Overview

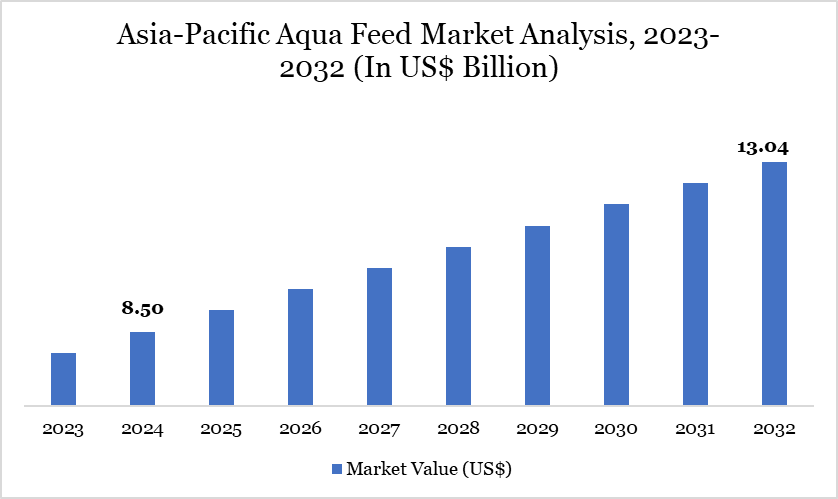

Asia-Pacific aqua feed market size reached US$ 8.50 billion in 2024 and is expected to reach US$ 13.04 billion by 2032, growing with a CAGR of 5.50% during the forecast period 2025-2032.

The Asia-Pacific aquafeed market is experiencing robust growth, driven by escalating seafood consumption, expanding aquaculture activities, and supportive governmental policies. The surge is fueled by changing dietary patterns and increased awareness of seafood's health benefits. Notably, per capita seafood consumption in Asia has nearly tripled from 9.1 kg in 1961 to 20.6 kg in 2021, as reported by the FAO. As aquaculture expands to meet this demand, the need for high-quality aquafeed continues to rise, underscoring the market's robust growth trajectory.

Aqua Feed Market Trend

A notable trend in the Asia-Pacific aquafeed market is the increasing adoption of sustainable and environmentally conscious feed production practices. For instance, Vietnam's national plan aims to achieve shrimp product export revenue of US$ 10 billion by 2025, focusing on sustainable production methods across 750,000 hectares of brackish water shrimp farming. This initiative has prompted aquafeed manufacturers to develop eco-friendly feed formulations and implement responsible sourcing practices for raw materials.

Additionally, technological advancements, such as the integration of automation and advanced manufacturing technologies, have improved production efficiency and enabled better tracking of feed quality and consistency. These developments reflect a broader shift towards sustainability and innovation in the aquafeed industry.

Market Scope

Metrics | Details |

By Species | Carp, Salmon, Tilapia, Catfish, Others |

By Ingredients | Cereals, Oilseed Meals, Supplements, Molasses, Oil, Others |

By Additives | Antibiotics, Vitamins, Antioxidants, Amino Acids, Feed Enzymes, Feed Acidifiers, Other Additives |

By Form | Pellets, Extruded, Powder, Liquid |

By Country | China, India, Japan, Australia, Rest of Asia-Pacific |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Dynamics

Increasing Demand for Seafood

Asia-Pacific aqua feed market is experiencing significant growth driven by increasing global demand for seafood and rising consumption patterns in the region. According to global data, seafood consumption has nearly tripled from 9.1 kg per capita in 1961 to over 21 kg per capita in 2024. This rising trend is continued in Asia-Pacific, with countries like India and China showing substantial seafood consumption rates—6.31 kg per capita in India and 10.9 kg per capita in China in 2021.

The FAO projects that by 2050, the production of aquatic animal foods will need to increase substantially, with aquaculture expected to grow by 90%. This surge in aquaculture is directly linked to the rising demand for seafood, which in turn drives the need for aqua feed. As Asia-Pacific continues to expand its aquaculture sector to meet both domestic and global seafood demands, the aqua feed market experiences substantial growth.

High Costs of Raw Materials

The aqua feed industry heavily depends on raw materials like fishmeal and fish oil. Fluctuations in their supply and prices, driven by overfishing and environmental changes, can significantly impact feed production costs and stability. The volatility can lead to higher expenses for manufacturers and potentially increased costs for aquaculture producers, hindering market growth.

Segment Analysis

The Asia-Pacific aqua feed market is segmented based on species, ingredients, additives, form and region.

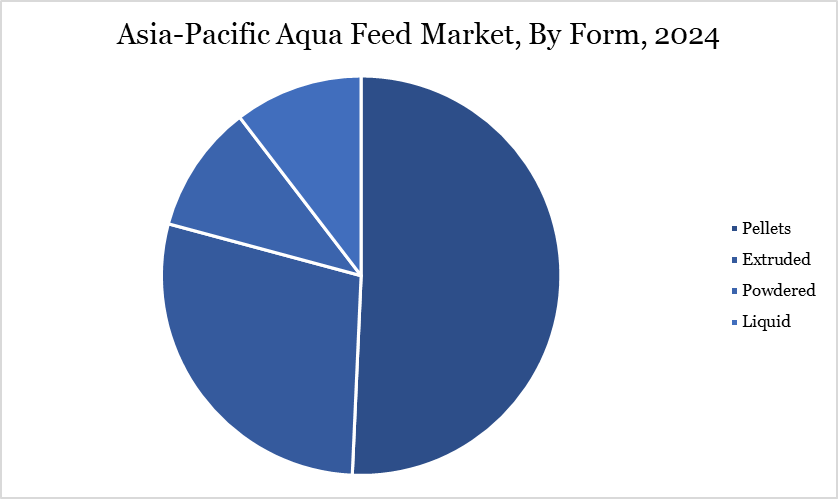

Pellets Form Segment Driving Aqua Feed Market

The Asia-Pacific aqua feed market is segmented based on form into form, pellets, extruded, powdered and liquid. The pallet segment accounted for the largest share of the due to their practical advantages and cost-effectiveness. Pellet feeds are highly favored because they offer a convenient and efficient method for delivering balanced nutrition to various aquatic species.

The uniform size and density of the pellet ensure that fish and other aquatic animals receive a consistent intake of nutrients. Additionally, pellets are easier to handle, store and transport compared to powdered or liquid feeds, making them a more economical choice for both producers and consumers. Also, the ability to meet the dietary needs of aquaculture species while minimizing waste and optimizing feed conversion rates, expands segment growth.

Geographical Penetration

Demand for Aqua Feed in China

China continues to dominate the Asia-Pacific aquafeed market, underpinned by its position as the world's largest seafood producer. In 2024, China's total seafood production reached 74.1 million metric tons (MMT), marking a 4% increase from the previous year, with aquaculture accounting for 58.1 MMT a 4.4% year-on-year growth.

The expansion underscores China's substantial investment in aquaculture, driving demand for high-quality aquafeed to support and enhance seafood production. Additionally, China's seafood imports rose by 1.2% in volume to 4.54 MMT during the first three quarters of 2024, reflecting sustained demand for high-value seafood products and the necessity for specialized aquafeeds to bolster domestic aquaculture growth

Sustainability Analysis

The Asia-Pacific aquafeed market is undergoing a significant transformation towards sustainability, driven by government initiatives, technological advancements, and evolving industry practices. China, leading global aquaculture production with 64.46 million metric tons in 2022, has implemented policies under its 14th Five-Year Plan to promote sustainable aquaculture, including the adoption of advanced feed technologies and infrastructure modernization.

Vietnam aims to achieve shrimp export revenues of US$ 10 billion by 2025, focusing on sustainable production methods across 750,000 hectares of brackish water shrimp farming. Additionally, the adoption of Aquaculture Stewardship Council (ASC) certifications in countries like Thailand, Vietnam, and Indonesia underscores a regional commitment to environmentally responsible aquafeed practices. These concerted efforts reflect a broader shift in the Asia-Pacific aquafeed industry towards sustainable and eco-friendly practices.

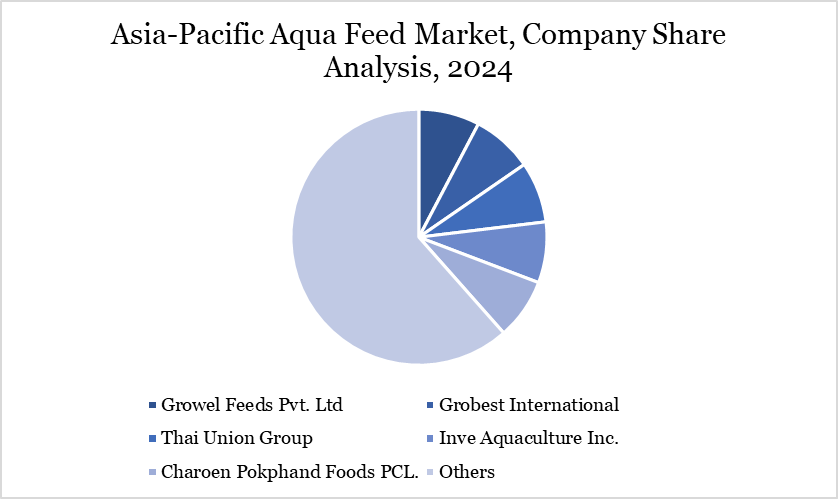

Competitive Landscape

The major global players in the market include Godrej Agrovet Ltd, Growel Feeds Pvt. Ltd, Grobest International, Thai Union Group, Inve Aquaculture Inc., Charoen Pokphand Foods PCL., PT Japfa Comfeed Indonesia Tbk, Greenfeed Vietnam, Santeh Feeds Corporation and The Symrise Group.

Key Developments

In May 2024, Yuehai Group from China began constructing an aquafeed plant in Vinh Long province, Vietnam, a key aquaculture hub. This move leverages Vietnam's favorable climate and extensive coastlines to strengthen its position in the aquaculture industry.

In June 2024, Skretting launched AmiNova, a new feed formulation that improves fish nutrition by focusing on an ideal digestible amino acid profile, enhancing precision and efficiency.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies