Global Automotive Interior Materials Market: Industry Outlook

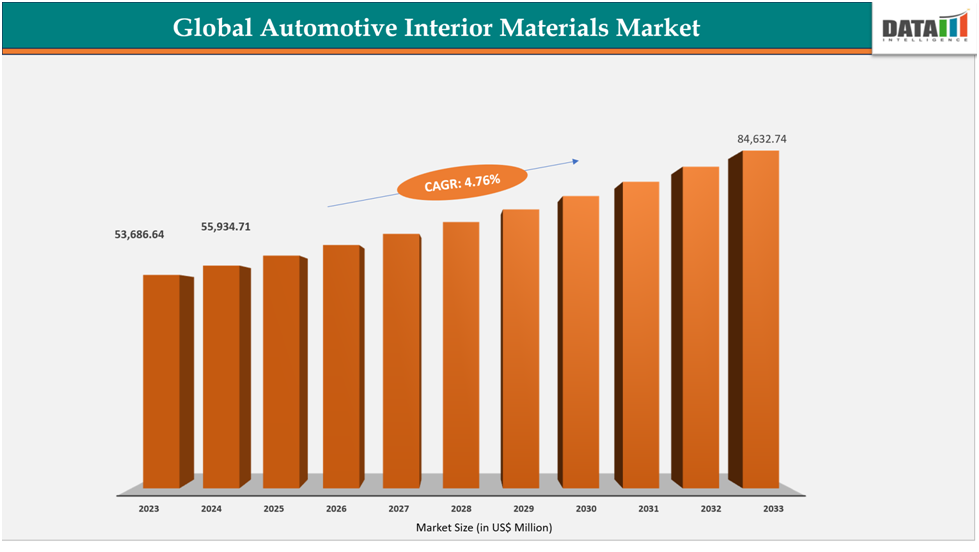

The global automotive interior materials market reached US$ 53,686.64 million in 2023, with a rise to US$ 55,934.71 million in 2024, and is expected to reach US$84,632.74 million by 2033, growing at a CAGR of 4.76%during the forecast period 2025–2033.

The global automotive interior materials market is being reshaped by regulations and sustainability mandates worldwide. In the US, the Corporate Average Fuel Economy (CAFE) standards target 49 miles per gallon fleetwide efficiency by 2026, driving OEMs to reduce vehicle weight using polymers and composites in interiors. China, producing 30.1 million vehicles in 2023, including 9.5 million NEVs, is setting the pace for demand, as lightweight interiors offset battery mass. Meanwhile, the EU requires interiors to be 85% recyclable and 95% recoverable under the End-of-Life Vehicles Directive, directly influencing design and material choices in dashboards, seating, and trims.

A unique trend shaping this market is the integration of sustainable and recyclable materials to comply with global environmental policies. The EU’s Circular Economy Action Plan mandates recycling of plastics and fabrics in interiors, while India’s 2023 Battery Waste Management Rules promote eco-friendly material use in EVs. The US Department of Energy is funding projects to cut carbon fiber costs by up to 50%, aiming to make lightweight composites more affordable for mass-market interiors. China is also pushing for bio-based polymers in NEVs to reduce reliance on petroleum-based plastics. Together, these policies are making eco-design and recyclability a central pillar of automotive interior innovation.

Key Market Trends & Insights

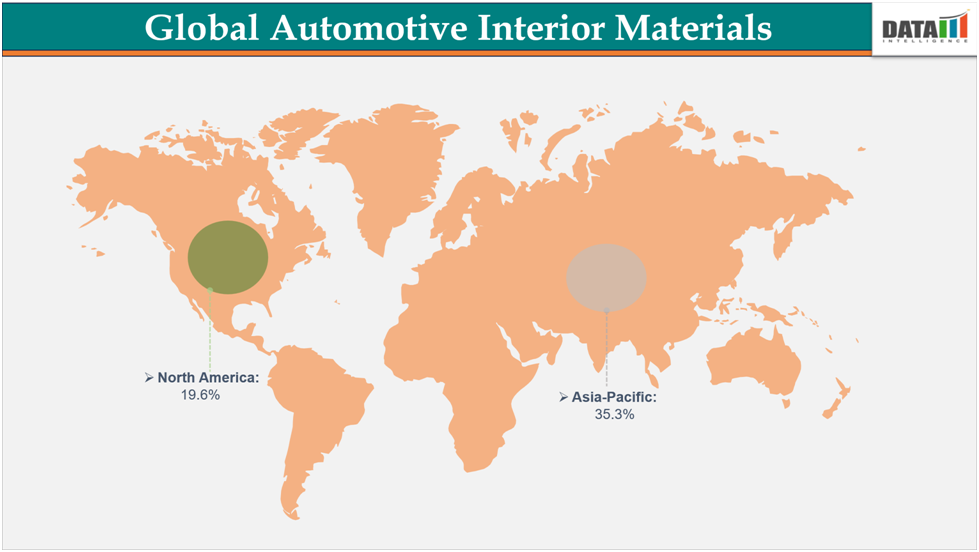

North America is the fastest-growing region, driven by US federal regulations such as the Corporate Average Fuel Economy (CAFE) standards, which target fleetwide fuel economy of 49 miles per gallon by 2026. This compels automakers to adopt lightweight interior polymers and composites to meet efficiency goals, while US EV sales crossing 1.6 million units in 2023 further boosts demand for advanced interiors.

Asia-Pacific remains the largest region, led by China’s dominance in vehicle output, with 30.1 million vehicles produced in 2023 as reported by the Ministry of Industry and Information Technology. Coupled with the country’s 9.5 million New Energy Vehicle (NEV) sales in the same year, the sheer scale is creating massive demand for lightweight, durable, and sustainable interior materials in dashboards, trims, and seating.

Europe is evolving as a sustainability-driven hub, with the EU End-of-Life Vehicles Directive requiring automakers to design interiors that are 85% recyclable and 95% recoverable by weight. Additionally, the EU’s new Circular Economy Action Plan enforces stricter recycling mandates for plastics, fabrics, and foams used in interiors, accelerating adoption of bio-based and recyclable materials across European OEM supply chains.

Market Size & Forecast

2024 Market Size: US$ 55,690.23 million

2033 Projected Market Size: US$84,632.74 million

CAGR (2025–2033): 4.76%

Asia Pacific: Largest market in 2024

North America: Fastest-growing market

Drivers & Restraints

Driver: Integration of Smart and Sustainable Materials for Connected Car Interiors

Governments in the EU have introduced binding rules requiring new vehicles to contain at least 20% recycled plastic in each model within six years of a new regulation’s entry into force, rising to 25% within ten years. The End-of-Life Vehicles directive and new circular economy regulation mandate designs that facilitate removal, reuse, and recycling of interior components.

Meanwhile, over 10% of EU plastic demand is already tied to new vehicles entering the market, and innovative requirements are pushing for greater recycling of critical raw materials used in connected surfaces, sensors, and functional trim. In China, the NEV (New Energy Vehicle) industry is moving toward intelligent, connected interiors, accelerating demand for sustainable materials such as bio-based plastics, recycled polymers, and functional smart surfaces to meet strict environmental and design standards.

Restraint: High Cost of Advanced Lightweight Composites Limiting Mass Adoption

The US Department of Energy has found that carbon fiber-reinforced polymers (CFRPs) cost roughly $15-$30 per kilogram, compared to high-strength steel at about $2-$4/kg, making advanced composites 5-10 times more expensive than traditional metals in many automotive uses. Current composites also suffer from low production volumes, which means tooling and processing costs per part remain very high, especially for mass-market vehicles.

Policymakers in countries like India note that, for cost-sensitive segments under fuel efficiency norms, OEMs prefer thermoplastics or hybrid blends over full CFRP due to the high upfront material and manufacturing investment. Government R&D programs (for example in the US) aiming to reduce composite manufacturing costs cite that until CFRP cost drops significantly (towards $5-$10/kg), conventional materials will continue dominating interior structural and trim components.

For more details on this report - Request for Sample

Segmentation Analysis

The global automotive interior Materials Market is segmented based on material type, vehicle type, component, end-user, and region.

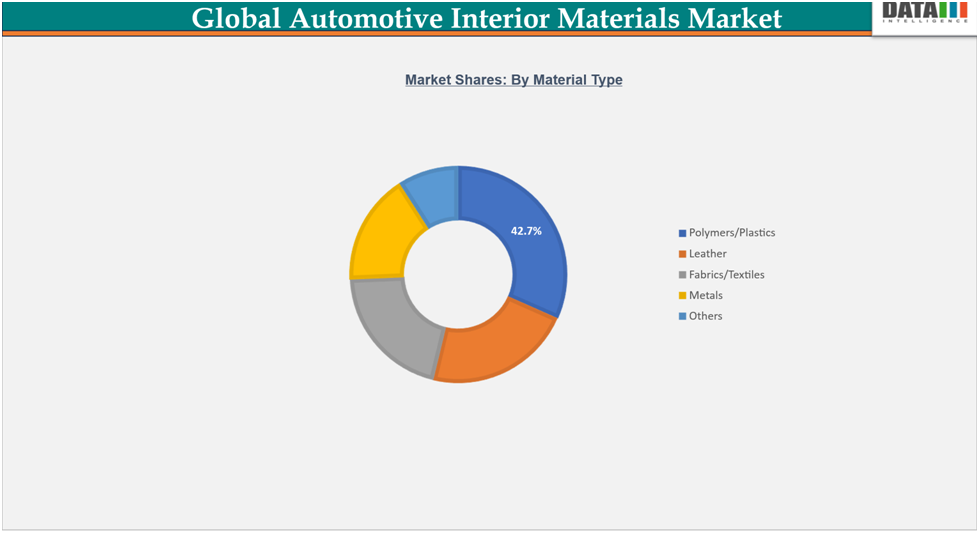

Material Type: The polymers segment is estimated to have 42.7% of the automotive interior Materials Market share.

Polymers represent the dominant material type in the automotive interior materials market, accounting for approximately 42.7% of the total segment share. This strong position is driven by their lightweight nature, high versatility in molding into complex shapes, and cost efficiency, making them especially desirable for dashboards, door panels, seat trim, and interior fascia. Governments’ fuel-efficiency and emissions regulations are pushing automakers toward lighter materials; polymers contribute significantly to weight reduction targets needed to meet those mandates without sacrificing interior design or durability.

In Asia-Pacific, polymer materials are leading in market share across automotive interiors, aligning with that ~42-43% figure, particularly in China, where large scale vehicle production and strong electric vehicle incentives are encouraging use of polymer components. In India, rising demand for interior trim and dashboards in the growing middle-class market is also boosting local polymer composites development under government-supported programs.

Meanwhile, the US Department of Transportation and Environmental Protection Agency regulations around emissions and fuel economy encourage OEMs to adopt high-performance plastics and advanced polymer composites in interior parts. The trend is further reinforced by government R&D programs in lightweight materials and polymers to enhance safety, comfort, and sustainability, maintaining polymer’s near-half share of interior material use.

Geographical Analysis

The Asia-Pacific automotive interior Materials Market was valued at 35.3%market share in 2024

Asia-Pacific dominates the global automotive interiors demand due to its massive vehicle production scale. China alone produced 30.1 million vehicles in 2023, according to the Ministry of Industry and Information Technology, making it the world’s largest auto manufacturer. Government-backed promotion of New Energy Vehicles (NEVs), which exceeded 9.5 million units sold in 2023, requires lighter, more efficient interiors to balance heavy battery packs.

India is also driving growth, with the Ministry of Heavy Industries reporting that EV sales rose by 91% in FY2023–24, supported by the FAME-II scheme. As EV adoption climbs toward the government’s 30% by 2030 target, automakers are investing in lighter polymers, recycled plastics, and bio-based interiors. Across APAC, sustainability policies and sheer production volume ensure the region remains the largest consumer of advanced automotive interior materials.

The North America Automotive Interior Materials Market was valued at 19.60% market share in 2024

In North America, demand for automotive interior materials is strongly tied to rising vehicle production and EV adoption. According to the US Department of Energy, EV sales reached 1.6 million units in 2023, nearly 7.6% of all light-duty vehicle sales, which drives higher use of lightweight interiors to extend range. The US EPA’s stringent fuel economy standards are also pushing OEMs toward advanced composites and plastics in seats, panels, and trims.

Canada is reinforcing this shift with its Zero Emission Vehicle (iZEV) mandate, requiring 20% of new vehicles to be electric by 2026, rising to 100% by 2035. This accelerates demand for interiors that combine lightweight properties with comfort and durability. Additionally, US safety regulations, such as FMVSS standards for flammability, are pushing suppliers to upgrade material quality, boosting demand for high-performance foams and fabrics.

Competitive Landscape

The global automotive interior materials market features several prominent players, including Lear Corporation, Asahi Kasei Corporation, Toyota Boshoku Corporation, Forvia, Toyoda Gosei Co., Ltd., Grupo Antolín-Irausa, S.A.U., Yanfeng Automotive Interiors, SEIREN Co., Ltd., DK Leather Seats Sdn. Bhd., and DRÄXLMAIER Groupamong others.

Yanfeng Automotive Interiors: Yanfeng Automotive Interiors is one of the world’s largest suppliers of vehicle cabin systems, focusing on instrument panels, door panels, consoles, and smart cabin technologies. The company emphasizes sustainability by integrating recycled plastics and bio-based materials into its interiors. Its innovation strategy heavily invests in digitalized and connected cabin experiences, including in-car touch, gesture, and voice control systems. With a global manufacturing footprint and strong partnerships with leading automakers, Yanfeng is driving the evolution of next-generation mobility interiors.

Market Scope

Metrics | Details | |

CAGR | 4.76% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US $Mn) | |

Segments Covered | Material Type | Polymers/Plastics, Leather, Fabrics/Textiles, Metals, Others |

Vehicle Type | Passenger Vehicles, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs) | |

Component | Carpets, Seats, Door Panels & Trims, Airbags & Seat Belts, Steering Wheels, Others | |

| End-User | OEMs, Aftermarket |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global automotive interior Materials Market report delivers a detailed analysis with 66 key tables, more than 70visually impactful figures, and 230 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more related reports, please click here