Anti-Corrosion Coatings Market Overview

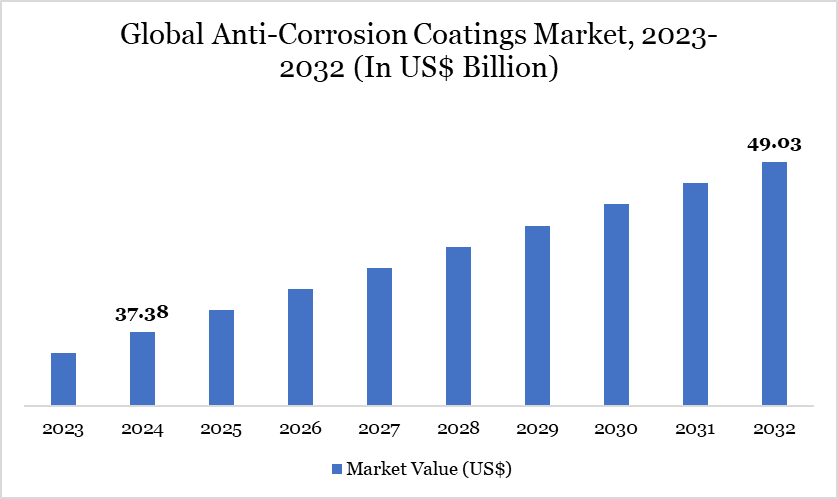

Global anti-corrosion coatings market reached US$37.38 billion in 2024 and is expected to reach US$49.03 billion by 2032, growing with a CAGR of 3.45% during the forecast period 2025-2032, according to DataM Intelligence report.

The global anti-corrosion coatings market is set for significant expansion, propelled by the rising need for protective solutions in sectors such as infrastructure, oil and gas, marine, and automotive. The proliferation of steel-intensive buildings and the vigorous spread of hybrid vehicles have required sophisticated coatings to avert material deterioration.

The increase in offshore exploration operations and the ongoing development of marine trade in the Asia-Pacific and North America are further solidifying the market landscape. Significantly, innovations in enhanced oil recovery (EOR) methods are necessitating coatings capable of enduring harsh operational environments.

Governmental infrastructure investments exemplified by the US$229.6 billion designated by China's Ministry of Finance and the US$91.7 billion from global private sector involvement highlight the essential importance of corrosion resistance in protecting these assets. With the increasing emphasis on sustainability, bio-based coatings are developing as a means for environmentally responsible innovation while maintaining material durability.

Market Trends

Emerging market trends indicate a substantial evolution in the anti-corrosion coatings sector, primarily driven by technological advancements and changing end-user requirements. Hybrid and electric vehicles, which rely less on internal combustion engines, are diminishing the demand for lubricants, hence affecting anti-corrosion coatings that serve as lubricant additives.

The concurrent advancement of ultra-thin, high-performance coatings through nanotechnology is improving durability, hydrophobicity, and chemical resistance. These advanced coatings are engineered to perform under extreme weather conditions and operational stress, therefore attracting the oil and gas, maritime, and construction industries.

The infrastructure expansion in the Asia-Pacific region, exemplified by India's 26,000 km Bharatmala Pariyojna and China's substantial public funding, is stimulating demand for coatings. Innovations such as self-healing and VOC-free coatings further synchronize the industry with global environmental objectives. These improvements combined create a progressive market, with sustainability and performance establishing new standards for anti-corrosion coating solutions.

Market Scope

Metrics | Details |

By Resin | Epoxy, Alkyds, Polyester, Polyurethane, Vinyl Ester, Other |

By Technology | Water-borne, Solvent-borne, Powder, UV-cured |

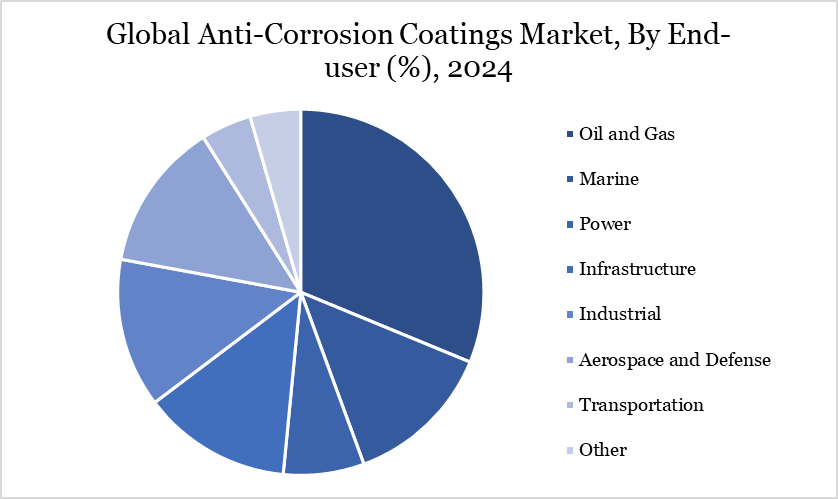

By End-user | Oil and Gas, Marine, Power, Infrastructure, Industrial, Aerospace and Defense, Transportation, Other |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Dynamics

Infrastructure Resurgence: The Foundation of Coatings Demand

The primary catalyst for the expansion of the anti-corrosion coatings industry is the worldwide emphasis on infrastructure construction. As countries strive to update infrastructure such as roads, railroads, bridges, ports, and skyscrapers, safeguarding steel and concrete elements against environmental degradation is imperative. These materials are extremely vulnerable to corrosion caused by moisture, temperature fluctuations, and chemicals. Anti-corrosion coatings function as vital protective layers to guarantee long-term integrity and safety.

Initiatives like India's Bharatmala highway expansion, China's US$229.6 billion infrastructure stimulus, and the US Department of Transportation’s US$120 billion budget for highways and bridges from 2022 to 2030 illustrate the magnitude of demand. Moreover, the Asian Development Bank's forecast of US$1.7 trillion in yearly infrastructure investment in the Asia-Pacific region until 2030 substantiates this trend. This extraordinary construction surge establishes anti-corrosion coatings as a vital element in contemporary infrastructure design and implementation.

VOC Emissions: The Cost of Environmental Compliance

A significant constraint affecting the anti-corrosion coatings business is the control of volatile organic compounds (VOCs). Governments worldwide have implemented stringent emission guidelines, including REACH and LEED GreenSeal GC-03, to restrict VOC concentration in coatings to address environmental and public health issues.

These chemicals, frequently found in solvent-based coatings, facilitate smog formation and respiratory ailments. Consequently, businesses must reformulate products to adhere to these rules, resulting in heightened research and development expenses and alterations in production technology.

Compliance promotes environmental sustainability but concurrently imposes financial and operational challenges, especially for small to medium-sized firms. This situation has limited short-term market growth and impeded the pace of new product uptake. The issue is to sustain high performance while minimizing environmental damage, rendering the regulatory landscape a double-edged sword for the business.

Segment Analysis

The global anti-corrosion coatings market is segmented based on resin, technology, end-user and region.

Infrastructure-Driven Growth in Anti-Corrosion Coatings Market

The infrastructure industry is both the largest consumer of anti-corrosion coatings and the fastest-growing, indicative of increasing global investment in resilient public assets. Critical subsegments, including trains, roads, and bridges, predominate in infrastructure demand owing to their continual exposure to environmental stressors such as moisture, pollution, and temperature variations.

These projects depend significantly on corrosion-resistant materials to prevent expensive breakdowns and prolong service life. Given the substantial annual investments by governments and the private sector in new infrastructure, the demand for anti-corrosion coatings in this sector is anticipated to remain strong during the forecast period.

Geographical Penetration

Rising Maritime and Infrastructure Forces Drive Asia Pacific Coatings Market

The Asia-Pacific region is a dominant force in the worldwide anti-corrosion coatings industry, driven by swift urbanization, maritime capabilities, and infrastructure development. China, the foremost importer and exporter of crude oil, is profoundly impacted by the growth of the energy sector and its commitment to achieving carbon neutrality by 2060.

Infrastructure initiatives, such as the US$229.6 billion stimulus for regional development and ongoing railway and road projects, generate sustained demand for corrosion-resistant materials. Japan, South Korea, and China dominate the worldwide shipbuilding sector, although burgeoning centers in Vietnam, India, and the Philippines signify a rapid transformation in maritime operations.

The geographical positioning of Australia and New Zealand enhances demand owing to their substantial shipping fleets. Furthermore, the Asian Development Bank's yearly infrastructure objective of US$1.7 trillion through 2030 highlights the sustained regional need. These characteristics collectively establish Asia-Pacific as both a present leader and a future epicenter for anti-corrosion coating applications.

Sustainability Analysis

Sustainability has emerged as a critical element in the development of the anti-corrosion coatings market. Recognizing environmental issues, the industry is progressively investing in the creation of sustainable formulas, including water-based and bio-based coatings. These options provide diminished VOC emissions and comply with regulatory criteria such as REACH and LEED, fostering safer utilization and minimizing environmental effects.

China's pursuit of carbon neutrality by 2060 and its low-carbon production initiatives illustrate the legislative impetus for sustainable practices. Manufacturers are creating advanced coatings that provide enhanced corrosion resistance while reducing environmental impact. Nanotechnology-driven innovations are facilitating the development of thinner, more efficient coatings that utilize fewer resources and prolong the lifespan of buildings, hence diminishing maintenance and replacement requirements. As sustainability emerges as a purchase factor for consumers, ecologically friendly anti-corrosion coatings will increasingly influence the industry's direction over the next decade.

Competitive Landscape

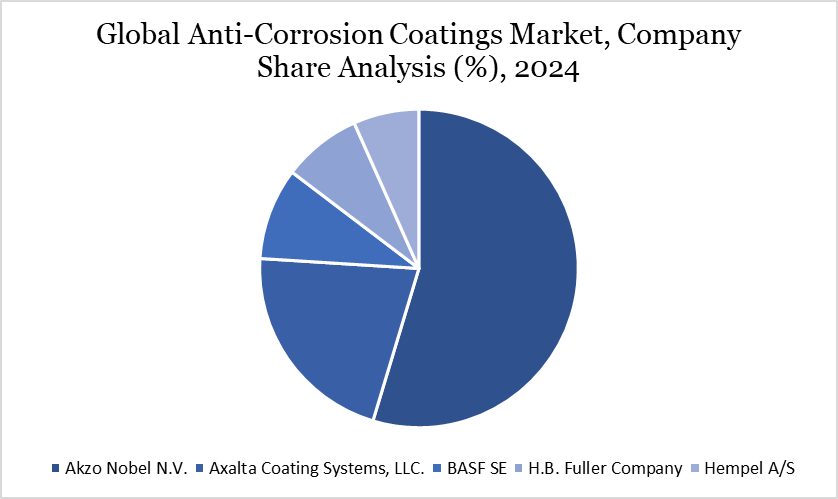

The major global players in the market include Akzo Nobel N.V., Axalta Coating Systems, LLC., BASF SE, H.B. Fuller Company, Hempel A/S, Jotun, Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., PPG Industries, Inc., RPM International Inc., and among others.

Key Developments

In March 2023, to safeguard and offer exceptional corrosion resistance to metal substrates such as aluminum, metalized steel and hot-dip galvanized steel, PPG Industries introduced the PPG ENVIROCRON Primeron primer powder.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies