1. Disease Overview:

- Atopic dermatitis (eczema) is a chronic disease that causes inflammation, redness, and skin irritation.

- Atopic dermatitis is not contagious and cannot be spread from person to person.

- It is estimated that 1-2% of people will develop persistent postoperative corneal oedema.

- AD is a common condition that causes itchy, dry, and inflamed skin. It usually begins in childhood but can start at any age.

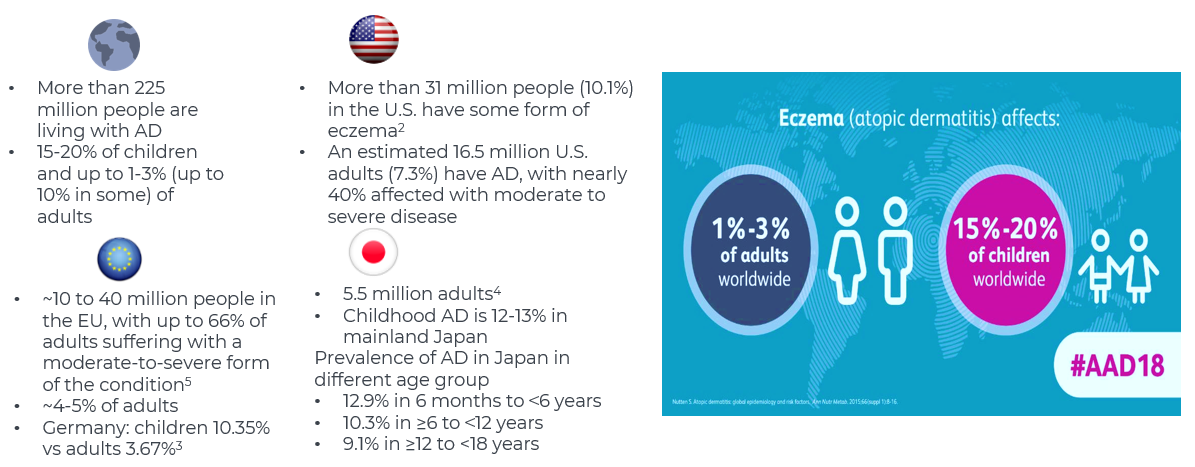

2. Epidemiology Analysis (Current & Forecast)

- The prevalence of atopic dermatitis is high, affecting up to 15-20% of children and up to 1-3% (up to 10% in some) of adults.

- The burden of disease ranks 15th worldwide for non-fatal diseases and number one for skin diseases, measured in disability-adjusted lifeyears (DALYs)

- Onset of disease is most common by 5 years of age, and early diagnosis and treatment are essential to avoid complications of AD and improve quality of life

3. Approved Drugs (Current SoC) - Sales & Forecast

Atopic dermatitis (AD) is a chronic inflammatory skin condition characterized by itching, redness, and skin barrier dysfunction. Treatment varies by severity, with topical therapies for mild cases and systemic biologics or JAK inhibitors for moderate-to-severe AD.

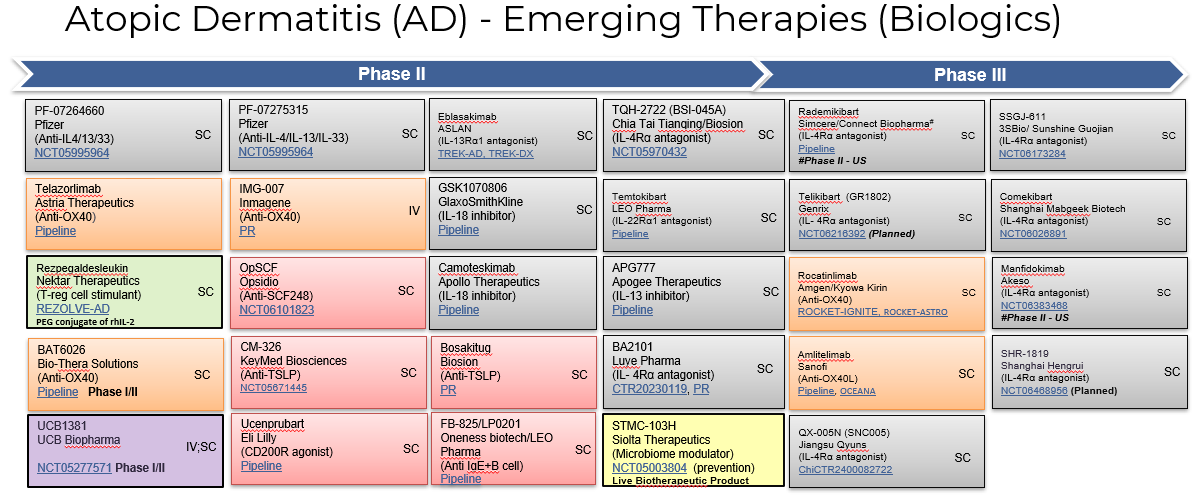

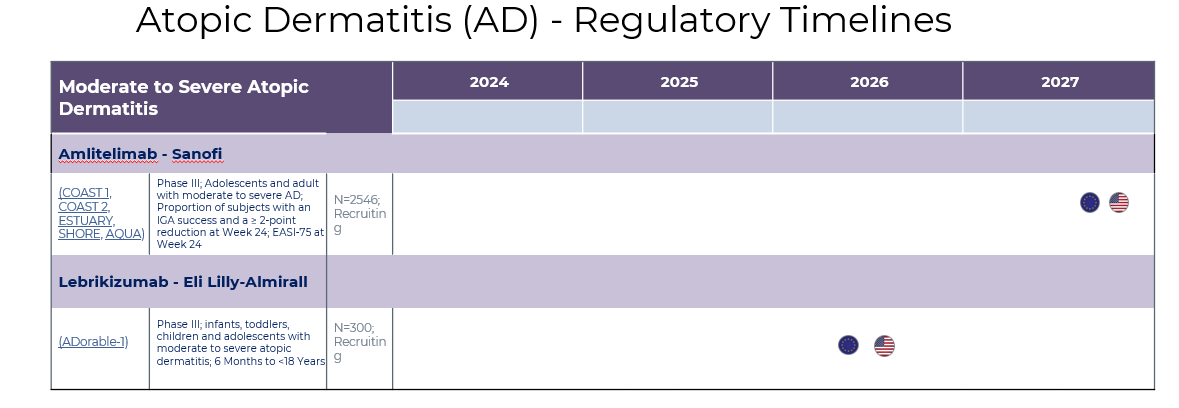

4. Pipeline Analysis and Expected Approval Timelines

The treatment landscape for atopic dermatitis (AD) is rapidly evolving, with several promising therapies in the pipeline.

5. Market Size & Forecasting

The atopic dermatitis market was valued at ~$16.2 billion in 2024 and is anticipated to be valued at US$ XX Bn by 2033, registering a CAGR of ~10-11% over the forecast period.

Unmet Needs

Despite recent advancements, significant gaps remain in the treatment of atopic dermatitis (AD), particularly for moderate-to-severe cases. Addressing these unmet needs is crucial for better patient outcomes and improving quality of life.

Below are key gaps in current therapeutic approaches:

- Therapies that provide lasting immune modulation with fewer relapses.

- Treatments with rapid itch relief and quick skin clearance (within days).

- Less frequent dosing (quarterly or annual treatments).

- Broader targeting of inflammatory pathways (e.g., IL-31, OX40, PDE4).

- More personalized treatment selection based on biomarkers.

- Systemic therapies with fewer long-term risks.

- Steroid-free options with better efficacy & tolerability.

- Topicals for moderate-to-severe AD to delay systemic therapy initiation.

6. Competitive Landscape and Market Positioning

The AD market is highly competitive, with a mix of biologics, JAK inhibitors, and emerging therapies. Companies are positioning their drugs based on efficacy, safety, speed of action, and convenience to gain market share.

| Segment | Drug (Brand Name) | Company | MoA | Market Positioning | Key Advantages | Challenges |

| Market Leader | Dupixent (Dupilumab) | Sanofi/Regeneron | IL-4 & IL-13 Inhibitor | Gold standard biologic | Broad efficacy, well-established safety, multiple indications | High cost, emerging competition from IL-13 inhibitors |

| Biologics (IL-13 & IL-31 Inhibitors) | Adbry (Tralokinumab) | LEO Pharma | IL-13 Inhibitor | Alternative to Dupixent | More selective IL-13 targeting | Competes directly with Dupixent, slower uptake |

| Lebrikizumab | Eli Lilly | IL-13 Inhibitor | Dupixent competitor (pending FDA approval) | Potentially improved efficacy & convenience | Regulatory delay in US, strong competition from Dupixent | |

| Nemolizumab | Galderma | IL-31 Inhibitor | First-in-class pruritus-focused biologic | Targets severe itch, different MOA | Limited data vs. IL-4/IL-13 inhibitors | |

| JAK Inhibitors (Oral & Topical) | Rinvoq (Upadacitinib) | AbbVie | JAK1 Inhibitor | Oral alternative to biologics | Fast symptom relief, effective for severe AD | Black box warning (safety concerns) |

| Cibinqo (Abrocitinib) | Pfizer | JAK1 Inhibitor | Competes with Rinvoq | Similar efficacy, rapid onset | Safety warnings, physician hesitation | |

| Opzelura (Ruxolitinib, topical) | Incyte | JAK1/JAK2 Inhibitor | First topical JAK inhibitor | Effective for mild/moderate AD | Safety concerns limit long-term use | |

| Next-Gen & Emerging Therapies | Rocatinlimab (AMG 451) | Amgen/Kyowa Kirin | OX40 Inhibitor | Potential disease-modifying biologic | Targets long-term immune modulation | Longer clinical development timeline (2026-2027) |

| Tapinarof (VTAMA, topical) | Dermavant/Organon | AhR Agonist | Steroid-free topical for mild/moderate AD | Non-immunosuppressive, safe for long-term use | Limited data in severe AD | |

| Roflumilast Cream 0.15% | Arcutis Biotherapeutics | PDE4 Inhibitor | Alternative to topical steroids | Better tolerability, low systemic absorption |

7. Target Opportunity Profile (TOP) & Benchmarking

The ideal AD therapy should address efficacy, safety, convenience, and affordability while filling unmet needs. Below is a framework for evaluating emerging therapies:

| Criteria | Current Standard (Dupixent, JAKs) | Unmet Need (TOP Target) |

| Efficacy | 50-75% EASI-75 response | ≥80% EASI-75 response |

| Onset of Action | 4-8 weeks for biologics; JAKs work faster (1-2 weeks) | Fast onset (<2 weeks) for all therapies |

| Long-Term Control | Biologics require chronic use | Disease-modifying potential (remission after stopping treatment) |

| Safety Profile | Biologics: good safety; JAKs: black box warnings | Lower risk, no immunosuppression |

| Convenience | Injections (biologics), daily pills (JAKs) | Less frequent dosing (monthly/quarterly) |

| Pruritus Relief | Moderate itch relief | Rapid, significant itch relief |

| Patient Access | High cost ($30K+/year), insurance barriers | Lower-cost alternatives, biosimilars |

Key companies

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

2. Make Data-Driven Decisions

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

3. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

4. Optimize R&D and Clinical Development

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

5. Enhance Market Access & Pricing Strategy

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

- Ensure smooth market entry and optimize pricing strategies for better adoption. your needs!

6. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

7. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.