Disease Overview:

Uveal melanoma is a rare but the most common primary intraocular malignancy in adults. It arises from melanocytes, pigment-producing cells within the uvea, the middle layer of the eye, which includes the:

Iris (front),

Ciliary body (middle), and

Choroid (back) the most common site.

Key Characteristics:

Distinct from cutaneous melanoma (melanoma of the skin) in terms of genetics, biology, and metastatic behavior.

Typically, non-pigmented or pigmented tumors are detected via ophthalmologic exam.

Has a high propensity to metastasize, particularly to the liver.

Common Genetic Mutations:

GNAQ, GNA11 (~80–90%)

BAP1, SF3B1, and EIF1AX mutations are linked with prognosis and metastasis.

Prognosis:

Localized disease can be effectively treated (e.g., brachytherapy or enucleation).

Metastatic uveal melanoma (mUM) has a poor prognosis, with a median overall survival often under 1 year without effective systemic therapy.

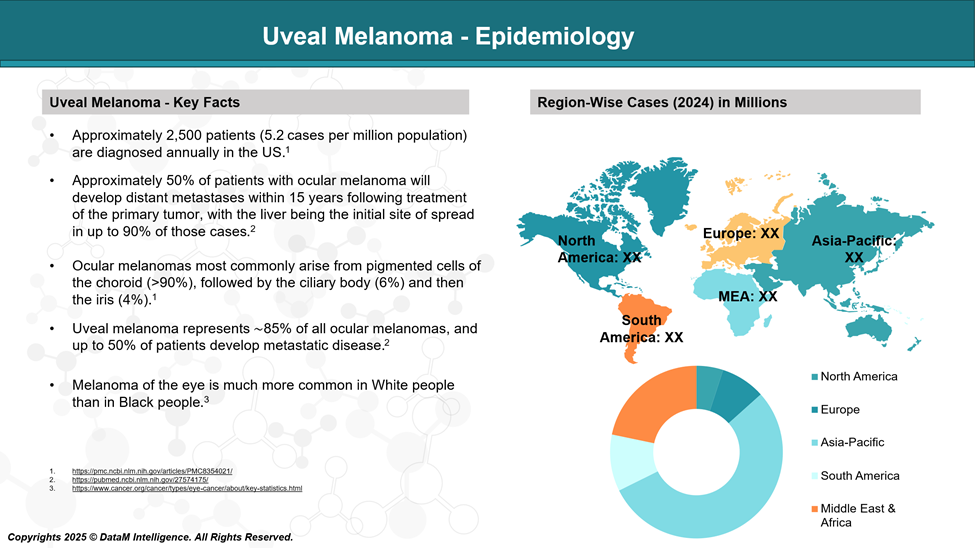

Epidemiology Analysis (Current & Forecast)

Uveal melanoma is a rare but the most common primary intraocular malignancy in adults. Its incidence, demographics, and natural history differ significantly from those of cutaneous melanoma, underscoring its unique clinical and biological characteristics.

Global Incidence and Distribution

Incidence Rate:

Varies between 4 to 8 cases per million people per year in predominantly Caucasian populations.

United States: ~2,500 new cases annually.

Europe: Higher incidence in Northern Europe (e.g., Scandinavia, the UK), with rates up to 9 per million/year; lower in Southern Europe and rare in Asia and Africa.

Racial/Ethnic Distribution:

The vast majority (>95%) of cases occur in Caucasians.

Very rare in individuals of African, Asian, or Hispanic descent.

The disparity is thought to be related to melanin content, pigmentation, and genetic predisposition.

Anatomic Site Distribution

Uveal melanoma arises from the melanocytes within the uveal tract, which comprises:

Choroid (~85–90% of cases) – most common and posterior location.

Ciliary body (~5–8%) – associated with worse prognosis.

Iris (~3–5%) – often detected earlier, less aggressive.

Factor | Trend/Details |

Age at Diagnosis | Peak incidence is between 50 and 70 years of age. Rare in children. |

Sex | Slight male predominance (M: F ratio ≈ 1.2:1). |

Eye Color | Strong correlation with light-colored eyes (blue or green iris). |

Skin Type | More common in individuals with fair skin and poor tanning ability. |

Geographic Influence | Higher rates in northern latitudes, possibly linked to UV exposure patterns. |

Metastasis and Disease Progression

- Metastatic rate: ~50% of patients will develop metastases within 15 years of diagnosis and local treatment.

- Liver is the predominant metastatic site in ~90% of metastatic cases, followed by lungs, bone, and skin.

- Survival after metastasis is poor:

- Median overall survival: 6–12 months with conventional therapies

- <15% survive beyond 1 year without newer targeted or immunotherapies

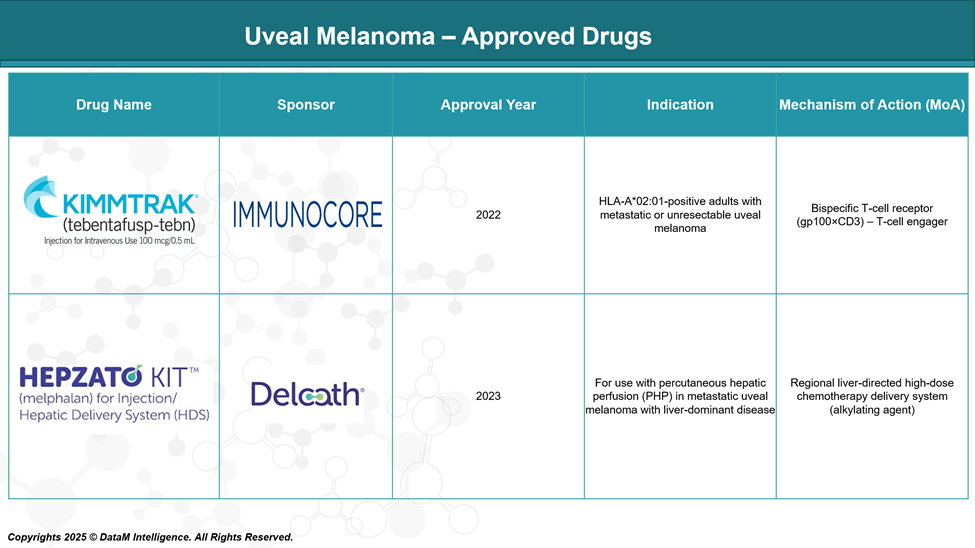

Approved Drugs - Sales & Forecast

As of June 2025, the U.S. Food and Drug Administration (FDA) has only one drug specifically approved for the treatment of metastatic or unresectable uveal melanoma (UM):

Uveal melanoma is a rare but aggressive cancer that arises from melanocytes within the uveal tract of the eye. While primary tumors can often be effectively treated with radiation or surgery, nearly 50% of patients develop metastases, with the liver being the predominant site of spread. Historically, there were no FDA-approved therapies specifically targeting metastatic uveal melanoma (mUM), and treatment relied on off-label use of skin melanoma agents with limited benefit.

In recent years, two milestone FDA approvals have reshaped the therapeutic landscape of uveal melanoma:

FDA-Approved Drug for Uveal Melanoma

KIMMTRAK® (tebentafusp-tebn)

Sponsor: Immunocore Holdings

Approval Year: 2022

Indication: HLA-A*02:01-positive adult patients with unresectable or metastatic uveal melanoma

Mechanism of Action:

Tebentafusp is a bispecific fusion protein comprising:A T-cell receptor (TCR) that targets gp100 (a melanocyte differentiation antigen),

Linked to an anti-CD3 scFv, which activates and redirects T cells to kill gp100-expressing tumor cells.

Key Differentiators:

First and only systemic therapy approved for metastatic uveal melanoma.

Demonstrated overall survival benefit in the Phase III IMCgp100-202 trial (median OS: 21.7 months vs 16 months for control).

Selectively works in HLA-A*02:01-positive patients, which represent ~44% of the Western population.

Administered weekly via intravenous infusion.

Strategic Impact:

A paradigm-shifting approval, representing a new class of T-cell receptor (TCR) therapeutics.

Opens opportunities for TCR bispecifics in other solid tumors.

Positioned as the new first-line standard for eligible metastatic uveal melanoma patients.

HEPZATO KIT™ (melphalan for hepatic delivery using percutaneous hepatic perfusion – PHP)

Sponsor: Delcath Systems, Inc.

Approval Year: 2023

Indication: Adults with metastatic uveal melanoma with liver-dominant disease

Mechanism of Action:

Delivers high-dose melphalan hydrochloride directly into the hepatic artery using a proprietary PHP system.

Isolates liver circulation to limit systemic exposure, allowing intensified regional chemotherapy.

Key Differentiators:

Targets the liver, the most common site of metastasis in UM (seen in ~90% of cases).

Offers localized, liver-directed therapy, useful when liver is the main site of tumor burden.

Requires a specialized procedure performed in interventional radiology settings.

Strategic Impact:

Complements systemic therapies like KIMMTRAK by focusing on organ-dominant disease.

Represents an advanced drug-device combination with niche clinical utility.

Highlights the importance of regional therapy in UM, where liver metastases often dictate prognosis.

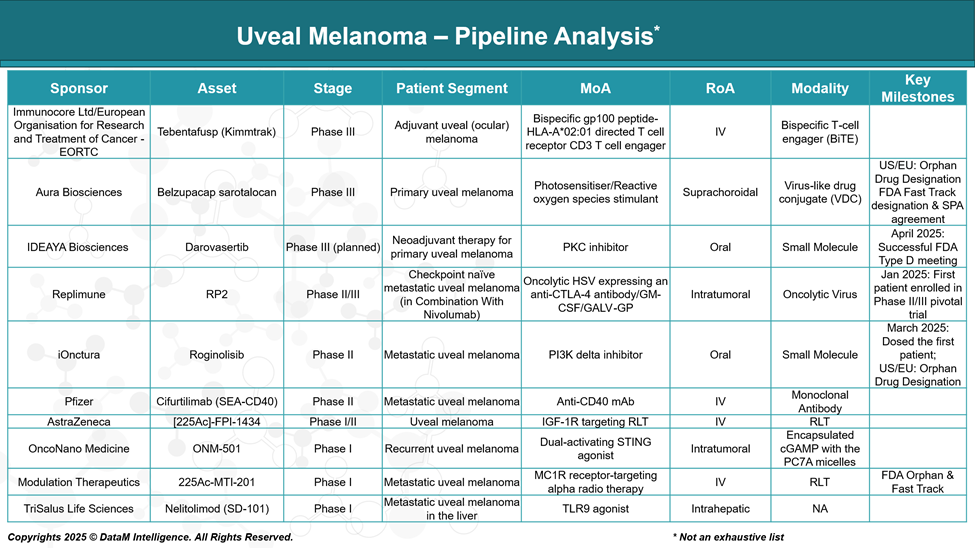

Pipeline Analysis and Expected Approval Timelines

The FDA approvals of KIMMTRAK® (tebentafusp-tebn) and HEPZATO KIT™ (melphalan/HDS) have marked a significant turning point. Yet, unmet needs persist, particularly for non-HLA-A*02:01 patients, liver-dominant relapse, and immune-resistant tumors.

As a result, the UM pipeline has gained strong momentum, with a diverse array of clinical-stage candidates progressing through Phase I to III trials. These investigational agents span a broad mechanistic spectrum, including:

T cell engagers and immune stimulants (e.g., STING agonists, CD40 agonists)

Targeted kinase inhibitors (e.g., PKC and PI3K inhibitors)

Radioligand and alpha-particle therapies

Oncolytic viruses and TLR agonists

Novel delivery systems for improved liver targeting

Moreover, the pipeline is expanding into adjuvant and neoadjuvant settings, aiming to reduce recurrence risk post-surgery and intercept micrometastatic spread early.

Tebentafusp (KIMMTRAK – Adjuvant Use)

Sponsor: Immunocore Ltd / EORTC

Stage: Phase III (Adjuvant setting)

MoA: Bispecific gp100 peptide–HLA-A*02:01–directed T cell receptor fused to CD3 T cell engager

Details: Following its systemic approval, tebentafusp is being tested in earlier stages (post-surgical/adjuvant) to prevent relapse in high-risk urothelial carcinoma (UM) patients. This may expand its utility beyond metastatic disease.

Belzupacap Sarotalocan (AU-011)

Sponsor: Aura Biosciences

Stage: Phase III (Primary UM)

MoA: Virus-like drug conjugate (VDC) delivering a photosensitizer that induces reactive oxygen species upon laser activation

Details: Aimed at treating early-stage primary UM to preserve vision and avoid enucleation. If successful, it would be the first vision-preserving targeted therapy for primary ocular melanoma.

Darovasertib

Sponsor: IDEAYA Biosciences

Stage: Phase III planned (Neoadjuvant setting)

MoA: PKC inhibitor targeting mutations downstream of GNAQ/GNA11

Details: Positioned to downstage tumors preoperatively or to prevent micrometastatic spread. Often considered in combination with other therapies like crizotinib or immunotherapy.

RP2 (in combo with Nivolumab)

Sponsor: Replimune Inc.

Stage: Phase II/III (Checkpoint-naïve metastatic UM)

MoA: Oncolytic HSV encoding anti-CTLA-4, GM-CSF, and GALV-GP

Details: Designed to enhance immune infiltration and response in cold tumors like UM. Combination with checkpoint blockade could offer a synergistic effect.

Roginolisib (IOA-244)

Sponsor: iOnctura

Stage: Phase II (Metastatic UM)

MoA: PI3K delta inhibitor

Details: A precision approach targeting the PI3K pathway, which may drive tumor growth and immune evasion. Being evaluated for immunomodulatory as well as direct tumor effects.

Cifurtilimab (SEA-CD40)

Sponsor: Pfizer

Stage: Phase II (Metastatic UM)

MoA: Non-fucosylated anti-CD40 monoclonal antibody

Details: Aims to enhance dendritic cell activation and T-cell priming, boosting antitumor immunity. It could be combined with checkpoint inhibitors or cancer vaccines.

225Ac]-FPI-1434

Sponsor: Fusion Pharmaceuticals / AstraZeneca

Stage: Phase I/II (UM and other tumors)

MoA: IGF-1R–targeted radioligand therapy (RLT) with Actinium-225

Details: A novel alpha particle-based targeted radiotherapy. Focuses on high tumor specificity with lethal radiation payloads potentially useful in liver mets.

ONM-501

Sponsor: OncoNano Medicine, Inc.

Stage: Phase I (Recurrent UM)

MoA: Dual-activating STING agonist

Details: Targets tumor-resident dendritic cells to stimulate innate immunity. It may help convert immunologically “cold” UM tumors into responsive ones.

225Ac-MTI-201

Sponsor: Modulation Therapeutics, Inc.

Stage: Phase I (Metastatic UM)

MoA: MC1R receptor–targeting alpha therapy using Actinium-225

Details: Alpha-emitter therapy targeting melanocortin receptors on melanoma cells. Offers precision radiotherapy with minimal off-target effects.

Nelitolimod (SD-101)

Sponsor: TriSalus Life Sciences, Inc.

Stage: Phase I (UM with liver metastasis)

MoA: TLR9 agonist

Details: Delivered directly to liver metastases using pressure-enabled drug delivery. Aims to reprogram the tumor microenvironment and boost the immune response locally.

Strategic Summary

- The pipeline shows strong innovation across multiple mechanisms: targeted therapy, immunotherapy, oncolytic viruses, and radioligand therapy.

- There's growing emphasis on liver-directed and immune-modulating strategies, reflecting the metastatic pattern and immune-evading nature of UM.

- Early intervention (adjuvant, neoadjuvant) is a rising trend, as seen with Immunocore and IDEAYA.

- Combination strategies (e.g., RP2 + nivolumab, darovasertib + crizotinib) aim to overcome UM’s historical resistance to immunotherapy.

Competitive Landscape and Market Positioning

Current Market: A Narrow but Groundbreaking Start

As the therapeutic landscape for Uveal Melanoma (UM) continues to evolve, the Target Opportunity Profile (TOP) serves as a strategic framework to benchmark emerging therapies against existing standards of care, namely KIMMTRAK® (tebentafusp-tebn) and HEPZATO KIT™.

Given the unique clinical and biological features of UM, including its distinct metastatic pattern (predominantly hepatic) and immunologically cold tumor environment, next-generation therapies must not only demonstrate superior efficacy and safety but also address the unmet needs left by current options.

TOP analysis evaluates these candidates across multiple dimensions:

- Mechanism of Action (MoA)

- Efficacy

- Safety & Tolerability

- Route of Administration (RoA)

- Dosing Convenience

- Modality & Innovation Potential

- Patient Access Scope

- Combination Synergy

By applying this structured lens, stakeholders, including biopharma companies, investors, and clinicians, can identify differentiation levers, optimize clinical development strategy, and de-risk positioning in a competitive and high-need oncology segment.

Emerging therapies that align with or exceed these TOP benchmarks will be best positioned to displace or complement current leaders and address the full spectrum of disease burden in UM patients.

Approved Therapies

KIMMTRAK® (tebentafusp-tebn) – Immunocore

- Mechanism: TCR–CD3 bispecific engager (gp100-HLA-A*02:01 specific)

- Positioning:

- First FDA-approved systemic therapy for metastatic UM

- First TCR therapy with OS benefit in a solid tumor

- Restricted to HLA-A*02:01 positive patients (~40–50% of Caucasians), limiting broad use

- Competitive Edge: First-mover advantage, proven survival benefit, novel MoA

- Vulnerability: HLA restriction, immune-related toxicity, no liver-specific targeting

HEPZATO KIT™ (melphalan/HDS) – Delcath Systems

- Mechanism: Percutaneous hepatic perfusion of melphalan

- Positioning:

- For liver-dominant metastatic UM, the most common site of progression

- Regional, liver-targeted approach when systemic therapy fails or is contraindicated

- Competitive Edge: Focused liver delivery, ideal for dominant liver mets

- Vulnerability: Invasive procedure, lacks systemic disease control, niche positioning

Pipeline Therapies: Expanding Across MoAs and Stages

Key Strategic Trends in Pipeline Competition:

- Broader Patient Coverage: Many pipeline drugs aim to treat all UM patients, overcoming KIMMTRAK’s HLA restriction.

- Liver-Targeting & Immuno-Oncology: Drugs like ONM-501, Nelitolimod, and radioligand therapies focus on liver mets and modulating immune resistance.

- Stage Expansion: Some drugs target adjuvant or neoadjuvant stages, aiming to prevent metastasis after surgery (e.g., darovasertib, tebentafusp as an adjuvant).

- Combination-Ready Mechanisms: Many MoAs (e.g., CD40 agonists, PI3K inhibitors, STING agonists) are positioned to work synergistically with checkpoint inhibitors.

Competition: Approved vs. Pipeline

Category | Approved Therapies | Emerging Competitors | Competitive Dynamics |

Patient Population | KIMMTRAK (HLA-A*02:01 only) | Broad-spectrum drugs (e.g., darovasertib, RP2, ONM-501) | Pipeline players aim for universal applicability, expanding beyond KIMMTRAK’s niche. |

Liver-specific Targeting | HEPZATO KIT | ONM-501, [225Ac]-FPI-1434, SD-101, MTI-201 | More precise, less invasive therapies are under development for liver metastases, a major driver of mortality. |

Mechanism of Action | TCR T-cell engager, localized chemo | PKC/PI3K inhibitors, RLTs, oncolytics, TLR/STING/CD40 agonists | Pipeline is more diverse and immunologically innovative, aiming to bypass or enhance current T-cell strategies. |

Market Penetration Strategy | Systemic (KIMMTRAK), regional (HEPZATO) | Adjuvant (tebentafusp), neoadjuvant (darovasertib), combo (RP2) | Positioning for earlier intervention and combination use, unlike the current treatments reserved for the metastatic stage. |

Combination Therapy Potential | Limited | High: RP2 + nivolumab, darovasertib + crizotinib | Many emerging drugs are combo-friendly, enhancing market flexibility and treatment personalization. |

Innovation Differentiation | First-in-class TCR | First-in-class RLTs, oncolytic viruses, and synthetic immunostimulants | Innovation race continues with multiple novel modalities not previously used in UM. |

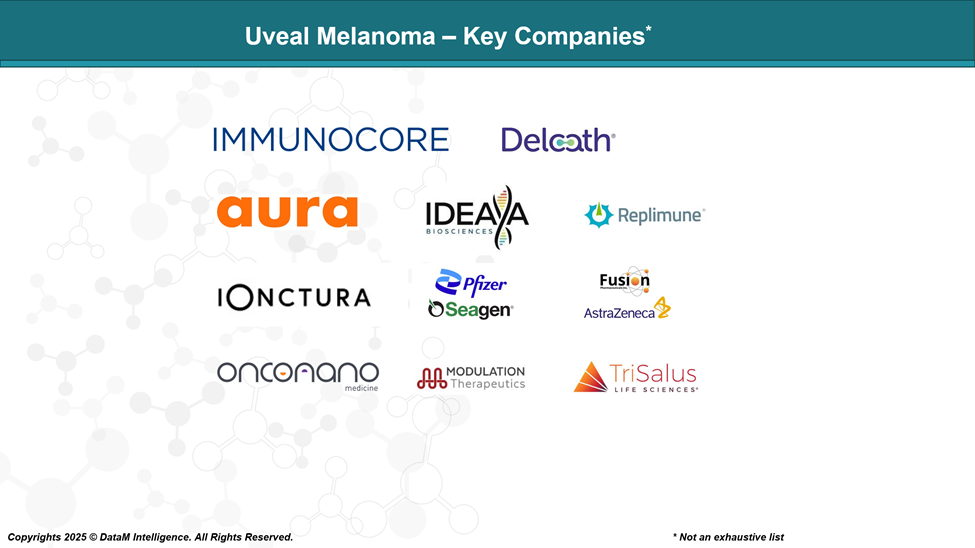

Key Companies:

Target Opportunity Profile (TOP)

Here is a Target Opportunity Profile (TOP) for emerging therapies in Generalized Anxiety Disorder (GAD), benchmarking the key attributes that new drugs must demonstrate to outperform existing FDA-approved options and establish a competitive advantage:

1. Efficacy

- Current Benchmark:

- KIMMTRAK showed a median OS of ~21.7 months vs. 16 months (SOC), mPFS of 3.3 months vs. 2.9 months in HLA-A*02:01-positive patients.

- HEPZATO KIT offers high hepatic response rates, but limited systemic effects.

- Opportunity:

- Show survival benefit in a broader population, including HLA-A*02:01-negative.

- Achieve dual organ control – systemic + hepatic metastases.

- Enable early-stage disease modification (adjuvant/neoadjuvant settings).

2. Safety/Tolerability

- Current Benchmark:

- KIMMTRAK: high rate of immune-related AEs, including cytokine release syndrome.

- HEPZATO KIT: procedure-related complications, hepatic toxicity.

- Opportunity:

- Improve immune tolerance profile (e.g., avoid CRS, irAEs).

- Reduce procedural burden (oral/IV over perfusion-based delivery).

- Allow use in elderly or frail patients.

3. Mechanism of Action (MoA)

- Current Benchmark:

- KIMMTRAK: TCR-based immune redirection (restricted to gp100/HLA-A*02:01).

- HEPZATO: regional chemotherapy without immune modulation.

- Opportunity:

- Target non-HLA-restricted antigens or immune escape pathways.

- Engage bystander immune activation (e.g., STING, TLR9, CD40).

- Enable synthetic lethality or tumor microenvironment modulation.

- Combine multiple immune mechanisms (e.g., oncolytic virus + checkpoint inhibition).

4. Route of Administration (RoA)

- Current Benchmark:

- KIMMTRAK: IV infusion.

- HEPZATO: hepatic artery catheterization (interventional).

- Opportunity:

- Prioritize non-invasive or less intensive delivery (oral, subcutaneous, intratumoral).

- Enable repeat dosing with manageable logistics (outpatient-based treatment).

5. Dose Frequency/Dosing Convenience

- Current Benchmark:

- Weekly (KIMMTRAK); episodic hepatic perfusion (HEPZATO).

- Opportunity:

- Offer monthly or bi-monthly dosing with sustained responses.

- Provide home-based or self-administered options.

6. Modality

- Current Benchmark:

- TCR therapy and hepatic-directed chemotherapy.

- Opportunity:

- Break new ground with radioligand therapy (RLT), oncolytic viruses, STING/CD40/TLR agonists, or targeted kinase inhibitors.

- Combine molecular specificity with immune priming for dual action.

- Utilize engineered small molecules or next-gen biologics.

7. Innovation & Differentiation

- Current Benchmark:

- First-in-class TCR agent (KIMMTRAK); first regional chemo-approved device (HEPZATO).

- Opportunity:

- Be first-in-class in MoA or delivery method.

- Deliver biomarker-driven precision (e.g., MC1R, IGF-1R, PKC isoforms).

- Exhibit combo-readiness with immune checkpoint inhibitors.

8. Patient Population Expansion

- Current Benchmark:

- KIMMTRAK: HLA-A*02:01-positive only.

- HEPZATO: liver-dominant disease only.

- Opportunity:

- Serve HLA-A*02:01-negative patients (~50% of UM population).

- Extend to non-liver-dominant and early-stage patients.

- Address recurrence prevention in adjuvant settings.

9. Combination Potential

- Current Benchmark:

- Limited synergy shown.

- Opportunity:

- Enable rational IO + targeted therapy combinations (e.g., RP2 + anti-PD-1).

- Demonstrate additive/synergistic activity in dual-modality approaches.

Summary Table

Category | Current Therapies | TOP Requirement for Emerging Drugs |

Efficacy | OS benefit (KIMMTRAK), liver control (Hepzato) | Survival + systemic + liver efficacy + early-stage impact |

Safety | CRS, liver toxicity | Favorable AE profile, less immune risk |

MoA | TCR, regional chemo | Novel pathways: STING, PKC, RLT, oncolytics, CD40, etc. |

RoA | IV or catheter-based | Oral, SC, or localized direct tumor delivery |

Dosing | Weekly or interventional | Long-acting, monthly, outpatient-friendly |

Modality | Biologics (TCR), chemotherapy | Engineered viruses, targeted RLT, and synthetic immunomodulators |

Innovation | First-in-class | Novel MoA, combo-enabled, biomarker-guided |

Population Access | HLA-A*02:01-positive, liver-dominant only | HLA-A*02:01-negative, full-stage spectrum, liver-independent |

Combo Flexibility | Limited | Synergy with ICI, TKI, or dual-pathway targeting |

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: