Market Overview

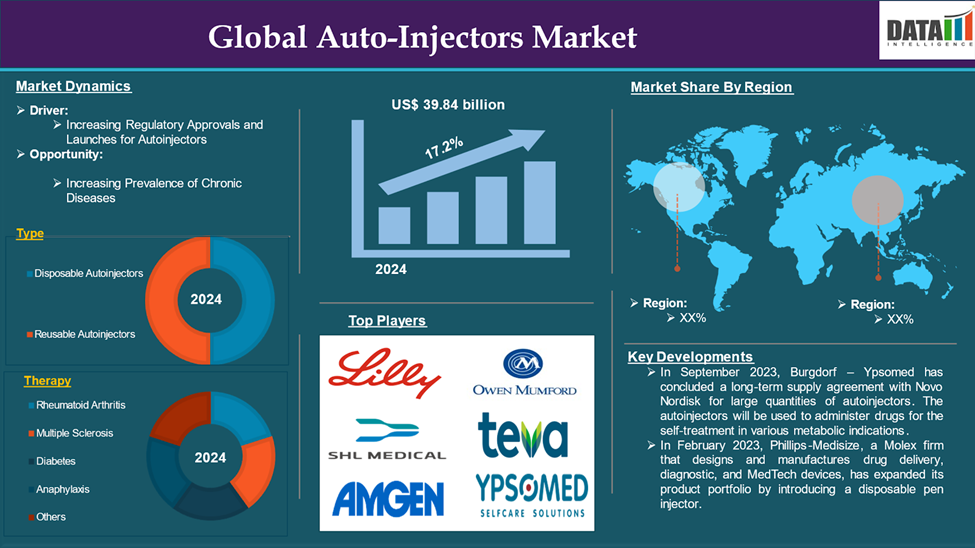

The Global Autoinjectors Market reached US$ 10.37 billion in 2024 and is expected to reach US$ 39.84 billion by 2033, growing at a CAGR of 17.2% during the forecast period 2025-2033.

Auto-injectors are specialized medical devices used to self-administer premeasured dosages of medication, typically in emergency situations or for chronic diseases. These devices often have a spring-loaded syringe that allows users to inject medication without the need for manual plunger depression, making them user-friendly and accessible even to those with no prior medical experience. The design of auto-injectors allows for faster drug delivery, which is critical in situations like anaphylaxis, where quick treatment is required to prevent severe allergic reactions.

The increasing regulatory approvals and launches for autoinjectors are the driving factors that drive the market over the forecast period. For instance, in March 2023, Coherus Biosciences announced that the FDA approved a single-dose, prefilled autoinjector version of its pegfilgrastim biosimilar for the treatment and prevention of febrile neutropenia, a common complication related to chemotherapy treatment. The autoinjector device will allow patients to be administered pegfilgrastim the day after receiving chemotherapy, decreasing the risk of patients developing febrile neutropenia. The Udenyca autoinjector is triggered by push-on-skin activation, allowing for reliable and immediate delivery of a total pegfilgrastim dose.

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Increasing regulatory approvals and launches for autoinjectors

The increasing regulatory approvals and launches for autoinjectors are expected to be a significant factor in the growth of the global auto-injector market. As the global demand for self-administration devices expands, regulatory bodies like the FDA and EMA are modifying their frameworks to allow for quick approvals of novel auto-injector technology. This trend is critical because it not only improves patient access to important pharmaceuticals but also instills optimism regarding the safety and usefulness of these devices among healthcare providers and patients alike.

In recent times, there have been many regulatory approvals and new launches of auto-injectors by various manufacturing companies. For instance, in June 2023, Halozyme Therapeutics, Inc., announced that argenx received U.S. Food and Drug Administration (FDA) approval for VYVGART Hytrulo injection with ENHANZE for subcutaneous use for the treatment of generalized myasthenia gravis (gMG) in adult patients who are anti-acetylcholine receptor (AChR) antibody positive.

Moreover, in May 2023, The U.S. Food and Drug Administration (FDA) approved the Cyltezo Pen, a new autoinjector alternative for Cyltezo (adalimumab-adbm), an FDA-approved Interchangeable biosimilar to Humira (adalimumab). Cyltezo was initially approved as a pre-filled syringe and is utilized for treating a variety of chronic inflammatory conditions. Thus increase in the number of approvals is expanding the market.

High cost of auto-injectors

Factors such as the high cost of auto-injectors are expected to hamper the global auto-injector market. While these devices provide comfort and ease of use for people who require self-administration of medications, they are sometimes prohibitively expensive. This financial barrier can impede access, especially in low- and middle-income countries where healthcare budgets are tight. Patients and healthcare professionals may struggle to justify the cost, especially since alternate drug delivery techniques, such as traditional syringes or nasal sprays, are more affordable. For instance, according to the Journal of Allergy and Clinical Immunology, The average retail price for autoinjectors has increased from < $100 prior to 2010, to > $600 for some devices. Mean annual out-of-pocket costs for epinephrine autoinjectors were $115.80. These high costs hamper the market diverting the customers to explore alternative options.

Segment Analysis

The global auto-injector market is segmented based on type, technology, route of administration, therapy, end-user, and region.

Automated autoinjectors segment is expected to dominate the global auto-injector market share

Several compelling factors are driving the automated autoinjector segment to dominate the global autoinjector market. First and foremost, these devices are intended to improve the user experience by making self-administration of drugs easier. Automated autoinjectors reduce the need for manual injection techniques, making them ideal for patients who are nervous or unsure about using standard syringes. This ease of use is especially important for people with chronic diseases that necessitate frequent medicine administration, such as diabetes or rheumatoid arthritis. As a result, demand for automated solutions is likely to increase, contributing to their market domination.

In recent times, there have been new launches that use the latest technology. For instance, in August 2024, the U.S. Food and Drug Administration approved Zurnai, the first nalmefene hydrochloride auto-injector for the emergency treatment of known or suspected opioid overdose in adults and pediatric patients 12 years of age and older. The agency approved the first nasal spray formulation of nalmefene in May 2023. Nalmefene is an opioid receptor antagonist which is used to treat acute opioid overdose. If nalmefene is administered quickly, it can reverse the effects of opioid overdose, including respiratory depression, sedation, and low blood pressure (hypotension). The newly approved product delivers 1.5 milligrams (mg) of nalmefene under the skin (subcutaneous) or into muscle (intramuscular). Zurnai is a single-dose, pre-filled auto-injector and is available only by prescription.

The ease of use and recent launches using the latest technology increases the demand of automated autoinjectors and makes this segment the most dominating one.

Geographical Analysis

North America is expected to hold a significant position in the global auto-injector market share

This dominance of auto-injector market in the North American region can be due to a number of causes, including a highly established healthcare infrastructure, recent approvals and launches, rising chronic disease prevalence, and extensive acceptance of self-administration techniques by patients. The increasing prevalence of chronic diseases such as diabetes is one the major driving factor for the market in this region. For instance, according to the Centers for Disease Control and Prevention, in 2024 more than 38 million Americans have diabetes (about 1 in 10), and about 90% to 95% of them have type 2 diabetes. Type 2 diabetes most often develops in people 45 or older, but more and more children, teens, and young adults are also developing it.

There are recent launches of auto-injectors in the region that are manufactured using latest technology. For instance, in October 2024, Instron has announced the release of the next-generation Autoinjector Testing System for comprehensive functionality testing of pens and autoinjectors to ISO 11608. This system, developed in close collaboration with pharmaceutical firms and CDMOs, measures a wide range of critical performance requirements, including cap removal, dose accuracy, activation force, injection duration, needle depth, and needle guard lockout.

Moreover, in May 2023, Coherus BioSciences, Inc. has announced that the single-dose (6mg/0.6mL) prefilled autoinjector presentation of UDENYCA (pegfilgrastim-cbqv) is now available for commercial sale in the United States. UDENYCA is a pegfilgrastim biosimilar that is given the day following chemotherapy to reduce the risk of infection, as indicated by febrile neutropenia. So, the increasing prevalence of chronic diseases and recent launches and approvals drives the market in this region.

Asia Pacific is growing at the fastest pace in the global auto-injector market

The Asia Pacific region is experiencing rapid growth in the global auto-injector market. Several significant factors contribute to this expansion, including increasing prevalence of chronic diseases, increasing demand for self-administration and technological advancements. For instance, according to the National Institute of Health, the expected number of cancer cases in India for 2022 is 14,61,427 (crude rate: 100.4 per 100,000). In India, one out of every nine people is likely to develop cancer over his or her lifetime. Males and females were most likely to develop lung and breast cancer, respectively.

Competitive Landscape

The major global players in the global auto-injector market include Eli Lilly and Company, SHL Medical AG, Amgen Inc., Owen Mumford Ltd., Ypsomed AG, Teva Pharmaceutical Industries Ltd., Biogen, Mylan Inc., Pfizer Inc., and Sanofi among others.

Emerging Players

Midas Pharma, Jiangsu Delfu Medical Device, and Oval Medical Technologies among others

| Metrics | Details | |

| CAGR | 17.2% | |

| Market Size Available for Years | 2018-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Type | Disposable Autoinjectors, Reusable Autoinjectors |

| Technology | Manual Autoinjectors, Automated Autoinjectors | |

| Route of Administration | Intramuscular, Intravenous, Subcutaneous | |

| Therapy | Rheumatoid Arthritis, Multiple Sclerosis, Diabetes, Anaphylaxis, Others | |

| End-User | Hospitals, Home Care Setting, Ambulatory Surgical Centers | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Key Developments

- In September 2023, Burgdorf – Ypsomed has concluded a long-term supply agreement with Novo Nordisk for large quantities of autoinjectors. The autoinjectors will be used to administer drugs for the self-treatment in various metabolic indications. Ypsomed is in the process of substantially increasing its annual manufacturing capacity in several steps until 2031.

- In February 2023, Phillips-Medisize, a Molex firm that designs and manufactures drug delivery, diagnostic, and MedTech devices, has expanded its product portfolio by introducing a disposable pen injector. Phillips-Medisize, which is ideal for high-volume manufacturing, provides pharmaceutical companies with a well-known, highly competitive pen injector to help them enter the market faster, more efficiently, more affordably.

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global auto-injector market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.