Agricultural Micronutrients Market Size

The Global Agricultural Micronutrients Market reached USD 9,706 million in 2022 and is projected to witness lucrative growth by reaching up to USD 19,197 million by 2031. The market is expected to exhibit a CAGR of 9% during the forecast period (2024-2031).

The global agricultural micronutrients market has been experiencing steady growth in recent years due to increasing demand for high-quality crops and the need for sustainable agriculture practices. The global agricultural micronutrients market is primarily driven by the growing population and the increasing demand for food. The need for efficient and sustainable agriculture practices has also led to increased use of agricultural micronutrients.

Market Summary

| Metrics | Details |

| CAGR | 9% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Type, Application, Form, Crop Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa |

| Fastest Growing Region | Asia Pacific |

| Largest Region | Asia Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more Insights about the Market Request Free Sample

Agricultural Micronutrients Market Dynamics

The increasing global population and demand for the food drive the market growth

The increasing global population and the resulting rise in demand for food are expected to continue driving the growth of the global agricultural micronutrients market. As farmers seek to improve crop yields and quality to meet the rising demand, they will increasingly turn to agricultural micronutrients.

For instance, according to the Population Reference Bureau (PRB), the number of people in the world will increase by 75 million each year, or 1.1% annually. This will result in a 33% increase in the global population from an estimated 7.4 billion in 2017 to 9.9 billion in 2050.

Increasing demand for higher crop yield with increasing focus on R&D by major companies

There is an increasing demand for food with a growing population and decreasing arable land globally. The decreasing per capita of arable land is demanding new technologies and measures to increase the yield and quality rate. The world’s population is expected to increase by 25% from 2020 to 2050. Its growing demand for food must be reconciled with limited natural resources such as arable land and water. As a result, farmers around the world face the challenge of increasing agricultural productivity in a sustainable way by about 50% by 2050 compared with baseline 2012 to meet the needs of a growing population.

Agricultural Micronutrients Market Segment Analysis

The global agricultural micronutrients market is segmented based on type, application, form, crop type, and region.

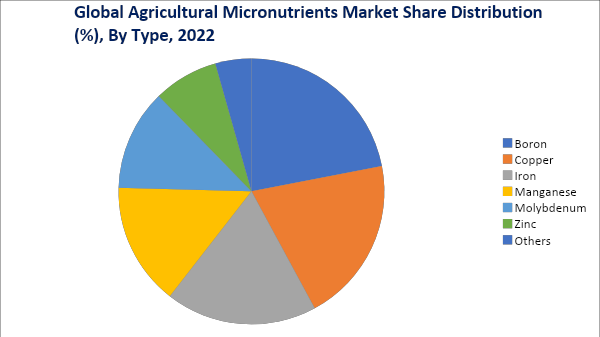

Increased use of boron in modern agricultural practices

The boron segment held a signfiicant share of 8% of the global agricultural micronutrients market in 2022. The increasing adoption of precision farming techniques and the need for sustainable agriculture practices have been driven by the demand for boron micronutrients.

Furthermore, an increase in product launches by major key players helps to boost segment growth in the forecast period. For instance, On January 2021, U.S. Borax launched NHYBOR and ZINCUBOR to provide a solution for both zinc and boron deficiency challenges. Both micronutrients are essential in reaching a crop’s yield. These products are 100% water soluble.

Agricultural Micronutrients Market Geographical Share

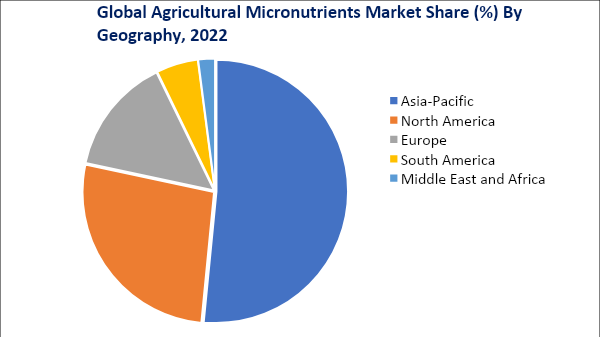

The increasing population and adoption of modern agricultural practices in APAC are expected to drive the market growth

The Asia Pacific region dominated the global agricultural micronutrients market with a share of 37% due to its large agricultural sector and growing population in 2022. The region has several major manufacturers of agricultural micronutrients. These companies have invested in research and development to develop innovative products and technologies, and driven the growth of the market in the region.

For instance, in April 2021, Verdesian Life Sciences' announced the acquisition of Cytozyme Laboratories, Inc. While the acquisition of Cytozyme made sense from the standpoint of culture and product mix, it also allowed the business to provide farmers in areas that hadn't previously had access to the most advanced nutrient usage efficiency products.

Agricultural Micronutrients Companies

The major global players include Nutrien Ltd., Nouryon, BASF SE, Coromandel International Limited, Hafia Group, Trade Corporation International, The Mosaic Company, Valagro SpA, Yara International AsA, and Stoller USA, Inc.

COVID-19 Impact on Market

The global agricultural micronutrients market was impacted by the COVID-19 pandemic, primarily due to disruptions in supply chains and trade restrictions. The lockdowns and restrictions on movement in several countries led to reduced demand for agricultural products, resulting in a decline in demand for agricultural micronutrients. However, the market showed resilience due to the essential nature of agriculture and the need for sustainable food production. Furthermore, the increasing focus on food security and the adoption of precision farming techniques presented growth opportunities for the market.

Ukraine-Russia War Impact Analysis

The Ukraine-Russia war has led to an increase in input costs, including the cost of agricultural micronutrients, which has affected the profitability of farmers in Ukraine and other countries. The disruption in the supply chain and logistics has also led to increased transportation costs, which have further increased the input costs. It has led to a decline in foreign investments in the region, which has affected the growth of the agricultural micronutrients market. The uncertainty surrounding the conflict has made investors cautious, leading to a decline in investments in the agricultural sector.

Artificial Intelligence Impact Analysis

Artificial intelligence (AI) can be used to monitor and analyze market trends and consumer preferences, enabling manufacturers and distributors to develop and market agricultural micronutrients more effectively. The integration of AI-based technologies in the agricultural sector is expected to lead to increased productivity, reduced costs, and improved sustainability, all of which can drive the growth of the global agricultural micronutrients market in the coming years.

Key Developments

- In February 2023, Andersons Inc. announced the introduction of MicroMark DG, a brand-new line of granular micronutrients that uses dispersing granule (DG) technology. With the aid of new technology, spherical homogeneous granules can be blended, spread, and used more effectively.

- In September 2022, ICL Group Ltd. introduced eqo.x, which is the revolutionary rapidly biodegradable release, an Israeli developer and producer of metals, fertilizers, and specialty chemicals. It was developed for open-field agriculture. This novel approach helps farmers maximize agricultural crop performance while reducing environmental impact by reducing nutrient loss and increasing nutrient use efficiency (NUE) by up to 80%.

- In August 2021, BASF introduced its new Basagran Zinc, a brand-new micronutrient product. The product combines zinc and the herbicide Basagran, which aids in the healthy development and growth of crops.

Why Purchase the Report?

- To visualize the global agricultural micronutrients market segmentation based on type, application, form, crop type, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of agricultural micronutrients market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global agricultural micronutrients market report would provide approximately 69 tables, 72 figures and 141 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies