Disease Overview:

Duchenne muscular dystrophy (DMD) is a serious and progressive condition characterized by muscle degeneration and weakening over time. As the disease advances, individuals experience increasing difficulty with mobility, often requiring ventilatory support and facing a significantly shortened lifespan.

DMD is caused by mutations in the DMD gene, which leads to a complete absence of dystrophin—a crucial protein that helps maintain muscle integrity. Without dystrophin, muscle fibers become more vulnerable to damage, leading to continuous muscle loss, reduced physical function, and complications such as cardiomyopathy.

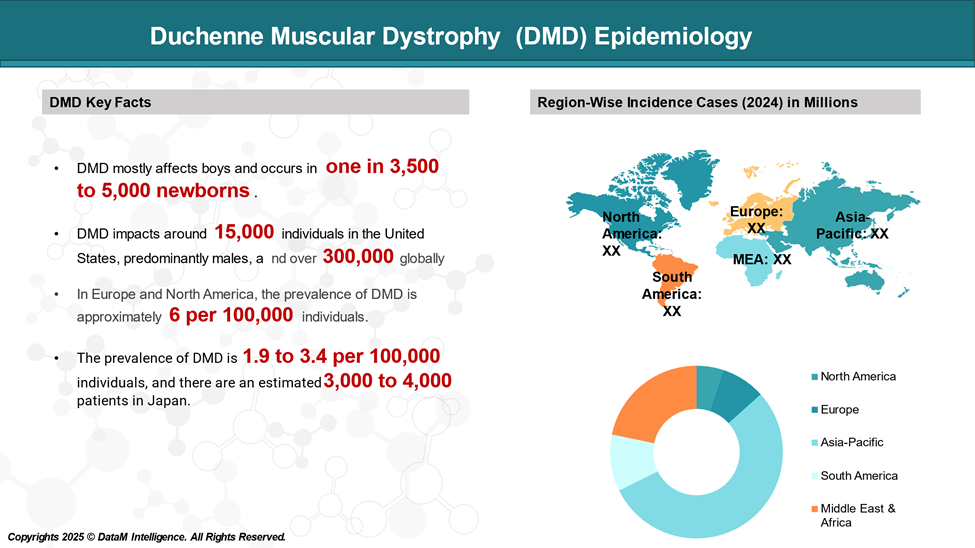

Epidemiology Analysis (Current & Forecast)

DMD is the most common form of muscular dystrophy with a reported global incidence of 1 in 3500 to 1 in 5000 live male births.

Affected children usually present with gait disturbance, including gross motor delay and/or functional motor decline by the age of 5 years, becoming wheelchair dependent by on average 13 years of age.

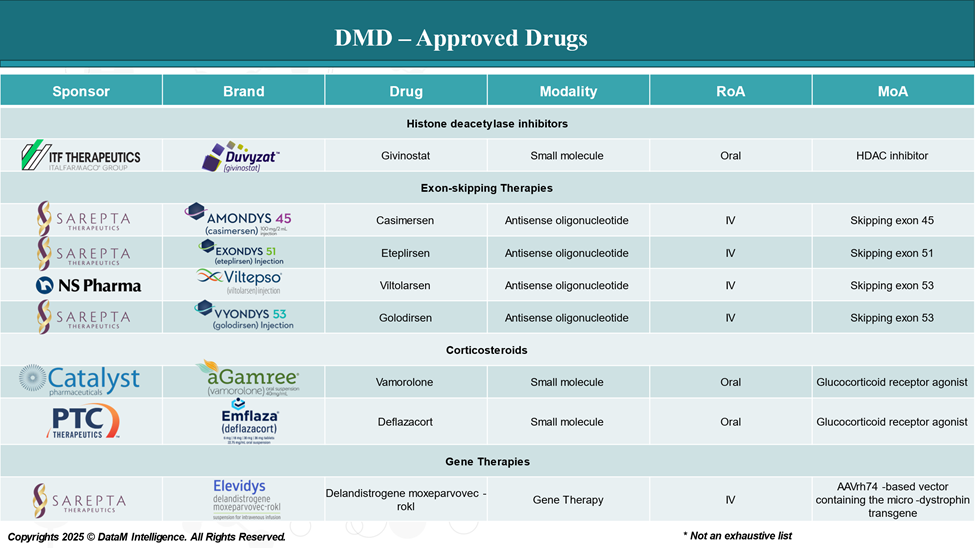

Approved Drugs (Current SoC) - Sales & Forecast

Although there is no cure for Duchenne muscular dystrophy, several therapies have been approved to slow disease progression and manage symptoms. These treatments aim to either restore dystrophin production or reduce inflammation and muscle damage.

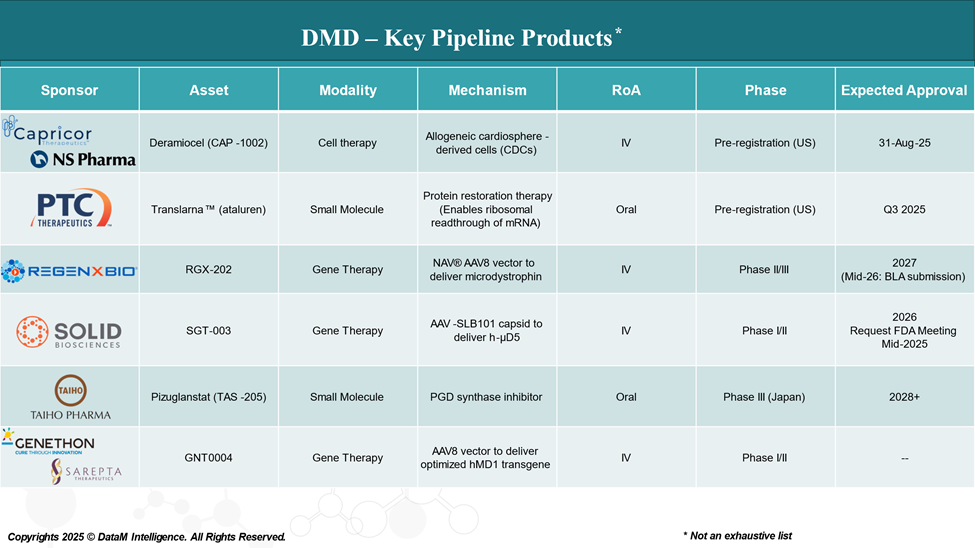

Pipeline Analysis and Expected Approval Timelines

The therapeutic pipeline for DMD is rapidly evolving, with a growing focus on disease-modifying treatments aimed at correcting the underlying genetic defect, enhancing muscle repair, and improving quality of life.

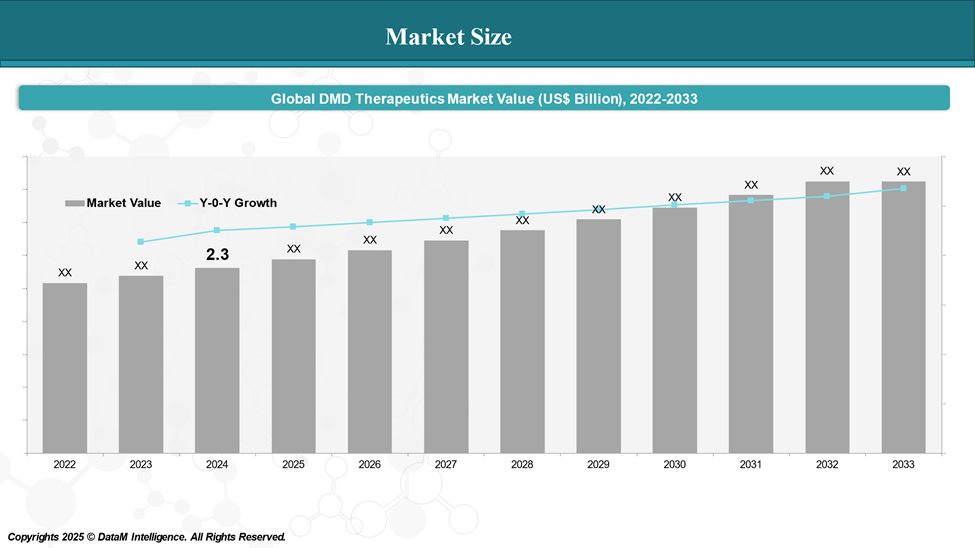

Market Size & Forecasting

In 2024, the global DMD Therapeutics market was valued at approximately US$ 2.3 billion, with a rise to US$ XX billion in 2033, reflecting a compound annual growth rate of XX%.

Unmet Needs

| Unmet Need | Description |

| Universal Cure | Current treatments are mutation-specific. A lasting, mutation-independent cure (e.g., CRISPR) is still in development. |

| Non-Ambulatory Patient Options | Most approved therapies target younger, ambulatory patients. Older or non-ambulatory individuals have limited options. |

| Early Diagnosis | Delayed diagnosis prevents timely intervention. Newborn screening and early detection tools are needed. |

| Cognitive & Behavioral Support | Cognitive and behavioral issues in DMD are often overlooked. Few therapies address brain-related symptoms. |

| Long-Term Data on Therapies | Limited long-term safety and efficacy data for new gene and exon-skipping therapies. Need for real-world evidence and monitoring. |

| Global Access & Affordability | High treatment costs and unequal access to care limit availability in low-income regions and uninsured populations. |

| Multidisciplinary Care Access | Many patients lack access to coordinated care across neurology, cardiology, respiratory therapy, physical rehab, and mental health. |

Competitive Landscape and Market Positioning

The DMD therapeutic landscape is rapidly expanding, with both established pharmaceutical companies and innovative biotech startups competing to deliver life-changing treatments.

Market Positioning Highlights

| Positioning Factor | Insights |

| First-Mover Advantage | Sarepta leads with the first gene therapy approved (Elevidys) and a robust exon-skipping portfolio. |

| Innovation Leadership | Companies like Wave and Solid Biosciences are exploring next-gen platforms (stereopure oligos, muscle-targeted vectors). |

| Regulatory Progress | Sarepta and NS Pharma have secured multiple FDA approvals; Pfizer trails closely in gene therapy trials. |

| Patient Segment Focus | Current gene therapies target early-stage ambulatory boys. There's an unmet opportunity in older and non-ambulatory groups. |

| Therapeutic Breadth | Santhera’s vamorolone positions as a safer steroid alternative, targeting a broader patient population. |

| Global Reach | NS Pharma and Santhera have strong positioning in both U.S. and non-U.S. markets (e.g., Japan, Europe). |

Emerging Market Trends

- Personalized Medicine: Custom exon-skipping therapies tailored to individual mutations are expanding the market.

- CRISPR & Gene Editing: Though early, companies are investigating genome editing as the next leap toward a cure.

- Consolidation & Partnerships: Increasing collaborations (e.g., Roche & Sarepta) signal a maturing, high-stakes market.

- Access Challenges: High therapy costs may affect commercial uptake and favor companies offering scalable, cost-effective solutions.

Key Companies:

Target Opportunity Profile (TOP)

The ideal clinical target opportunity in DMD would be a mutation-agnostic, systemic therapy (e.g., next-gen gene therapy or gene editing) that is safe for pediatric patients, improves dystrophin expression, and delivers sustained functional benefits with minimal toxicity and single-dose efficacy.

| Category | Ideal Target Profile |

| Mechanism of Action |

|

| Route of Administration |

|

| Safety Profile |

|

| Clinical Efficacy Endpoints |

|

| Duration of Effect |

|

| Patient Eligibility |

|

| Trial Design Goals |

|

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

2. Make Data-Driven Decisions

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

3. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

4. Optimize R&D and Clinical Development

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

5. Enhance Market Access & Pricing Strategy

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

- Ensure smooth market entry and optimize pricing strategies for better adoption. your needs!

6. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

7. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.