Disease Overview:

Immune Thrombocytopenia (ITP) is an autoimmune condition in which the immune system mistakenly destroys platelets, resulting in a low platelet count and an increased risk of bleeding. It may occur on its own (primary) or alongside other conditions (secondary). ITP can be acute or chronic and often presents with easy bruising or prolonged bleeding. Treatment aims to raise platelet levels and reduce immune system attacks.

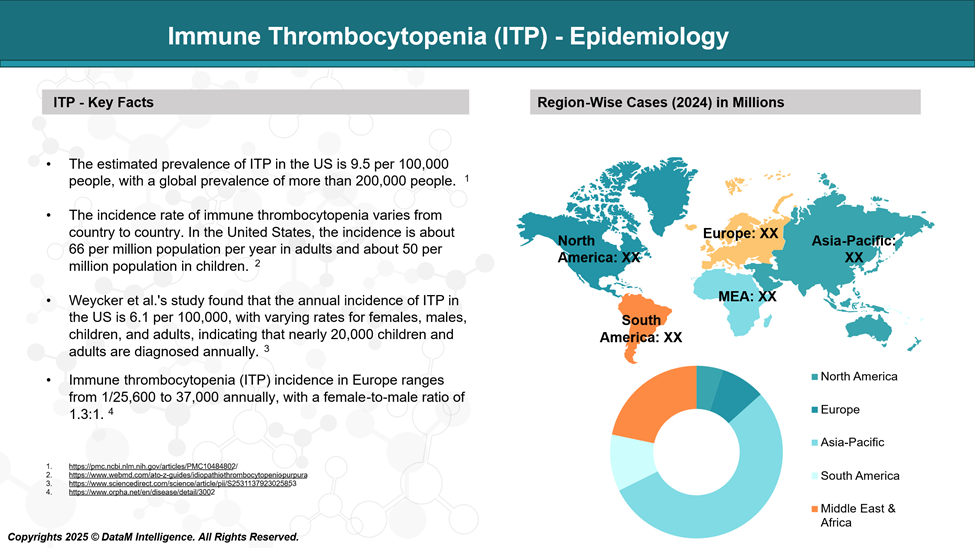

Epidemiology Analysis (Current & Forecast)

ITP is a rare condition, with an estimated annual incidence of about 2 to 5 cases per 100,000 individuals.

It can affect people of any age, but it is more commonly acute and short-lived in children, while it is often chronic in adults. Women under age 50 are slightly more affected than men. The likelihood of developing ITP tends to increase with age, especially in older adults.

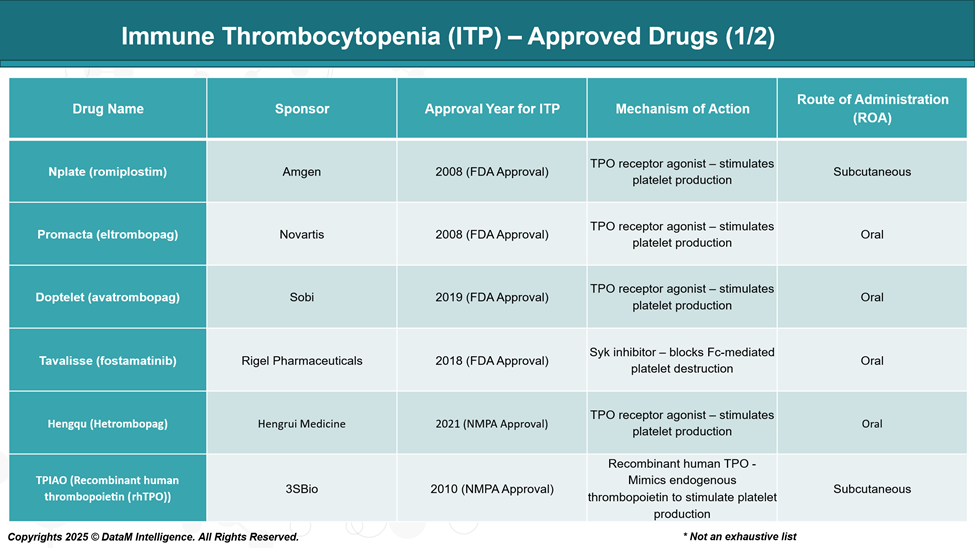

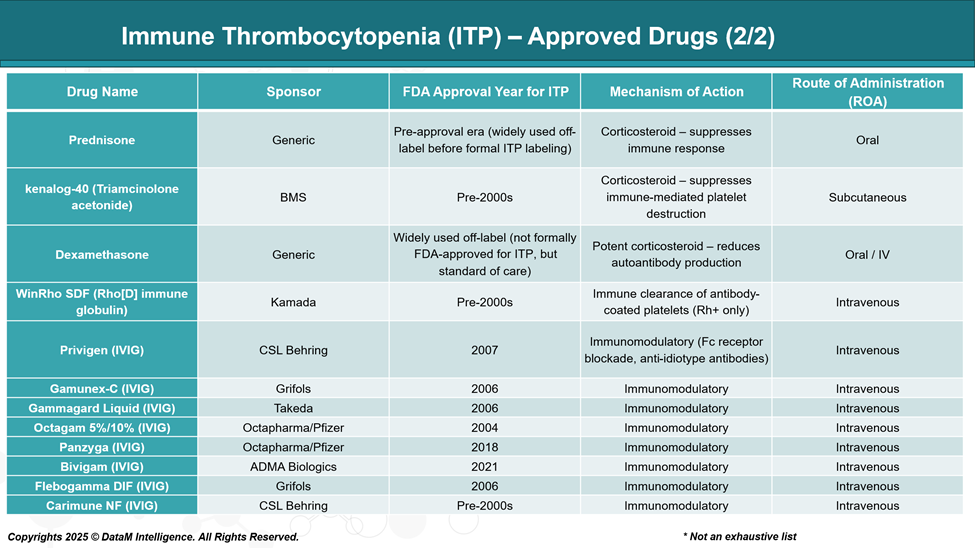

Approved Drugs - Sales & Forecast

Treatment decisions are based on platelet count, bleeding symptoms, and patient-specific factors. First-line therapy typically involves corticosteroids, intravenous immunoglobulin (IVIG), or anti-D immunoglobulin.

In patients who relapse or do not respond adequately, second-line treatments include thrombopoietin receptor agonists (TPO-RAs), SYK inhibitors, and B-cell depleting agents.

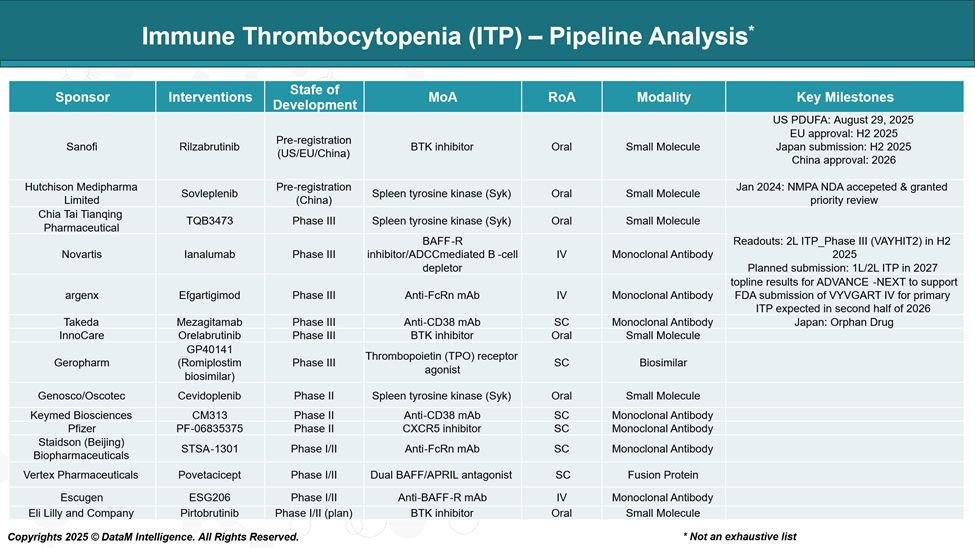

Pipeline Analysis and Expected Approval Timelines

The ITP therapeutic landscape is rapidly evolving, with a strong pipeline of investigational drugs exploring novel mechanisms of action.

These include inhibitors of spleen tyrosine kinase (SYK), Bruton’s tyrosine kinase (BTK), and neonatal Fc receptors (FcRn), as well as monoclonal antibodies targeting B cells, plasma cells, or immune-modulating pathways.

Several candidates are in late-stage clinical development and show promise in addressing unmet clinical needs such as steroid-refractory disease, long-term remission, and improved safety profiles.

Competitive Landscape and Market Positioning

The ITP market is witnessing increased competition from both established global players and emerging regional innovators, particularly in China. While TPO receptor agonists remain the cornerstone, newer therapies aim to offer immune modulation, oral convenience, or cost disruption (via biosimilars).

Here's how the companies are positioned:

Company | Drug | Mechanism | Stage/Region | Strategic Focus | Competitive Position |

Novartis | Eltrombopag, Ianalumab | TPO-RA, BAFF-R mAb | Approved/ Phase III (Global) | Market leader in TPO-RA + B-cell modulation | Strong global share; expanding into immune-targeted therapies |

Sanofi | Rilzabrutinib | BTK inhibitor | Pre-registration (US/EU/China) | Oral immune modulator | Late-stage challenger; potential 2L+ standard |

argenx | Efgartigimod | FcRn inhibitor | Phase III (Global) | IgG autoantibody removal | Precision biologic for refractory ITP |

Takeda | Mezagitamab | Anti-CD38 mAb | Phase III | Plasma cell targeting | Unique approach; less crowded mechanism |

Rigel | Fostamatinib | SYK inhibitor | Approved (US) | First-in-class immunotherapy | Moderate use in refractory ITP, facing competition |

Amgen | Romiplostim | TPO-RA | Approved (Global) | SC TPO agonist | First-in-class; injectable route is a limitation |

Sobi | Avatrombopag | TPO-RA | Approved (US, China) | Oral TPO-RA | Growing global use due to the safety profile |

Jiangsu Hengrui | Hetrombopag | TPO-RA | Approved (China) | Domestic innovation | Competes with global TPOs locally |

3SBio | TPIAO (rhTPO) | Recombinant TPO | Approved (China) | First-generation biologic | Widely adopted in China; limited global presence |

HUTCHMED | Sovleplenib | SYK inhibitor | Pre-registration (China) | SYK-targeted therapy | Domestic alternative to Fostamatinib |

Chia Tai Tianqing | TQB3473 | BTK inhibitor | Phase III (China) | Oral BTK competitor | Competing with Sanofi’s BTK in China |

InnoCare Pharma | Orelabrutinib | BTK inhibitor | Phase III (China) | BTK innovation in Asia | Strong local pipeline; competing regionally |

Geropharm | GP40141 (biosimilar) | Romiplostim biosimilar | Phase III | Cost-disruptive biosimilar | May challenge Amgen in price-sensitive markets |

Roche | Rituximab (off-label) | Anti-CD20 mAb | Off-label | B-cell depletion | Off-label use: benchmark for B-cell targeting |

IVIG/Anti-D Providers | Multiple (Grifols, Octapharma, etc.) | Immunoglobulins | Approved (Global) | Acute treatment standard | Short-term relief, not a long-term solution |

Key Companies

Target Opportunity Profile (TOP)

Here's a Target Product Profile (TPP) or Opportunity Profile for emerging drugs in Immune Thrombocytopenia (ITP). This outlines the ideal attributes a new therapy should demonstrate to outperform current approved options and become competitive in the treatment landscape:

Target Opportunity Profile for Emerging ITP Therapies

Attribute | Current Standard (Benchmark) | Opportunity / Ideal Profile for Emerging Drugs |

Efficacy | - Platelet response rate ~40–70% (TPO-RAs) | ≥70–80% durable response Long-term remission potential |

Safety / Tolerability | - TPO-RAs: risk of thrombosis, liver enzyme elevation | Minimal immunosuppression |

Mechanism of Action (MoA) | - TPO stimulation (TPO-RAs) | Novel MoA targeting autoimmune root causes |

Route of Administration (RoA) | - Oral (Eltrombopag, Avatrombopag, Fostamatinib) | Convenient oral or subcutaneous route |

Dosing Frequency | - Daily (oral) | Once-daily or better (e.g., weekly oral or SC) |

Modality | - Small molecules (BTK, SYK inhibitors, TPO-RAs) | Oral small molecule OR |

Immunomodulation | - Limited targeting (e.g., B-cells or SYK/BTK only) | Dual immune modulation (B- and plasma cells, FcRn, BAFF) |

Patient Segmentation | - Many agents used in 2L+ (refractory patients) | Safe and effective across age groups |

Drug Interactions / Monitoring | - Eltrombopag: food/calcium interactions | No dietary or drug restrictions |

Innovation Level | - Mostly incremental (new TPOs, repurposed kinase inhibitors) | First-in-class or best-in-class innovation |

Differentiation | - Many drugs share MoA (TPO-RAs, BTK inhibitors) | Unique MoA or synergy with existing agents |

Cost / Access | - Biosimilars emerging (Romiplostim), branded TPOs expensive | Competitive pricing OR superior value proposition |

Strategic Summary: What Will Win in ITP?

A game-changing ITP drug would ideally:

- Act faster, last longer, and have less toxicity than TPO-RAs.

- Offer novel immune resetting, not just symptomatic platelet boosting.

- Be oral or SC, low-burden, and easily combined with other agents.

- Address refractory or frontline use, with broad patient applicability.

- Carry first-in-class IP or clear clinical superiority to justify premium.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: