Anti-Amyloid Monoclonal Antibodies Market Overview

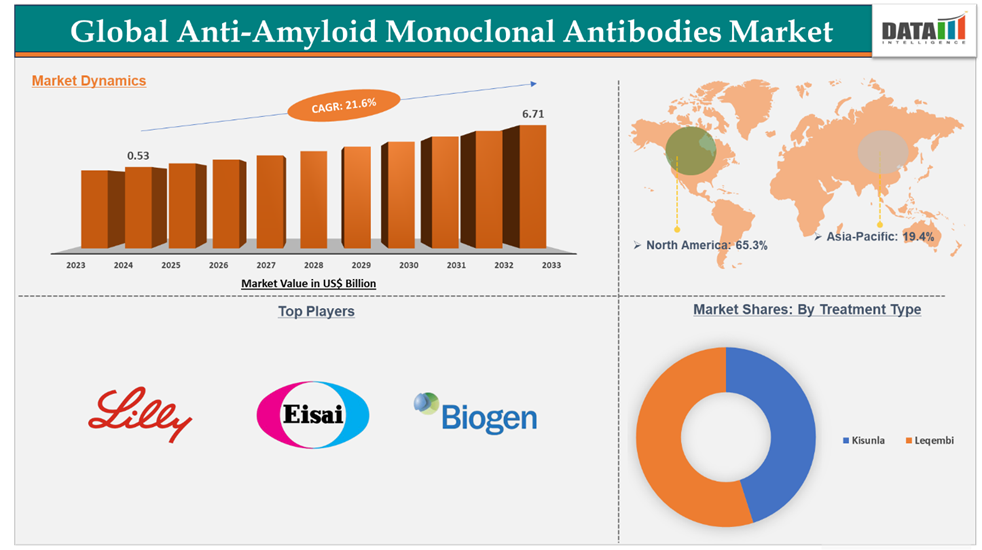

Anti-Amyloid Monoclonal Antibodies Market reached US$ 0.53 billion in 2024 and is expected to reach US$ 6.71 billion by 2033, growing at a CAGR of 21.6% during the forecast period 2025-2033.

Anti-amyloid monoclonal antibodies are the disease-modifying therapies for Alzheimer's disease. These agents slow down the progression of the disease and prevent further cognitive impairment. Currently, two anti-amyloid monoclonal antibodies are approved, and they are lecanemab and donanemab. These agents are considered disease-modifying therapies, as they produce a marked reduction in amyloid plaques when observed on amyloid positron emission tomography (PET). A 30% reduction in the decline of cognitive impairment is considered statistically significant, and these agents in their clinical testing phases, especially donanemab, have reduced the cognitive decline by 32%, and lecanemab reduced the cognitive decline by 27%. The manufacturer of aducanumab has announced its discontinuation in January 2024, but the drug is made available for people who are receiving it in clinical trials.

The market for these monoclonal antibodies is experiencing significant growth due to rising market access across various geographies, and increasing awareness of early Alzheimer's diagnosis, combined with advancements in diagnostic technologies such as amyloid PET imaging and cerebrospinal fluid biomarkers. As healthcare systems begin to integrate these innovations, the demand for disease-modifying treatments like lecanemab and donanemab is growing.

Executive Summary

For more details on this report – Request for Sample

Anti-Amyloid Monoclonal Antibodies Market Dynamics: Drivers & Restraints

The rising prevalence of alzheimer’s disease is driving the market growth

At present 8 drugs are approved and available in the market for Alzheimer's disease, of which 3 are the disease-modifying drugs that can change the underlying pathology. These disease-modifying drugs play a crucial role in reducing the disease progression and improvement of cognitive function in Alzheimer's patients. As the number of patients increases, the demand for these advanced therapies is expected to rise.

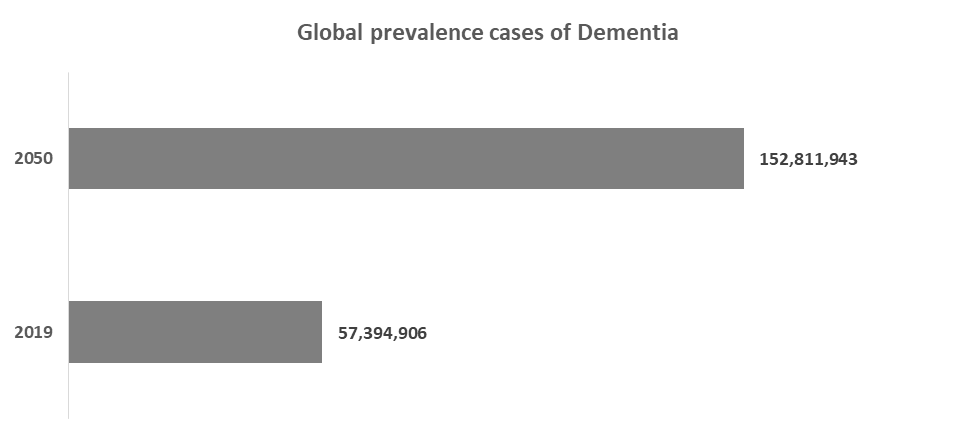

For instance, according to a recent epidemiology study published in the Lancet Public Health journal, nearly 152.8 million dementia cases are expected to be reported by 2050, from 57.4 million in 2019. This increase is attributable to population growth and population aging. According to the Alzheimer's Association, 60% to 80% of dementia cases are due to Alzheimer's disease.

High cost of monoclonal antibodies may restrain the market growth

The high cost of anti-amyloid monoclonal antibodies may restrain the market growth in the forecasted period. Since the current available anti-amyloid monoclonal antibodies are newer agents and are sold under brand names, these drugs are more expensive This high cost may result in lower adoption among the patient population living in low and middle-income countries.

For instance, Kisunla (donanemab) by Eli Lilly and LEQEMBI by Eisai are the two currently available anti-amyloid monoclonal antibodies. The per-patient treatment cost in the U.S. is as follows.

Name of the Drug | Manufacturer | Listed Price in U.S. | Annual Cost of Treatment |

Kisunla (donanemab) | Eli Lilly and Company | US$ 695.65 per Vial | US$ 32,000.00 |

LEQEMBI (lecanemab) | Eisai Inc. | US$ 637.02 (500mg Vial) | US$ 26,500.00 |

Anti-Amyloid Monoclonal Antibodies Market Segment Analysis

The global anti-amyloid monoclonal antibodies market is segmented based on product and region.

Lecanemab in the product segment accounted for 54.9% of the market share in 2024 in the global anti-amyloid monoclonal antibodies market.

Lecanemab, sold under the brand name Leqembi co-developed by Eisai Inc. and Biogen. It is the first anti-amyloid monoclonal antibody approved in different countries across the world. Leqembi is a prescription medicine for patients with mild cognitive impairment (MCI) or mild dementia due to Alzheimer’s disease. Leqembi is a humanized immunoglobulin gamma 1 (IgG1) monoclonal antibody directed against aggregated soluble and insoluble forms of amyloid beta, which is the main pathological feature of Alzheimer’s disease.

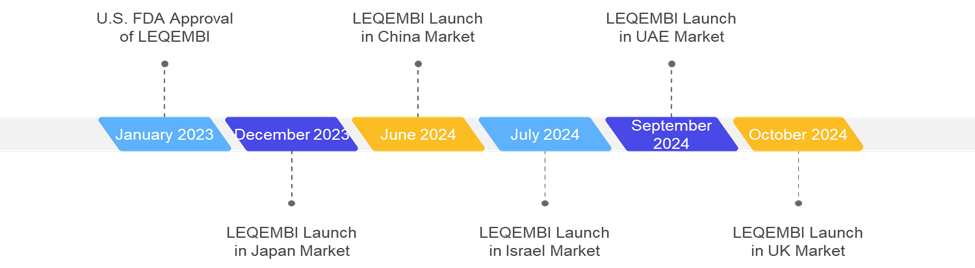

Post its approval from the U.S. Food and Drug Administration (FDA), Leqembi has expanded its presence across the globe. The drug is now available in all regions. According to the latest reports of Eisai Inc., Leqembi has a revenue growth of 108.1% from the previous financial year. The company also aims to generate a sales value of approximately US$ 300 million in the next financial year (April 1, 2024, to March 31, 2025).

Anti-Amyloid Monoclonal Antibodies Market Geographical Analysis

North America dominated the anti-amyloid monoclonal antibodies market with the highest share of 65.3% in 2024

North America is expected to hold a significant market share and grow with the highest CAGR in the forecast period due to various factors, including higher demand for novel therapies, major revenue generated by market players, and higher prevalence of Alzheimer’s disease.

For instance, according to the annual report by the Alzheimer’s Association, nearly 6.9 million Americans aged 65 and older are living with Alzheimer’s dementia in 2024, and the number of patients is expected to reach 8.5 million by 2030, 11.2 million by 2040, and 12.7 million by 2050.

This rising prevalence of Alzheimer’s disease is attributable to the aging population. The population above 65 years of age is expected to reach 82 million by 2050, from 58 million in 2022.

In addition to higher prevalence, North America is the hotspot for any novel drug launch. Due to favorable yet stringent regulatory policies, higher expenditure on research and development activities, higher expenditure on healthcare, higher per-capita income, and spending on healthcare, manufacturers intend to launch their products in the U.S. market first. Their products are sold at higher prices in the North America market as compared to other nations. Due to this, manufacturers generate a majority of their revenue from the region.

For instance, the latest anti-amyloid monoclonal antibody Kisunla (donanemab), developed by Eli Lilly and Company, was first approved by the U.S. Food and Drug Administration (FDA) in July 2024. Post the FDA approval in the U.S., the product received approval in the European Market in October 2024. This reflects the early access of the drug to U.S. patients.

All these factors contribute to the dominance of the North America region in the anti-amyloid monoclonal antibodies market.

Anti-Amyloid Monoclonal Antibodies Market Major Players

The major players in the anti-amyloid monoclonal antibodies market are Eli Lilly and Company., Eisai Co., Ltd. and Biogen Inc., among others.

Key Development

In July 2024, the U.S. Food and Drug Administration (FDA) approved Kisunla (donanemab-azbt), developed by Eli Lilly and Company. Kisunla is a monthly i.v. infusion for the treatment of alzheimer’s disease in adults with mild cognitive impairment (MCI) and Mild dementia.

In July 2023, the U.S. Food and Drug Administration (FDA) approved LEQEMBI (lecanemab-irmb), co-developed by Eisai Co., Ltd. and Biogen Inc. Leqembi is a 100 mg/mL injection for intravenous use and is approved for use in adults with Alzheimer’s Disease.

Market Scope

Metrics | Details | |

CAGR | 21.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Product | Donanemab and Lecanemab |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |