Disease Overview:

Dermatomyositis is an inflammatory muscle disease that involves both muscle and skin damage. Symptoms and clinical signs can differ greatly among individuals, as each case may present with unique features.

The exact cause is unknown, but it involves an autoimmune response where the immune system attacks the body’s own muscle and skin tissues. It may be triggered by infections, medications, or malignancies in some cases.

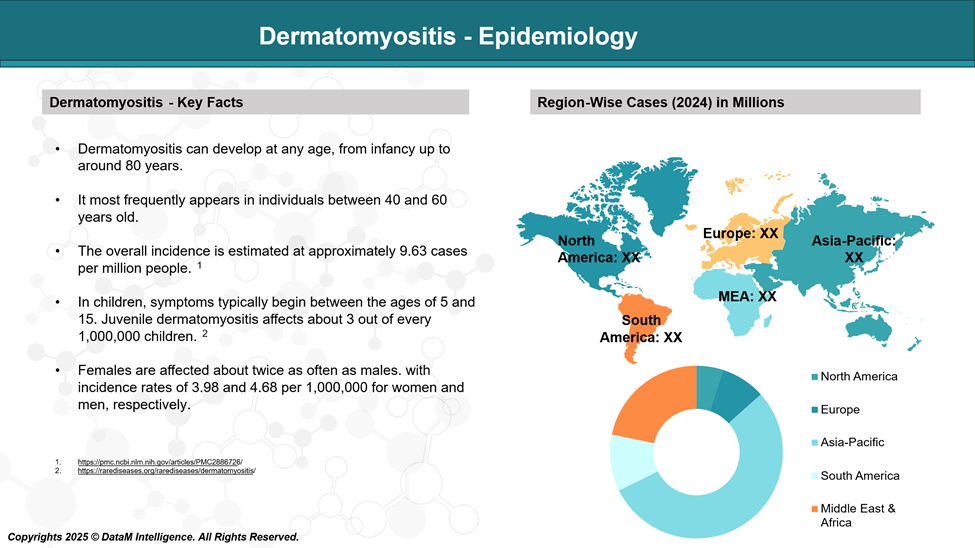

Epidemiology Analysis (Current & Forecast)

A recent study conducted in the United States found that dermatomyositis has an incidence of 1.4 cases and a prevalence of 5.8 cases per 100,000 individuals, with a higher occurrence in females and greater prevalence among older adults.

Approved Drugs - Sales & Forecast

As of now, the only FDA-approved drug specifically indicated for dermatomyositis (DM) is:

Octagam 10% (Immune Globulin Intravenous [Human])

Indication: Approved by the FDA in July 2021 for the treatment of adult dermatomyositis.

Use: For patients with muscle weakness and inflammation related to DM, especially when other immunosuppressive therapies are not effective or suitable.

Mechanism: Modulates immune system activity by providing pooled IgG antibodies.

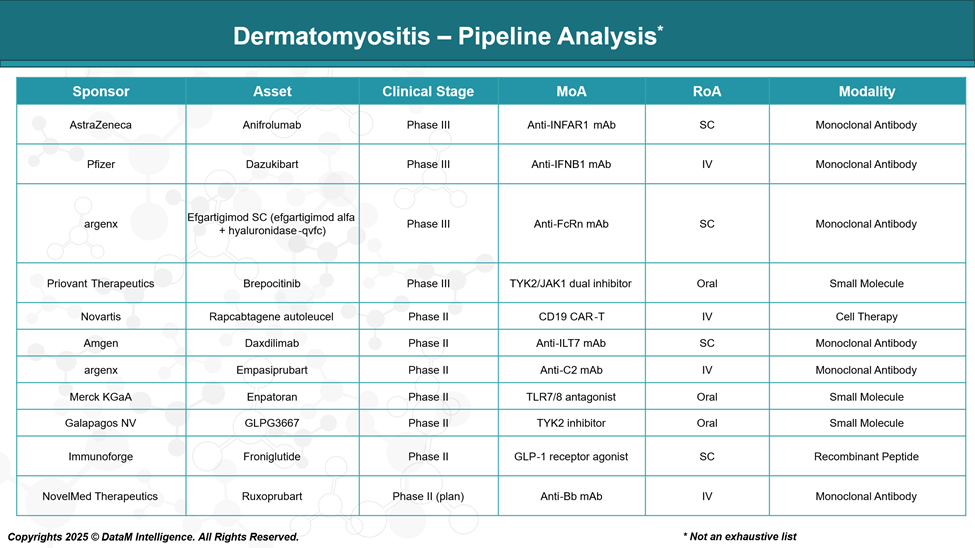

Pipeline Analysis and Expected Approval Timelines

The therapeutic landscape for dermatomyositis (DM) is expanding, with numerous investigational drugs in various stages of clinical development. Below is an overview of key candidates currently in the pipeline:

Competitive Landscape and Market Positioning

Drug (Phase) | Company | Target & Modality | Route | Approval Status | Market Positioning / Insights |

Octagam 10% (Approved) | Pfizer / Octapharma | IVIG (Immune modulation) | IV | FDA Approved (adult DM) | Only FDA-approved drug; standard of care for refractory dermatomyositis |

Anifrolumab (Phase III) | AstraZeneca | Anti-IFNAR1 Monoclonal Antibody | SC | Phase III | Targets the interferon pathway; potential for SC convenience vs IVIG |

Dazukibart (Phase III) | Pfizer | Anti-IFNB1 Monoclonal Antibody | IV | Phase III | Focuses on interferon beta blockade; direct competitor to Octagam |

Efgartigimod SC (Phase III) | argenx | Anti-FcRn Monoclonal Antibody | SC | Phase III | FcRn blockade reduces pathogenic antibodies; SC route for ease of use |

Brepocitinib (Phase III) | Priovant Therapeutics | TYK2/JAK1 Dual Inhibitor (Small Molecule) | Oral | Phase III | Oral administration offers improved patient convenience |

Rapcabtagene autoleucel (Phase II) | Novartis | CD19 CAR-T Cell Therapy | IV | Phase II | Novel cell therapy approach; potential for refractory or severe cases |

Daxdilimab (Phase II) | Amgen | Anti-ILT7 Monoclonal Antibody | SC | Phase II | Novel immune checkpoint target; SC administration |

Empasiprubart (Phase II) | argenx | Anti-C2 Monoclonal Antibody | IV | Phase II | Complement pathway inhibition; IV administration |

Enpatoran (Phase II) | Merck KGaA | TLR7/8 Antagonist (Small Molecule) | Oral | Phase II | Oral small molecule; targets innate immune activation |

Strategic Insights

- Route of administration plays a crucial role in patient preference and adherence, with oral and subcutaneous routes favored over intravenous.

- Emerging therapies focus on precise immunomodulation targeting interferon pathways, FcRn, and JAK/STAT signaling, representing a shift from broad immune suppression.

- Biologics dominate the late-stage pipeline, but small molecules like Brepocitinib and Enpatoran offer oral convenience.

- Cell therapy (CAR-T) remains an innovative option for difficult-to-treat or refractory patients but faces commercial and logistical challenges.

- As the only approved drug, Octagam currently holds the market leadership, but late-stage candidates have the potential to disrupt treatment paradigms, especially with novel mechanisms and better administration routes.

Key Companies:

Target Opportunity Profile (TOP)

To compete with and potentially displace Octagam 10%, currently the only FDA-approved therapy for adult dermatomyositis, emerging therapies must demonstrate clear advantages across multiple target opportunity dimensions. Here's a Target Opportunity Profile summarizing the attributes that new drugs must outperform to gain market traction:

Target Opportunity Profile for Emerging Dermatomyositis Therapies

Attribute | Benchmark (Octagam 10%) | Opportunity for Emerging Drugs |

Mechanism of Action (MoA) | Polyclonal immune modulation (non-specific) | Targeted immunomodulation (e.g., JAK/STAT, IFN, FcRn, complement) to improve precision and reduce off-target effects |

Efficacy | Moderate; effective in steroid-refractory cases | Must demonstrate superior or comparable efficacy in muscle strength, skin involvement, and steroid-sparing potential |

Safety Profile | Generally well tolerated, but risk of thromboembolism, aseptic meningitis, hemolysis | Improved safety with fewer infusion-related or thrombotic events; lower immunogenicity |

Route of Administration (RoA) | Intravenous (IV), requires infusion center visits | Preferably oral or subcutaneous for home-based treatment and better adherence |

Dosing Frequency | Every 3–4 weeks (IV) | Less frequent or more convenient dosing (e.g., weekly SC, daily oral) |

Modality | Biologic (IVIG; pooled human IgG) | Innovative modalities such as small molecules, targeted monoclonal antibodies, CAR-T cells |

Onset of Action | Variable (typically weeks) | Faster onset (e.g., JAK inhibitors show activity within weeks) |

Durability of Response | Modest; ongoing treatment is often required | Longer-lasting effects with potential for disease modification |

Innovation Level | Traditional, non-specific immunotherapy | First-in-class or best-in-class mechanistic novelty (e.g., ILT7, FcRn, IFNAR1) |

Convenience & Compliance | Low (infusion-based) | High (oral or SC self-administration, low monitoring burden) |

Steroid-Sparing Effect | Moderate | Must demonstrate significant steroid dose reduction or elimination |

Differentiation Potential | Limited | High if targeting unique patient subgroups (e.g., seropositive, refractory, juvenile DM) |

Biomarker Integration | Absent | Use of predictive biomarkers to personalize therapy and monitor response |

Key Takeaways

Emerging therapies will need to show clear advantages in one or more of the following to beat Octagam:

- Precision (targeted MoA) with fewer side effects

- Convenience (oral/SC vs IV) and home-based administration

- Stronger efficacy (muscle, skin, systemic) and faster action

- Innovation in mechanism or modality (e.g., FcRn, JAKi, ILT7, CAR-T)

- Durable, steroid-sparing response with minimal monitoring

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: