Acute Myeloid Leukemia Therapeutics Market Size & Industry Outlook

The global acute myeloid leukemia therapeutics market size reached US$ 2.89 Billion in 2023 with a rise of US$ 3.15 Billion in 2024 and is expected to reach US$ 7.25 Billion by 2033, growing at a CAGR of 9.7% during the forecast period 2025-2033.

Advancements in targeted and personalized therapies, coupled with strong regulatory support and accelerated approvals, are significantly driving growth in the acute myeloid leukemia (AML) therapeutics market. Precision medicines, including FLT3 inhibitors, IDH1/2 inhibitors, BCL-2 inhibitors, menin inhibitors, and antibody-drug conjugates, target specific genetic mutations, improving treatment efficacy and reducing systemic toxicity. Regulatory incentives from agencies like the FDA and EMA, such as breakthrough therapy designations and priority reviews, allow innovative drugs to reach patients faster, boosting market adoption. These developments address unmet clinical needs in relapsed or refractory AML and heterogeneous patient populations, enhance survival rates, and improve quality of life.

Key Highlights

- North America is dominating the global acute myeloid leukemia therapeutics market with the largest revenue share of a 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global acute myeloid leukemia Therapeutics Market, with a CAGR of 7.5% in 2024

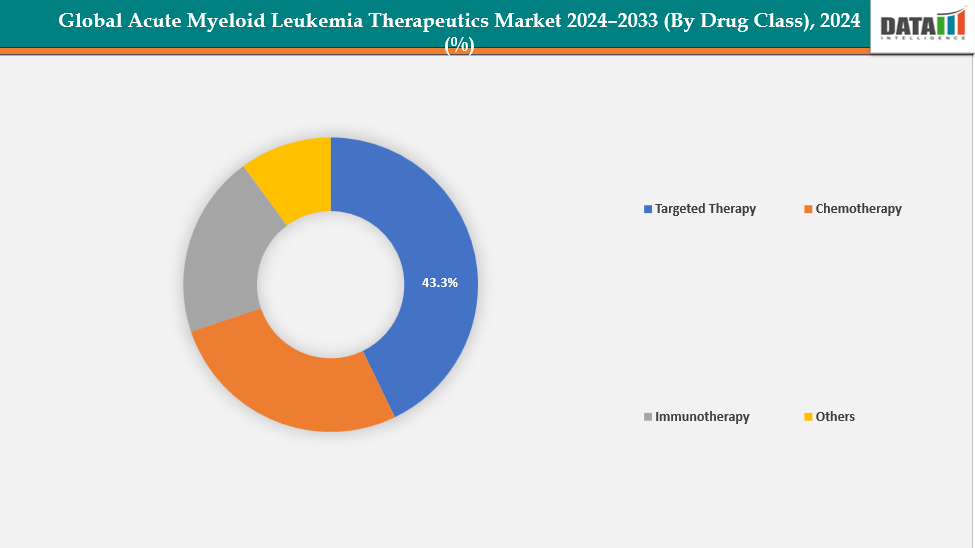

- The targeted therapy segment from drug class is dominating the acute myeloid leukemia therapeutics market with a 43.3% share in 2024

- The myeloblastic leukemia segment from disease type is dominating the acute myeloid leukemia therapeutics market with a 38.5% share in 2024

- Top companies in the acute myeloid leukemia therapeutics market include Genentech, Inc., Servier Pharmaceuticals LLC, Bristol-Myers Squibb Company, Rigel Pharmaceuticals, Inc., Novartis AG, Astellas Pharma Inc., Daiichi Sankyo, Inc., Jazz Pharmaceuticals plc, Pfizer Inc., and Teva Pharmaceutical Industries Ltd., among others.

Market Dynamics

Drivers: Rising prevalence of acute myeloid Leukemia is significantly driving the acute myeloid Leukemia therapeutics market growth

The rising prevalence of acute myeloid leukemia (AML) is a key driver of the AML therapeutics market. An increasing number of AML cases, particularly among the aging population, expands the patient pool, directly boosting demand for existing and novel therapies, including chemotherapy, targeted agents, and emerging immunotherapies. For instance, in March 2025, the American Cancer Society reported that approximately 22,010 people were diagnosed with AML, predominantly adults. AML represented about one-third of adult leukemias and roughly 1% of all cancers.

Improved diagnostics and heightened awareness have led to earlier detection, further increasing the reported prevalence. Environmental and lifestyle factors also contribute to the growing incidence. This rising patient base encourages healthcare infrastructure expansion, greater adoption of advanced treatment modalities, and increased pharmaceutical investment in research and development.

