Disease Overview:

Lupus nephritis (LN) is an inflammation of the kidneys that occurs as a complication of systemic lupus erythematosus (SLE), a long-term autoimmune disorder where the body's immune system mistakenly attacks healthy tissues, with the kidneys being a major site of damage.

It occurs when the immune system mistakenly attacks kidney tissues, leading to impaired waste filtration. Common signs include protein or blood in the urine and swelling. If untreated, LN can lead to chronic kidney damage or failure.

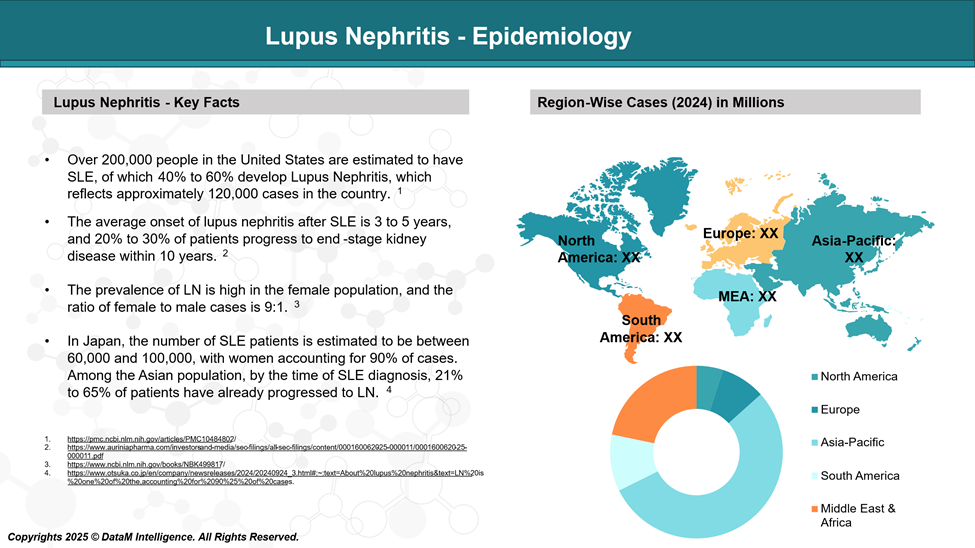

Epidemiology Analysis (Current & Forecast)

Lupus nephritis (LN) affects approximately 40–60% of people with SLE. It is more common in women, especially those of African American, Hispanic, and Asian descent.

LN often develops within the first five years after an SLE diagnosis and is more frequent and severe in younger patients.

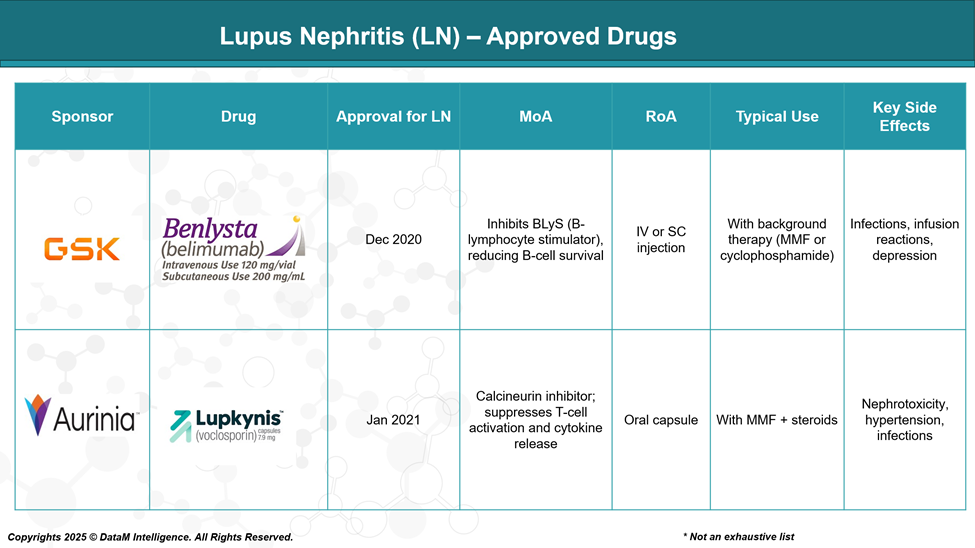

Approved Drugs - Sales & Forecast

As of June 2025, the only FDA-approved drugs specifically for lupus nephritis are Benlysta (belimumab) and Lupkynis (voclosporin). Benlysta targets B cells by inhibiting BLyS, while Lupkynis is a calcineurin inhibitor that suppresses T-cell activation. Both are used alongside standard therapies like mycophenolate mofetil and steroids.

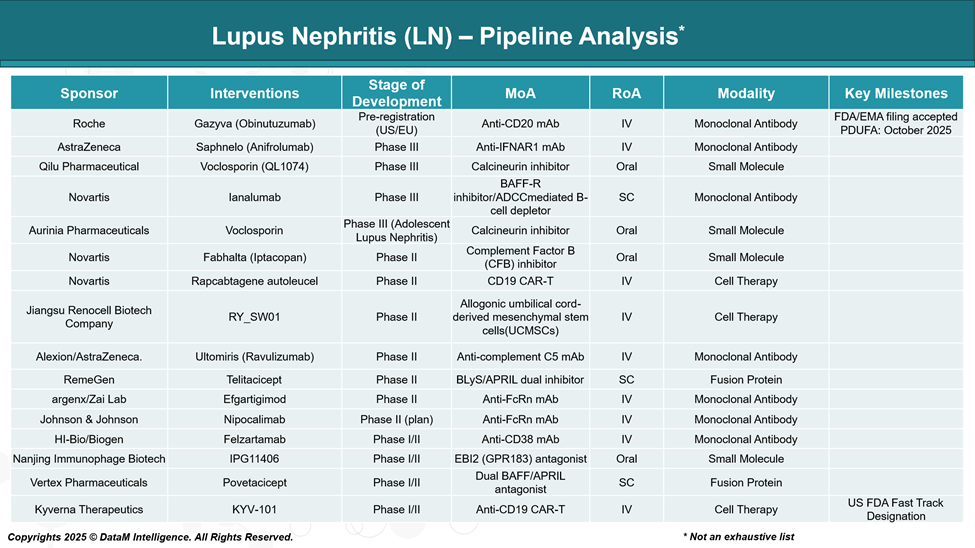

Pipeline Analysis and Expected Approval Timelines

As of June 2025, the lupus nephritis (LN) drug development pipeline is dynamic, with several promising therapies in various stages of clinical trials.

Here's an overview of notable investigational drugs:

Competitive Landscape and Market Positioning

The competitive landscape for lupus nephritis (LN) is evolving rapidly, driven by the unmet need for therapies that offer better efficacy, safety, and convenience. While Benlysta and Lupkynis have established the current treatment foundation, several late-stage pipeline therapies are poised to challenge them with novel mechanisms and improved profiles.

Company | Drug (RoA) | Phase | MoA | Indication Focus | Key Differentiator | Competitive Strengths |

GSK | Benlysta (IV/SC) | Approved | Anti-BLyS mAb → B-cell inhibition | Maintenance, Pediatric ≥5 years | First biologic approved for LN; pediatric indication | Well-established safety, flexible administration, pediatric label |

Aurinia | Lupkynis (Oral) | Approved | Calcineurin inhibitor → T-cell suppression | Induction (Adults), Steroid-sparing | Oral formulation; rapid onset | Convenient oral dosing, strong induction data, steroid sparing |

Roche | Gazyva (IV) | Pre-registration (US/EU) | Anti-CD20 → B-cell depletion | Induction & Maintenance | Next-gen anti-CD20; improved efficacy vs rituximab | Superior clinical outcomes in trials; strong oncology/autoimmune presence |

AstraZeneca | Saphnelo (IV) | Phase III | Anti-IFNAR1 → interferon pathway blockade | SLE (potential LN expansion) | Interferon pathway targeting | Established SLE brand; potential cross-over into LN |

Qilu Pharmaceutical | Voclosporin (Oral) | Phase III (China) | Calcineurin inhibitor (generic candidate) | Induction (China) | Local generic competitor | Targeting the Chinese LN market with a lower-cost option |

Novartis | Ianalumab (SC) | Phase III | BAFF-R inhibitor + ADCC-mediated B-cell depletion | Induction & Maintenance | Dual B-cell depletion; SC route | Convenient SC dosing; dual mechanism may improve efficacy |

Aurinia Pharmaceuticals | Voclosporin (Oral) | Phase III (Adolescent LN) | Calcineurin inhibitor | Pediatric LN | Label extension to adolescents | Expands market reach; pediatric safety and efficacy data |

Market Positioning Summary

- Benlysta: Dominates maintenance space with IV/SC flexibility; pediatric approval boosts reach.

- Lupkynis: Oral induction therapy; fast onset and steroid-sparing; positioned competitively with calcineurin advantages.

- Gazyva: Emerging next-gen anti-CD20 with potential superiority to rituximab; poised for rapid uptake post-approval.

- Saphnelo: Strong SLE brand; LN extension would leverage existing market access and physician familiarity.

- Ianalumab: Innovative dual-action B-cell depletor with SC route; could carve out niche based on convenience and efficacy.

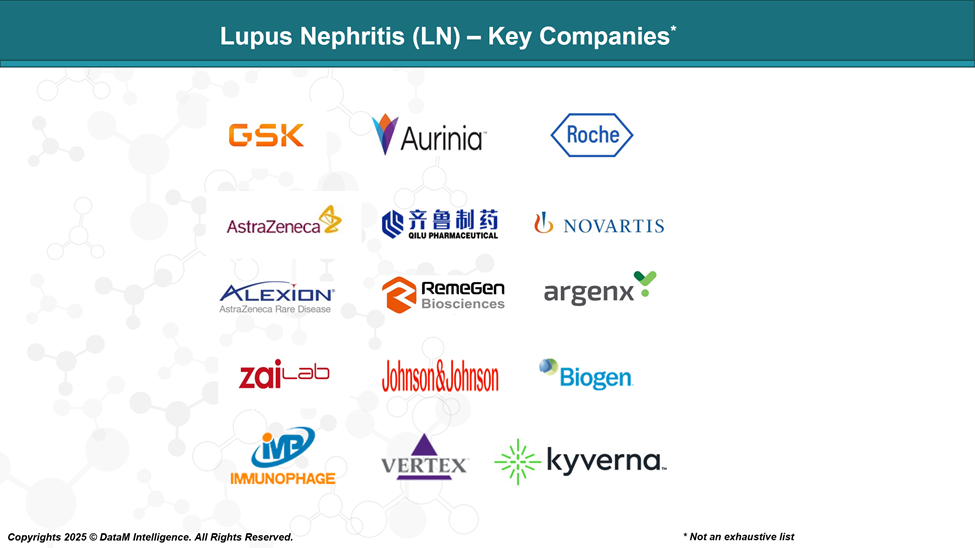

Key Companies:

Target Opportunity Profile (TOP)

To outperform approved lupus nephritis (LN) therapies, such as Benlysta and Lupkynis, emerging drugs must deliver a Target Product Profile (TPP) that significantly improves on multiple key dimensions.

Here’s a Target Opportunity Profile (TOP) outlining what attributes emerging LN drugs ideally need to demonstrate to gain a competitive advantage:

Target Opportunity Profile: Emerging Drugs in Lupus Nephritis

Attribute | Benchmark (Approved Drugs) | Target Opportunity (Emerging Drug Needs) |

Efficacy | Partial renal response ~40–50% at 12 months with Benlysta/Lupkynis combo | ≥60% complete renal response (CRR) with rapid onset, lower relapse rate, and sustained long-term remission |

Safety/Tolerability | Steroid-sparing effects but risks of infection, hypertension (Lupkynis), depression (Benlysta) | Low immunosuppressive burden, minimal infection risk, reduced cardiovascular/metabolic adverse events |

Mechanism of Action (MoA) | B-cell (Benlysta), calcineurin inhibition (Lupkynis) | Novel or dual MoA (e.g., B-cell + IFN blockade, Treg restoration, precision CAR-T) for deeper immune reset |

Route of Administration (RoA) | IV/SC (Benlysta), Oral (Lupkynis) | Preferred: Oral or infrequent SC/IV (e.g., monthly); home dosing to improve adherence |

Dosing Convenience | Daily (Lupkynis), monthly IV or weekly SC (Benlysta) | Infrequent dosing (e.g., biweekly SC or monthly oral); minimal monitoring burden |

Modality | mAbs, small molecule | Innovative modalities: e.g., gene-modified cells, bispecifics, RNA-based drugs |

Innovation Level | Biologics and reformulated CNIs | Breakthrough class with curative potential or disease-modifying effect (e.g., CAR-T, oral biologics) |

Onset of Action | 2–3 months for Benlysta; ~2 weeks for Lupkynis | <2 weeks to partial renal response; rapid proteinuria reduction |

Pediatric Potential | Benlysta: ≥5 years approved; Lupkynis not yet | Pediatric safety data early in development; active adolescent trials |

Combination Use | Combined with MMF/steroids | Monotherapy potential or synergistic effect with MMF; steroid-free protocols |

Health System Value | Moderate cost, high monitoring requirements (especially Lupkynis) | Cost-effective, reduced monitoring, improved QOL and healthcare resource utilization |

Strategic Insights

Emerging therapies must aim to either:

- Disrupt current standard with transformative efficacy and first-in-class mechanisms (e.g., CD19 CAR-Ts, IFN/CD20 bispecifics), or

- Outperform on convenience and safety, especially with oral or less frequent SC formulations.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: