1. Disease Overview:

- AMD impacts central vision, making it difficult to see fine details.

- It damages the macula, a part of the retina, and in advanced stages, it can lead to the loss of essential visual abilities, such as recognizing faces, reading small print, and driving.

Two Types of AMD:

Dry AMD

This form is quite common. About 80% of people with AMD have the dry form. Dry AMD is when parts of the macula get thinner with age and tiny clumps of protein called drusen grow.

Wet AMD:

This form is less common but much more serious.

Wet AMD is when new, abnormal blood vessels grow under the retina. These blood vessels may leak blood or other fluids, causing scarring of the macula. The vision loss is faster with wet AMD than with dry AMD.

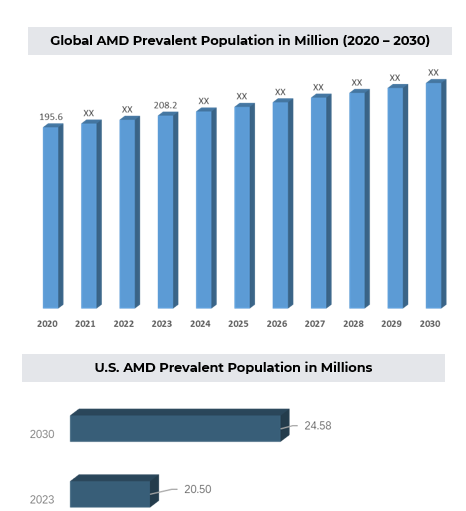

2. Epidemiology Analysis (Current & Forecast)

- Approximately 200 million people worldwide are estimated to have AMD, with this number expected to rise to nearly 300 million by 2040. In the U.S., 5.4 million Americans are projected to be affected by 2050 due to similar increasing trends.

- Approximately 10% to 15% of patients with AMD develop neovascular disease. In the absence of anti-VEGF therapy, around 80% to 90% of affected eyes eventually become legally blind due to complications from neovascularization.

3. Approved Drugs (Current SoC) - Sales & Forecast

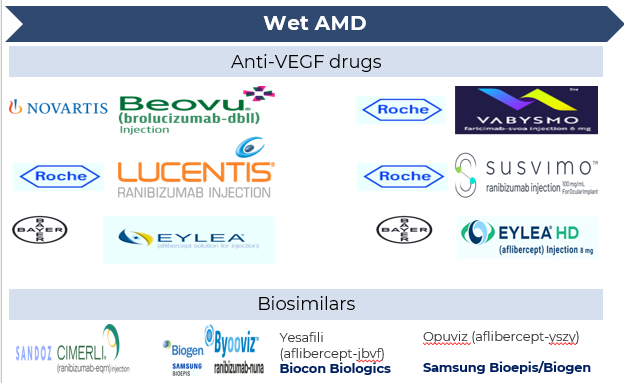

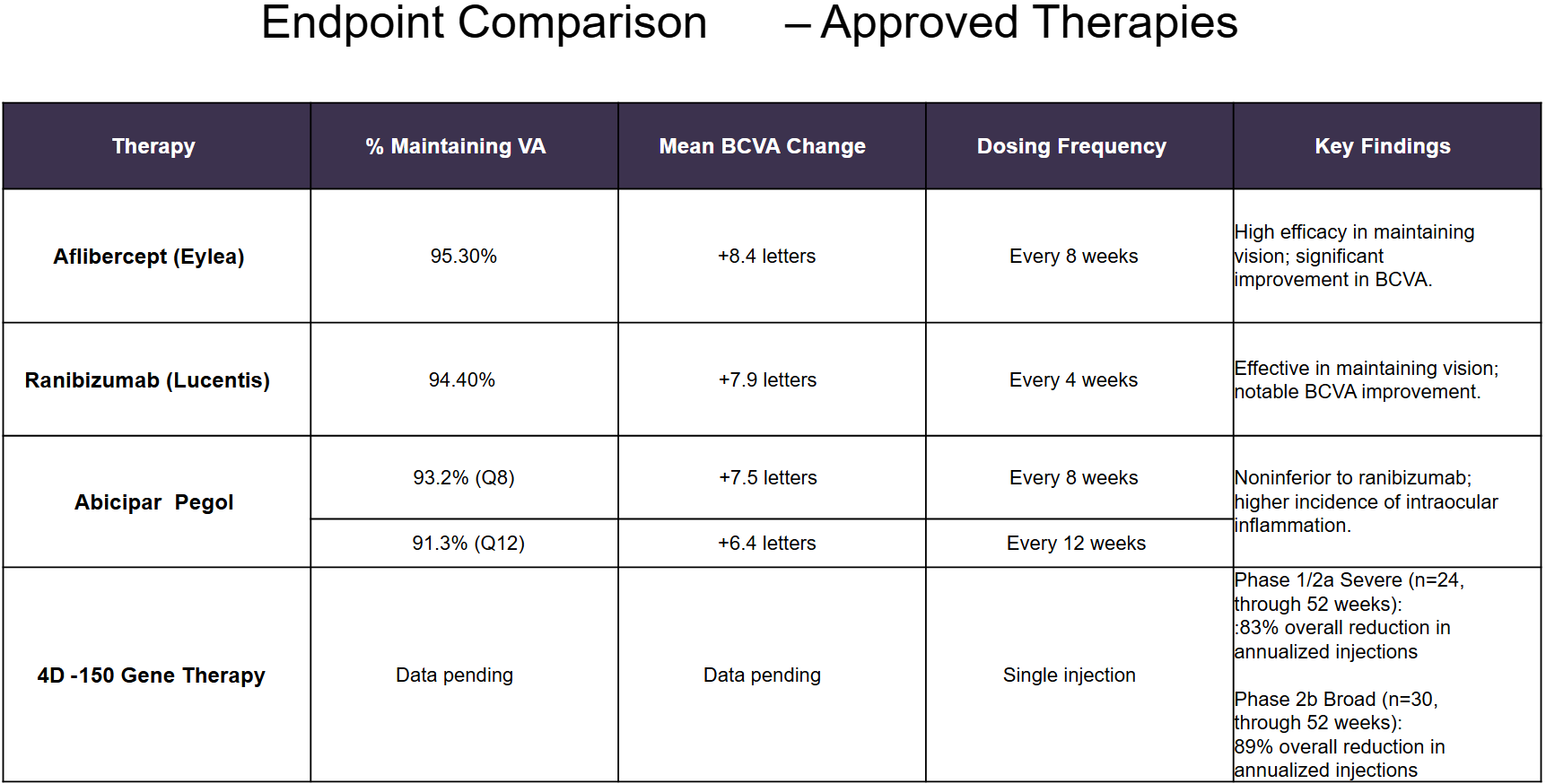

Wet age-related macular degeneration (AMD) is often managed using anti-vascular endothelial growth factor (anti-VEGF) therapies. These medications work by blocking VEGF, a protein responsible for promoting abnormal blood vessel growth in the eye, which helps reduce fluid leakage, swelling, and further vision deterioration. Several FDA-approved drugs are available for treating wet AMD:

- Aflibercept (Eylea; Bayer/Regeneron): Approved by the FDA in 2011. Aflibercept, a recombinant fusion protein, acts as a "VEGF trap" by binding to and neutralizing vascular endothelial growth factor (VEGF) and placental growth factor (PlGF), thereby inhibiting abnormal blood vessel growth and reducing vascular permeability,

- Ranibizumab (Lucentis; Roche/Novartis): Ranibizumab is a genetically engineered, humanized monoclonal antibody fragment that targets and inhibits vascular endothelial growth factor A (VEGF-A).

- Brolucizumab (Beovu; Novartis): Beovu received FDA approval in October 2019 and is used to treat wet AMD. Brolucizumab is a humanized single-chain antibody fragment that targets and inhibits vascular endothelial growth factor A (VEGF-A).

- Faricimab-svoa (Vabysmo; Roche): Faricimab is a bispecific IgG1 antibody designed to simultaneously target and inhibit both VEGF-A and Ang-2.

Additionally, bevacizumab (Avastin), though not initially developed for eye diseases, is frequently used off-label due to its effectiveness and affordability.

Recent developments include the FDA approval of Byooviz (ranibizumab-nuna) in 2021, marking the first biosimilar to Lucentis, offering a potentially more cost-effective alternative. In 2024, the FDA approved Yesafili (aflibercept-jbvf) and Opuviz (aflibercept-yszy) as interchangeable biosimilars to Eylea, increasing treatment options for patients.

Dry AMD currently has no cure, but treatments can slow its progression.

Approved Drugs for Geographic Atrophy (Advanced Dry AMD):

- Syfovre (Pegcetacoplan; Apellis Pharmaceuticals): FDA-approved in 2023 is indicated for the treatment of geographic atrophy (GA) secondary to age-related macular degeneration (AMD). SYFOVRE binds to C3 and its activation fragment C3b with high affinity, regulating the cleavage of C3 and the generation of downstream effectors of complement activation.

- Izervay (Avacincaptad Pegol; Astellas): Approved in 2023 for the treatment of geographic atrophy (GA) secondary to AMD. Avacincaptad pegol is an RNA aptamer, a PEGylated oligonucleotide that binds to and inhibits complement protein C5.

Other Approaches:

- Photobiomodulation Therapy: FDA-approved light therapy for intermediate dry AMD.

- AREDS2 Supplements: Vitamins and minerals may help slow progression.

- Healthy Diet & Lifestyle: Leafy greens, nuts, quitting smoking, and regular eye exams support eye health.

4. Pipeline Analysis and Expected Approval Timelines

The development pipeline for age-related macular degeneration (AMD) includes several promising therapies at various stages of clinical development. Below is an overview of notable drugs, their respective companies, and their highest achieved development phases:

Dry AMD (Geographic Atrophy) Pipeline:

- ALK-001

- Company: Alkeus Pharmaceuticals

- Mechanism: Modified vitamin A derivative aimed at slowing geographic atrophy progression.

- Development Stage: Phase II/III (NCT03845582).

- Tinlarebant (LBS-008)

- Company: Belite Bio

- Mechanism: Oral therapy designed to reduce vitamin A transport to the eye, potentially slowing disease progression.

- Development Stage: Phase III (NCT05949593)

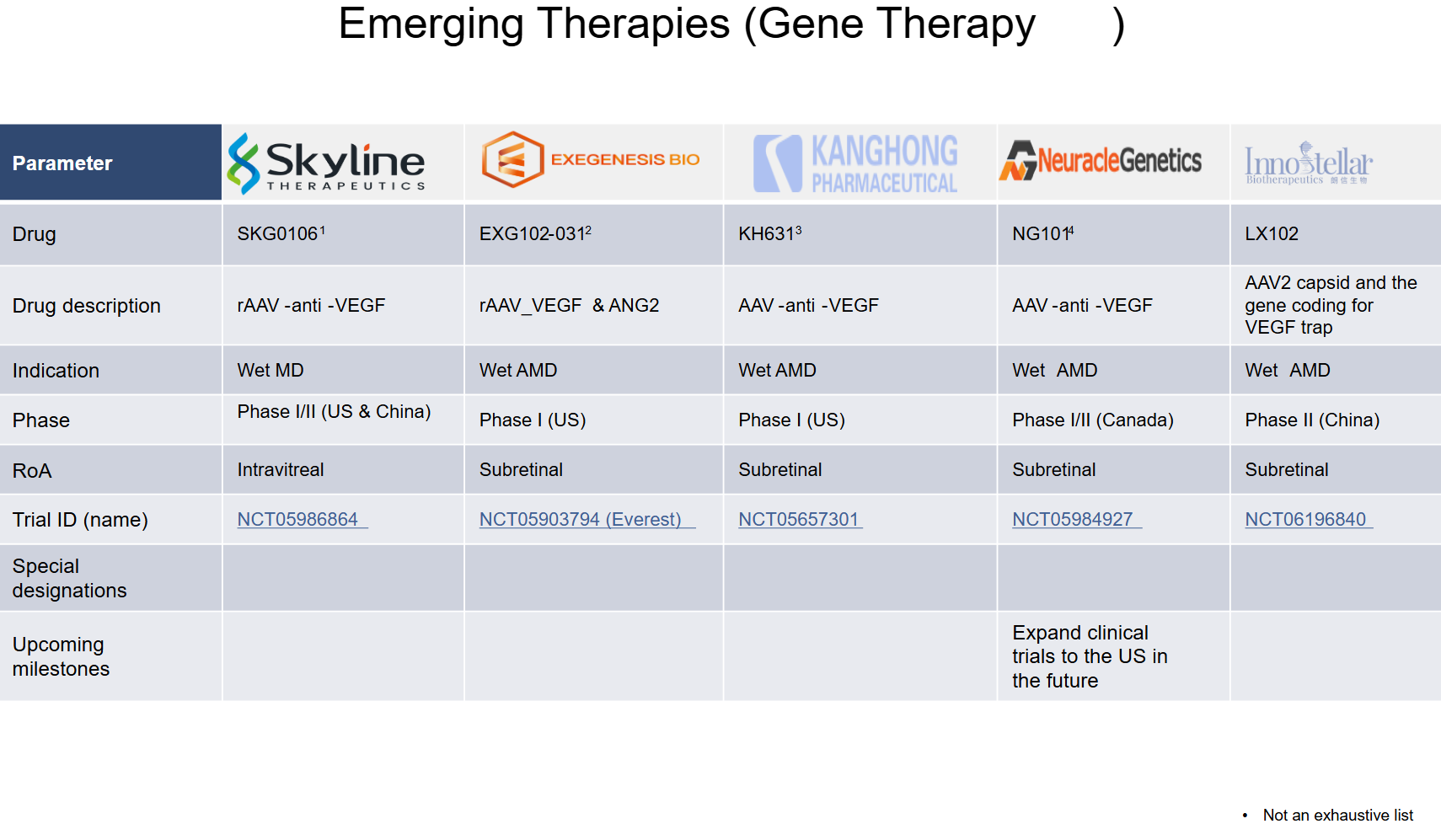

Wet AMD (Neovascular) Pipeline:

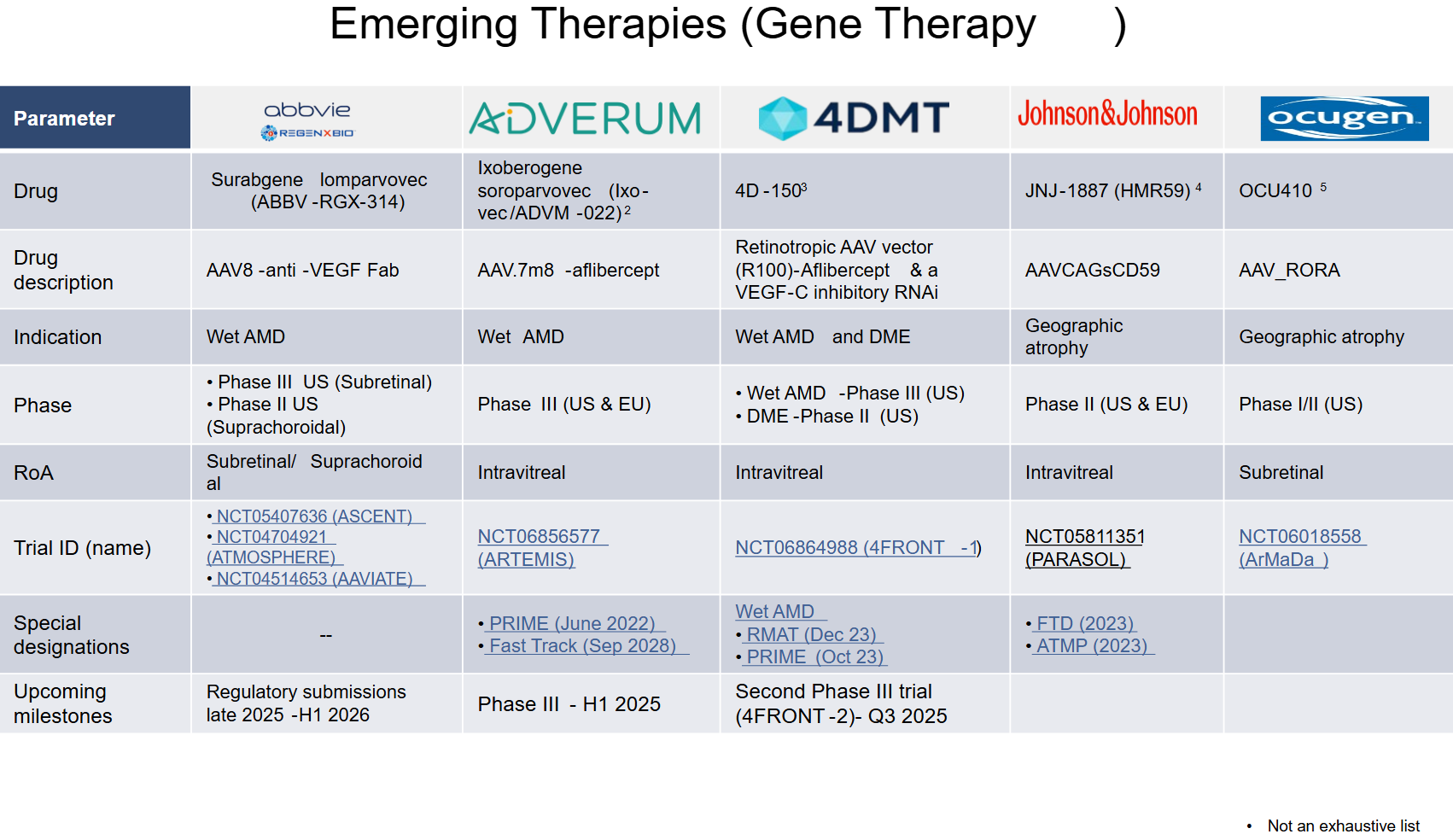

- Surabgene lomparvovec (ABBV-RGX-314)

- Company: REGENXBIO in collaboration with AbbVie

- Mechanism: Subretinal and suprachoroidal delivery gene therapy delivering an anti-VEGF antibody fragment to reduce the need for frequent intravitreal injections potentially.

- Development Stage: Phase III (Subretinal/NCT04704921, NCT05407636)

- 4D-150

- Company: 4D Molecular Therapeutics

- Mechanism: It is designed to provide a multi-year sustained delivery of anti-VEGF (aflibercept and anti-VEGF-C) from the retina with a single, safe, intravitreal injection.

- Development Stage: Phase III (NCT06864988).

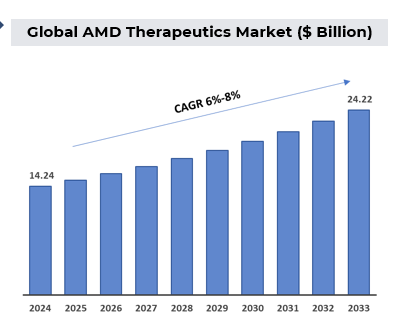

5. Market Size & Forecasting

The Age-Related Macular Degeneration (AMD) therapeutics market was valued at ~$14.24 billion in 2024 and is anticipated to be valued at US$ XX Bn by 2032, registering a CAGR of ~6-8% over the forecast period.

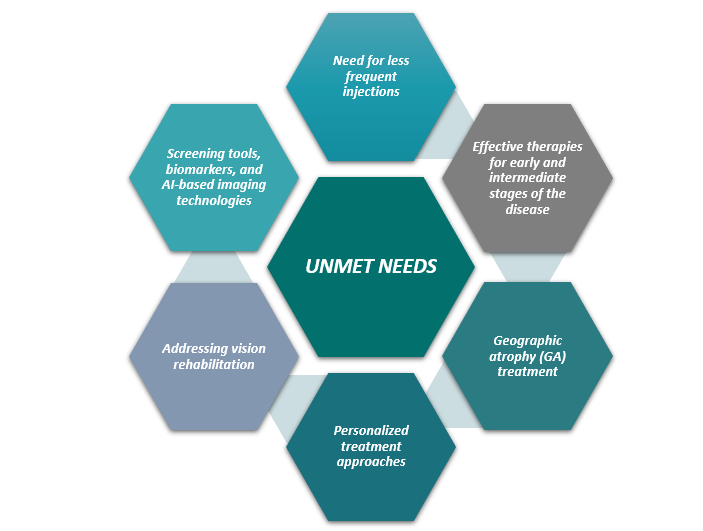

Unmet Needs

Unmet needs in age-related macular degeneration (AMD) remain significant despite advancements in treatment. Key challenges include:

6. Competitive Landscape and Market Positioning

Several major pharmaceutical companies and biotech firms are actively pursuing treatments for AMD:

Leading Late-Stage Pipeline Candidates

1. Market Leaders & Established Players

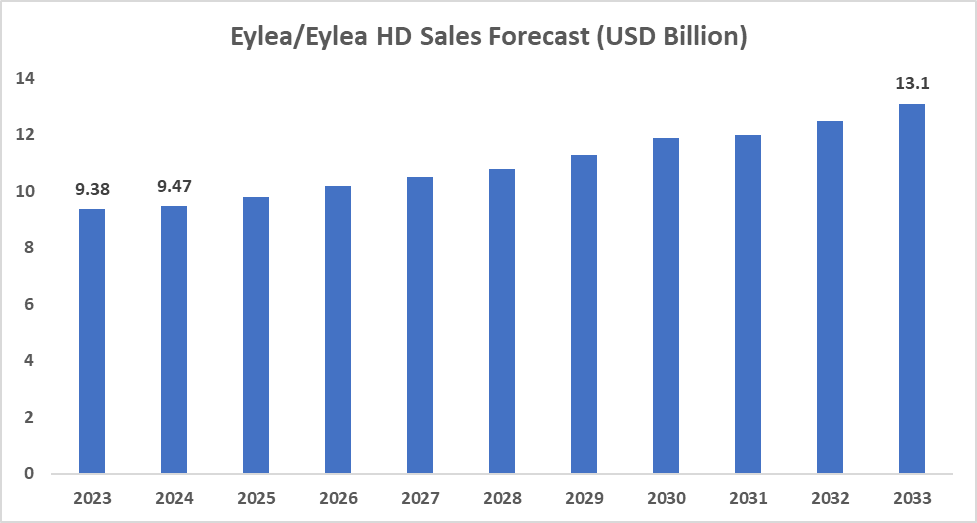

- Regeneron (Eylea, Eylea HD) dominates the anti-VEGF market but faces biosimilar competition and emerging long-acting therapies.

- Roche/Genentech (Vabysmo, Susvimo, Lucentis) – Vabysmo’s dual-targeting (VEGF-A & Ang-2) offers extended durability, challenging Eylea.

- Novartis (Beovu) – Efficacy with longer dosing intervals, though safety concerns have impacted adoption.

2. Emerging & Next-Gen Competitors

- REGENXBIO (RGX-314, Gene Therapy) – Aims to replace frequent injections with a single-dose, long-term solution.

- Adverum Biotechnologies (ADVM-022, Gene Therapy) – Developing a one-time anti-VEGF therapy to reduce patient burden.

3. Rising Biosimilar Competition

- Samsung Bioepis, Biocon, Formycon, Polpharma – Biosimilars for Lucentis and Eylea (e.g., Yesafili, Opuviz, Enzeevu) are entering the market, increasing competition and reducing costs.

4. Strategic Market Positioning & Differentiation

- Durability & Reduced Injection Burden:

- Vabysmo (Roche) & Eylea HD (Regeneron) focus on longer dosing intervals.

- RGX-314 (REGENXBIO) & ADVM-022 (Adverum) gene therapies aim for a one-time treatment approach.

- Expanded Indications Beyond Wet AMD:

- Syfovre & Izervay lead the geographic atrophy market, with more GA therapies in development.

- Cost-Effective Biosimilars:

- Companies like Samsung Bioepis, Biogen, Sandoz, and Biocon challenge branded drugs by offering lower-cost alternatives.

7. Target Opportunity Profile (TOP) & Benchmarking

1. Target Patient Population

- Wet AMD (nAMD): ~10-15% of AMD cases, but responsible for most severe vision loss.

- Geographic Atrophy (GA): Advanced dry AMD affecting ~5 million people worldwide.

- Early & Intermediate AMD: Growing focus on preventive and disease-modifying treatments.

Benchmarking: Competitive Comparison

| Company | Drug | Mechanism | Dosing Advantage | Market Position |

| Regeneron | Eylea HD | Anti-VEGF | 12- to 16-week dosing | Market Leader |

| Roche | Vabysmo | Anti-VEGF & Ang-2 | 16-week dosing | Strong Growth |

| Apellis | Syfovre | Complement Inhibitor | 25%-36% GA slowing | GA Market Leader |

| Iveric Bio | Izervay | Complement Inhibitor | 14%-19% GA slowing | GA Competitor |

| REGENXBIO | RGX-314 | Gene Therapy (Anti-VEGF) | Potential one-time treatment | Future Disruptor |

| Adverum | ADVM-022 | Gene Therapy (Anti-VEGF) | Potential one-time treatment | Future Disruptor |

| Biosimilars | Yesafili, Opuviz | Anti-VEGF | Similar to originator | Cost Competitor |

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

2. Make Data-Driven Decisions

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

3. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

4. Optimize R&D and Clinical Development

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

5. Enhance Market Access & Pricing Strategy

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

- Ensure smooth market entry and optimize pricing strategies for better adoption. your needs!

6. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

7. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.