Restraints: Disease heterogeneity associated with acute myeloid leukemia therapeutics are hampering the growth of the acute myeloid leukemia therapeutics market

Disease heterogeneity in acute myeloid leukemia (AML) is significantly hampering the growth of the AML therapeutics market. AML exhibits high genetic and molecular diversity, with mutations in FLT3, IDH1/2, TP53, NPM1, and others, leading to variable disease progression and treatment responses. For instance, FLT3 inhibitors like midostaurin (Rydapt) are effective only in AML patients with FLT3 mutations, which account for roughly 25–30% of cases. Patients without this mutation do not benefit, limiting the drug’s target population. Similarly, IDH inhibitors like ivosidenib and enasidenib target specific IDH1 or IDH2 mutations, leaving a large portion of AML patients ineligible.

Moreover, this heterogeneity complicates treatment selection, as targeted therapies are effective only in specific patient subgroups, limiting the eligible population and potential drug sales. Additionally, diverse subclones can develop resistance, necessitating combination therapies or novel approaches.

For more details on this report, see Request for Sample

Segmentation Analysis

The global acute myeloid leukemia therapeutics market is segmented based on drug class, disease type, route of administration, distribution channel and region

By Drug Class: The targeted therapy segment from drug class is dominating the acute myeloid leukemia therapeutics market with a 43.3% share in 2024

The targeted therapy segment dominates the AML therapeutics market due to its precision-based approach, directly addressing genetic mutations and cellular pathways that drive leukemia. Drugs such as FLT3 inhibitors, IDH inhibitors, BCL-2 inhibitors, Mylotarg, menin inhibitors, and hedgehog pathway inhibitors offer higher efficacy and better survival outcomes than conventional chemotherapy. For instance, on November 15, 2024, Syndax Pharmaceuticals announced that the FDA approved revumenib (Revuforj), a menin inhibitor, for the treatment of relapsed or refractory acute leukemia in patients aged one year and older with a KMT2A translocation, marking a significant advancement in targeted AML therapy.

Additionally, widespread genetic and molecular profiling enables clinicians to identify eligible patients, increasing adoption. Regulatory approvals for these agents facilitate market access, while their relatively favorable safety profiles make them suitable for elderly and comorbid patients. Many targeted therapies can also be combined with chemotherapy or other agents, further improving outcomes.

The myeloblastic Leukemia segment from disease type is dominating the acute myeloid leukemia therapeutics market with a 38.5% share in 2024

The myeloblastic leukemia segment is dominating the acute myeloid leukemia therapeutics market due to its high prevalence and aggressive clinical profile. As the most common AML subtype, myeloblastic leukemia accounts for the largest patient population, driving strong demand for treatments including chemotherapy, targeted therapies, and supportive care. For instance, according to Medscape, acute myeloblastic leukemia with maturation accounted for approximately 25% of adult AML cases.

Moreover, most newly approved targeted therapies, such as FLT3 inhibitors, IDH inhibitors, BCL-2 inhibitors, and antibody-drug conjugates, are primarily studied and prescribed for myeloblastic AML, further boosting adoption. For instance, in July 2023, Daiichi Sankyo announced that the FDA approved VANFLYTA (quizartinib) for adult patients with newly diagnosed FLT3-ITD-positive acute myeloid leukemia, to be used with standard induction and consolidation chemotherapy and as maintenance monotherapy thereafter.

Geographical Analysis

North America is dominating the global acute myeloid leukemia therapeutics market with a 48.5% in 2024

North America dominates the global acute myeloid leukemia therapeutics market due to a combination of high healthcare expenditure, advanced medical infrastructure, and strong pharmaceutical presence. The region benefits from widespread adoption of innovative therapies, including targeted agents like FLT3 and IDH inhibitors, BCL-2 inhibitors, Mylotarg, and combination regimens, which improve patient outcomes. Advanced diagnostic capabilities, such as genetic and molecular profiling, enable early detection and identification of patients eligible for precision therapies, increasing treatment uptake.

The dominance of the U.S. is further reinforced by recent regulatory and market development. For instance, in January 2025, Medexus Pharmaceuticals announced that the FDA approved treosulfan, in combination with fludarabine, as a preparative regimen for allogeneic hematopoietic stem cell transplantation in adult and pediatric patients aged one year and older with AML or MDS.

Europe is the second region after North America which is expected to dominate the global acute myeloid leukemia therapeutics market with a 34.5% in 2024

Europe is the second-largest region in the global acute myeloid leukemia (AML) therapeutics market, following North America. Its dominance is driven by targeted therapies, immunotherapies, and combination regimens, supported by public healthcare systems and insurance coverage, further boosting market growth. Additionally, Europe’s emphasis on precision medicine and active participation in clinical trials accelerates the uptake of newly approved therapies, reinforcing the region’s significant share in the AML therapeutics market. For instance, in September 2025, Moleculin Biotech announced that it enrolled the first EU patients and treated one in its pivotal Phase 2B/3 MIRACLE trial, evaluating Annamycin combined with cytarabine for adults with relapsed or refractory acute myeloid leukemia across the US and Europe.

Germany’s acute myeloid leukemia therapeutics market is driven by advanced healthcare infrastructure, supportive regulations, and high disease awareness. Well-equipped hospitals, specialized cancer centers, and diagnostic laboratories ensure broad access, while strong government support, public funding, and adoption of targeted and precision therapies sustain market growth and improve treatment outcomes nationwide.

The Asia Pacific region is the fastest-growing region in the global acute myeloid leukemia therapeutics market, with a CAGR of 7.5% in 2024

The Asia-Pacific AML therapeutics market, including Japan, China, India, and South Korea, is growing due to rising disease awareness, urbanization, and improved healthcare access. Advances in research, government support, clinical trials, and educational initiatives promote adoption of targeted and combination AML therapies, driving market expansion across the region.

China is witnessing growing demand for AML therapeutics due to rising disease awareness, expanding healthcare infrastructure, and government healthcare initiatives. Improved access through hospitals, cancer centers, pharmacies, and diagnostic labs, along with more focus on drug approval and clinical trial availability, is driving adoption of targeted and combination AML therapies. For instance, in June 2025, at ASCO 2023, CStone Pharmaceuticals’ partner, Servier, presented updated Phase 3 AGILE study results showing that TIBSOVO (ivosidenib) tablets, combined with azacitidine, demonstrated promising efficacy and safety in patients with newly diagnosed IDH1-mutated acute myeloid leukemia, highlighting its potential as a targeted treatment option in this population.

Competitive Landscape

Top companies in the acute myeloid leukemia therapeutics market include Genentech, Inc.; Servier Pharmaceuticals LLC; Bristol-Myers Squibb Company; Rigel Pharmaceuticals, Inc.; Novartis AG; Astellas Pharma Inc., Daiichi Sankyo, Inc.; Jazz Pharmaceuticals plc; Pfizer Inc.; and Teva Pharmaceutical Industries Ltd., among others.

Genentech, Inc.: Genentech, Inc. is a biotechnology leader with a robust AML treatment portfolio, including targeted therapies, immunotherapies, and combination regimens. The company focuses on developing precision medicines such as FLT3 inhibitors and BCL-2 inhibitors, supported by extensive clinical trials. Genentech’s innovative approach aims to improve survival, manage relapsed or refractory cases, and address unmet needs in acute myeloid leukemia care.

Key Developments:

- In June 2024, HUTCHMED initiated a Phase I, multicenter, open-label trial in China to evaluate HMPL-506, a novel oral menin inhibitor, in patients with hematological malignancies. The study assessed safety, pharmacokinetics, and efficacy. HMPL-506 targets the menin protein, a key regulator of gene expression and cell signaling, addressing critical drivers of AML, including mixed-lineage leukemia rearrangements and nucleophosmin mutations.

- In June 2025, Johnson & Johnson announced Phase 1b data showing that bleximenib, an investigational selective menin inhibitor, demonstrated promising antileukemic activity and a favorable safety profile in combination with venetoclax and azacitidine. The study evaluated patients with newly diagnosed, intensive chemo-ineligible AML and relapsed or refractory AML, including those with KMT2A rearrangements or NPM1 mutations, with results presented at the 2025 European Hematology Association Congress.

Market Scope

| Metrics | Details | |

| CAGR | 9.7% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Drug Class | Chemotherapy, Targeted Therapy, Immunotherapy and Others |

| By Disease Type | Myeloblastic Leukemia, Myelomonocytic Leukemia, Promyelocytic Leukemia, Monocytic Leukemia and Others | |

| By Route of Administration | Parenteral, Oral | |

| By Distribution Channel | Hospital Pharmacy, Online Pharmacy, Retail Pharmacy | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global acute myeloid leukemia therapeutics market report delivers a detailed analysis with 70 key tables, more than 62 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape