover, regulatory support, widespread awareness of personalized medicine, and high volume of clinical trials contribute to the steady demand for biospecimen collection, processing, and long-term storage.

Furthermore, both the U.S. and Canada are at the forefront of the biobanking revolution, leveraging advanced technologies and collaborative frameworks to drive innovation in healthcare, research, and therapeutics. The U.S. leads in market size and technological integration, while Canada excels in research infrastructure and population-based studies, with both countries prioritizing regulatory compliance and data-driven approaches. Hence, all these factors reflect the dominance of North America in the global biobanking services market.

Asia-Pacific is the global biobanking services market with a market share of 21.5% in 2024

The Asia Pacific region is experiencing significant growth in the global biobanking services market due to its expanding healthcare infrastructure, government-backed genomic research initiatives, rising chronic disease prevalence, and increasing collaborations between academic institutions, pharmaceutical companies, and contract research organizations.

The region's large, genetically diverse population provides valuable resources for disease-specific biobanking, further bolstered by improvements in data management technologies and digital health platforms. The growing awareness of the importance of biological sample preservation for future therapeutic use and the growing prevalence of chronic diseases are contributing to market expansion.

For instance, in March 2025, the Japanese government initiated a new national biobank initiative, collaborating with major universities to build a centralized genomic and biospecimen database supporting rare disease research.

Global Biobanking Services Market – Major Players

The major players in the biobanking services market include Thermo Fisher Scientific Inc., Tecan Trading AG, QIAGEN, Harrow Green Limited, TTP Labtech, UHN Biospecimen Services, VigiSolvo, Sampled, and Crown Bioscience Company (Indivumed Services), among others.

Global Biobanking Services Market – Key Developments

In January 2025, UK Biobank launched the world's most comprehensive study of proteins in our bodies, aiming to measure up to 5,400 proteins in 600,000 samples from half a million participants and 100,000 second samples from volunteers up to 15 years later.

In October 2024, BBMRI-ERIC launched a 10-Year Roadmap, adopting the "One Health" approach, to prioritize human, animal, and environmental health. The roadmap, co-created with key stakeholders, aims to advance biobanking for European and global health improvements, providing a blueprint for research infrastructure, the biobanking community, and wider partners.

Global Biobanking Services Market: Scope

Metrics | Details | |

CAGR | 5.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Service Type | Biobanking and Repository Services, Lab Processing Services, Qualification/Validation Services, Cold Chain Logistics, Sample Analysis and Testing, Data Management and Analytics |

Biospecimen Type | Blood Products, Human Tissues, Nucleic Acids, Others | |

Storage Type | Manual Storage, Automated Storage | |

| Application | Regenerative Medicine, Life Science Research, Clinical Research, Drug Discovery & Development |

| End User | Academic & Research Institutions, Pharmaceutical & Biotechnology Companies, Hospitals & Diagnostic Centers, Contract Research Organizations (CROs) |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

DMI Insights:

The global biobanking services market is expanding due to the demand for high-quality biospecimens in personalized medicine, drug discovery, and translational research. Technological innovations like AI-integrated tracking systems and digital biobank platforms are streamlining operations and improving efficiency.

The market is driven by precision medicine and multi-omics data integration. However, high infrastructure and operational costs remain a challenge, especially for smaller institutions in low- and middle-income countries. Opportunities lie in automated and robotic systems, and strategic collaborations between academia, biotech firms, and CROs. North America dominates due to advanced healthcare systems and genomic initiatives.

The global biobanking services market report delivers a detailed analysis with 75 key tables, more than 76 visually impactful figures, and 185 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more healthcare-IT-related reports, please click here