Disease Overview:

- Niemann-Pick Type C (NPC) is a rare, inherited disorder that leads to progressive damage in the nervous system and can affect individuals at any age, from infancy to adulthood. The condition is characterized by the abnormal buildup of fats (lipids) in organs such as the brain, liver, and spleen.

- NPC is categorized into two subtypes, NPC1 and NPC2, as each type is caused by a different gene mutation.

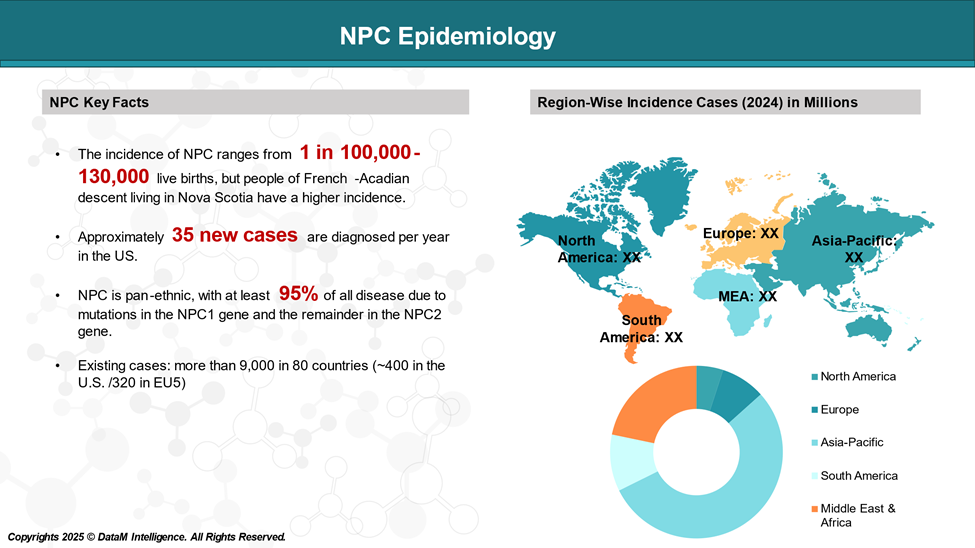

- Approximately 95% of NPC cases are caused by NPC1 gene mutations, with the other 5% caused by mutations in the NPC2 gene.

Epidemiology Analysis (Current & Forecast)

NPC is considered an ultra-rare disease, with an estimated prevalence of about 1 in 100,000 to 130,000 live births worldwide. It may vary depending on the population studied and the availability of diagnostic tools, as the disease is often underdiagnosed or misdiagnosed due to its wide range of symptoms and varying age of onset.

Approved Drugs (Current SoC) - Sales & Forecast

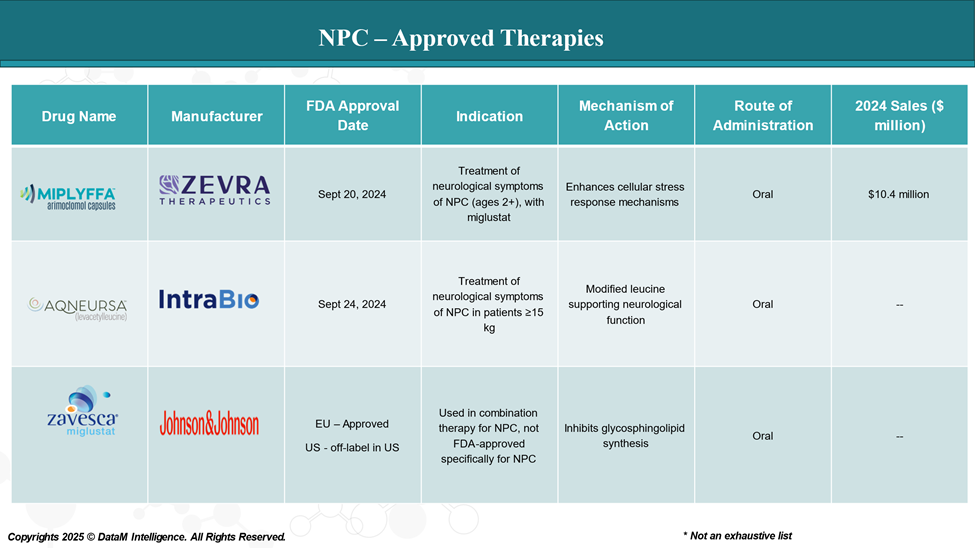

As of April 2025, two medications have been approved by the U.S. Food and Drug Administration (FDA) for the treatment of NPC.

Pipeline Analysis and Expected Approval Timelines

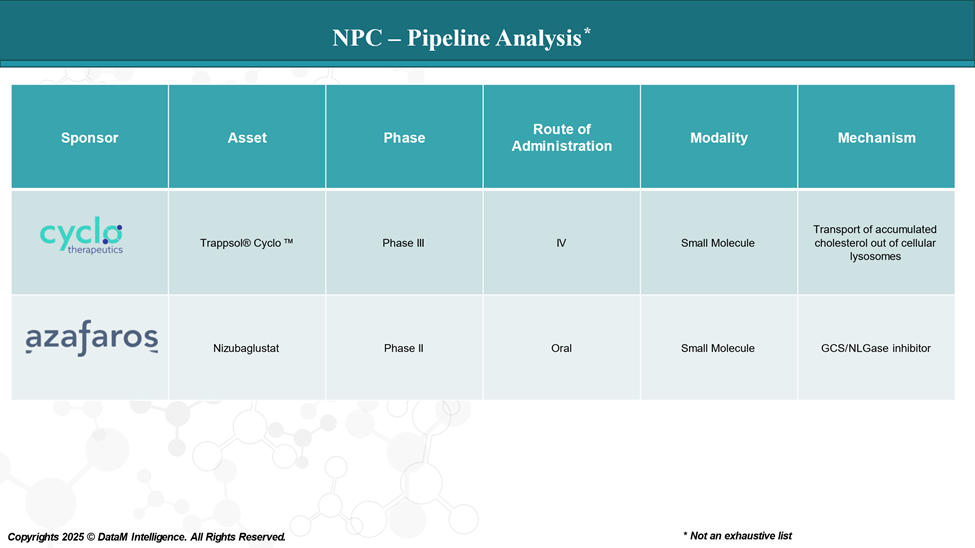

The treatment landscape for NPC is rapidly evolving, with several new therapies approved and a pipeline of investigational drugs targeting various disease mechanisms.

Competitive Landscape and Market Positioning

The NPC treatment landscape is experiencing significant growth, driven by two recent drug approvals and with a pipeline of therapies, and strategic market positioning by key pharmaceutical players.

| Parameter | Miplyffa (arimoclomol) | Aqneursa (levacetylleucine) |

| Manufacturer | Zevra Therapeutics | IntraBio Inc. |

| Approval | FDA approved (Sept 2024) for NPC (with miglustat) | FDA approved (Sept 2024) for NPC (≥15kg patients) |

| Mechanism | Enhances heat shock proteins to aid protein folding | Modified leucine analog that supports brain function |

| Route of Admin. | Oral (capsule or solution) | Oral (granules dissolved in water) |

| Efficacy | Shown to slow neurological progression, especially with miglustat | Improves motor function and neurological symptoms |

| Safety Profile | Generally well tolerated; mild GI and respiratory issues | Favorable; mild GI symptoms, rare swallowing difficulty |

| Side Effects | Diarrhea, weight loss, and upper respiratory infections | Abdominal pain, vomiting, and swallowing difficulties |

| Price Estimate | Average ~$1.02 million /year | ~$700,000 to $1,000,000 per year |

| Use with Other Drugs | Approved for use with miglustat | Standalone; may be used with miglustat |

| Adoption Potential | High—first FDA-approved NPC-specific treatment | High—new option for younger patients |

| Access Programs | Likely (compassionate/rare disease support) | Yes (early access in some countries) |

Key Companies:

Target Opportunity Profile (TOP)

To outperform current approved therapies for NPC, emerging therapies must demonstrate clear, differentiated value across clinical and commercial dimensions.

| Attribute | Current Standard | Emerging Therapy Needs To... |

| Mechanism of Action | Protein stabilization (Miplyffa), metabolic support (Aqneursa), lipid synthesis inhibition (Miglustat) | Target upstream causes like cholesterol trafficking or lysosomal dysfunction; gene therapy or substrate reduction advantage |

| Safety Profile | Mild to moderate GI and respiratory issues | Show equal or fewer side effects, ideally with no serious adverse events over long-term exposure |

| Efficacy | Slowing of neurological symptoms or ataxia improvement | Demonstrate superior or earlier functional improvement, ideally with neuroprotection or disease reversal |

| Clinical Trial Endpoints | R4DNPCCSS, fSARA (neurological function), quality of life | Match current gold standards and introduce validated biomarkers or neuroimaging endpoints for faster readout |

| Clinical Trial Results | Modest improvement or stabilization | Show statistically significant improvement (not just stabilization) on cognitive, motor, or survival outcomes |

| Route of Administration | Oral (daily dosing) | Maintain or improve on oral delivery, or offer less frequent dosing (e.g., monthly IV, gene therapy once) |

| Trial Size & Duration | Small (n=30–60), 12–24 months | Conduct larger (n=100+), multicenter, randomized studies to ensure generalizability and statistical power |

| Pricing | $150,000–$600,000 per year | Offer comparable or lower cost, or justify premium pricing with transformational benefit |

| Reimbursement Potential | Orphan drug + premium pricing accepted | Secure HTA and payer engagement early; demonstrate cost-effectiveness through QoL and productivity gains |

| Adoption Potential | High for Miplyffa (first-in-class), moderate for others | Demonstrate ease of use, faster onset, and better outcomes to drive rapid clinical adoption |

| Differentiation | Limited disease reversal | Show curative potential (gene therapy), broader symptom relief, or applicability to all NPC types |

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge & Make Data-Driven Decisions

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

2. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

3. Optimize R&D and Clinical Development & Enhance Market Access & Pricing Strategy

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

4. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

5. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.