Market Size

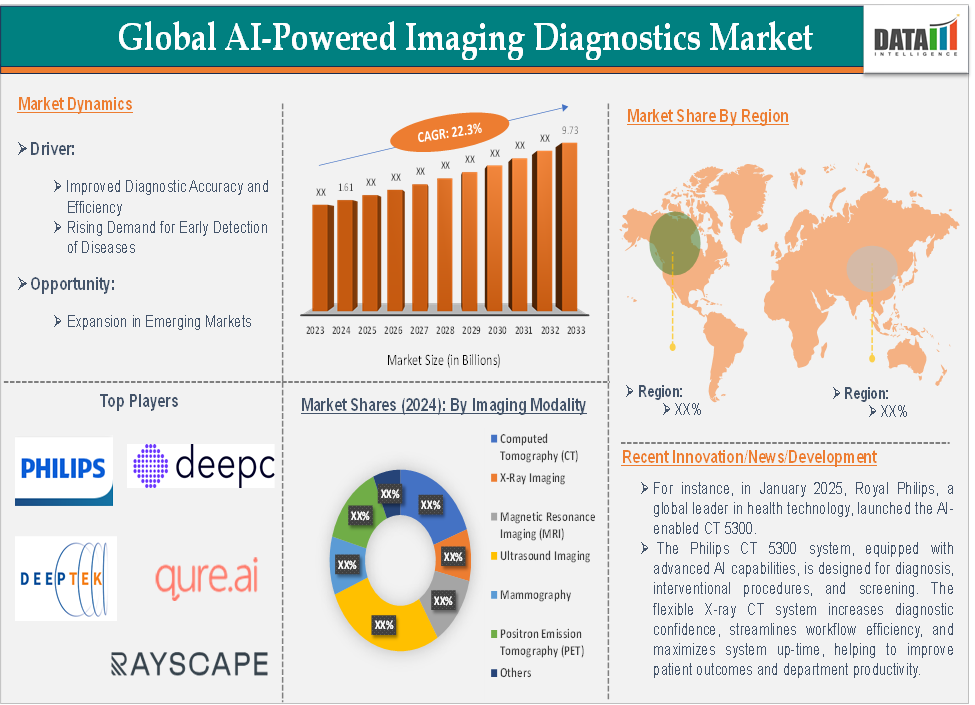

Global AI-powered imaging diagnostics market size reached US$ 1.61 billion in 2024 and is expected to reach US$ 9.73 billion by 2033, growing at a CAGR of 22.3% during the forecast period 2025-2033.

AI-powered imaging diagnostics refers to the use of artificial intelligence (AI) technologies, such as machine learning (ML), deep learning (DL), and computer vision, to analyze, interpret, and enhance medical imaging data to aid in the diagnosis of various medical conditions. This technology applies advanced algorithms to process medical images like X-rays, CT scans, MRIs, mammograms, ultrasounds, and other imaging modalities to detect patterns, identify abnormalities, and make diagnostic predictions, often with higher accuracy and speed than traditional methods.

Executive Summary

For more details on this report, Request for Sample

Market Dynamics: Drivers & Restraints

Improved diagnostic accuracy and efficiency are significantly driving the AI-powered imaging diagnostics market growth

AI systems are used to detect breast cancer in mammograms with a level of accuracy comparable to or even exceeding that of experienced radiologists. By reducing the number of false positives and false negatives, AI aids radiologists in providing a more accurate diagnosis, which is crucial for patient outcomes. The AI system identified more cancers and reduced false positives, thus improving the overall diagnostic process. Thus, major players in imaging diagnostics are focusing on AI-enabled imaging diagnostics.

For instance, in January 2025, Royal Philips, a global leader in health technology, launched the AI-enabled CT 5300. Philips CT 5300 system, equipped with advanced AI capabilities, is designed for diagnosis, interventional procedures, and screening. The flexible X-ray CT system increases diagnostic confidence, streamlines workflow efficiency, and maximizes system up-time, helping to improve patient outcomes and department productivity.

In addition to enhancing diagnostic accuracy, AI-powered imaging tools significantly improve the efficiency of the diagnostic process. AI can rapidly process medical images, delivering results faster than human radiologists. This increased efficiency benefits healthcare systems by reducing wait times, improving patient throughput, and optimizing workflows in busy clinical environments.

Cybersecurity and data security risks hampering market growth

As the AI-powered imaging diagnostics market continues to grow, there are significant concerns about cybersecurity and data security that can hinder the widespread adoption and advancement of these technologies. These risks are particularly important because AI-powered diagnostic tools depend heavily on the collection, storage, and analysis of vast amounts of sensitive patient data, including medical images, diagnostic results, and personal health information.

AI-powered imaging diagnostics systems rely on large datasets of medical images, which are often stored in cloud environments or healthcare information systems. These systems, while enabling powerful AI capabilities, also create significant vulnerabilities to data breaches and unauthorized access. The cyberattack compromised the data of patients who had used healthcare services where AI tools for imaging diagnostics were being implemented. The breach resulted in significant data loss, and multiple lawsuits were filed against the affected organizations.

For instance, according to the HIPAA Journal, in August 2023, 23 million breached healthcare records were reported. Over the past 12 months, an average of 9,989,003 healthcare records were breached each month. In the year to August 31, 2024, there have been 491 data breaches of 500 or more records, and at least 58,668,002 records are known to have been breached. The average breach size in 2024 is currently 119,487 records, and the median breach size is 4,109 records.

Market Segment Analysis

The global AI-powered imaging diagnostics market is segmented based on component, imaging modality, application, end-user, and region.

Application:

The radiology from application segment is expected to dominate the AI-powered imaging diagnostics market with the highest market share

Radiology generates a vast amount of imaging data, making it a key area where AI can significantly contribute. AI can analyze large datasets of medical images quickly and accurately, identifying patterns or anomalies that may not be immediately visible to human radiologists. AI-powered tools are already demonstrating their ability to improve diagnostic accuracy and reduce errors in radiology.

For instance, in September 2024, harrison.ai launched Harrison.rad.1, a radiology-specific vision language model. It represents a major breakthrough in applying AI to tackle the global healthcare challenge. The model is now being made accessible to selected industry partners, healthcare professionals, and regulators around the world to spark collective conversations about the safe, responsible, and ethical use of AI to revolutionise healthcare access and capability and to improve patient outcomes.

AI has a significant advantage in terms of speed. AI systems can analyze images in seconds, compared to the much longer time it takes human radiologists. This helps in time-sensitive scenarios like stroke diagnosis, where the rapid assessment of imaging data can significantly impact patient outcomes. AI's ability to reduce false positives and false negatives has proven valuable in reducing diagnostic errors.

Market Geographical Share

North America is expected to hold a significant position in the global AI-powered imaging diagnostics market with the highest market share

North America is a global leader in healthcare innovation and AI research. The region is home to some of the world's top universities, research institutions, and technology companies that are pushing the boundaries of AI in healthcare. This continuous innovation ensures that North America, especially the United States, maintains its leadership position in AI healthcare technologies.

For instance, the U.S. healthcare market is one of the largest in the world, with healthcare spending grew 4.1 percent in 2022, reaching $4.5 trillion or $13,493 per person, according to the Centers for Medicare & Medicaid Services (CMS). This substantial investment supports the adoption of cutting-edge technologies like AI in medical imaging to improve diagnostic accuracy and efficiency.

North America’s dominance in the AI-powered imaging diagnostics market is driven by its technological leadership, high healthcare spending, government support, and the presence of major AI and healthcare companies. The combination of advanced infrastructure, regulatory support, and robust investment in AI innovation positions North America at the forefront of the AI-powered medical imaging sector. With continued advancements in AI technology, North America is expected to remain the largest market for AI-powered diagnostic tools, significantly shaping the future of healthcare diagnostics.

Top Companies

Top companies in the AI-powered imaging diagnostics market includes deepc GmbH, Qure.ai Technologies Private Limited, DeepTek.ai, Inc, Koninklijke Philips N.V., Tempus AI, Inc., Rayscape, Infervision, AIKENIST, Rad AI, Brainomix Limited, and among others.

Market Scope

| Metrics | Details | |

| CAGR | 22.3% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Component | Software, Hardware, and Services |

| Imaging Modality | Computed Tomography (CT), X-Ray Imaging, Magnetic Resonance Imaging (MRI), Ultrasound Imaging, Mammography, Positron Emission Tomography (PET), and Others | |

| Application | Radiology, Cardiology, Ophthalmology, Oncology, Neurology, Orthopedic, Dentistry, and Others | |

| End-User | Hospitals, Specialty Clinics, Diagnostic Centers, Research & Academic Institutes, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global AI-powered imaging diagnostics market report delivers a detailed analysis with 70 key tables, more than 60 visually impactful figures and 172 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.