Disease Overview:

Frontotemporal dementia (FTD) is a progressive neurological condition that primarily impacts the frontal and temporal regions of the brain, areas crucial for managing language, personality, and behavior. The disorder presents in diverse ways, and its course can differ widely between individuals.

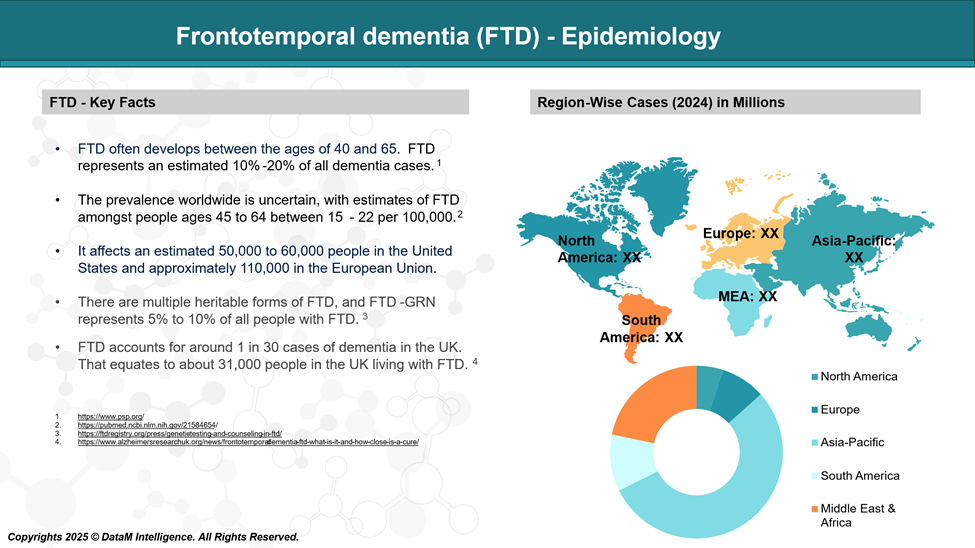

Epidemiology Analysis (Current & Forecast)

Frontotemporal dementia (FTD) is a rare form of dementia, estimated to make up fewer than 1 in 30 diagnosed cases. The condition usually starts to show symptoms in individuals between 45 and 64 years of age, though it can also develop in people outside this age range.

Approved Drugs - Sales & Forecast

Currently, there is no known cure for frontotemporal dementia, and no therapies have been proven to halt or slow its progression, but there are medications that can help manage some of the symptoms.

Antidepressants: Selective serotonin reuptake inhibitors (SSRIs) may be useful in managing symptoms such as reduced inhibition, compulsive behavior, and excessive eating, which can occur in some individuals.

Antipsychotics: These medications are generally used sparingly but may be considered if SSRIs prove ineffective. In such cases, they can help manage severe behavioral issues that pose a risk to the person with dementia or others around them.

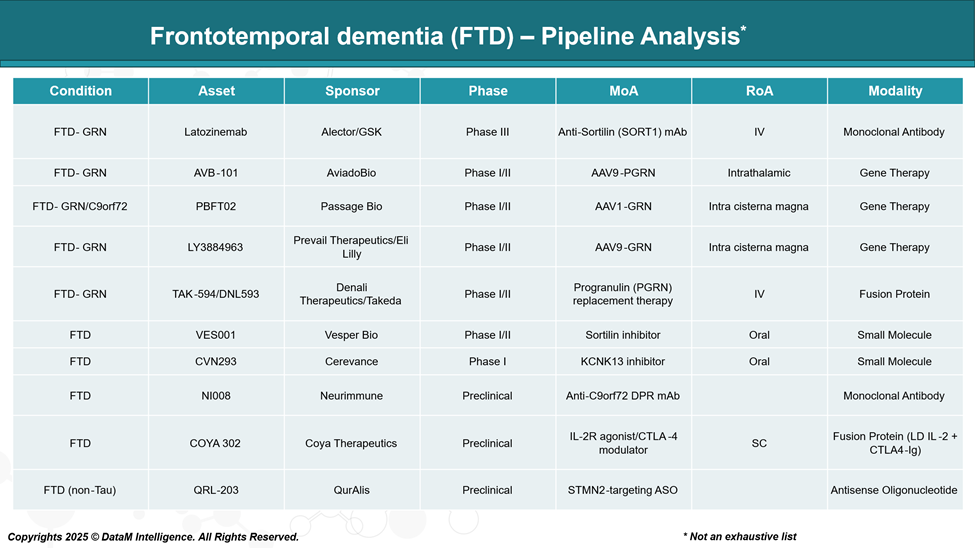

Pipeline Analysis and Expected Approval Timelines

The FTD pipeline is gaining momentum, especially in genetically defined subtypes. Antisense oligonucleotides, gene therapies, and monoclonal antibodies are leading innovations. Several key Phase II and III trials are expected to read out in the next 2–3 years, which could reshape the treatment landscape.

Competitive Landscape and Market Positioning

The FTD treatment landscape, especially for GRN-linked subtypes, is rapidly evolving. Alector/GSK currently leads the field with Latozinemab, while AAV-based gene therapies from AviadoBio and Passage Bio are gaining traction. Meanwhile, Denali and Lilly are positioning themselves to compete via differentiated delivery platforms and modalities. As genetic testing becomes standard in dementia care, these therapies will likely anchor personalized treatment paradigms in FTD.

Company | Lead FTD Program | Target | Modality | Strategic Position |

Alector | Latozinemab (AL001) | GRN | Monoclonal antibody | Phase III, frontrunner in GRN FTD |

AviadoBio | AVB-101 | GRN | AAV-based gene therapy | New entrant, focused CNS delivery |

Passage Bio | PBFT02 | GRN / C9orf72 | AAV9-based gene therapy | GRN dual-indication, early clinical |

Lilly | LY3884963 | GRN | Monoclonal antibody | Competing directly with AL001 |

Denali / Takeda | TAK-594 (DNL593) | GRN | BBB-penetrant small molecule | Novel delivery mechanism, oral potential |

Strategic Takeaways

Latozinemab (AL001):

- Market Leader in the GRN space with a pivotal Phase III trial ongoing

- Strong IP position, orphan designation, and potential for first approval

Gene Therapy Entrants:

- AviadoBio and Passage Bio are focusing on long-lasting AAV-based solutions

- Delivery route differentiation (intracisternal vs. intrathalamic) matters for safety and efficacy

Oral Alternatives:

- Denali’s TAK-594/DNL593 could offer a first-in-class oral GRN enhancer, a major advantage in chronic treatment settings

- A non-invasive option may support broader adoption and long-term adherence

Market Entry Timeline (GRN-Related Therapies)

Year | Expected Entries (if successful) |

2026–2027 | Latozinemab (Alector) |

2027–2028 | PBFT02 (Passage Bio), AVB-101 (AviadoBio) |

2028+ | LY3884963 (Lilly), TAK-594 (Denali/Takeda) |

Key Companies:

Target Opportunity Profile (TOP)

To effectively treat Frontotemporal Dementia (FTD) and successfully enter the market, emerging therapies must address a well-defined Target Opportunity Profile (TOP) that reflects clinical, regulatory, payer, and patient expectations.

Target Opportunity Profile for FTD Therapies

Attribute | Ideal Characteristics for Market Entry & Clinical Impact | Rationale |

Mechanism of Action (MoA) | Disease-modifying (e.g., ↑progranulin, ↓pathogenic tau, reduce TDP-43 toxicity, silence C9orf72 repeats) | Current treatments are only symptomatic; effective MoAs must directly address the underlying pathology |

Efficacy | - Delays cognitive/functional decline | Regulators and clinicians need a measurable impact on disease progression and QoL |

Safety & Tolerability | - Favorable safety in long-term use | Patients are younger, active, and may be more sensitive to adverse effects |

Modality | - Biologics (e.g., mAbs, ASOs) | Flexibility across delivery and durability; matches to genetic subtype or pathology |

Route of Administration (RoA) | - Preferred: Oral or IV | Ease of use is critical for chronic, progressive disease, especially given cognitive decline |

Onset & Duration | - Onset: within 6–12 months | Stakeholders will expect measurable benefits within 1 year to justify the cost and risk |

Patient Stratification | - Genetic (MAPT, GRN, C9orf72) or biomarker-based targeting | Precision medicine improves trial success and payer acceptance |

Innovation | - First-in-class or best-in-class profile | Demonstrates leadership and differentiation in a crowded or high-risk field |

Commercial Viability | - Competitive pricing for rare/orphan drug | Market access and payer adoption depend on clear value proposition |

Regulatory Strategy | - Orphan drug designation | Accelerates development and de-risks investment |

Unmet Need Alignment | - Covers behavioral variant FTD (bvFTD) and/or PPA subtypes | Must address broad clinical impact and real-world disease burden |

What the Ideal FTD Therapy Looks Like (Composite Profile)

- MoA: Enhances progranulin in GRN patients or silences toxic C9orf72 repeats (disease-targeted)

- Efficacy: Demonstrates statistically significant slowing of atrophy and cognitive/functional decline

- Modality: AAV9 gene therapy or BBB-penetrant oral small molecule

- Safety: Well-tolerated in long-term trials with minimal CNS-related adverse events

- RoA: Monthly IV infusion or one-time intrathecal for gene therapy

- Market Fit: Orphan pricing with real-world evidence to support cost-effectiveness

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: