Disease Overview:

Inflammatory bowel disease (IBD) is a chronic condition that affects the intestines. It develops when the body's immune system mistakenly targets healthy cells in the digestive tract, leading to persistent inflammation and tissue damage that does not resolve without treatment.

Ulcerative Colitis (UC)

- Ulcerative colitis (UC) is the most common type of inflammatory bowel disease (IBD).

- UC affects the inner lining of the colon and rectum, causing complete damage to the lining.

Crohn's Disease

- Crohn’s disease is a type of inflammatory bowel disease (IBD) that can affect any part of the digestive tract, from the mouth to the anus.

- It inflames areas of the intestine walls, causing patches of damage that can reach the outer lining

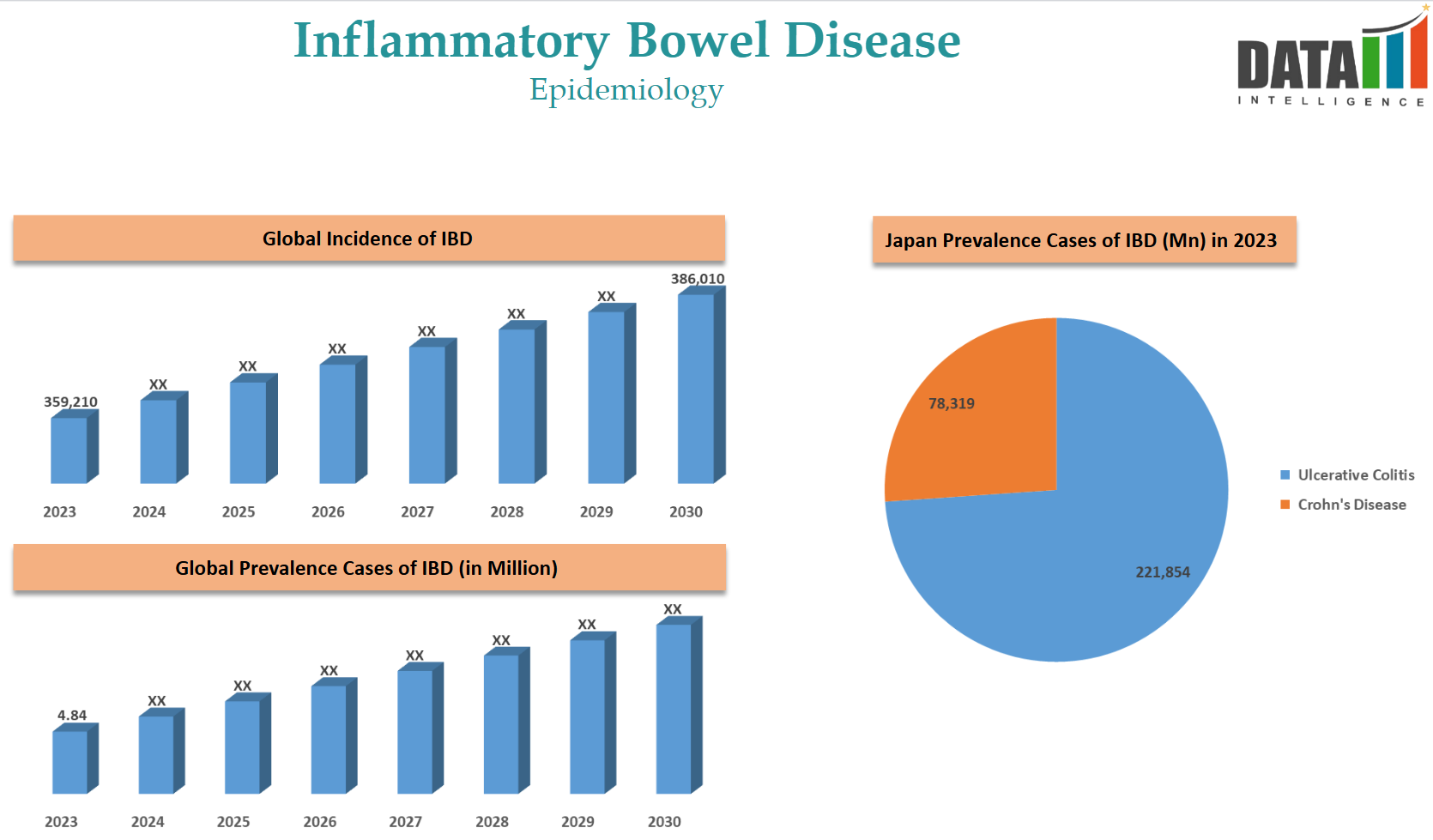

Epidemiology Analysis (Current & Forecast)

The prevalence of IBD is increasing due to the aging population worldwide. DataM estimates 359k incidence cases in 2023, with global prevalent cases of 4.84 million.

Approved Drugs (Current SoC) - Sales & Forecast

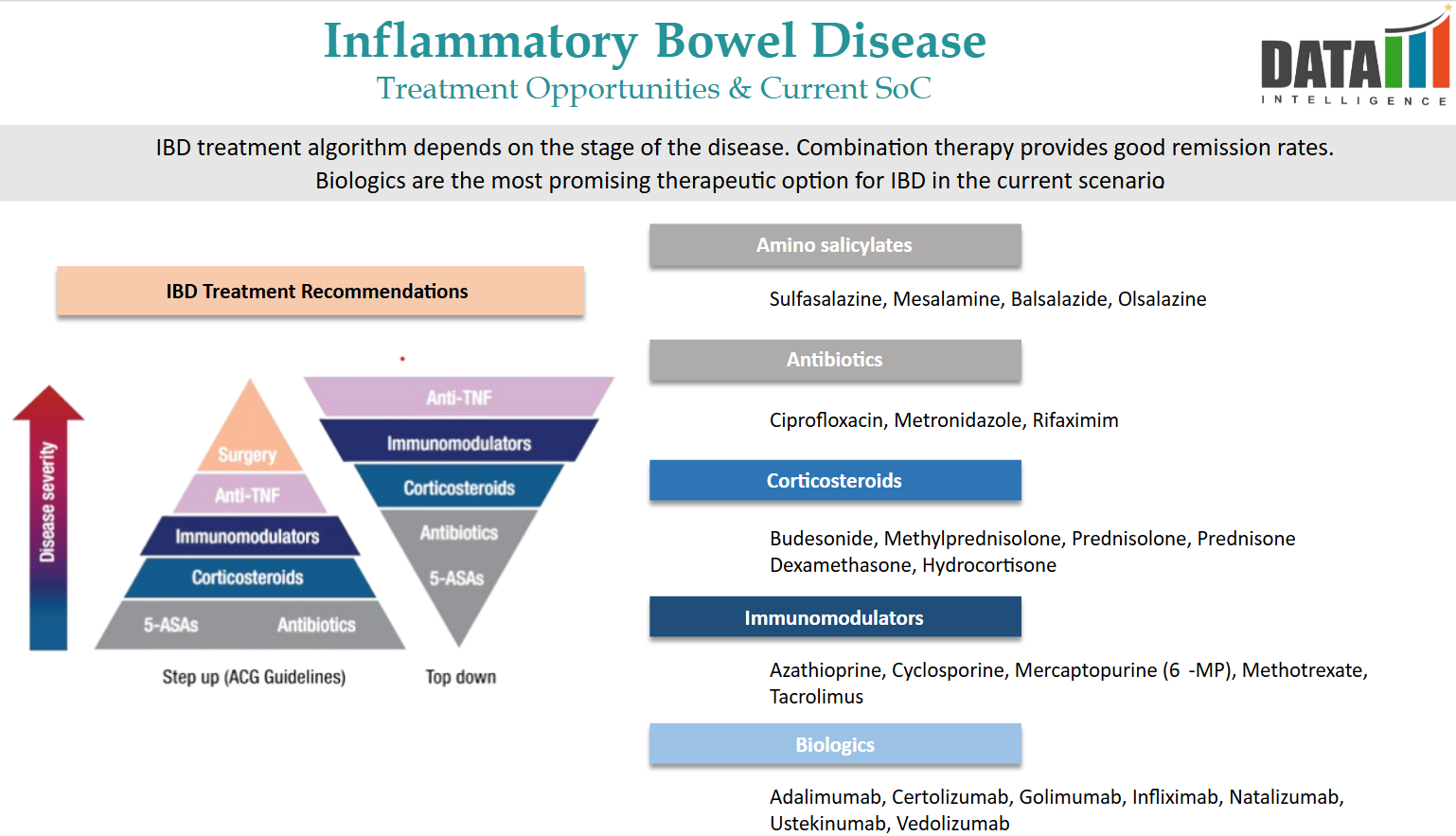

IBD treatment algorithm depends on the stage of the disease. Combination therapy provides good remission rates. Biologics are the most promising therapeutic option for IBD in the current scenario.

The current standard of care includes:

1. Aminosalicylates (5-ASA):

- Mesalamine: Available under brand names such as Lialda, Asacol, Pentasa, and Apriso, mesalamine is commonly used to treat mild to moderate ulcerative colitis by reducing inflammation in the lining of the colon.

- Sulfasalazine: Sold as Azulfidine, this medication combines sulfapyridine and 5-ASA, effective in treating mild to moderate ulcerative colitis and, in some cases, Crohn's disease.

2. Corticosteroids:

- Prednisone and Budesonide: These are utilized for the short-term management of moderate to severe IBD flare-ups due to their potent anti-inflammatory effects. Long-term use is generally avoided because of potential side effects.

3. Immunomodulators:

- Azathioprine and Mercaptopurine: These agents suppress the immune system to reduce inflammation and are often used when patients do not respond to standard therapies or to maintain remission.

4. Biologic Therapies:

- Anti-TNF Agents: Medications like infliximab (Remicade) and adalimumab target tumor necrosis factor-alpha (TNF-α), a pro-inflammatory cytokine, and are used in moderate to severe cases of IBD.

- Integrin Receptor Antagonists: Vedolizumab (Entyvio) is approved for adults with moderate to severe ulcerative colitis or Crohn's disease who have had an inadequate response to conventional therapy.

5. Janus Kinase (JAK) Inhibitors:

- Tofacitinib: An oral medication approved for moderate to severe ulcerative colitis, it works by inhibiting Janus kinase enzymes involved in the inflammatory process.

6. Recently Approved Treatments:

- Omvoh (mirikizumab): Approved by the U.S. FDA for the treatment of adults with moderate to severe Crohn's disease, expanding its previous indication for ulcerative colitis.

- Tremfya (guselkumab): Initially approved for psoriasis, its use has been expanded to include treatment for adults with ulcerative colitis.

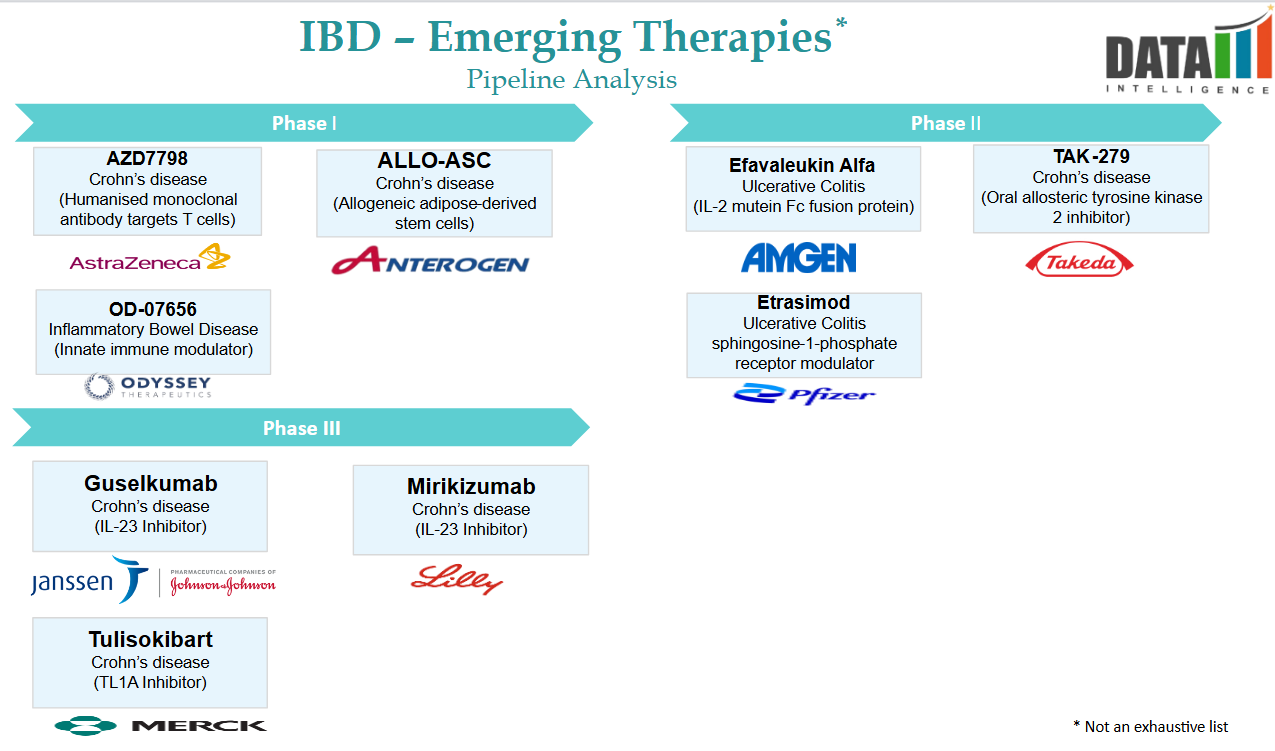

Pipeline Analysis and Expected Approval Timelines

Inflammatory Bowel Disease (IBD), encompassing conditions like Crohn's disease and ulcerative colitis, remains an area of active research with several promising therapies in development.

Below is an overview of select drugs currently in the pipeline, along with their expected approval timelines:

| Drug | Developer | Current Status | Expected Approval |

| Obefazimod (ABX464) | Abivax | Phase III | 2027 |

| Duvakitug (Anti-TL1A mAb) | Teva & Sanofi | Phase II | 2028 |

| Tamuzimod | Ventyx Biosciences | Phase II | 2028 |

| Glepaglutide | Zealand Pharma | CRL, FDA requested a new trial | 2027 |

| Rosnilimab | AnaptysBio | Phase II | 2028+ |

| NSHO-101 | Ensho Therapeutics | Phase I | TBD |

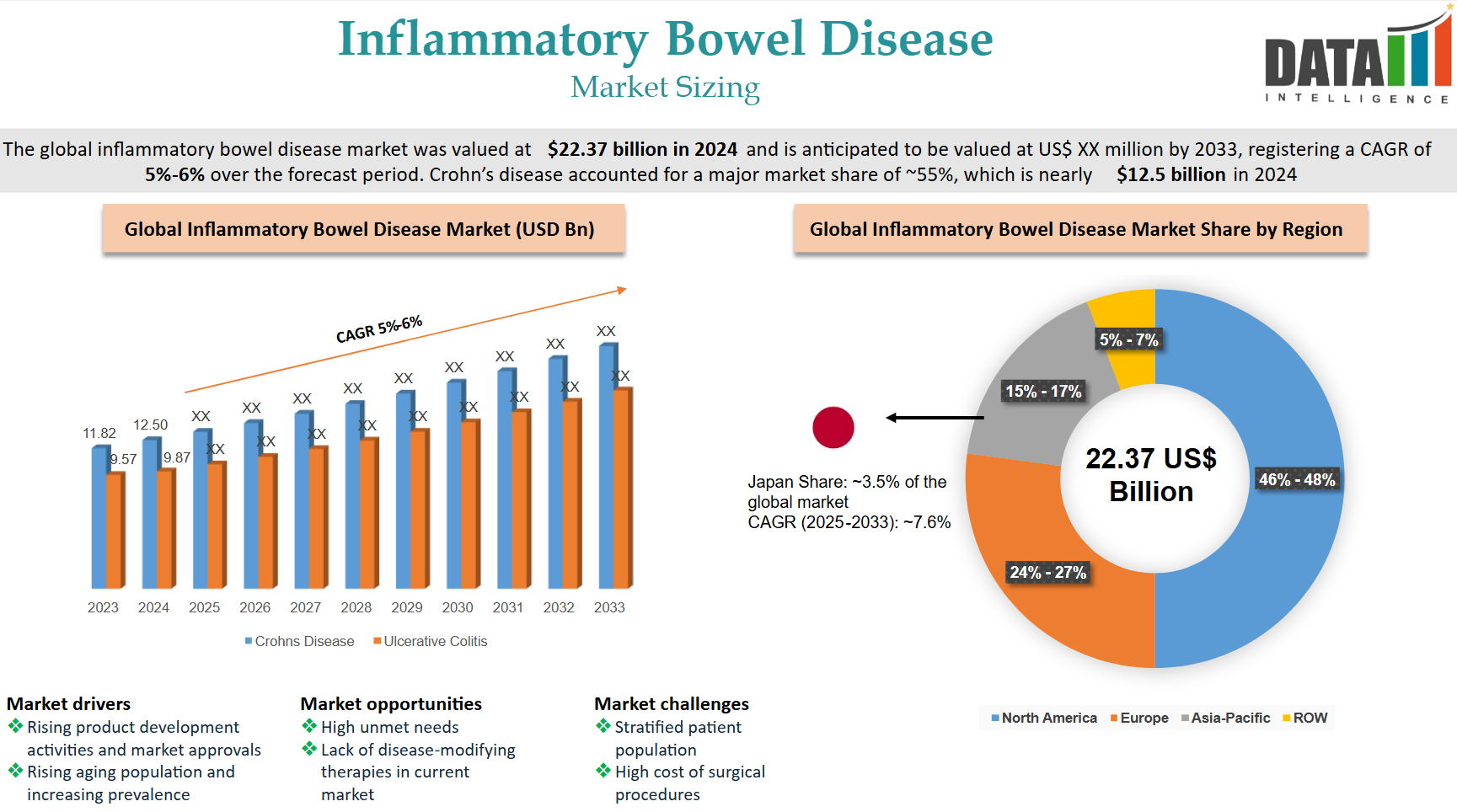

Market Size & Forecasting

The Age-Related Macular Degeneration (AMD) therapeutics market was valued at ~$14.24 billion in 2024 and is anticipated to be valued at US$ XX Bn by 2032, registering a CAGR of ~6-8% over the forecast period.

Unmet Needs

Despite advancements in IBD therapies, several gaps remain in treatment options, patient outcomes, and disease management.

Below are some key unmet needs in IBD care:

| Unmet Need | Challenges | Potential Solutions |

| Disease Modification & Long-Term Remission | Current treatments manage symptoms but do not alter disease progression. | Develop therapies that prevent complications like fibrosis and strictures. |

| More Effective & Safer Therapies | Only 30-40% of patients achieve remission, and many lose response over time. Some treatments have serious side effects. | Improve drug efficacy, reduce immunosuppressive risks, and develop new mechanisms of action. |

| Faster-Acting Treatments | Many drugs take weeks to months to show effects, leaving patients with prolonged symptoms. | Develop rapid-onset therapies for acute disease flares. |

| Personalized & Predictive Treatment | No reliable way to predict which drug will work best for each patient. | Use biomarkers and precision medicine approaches to tailor treatments. |

| Treatment for Fibrosis & Strictures | No FDA-approved drugs specifically target fibrosis and strictures in Crohn’s disease. | Research antifibrotic drugs to prevent complications and reduce the need for surgery. |

| Better Non-Invasive Monitoring | Colonoscopies are invasive, expensive, and inconvenient for regular monitoring. | Develop more reliable stool, blood, and imaging-based monitoring tools. |

| Management of Extraintestinal Manifestations | Many IBD patients suffer from joint, skin, and eye inflammation, which current drugs do not effectively treat. | Develop therapies that address both intestinal and systemic symptoms. |

| Mental Health & Quality of Life | High rates of anxiety and depression among IBD patients, but mental health care is often overlooked. | Integrate psychological support into IBD treatment plans. |

| Cost & Access to Treatment | Biologic drugs are expensive, and insurance barriers delay treatment access. | Improve affordability, reduce insurance restrictions, and expand biosimilar availability. |

| Pediatric & Elderly Treatment Gaps | Many clinical trials exclude children and older adults, leading to limited data on safe treatment. | Conduct more research to optimize therapies for these populations. |

Competitive Landscape and Market Positioning

The inflammatory bowel disease (IBD) market is highly competitive, with numerous pharmaceutical companies investing in innovative therapies to address unmet medical needs. The market includes biologics, small molecules, and emerging therapies, with companies competing based on efficacy, safety, cost, and patient convenience.

Competitive Positioning of Key Players

| Company | Key IBD Products | Competitive Strengths | Challenges |

| AbbVie | Humira (Adalimumab), Rinvoq (Upadacitinib), Skyrizi (Risankizumab) | Stronghold in the TNF inhibitor and IL-23 markets; expanding oral therapy portfolio. | Loss of Humira patent exclusivity to biosimilars. |

| Janssen (J&J) | Remicade (Infliximab), Stelara (Ustekinumab), Tremfya (Guselkumab) | Diversified IBD portfolio with IL-12/23 and IL-23 inhibitors. | Competition from biosimilars and newer targeted therapies. |

| Takeda | Entyvio (Vedolizumab) | Gut-selective mechanism reduces side effects, strong brand reputation. | Facing competition from new biologics and biosimilars. |

| Pfizer | Xeljanz (Tofacitinib) | First JAK inhibitor approved for UC; oral administration is a key advantage. | FDA safety warnings limit usage. |

| Eli Lilly | Omvoh (Mirikizumab) | IL-23p19 inhibitor with promising efficacy. | Competing against established IL-23 drugs like Skyrizi and Tremfya. |

| Bristol-Myers Squibb | Zeposia (Ozanimod) | First approved S1P modulator for UC, offering an oral alternative to biologics. | Competes with JAK inhibitors and has a slower onset of action. |

| Teva & Sanofi | Duvakitug (Anti-TL1A) | Novel mechanism targeting TL1A; strong potential in biologic-refractory patients. | It is still in clinical trials; approval is expected in 2028. |

Target Opportunity Profile (TOP) & Benchmarking

A Target Opportunity Profile (TOP) in the inflammatory bowel disease (IBD) market identifies ideal drug characteristics based on unmet needs, competitive gaps, and market dynamics. The goal is to define what an ideal new therapy should offer to maximize market potential.

| Key Attribute | Ideal Target Profile | Current Gaps |

| Efficacy | High induction and sustained remission rates (>50-60%) | Most biologics achieve remission in only ~30-40% of patients |

| Safety | Low risk of infections, malignancies, and cardiovascular events | Immunosuppressants and JAK inhibitors have safety concerns |

| Onset of Action | Rapid symptom relief within 1-2 weeks | Many therapies take 6-12 weeks for noticeable improvement |

| Durability of Response | Long-term maintenance of remission without loss of response | Anti-TNFs and JAK inhibitors lose efficacy over time |

| Administration Route | Oral or long-acting injection for convenience | Many therapies require frequent infusions or injections |

| Target Mechanism | Novel mechanisms beyond TNF, IL-12/23, and JAK pathways | Limited options for patients failing current biologics |

| Non-Invasive Monitoring | Biomarker-based tracking instead of colonoscopy | Current monitoring relies on invasive procedures |

| Combination Therapy Potential | Safe to combine with existing therapies | Drug interactions and immunosuppression risks |

| Cost & Accessibility | Competitive pricing and insurance coverage | Biologics and newer small molecules remain expensive |

This benchmarking analysis compares existing treatments and pipeline drugs against the ideal TOP criteria.

| Drug Class | Example Drugs | Efficacy | Safety | Onset | Convenience | Novel Mechanism |

| Anti-TNF Biologics | Adalimumab, Infliximab | Moderate | Moderate | Slow | Injection/IV | No |

| IL-12/23 Inhibitors | Ustekinumab | High | High | Moderate | Injection | No |

| IL-23 Inhibitors | Risankizumab, Guselkumab | High | High | Moderate | Injection | Partial |

| Integrin Inhibitors | Vedolizumab | Moderate | High | Slow | IV | No |

| JAK Inhibitors | Tofacitinib, Upadacitinib | High | Moderate (infection, thrombosis risk) | Fast | Oral | No |

| S1P Modulators | Ozanimod, Etrasimod | Moderate | Moderate | Slow | Oral | Yes |

| Anti-TL1A Therapies (Emerging) | Duvakitug (Teva/Sanofi) | Expected High | Expected High | Moderate | Injection | Yes |

| Microbiome-Based Therapies (Emerging) | SER-287, VE303 | Unknown | Expected High | Slow | Oral | Yes |

| Gene Therapies & Cell-Based Therapies (Future) | Under Research | Unknown | Unknown | Unknown | Unknown | Yes |

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

2. Make Data-Driven Decisions

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

3. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

4. Optimize R&D and Clinical Development

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

5. Enhance Market Access & Pricing Strategy

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

- Ensure smooth market entry and optimize pricing strategies for better adoption. your needs!

6. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

7. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.