Disease Overview:

Ankylosing Spondylitis (AS) is a chronic, inflammatory autoimmune disease that primarily affects the spine and sacroiliac joints (where the spine meets the pelvis). It belongs to a group of disorders known as spondyloarthropathies.

Key Features:

Chronic back pain and stiffness, especially in the lower back and hips, that worsens with rest and improves with activity.

Leads to progressive spinal fusion (ankylosis), resulting in reduced flexibility and, in severe cases, a hunched-forward posture.

Inflammation in other areas, including the eyes (uveitis), joints (peripheral arthritis), and entheses (sites where tendons or ligaments attach to bone).

Causes and Risk Factors:

Strongly associated with the HLA-B27 gene, although not all carriers develop AS.

Commonly starts in late adolescence or early adulthood, with a higher prevalence in males.

Diagnosis:

Based on clinical symptoms, physical examination, imaging (X-rays, MRI), and genetic testing for HLA-B27.

Treatment:

Includes NSAIDs, biologic DMARDs (like TNF inhibitors and IL-17 inhibitors), and physical therapy to reduce inflammation, preserve mobility, and manage pain.

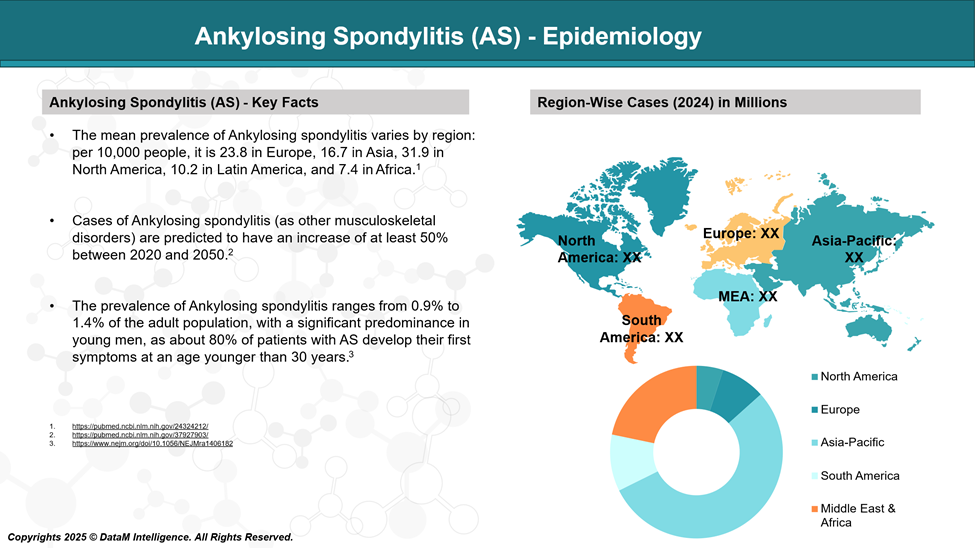

Epidemiology Analysis (Current & Forecast)

Ankylosing Spondylitis affects a significant portion of the population worldwide, with notable variations across regions and ethnicities due to genetic predisposition, especially the HLA-B27 gene.

Global Prevalence

The global prevalence of AS is estimated to be 0.9% to 1.4% of the population.

Higher prevalence is in populations with a higher frequency of HLA-B27, such as:

Northern Europeans: Up to 1% prevalence.

North Americans: ~0.2% to 0.5%.

African Americans and Japanese: Lower prevalence (<0.1%).

By Region

Europe: ~0.2% to 1.2%, depending on country.

Asia: ~0.2% to 0.4%, higher in China and India compared to Japan.

Africa: Rare, due to low HLA-B27 frequency.

India: Estimated prevalence is around 0.1–0.2%, with increasing recognition due to better diagnostic awareness.

Age of Onset

Most patients develop symptoms between the ages of 15 and 30.

Rarely begins after age 45.

Sex Distribution

AS is more common in males (male-to-female ratio ~2:1 to 3:1).

In females, the disease may be underdiagnosed or present with milder symptoms and more peripheral joint involvement.

Genetic Factor

Up to 90–95% of AS patients test positive for the HLA-B27 gene.

However, only a small proportion of HLA-B27-positive individuals develop AS.

Burden

AS significantly impacts quality of life, especially in young adults, and leads to long-term disability if not treated early.

Associated with increased healthcare utilization and economic burden, primarily due to loss of productivity and long-term treatment needs.

Approved Drugs - Sales & Forecast

Approved therapies for Ankylosing Spondylitis (AS) have expanded significantly beyond NSAIDs to include advanced biologics and oral small molecules. TNF inhibitors were the first targeted biologics to transform AS treatment, followed by IL-17 inhibitors for patients with inadequate response. Recently, JAK inhibitors have emerged as oral options. Biosimilars and generics have improved global access and affordability.

Non-Biologic Anti-Inflammatories (NSAIDs)

Approved NSAIDs (First-line treatment)

Drug | Mechanism | Form | Availability |

Naproxen, Ibuprofen, Diclofenac, Indomethacin | COX-1/COX-2 inhibition →prostaglandin synthesis | Oral/injectable | Widely available as generics globally |

NSAIDs are the initial therapy for symptom control. Long-term use requires GI, renal, and CV monitoring.

TNF Inhibitors

Drug | Type | Original Brand | Sponsor | Biosimilars/Generics |

Etanercept | Fusion protein | Enbrel | Amgen / Pfizer | Erelzi (Sandoz), Etacept (India), Nepexto (Mylan), others |

Infliximab | Chimeric mAb | Remicade | Janssen | Inflectra (Celltrion/Pfizer), Renflexis (Samsung Bioepis), Avsola (Amgen), Ixifi |

Adalimumab | Fully human mAb | Humira | AbbVie | Amgevita (Amgen), Hyrimoz (Sandoz), Hadlima (Samsung), Abrilada (Pfizer), Exemptia (Zydus – India), many others |

Golimumab | Fully human mAb | Simponi | Janssen | No biosimilars yet approved |

Certolizumab pegol | Pegylated Fab' fragment | Cimzia | UCB | No biosimilars yet approved |

TNF inhibitors are a cornerstone for moderate to severe AS, especially when NSAIDs fail.

IL-17 Inhibitors

Drug | Type | Brand | Sponsor | Biosimilars/Pipeline |

Secukinumab | Anti-IL-17A mAb | Cosentyx | Novartis | CT-P55 (Celltrion – in pipeline), CHS-201 (Coherus – pipeline) |

Ixekizumab | Anti-IL-17A mAb | Taltz | Eli Lilly | No biosimilars yet |

Bimekizumab | Dual IL-17A/F mAb | Bimzelx | UCB | Approved in EU/UK/Canada; biosimilars in early R&D |

IL-17 inhibitors are preferred for patients who do not respond to or tolerate TNF inhibitors.

JAK Inhibitors (Oral Small Molecules)

Drug | Mechanism | Brand | Sponsor | Biosimilars/Generics |

Upadacitinib | JAK1 selective | Rinvoq | AbbVie | No biosimilars yet |

Tofacitinib | JAK1/3 | Xeljanz | Pfizer | Generics are available in India and other countries |

JAK inhibitors offer an oral alternative but carry the risk of infections, thrombosis, etc.

Summary by Drug Class

Class | Examples | Biosimilars/Generics |

NSAIDs | Naproxen, Diclofenac | Generic available |

TNF Inhibitors | Adalimumab, Etanercept, Infliximab | Extensive biosimilar availability |

IL-17 Inhibitors | Secukinumab, Ixekizumab | Pipeline biosimilars only |

JAK Inhibitors | Upadacitinib, Tofacitinib | Generics (Tofacitinib in India); others pending |

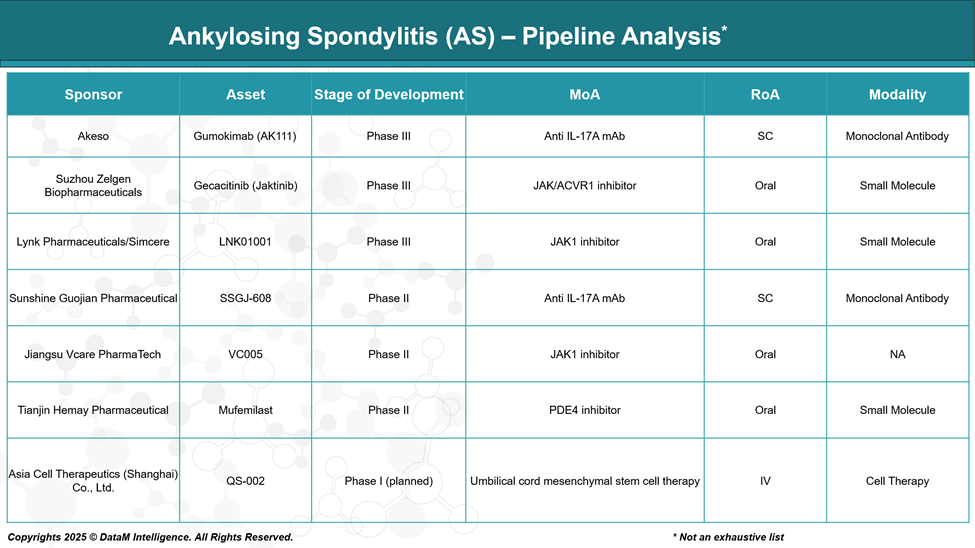

Pipeline Analysis and Expected Approval Timelines

The pipeline for Ankylosing Spondylitis (AS) is evolving beyond traditional TNF and IL-17 inhibitors, with a growing focus on oral small molecules, dual-targeting agents, and novel biologics. Emerging therapies from China, such as JAK inhibitors, IL-17A monoclonal antibodies, PDE4 modulators, and even cell therapies, are advancing through clinical stages with promising potential.

These candidates aim to improve convenience, broaden access, and address unmet needs like disease progression and safety. As global and regional markets shift, these pipeline innovations may reshape the AS treatment landscape over the next 3–5 years.

Akeso – Gumokimab (AK111)

Phase: Phase III

Mechanism: Anti-IL-17A monoclonal antibody

Type: Biologic

Overview:

Designed to mimic secukinumab (Cosentyx), Gumokimab targets the pro-inflammatory IL-17A cytokine central to AS pathology.

Strategic Positioning:

May serve as a cost-effective local alternative to Cosentyx in China and Asia.

Could capture TNFi-refractory patients or those preferring biologics over JAKis.

Differentiators:

May differentiate on safety, pricing, and accessibility in public markets.

Could be the first domestic IL-17A mAb approved for AS.

Suzhou Zelgen – Gecacitinib (Jaktinib)

Phase: Phase III

Mechanism: JAK / ACVR1 dual inhibitor

Type: Oral small molecule

Overview:

Jaktinib targets JAK kinases for cytokine inhibition and ACVR1, a BMP/TGF-β pathway protein involved in fibrosis.

Strategic Positioning:

Unique among JAK inhibitors for its anti-fibrotic potential, which could impact spinal ankylosis in AS.

Already being explored in myelofibrosis and other inflammatory conditions.

Differentiators:

If anti-fibrotic effects are confirmed, it may offer disease-modifying potential, not just symptom relief.

Lynk Pharmaceuticals / Simcere – LNK01001

Phase: Phase III

Mechanism: JAK1 selective inhibitor

Type: Oral small molecule

Overview:

Aims to replicate and possibly improve upon the profile of upadacitinib (Rinvoq), a JAK1-selective therapy approved for AS.

Strategic Positioning:

May enter Chinese and Asian markets as a local oral alternative with potentially lower cost.

Differentiators:

If safety data is favorable, it may gain traction among patients avoiding TNF/IL-17 biologics.

Potential for combination with MTX or other immunomodulators.

Sunshine Guojian – SSGJ-608

Phase: Phase II

Mechanism: Anti-IL-17A monoclonal antibody

Type: Biologic

Overview:

Similar to Gumokimab, this biologic blocks IL-17A signaling.

Strategic Positioning:

Still early, but could be positioned as an alternative IL-17 biologic.

Differentiators:

May offer better dosing, administration route, or stability compared to competitors.

Sunshine Guojian has expertise in biosimilars and innovation in mAbs.

Jiangsu Vcare – VC005

Phase: Phase II

Mechanism: JAK1 inhibitor

Type: Oral small molecule

Overview:

A smaller biotech's play in the competitive JAK1 space.

Strategic Positioning:

Will face competition from LNK01001 and global JAKis.

Differentiators:

Success may depend on safety profile, pharmacokinetics, or price-based access in China.

Tianjin Hemay – Mufemilast

Phase: Phase II

Mechanism: PDE4 inhibitor

Type: Oral small molecule

Overview:

Similar to apremilast, Mufemilast inhibits phosphodiesterase 4, reducing pro-inflammatory cytokines.

Strategic Positioning:

Non-immunosuppressive profile could make it attractive for mild-to-moderate AS or for patients avoiding immunosuppression.

Differentiators:

If tolerable and effective, may be used early in treatment, before TNFi or JAKi.

Oral and low-infection risk are key selling points.

Asia Cell Therapeutics – QS-002

Phase: Phase I (planned)

Mechanism: Umbilical cord-derived mesenchymal stem cell (MSC) therapy

Type: Cell therapy

Overview:

A regenerative medicine approach that may offer immune modulation, tissue repair, and anti-inflammatory effects.

Strategic Positioning:

Extremely innovative; potential for refractory cases, or progressive AS with structural damage.

Differentiators:

Unique among the pipeline: not a drug, but living cells aimed at modulating immune response and tissue regeneration.

Will require extensive safety validation.

Competitive Landscape and Market Positioning

Current Market: A Narrow but Groundbreaking Start

Class | Key Drugs | Companies | Strengths | Limitations | Market Positioning |

NSAIDs | Naproxen, Diclofenac, Indomethacin | Generic | Low-cost, rapid symptom relief | Do not halt disease progression, GI/CV side effects | First-line for mild to moderate symptoms |

TNF Inhibitors | Adalimumab (Humira), Etanercept (Enbrel), Infliximab (Remicade), Golimumab, Certolizumab | AbbVie, Amgen, Janssen, UCB | Proven efficacy, long-term data, multiple biosimilars | Infections (esp. TB), parenteral admin, immunogenicity | First-line biologics; widely used; biosimilar-driven access |

IL-17 Inhibitors | Secukinumab (Cosentyx), Ixekizumab (Taltz), Bimekizumab (Bimzelx) | Novartis, Eli Lilly, UCB | Effective for TNF-failures, rapid action, lower TB risk | Injection site reactions, fungal infections, limited long-term data | Second-line biologics; preferred in TNF-intolerant or resistant |

JAK Inhibitors | Upadacitinib (Rinvoq), Tofacitinib (Xeljanz) | AbbVie, Pfizer | Oral route, fast onset, effective in active AS | Risk of serious AEs (e.g., thrombosis), monitoring required | For oral convenience seekers or TNF/IL-17 inadequate responders |

Biosimilars | Adalimumab, Infliximab, Etanercept biosimilars (e.g., Amgevita, Inflectra, Erelzi) | Sandoz, Pfizer, Celltrion, Amgen, etc. | Affordable, widely available, equivalent efficacy | Price competition, limited differentiation | Cost-effective alternatives; strong uptake in Europe, India, LATAM |

Key Positioning Insights

- TNF inhibitors dominate first-line biologic use but are being challenged by biosimilars.

- IL-17 inhibitors are strong in second-line and increasingly preferred due to differentiated safety and efficacy.

- JAK inhibitors bring oral convenience, but uptake may be limited by safety concerns.

- Emerging therapies and biosimilars are intensifying competition, especially in value-driven markets.

Key Companies:

Target Opportunity Profile (TOP)

Here’s a Target Opportunity Profile (TOP) for emerging Ankylosing Spondylitis (AS) therapies outlining the benchmark attributes they must meet or exceed to compete with and potentially surpass approved drugs like TNF inhibitors (e.g., Humira, Enbrel), IL-17 inhibitors (e.g., Cosentyx, Taltz), and JAK inhibitors (e.g., Rinvoq):

Target Opportunity Profile (TOP) for Emerging AS Therapies

Dimension | Current Standard | Emerging Need / Opportunity | Strategic Insight |

Efficacy | TNF & IL-17 inhibitors show good symptom control (ASAS40 ~50–60%), but inconsistent impact on radiographic progression | Demonstrate superior and sustained ASAS40/ASDAS remission, with clear benefit on structural outcomes | Real opportunity lies in disease modification, not just symptom suppression—drugs that halt or reverse spinal fusion will redefine the standard |

Safety | Biologics: immunosuppression, TB reactivation; JAKs: CV, thrombosis, malignancy risk | Deliver biologic-level efficacy with oral JAK-like speed, but with a cleaner safety profile, especially in young, long-term users | Safety is the core bottleneck preventing long-term JAK use and broader uptake—drugs with immunologically “silent” profiles will scale faster |

Mechanism of Action (MoA) | TNF and IL-17: well-trodden; JAKs: broad but risky | Novel MoAs (e.g., TYK2, dual cytokine inhibition, GM-CSF, S1P, NLRP3 inhibition) or multi-targeted bispecifics | There’s clinical and payer fatigue for "me-too" drugs—MoA innovation = market access + pipeline longevity |

Route of Administration (RoA) | SC injections for biologics; daily oral for JAKs | Monthly or less frequent oral or SC dosing; even non-invasive (transdermal, depot) routes being explored | In a younger AS population, convenience = compliance—needle-free, low-frequency options win long-term adherence and QoL battles |

Onset of Action | JAKs act in ~1 week, TNF/IL-17 in ~2–4 weeks | Immediate symptomatic relief (within days), ideally sustained and without steroid bridging | Early onset isn't just clinical—it builds patient confidence and stickiness early in the therapy lifecycle |

Modality | Monoclonal antibodies, small molecules | Bispecifics, nanobodies, degraders (PROTACs), gene-regulated immunomodulators | Advanced modalities are the next wave: they can target upstream drivers, reduce dose, and extend intellectual property life |

Treatment Durability | Loss of response over time (anti-drug antibodies, disease adaptation) | Durable response with less immunogenicity and longer drug survival | Drug survival is an emerging key metric: durability lowers switch burden and improves payer alignment |

Unmet Population Coverage | 30–40% of patients are inadequate responders or develop intolerance | Effective in biologic failures, HLA-B27-negative, or those with comorbidities (e.g., IBD, uveitis) | The next breakout drugs will expand into currently underserved subtypes and comorbidity-driven patients |

Cost & Market Access | High biologic cost, some biosimilar-driven price competition | High-value pricing models, tiered access strategies, or first biosimilar in a new class (e.g., IL-17) | Drugs that combine clinical edge with payer-friendliness will dominate in value-driven markets (EU, India, LATAM) |

What Emerging Drugs Must Offer

To beat current therapies, pipeline drugs must:

- Match or exceed efficacy (especially ASAS40/20 and MRI outcomes)

- Lower safety risks (esp. vs JAKi/biologics in infection & CV events)

- Offer oral or ultra-convenient delivery

- Introduce novel mechanisms that may halt disease progression

- Be cost-competitive or accessible in emerging markets

- Show promise in comorbid spondyloarthropathies (e.g., IBD, PsO, uveitis)

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: