Disease Overview:

Geographic atrophy (GA) is a late-stage form of dry age-related macular degeneration marked by the gradual breakdown of cells in the macula, leading to central vision loss. It involves the thinning and loss of the retinal pigment epithelium, photoreceptors, and supporting tissues. GA typically progresses over time and may affect both eyes.

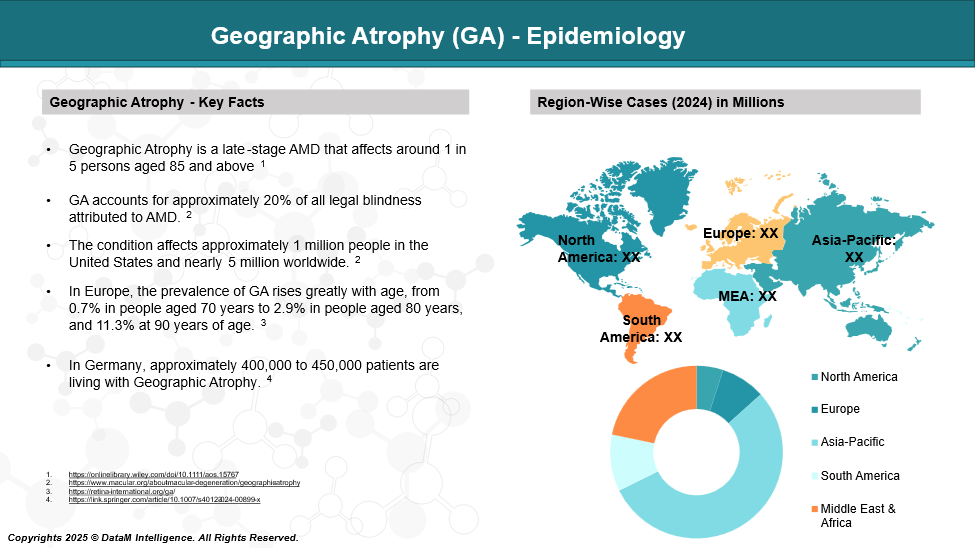

Epidemiology Analysis (Current & Forecast)

Geographic atrophy (GA), an advanced form of age-related macular degeneration, affects approximately 5 million people globally and 1 million in the United States. Its prevalence increases sharply with age, particularly in individuals over 75 years old.

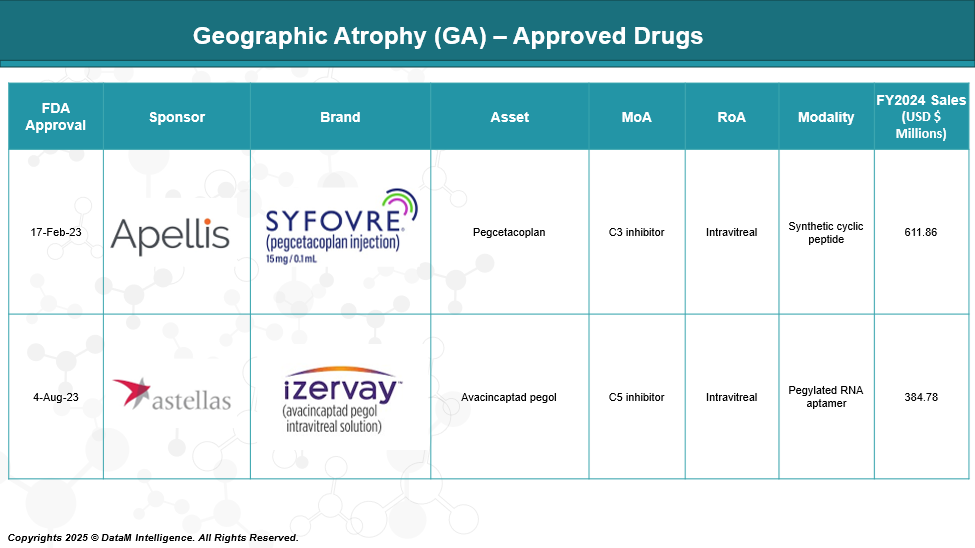

Approved Drugs - Sales & Forecast

As of May 2025, only two FDA-approved drugs are available to treat geographic atrophy: Syfovre (pegcetacoplan), a complement C3 inhibitor, and Izervay (avacincaptad pegol), a complement C5 inhibitor. Both are intravitreal injections that slow GA progression.

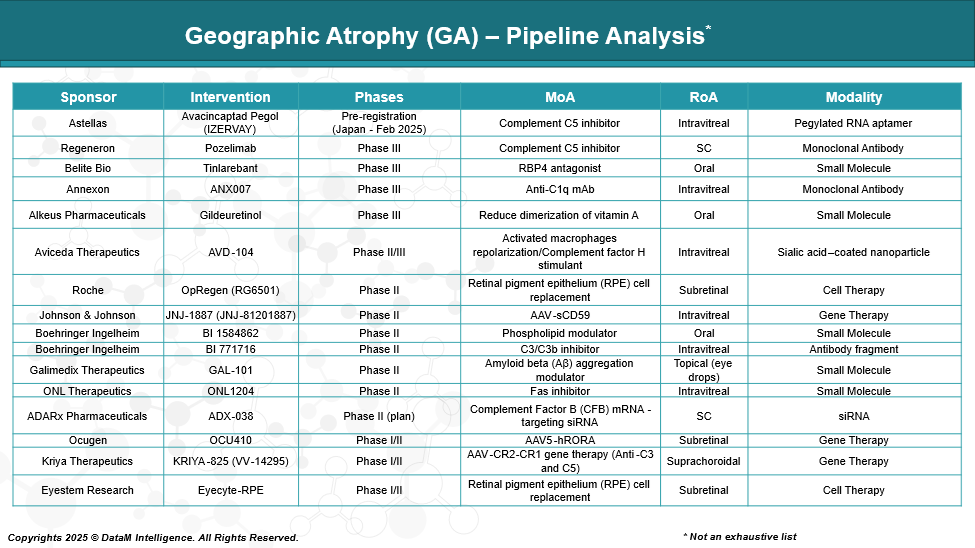

Pipeline Analysis and Expected Approval Timelines

As of May 2025, the therapeutic pipeline for geographic atrophy (GA) is robust, encompassing various modalities aimed at slowing disease progression and preserving vision. Here's an overview of key investigational therapies across different classes:

Competitive Landscape and Market Positioning

The current GA market is led by Syfovre and Izervay, but faces growing competition from diversified Phase III pipelines.

Regeneron’s pozelimab is the most immediate threat due to its similar mechanism and corporate muscle, while oral therapies like Tinlarebant and Gildeuretinol could shift patient preference toward non-invasive treatments. Novel mechanisms (e.g., ANX007, AVD-104, cell therapy, and gene therapy) add depth and may reshape long-term market dynamics.

Company | Drug | Stage | Mechanism | Delivery | Key Differentiator | Competitive Position |

Apellis | Syfovre (pegcetacoplan) | Approved (US) | C3 inhibitor | Intravitreal | First-to-market, broad complement inhibition | Market leader with early advantage; under safety watch |

Astellas | Izervay (avacincaptad pegol) | Approved (US); Pre-registration (Japan) | C5 inhibitor | Intravitreal | Safer C5 targeting; global expansion planned | Strong competitor to Syfovre |

Regeneron | Pozelimab | Phase III | C5 inhibitor | Intravitreal | Leverages Regeneron’s strong retina franchise | High threat due to scale and experience |

Belite Bio | Tinlarebant | Phase III | RBP4 inhibitor (vitamin A pathway) | Oral | Non-invasive, daily oral tablet | Moderate threat; ideal for patients avoiding injections |

Annexon | ANX007 | Phase III | C1q inhibitor | Intravitreal | Neuroprotective and anti-inflammatory | Unique MOA; appealing for early intervention |

Alkeus | Gildeuretinol | Phase III | Deuterated vitamin A analog | Oral | Targets retinal stress; oral administration | Moderate potential with systemic delivery |

Aviceda | AVD-104 | Phase II/III | Siglec-targeted nanoparticle | Intravitreal | Immunomodulatory + anti-inflammatory action | Differentiated MOA; in early pivotal testing |

Roche | OpRegen (RG6501) | Phase II | RPE cell replacement therapy | Subretinal | Regenerative cell therapy approach | Long-term potential; invasive delivery limits scale |

Johnson & Johnson | JNJ-1887 (JNJ-81201887) | Phase II | AAV-sCD59 gene therapy | Intravitreal | Sustained complement inhibition via gene delivery | Early gene therapy with durable effect potential |

Summary Insights

- The market is evolving from complement inhibitors to oral, regenerative, and gene-based approaches.

- Syfovre and Izervay dominate for now, but face growing pressure from:

- Convenience-focused oral drugs (Tinlarebant, Gildeuretinol)

- Differentiated MOA candidates (ANX007, AVD-104)

- Transformative platforms like cell therapy (OpRegen) and gene therapy (JNJ-1887).

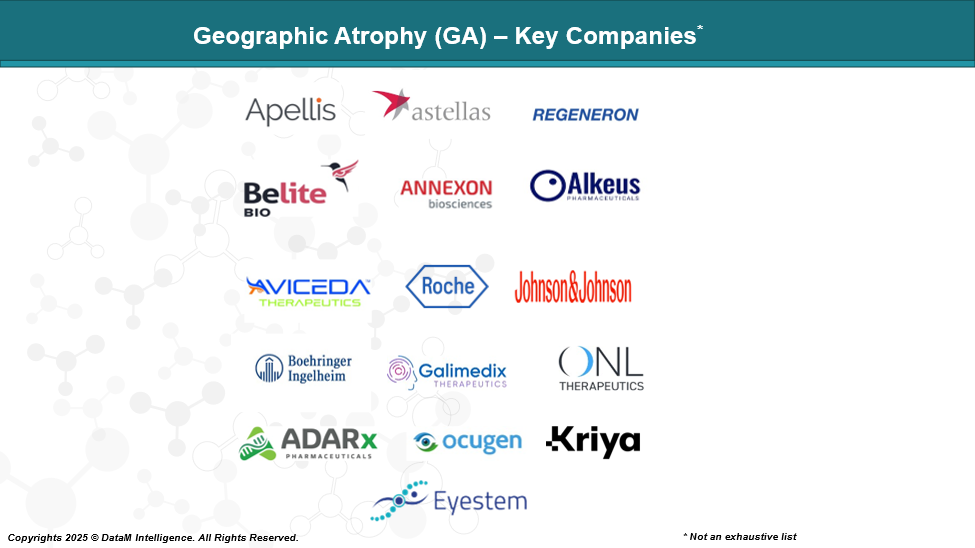

Key Companies:

Target Opportunity Profile (TOP)

To compete effectively against approved drugs like Syfovre (pegcetacoplan) and Izervay (avacincaptad pegol) in the geographic atrophy (GA) market, emerging therapies must demonstrate a superior Target Opportunity Profile (TOP) across several critical dimensions:

Target Opportunity Profile (TOP) – Competitive Attributes

Dimension | Desired Profile for Emerging Therapies | Rationale |

Safety | ●Lower risk of intraocular inflammation, vasculitis, or retinal detachment | Safety concerns (esp. with Syfovre) remain a barrier to uptake and long-term adherence |

Efficacy | ● Greater reduction in lesion growth | Approved drugs slow lesion progression but do not improve vision |

Mechanism of Action (MOA) | ● Novel or upstream complement targets (e.g., C1q) | Innovative MOAs may address non-responders and expand treatment to broader populations |

Route of Administration (ROA) | ● Oral or sustained delivery (gene, cell, implant) | Monthly/bi-monthly intravitreal injections are burdensome and limit compliance |

Dosing Frequency | ● Quarterly or less (ideally single administration: gene/cell therapy) | Reduces clinic visits, enhances real-world feasibility |

Modality | ● Gene therapy (AAV, RNAi) | Disruptive modalities can enable disease-modifying or one-time treatments |

Durability | ● Multi-month effect per dose or permanent benefit (for gene/cell therapies) | Addresses chronic nature of GA while reducing treatment burden |

Innovation Level | ● First-in-class or best-in-class mechanism | Payers and physicians favor drugs with clear mechanistic differentiation |

Visual Function Impact | ● Demonstrated benefit on reading speed, contrast sensitivity, or central vision retention | Current approvals focus only on anatomical (lesion) slowing; functional endpoints are unmet |

Patient Population Targeting | ● Broader applicability: earlier-stage GA, bilateral GA, non-foveal lesions | May capture untreated segments where current therapies are not yet approved |

Strategic Summary

To compete with Syfovre and Izervay, emerging GA therapies must go beyond slowing lesion growth and demonstrate functional vision benefits (e.g., reading speed, central vision). A superior safety profile is crucial, particularly given concerns about inflammation with existing drugs.

Less burdensome delivery methods (such as oral, long-acting, or gene therapy) will enhance real-world adoption. Mechanistic innovation (e.g., C1q, RBP4, or cell/gene therapy) can differentiate products and reach broader or earlier-stage GA populations. Success will depend on combining efficacy, safety, convenience, and innovation to reshape treatment expectations.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: