Virtual Care Market - Industry Outlook

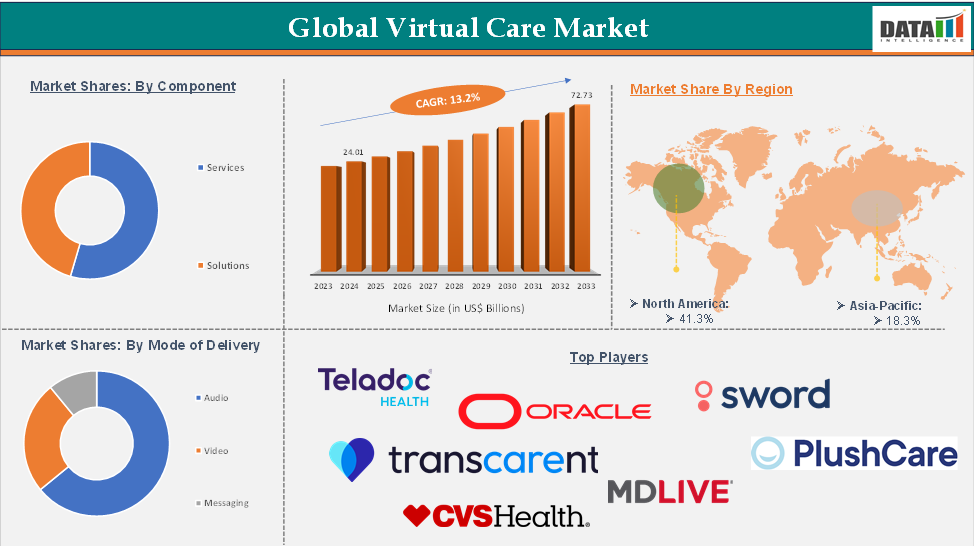

Virtual Care Market reached US$ 24.01 Billion in 2024 and is expected to reach US$ 72.73 Billion by 2033, growing at a CAGR of 13.2% during the forecast period 2025-2033.

The global virtual care market is experiencing rapid growth due to the demand for accessible, cost-effective, and patient-centric healthcare solutions. This includes telemedicine, remote monitoring, and digital consultations.

The market's expansion is driven by advancements in digital technology, rising smartphone and internet penetration, and growing awareness of remote healthcare services. However, challenges like data privacy concerns, regulatory hurdles, and limited digital infrastructure in developing regions hinder growth. Despite these obstacles, the virtual care market is poised for substantial expansion due to ongoing innovation, increased healthcare investments, and evolving patient expectations.

For more details on this report, Request for Sample

Virtual Care Market Dynamics: Drivers & Restraints

Driver: Rising demand for remote healthcare services

The global virtual care market is driven by the increasing demand for accessible healthcare solutions, driven by smartphone penetration, improved internet connectivity, and wearable health devices. The COVID-19 pandemic has accelerated this trend, emphasizing the convenience and safety of remote care. This trend is expected to continue as healthcare systems aim to improve patient engagement, reduce hospital visits, and manage chronic diseases effectively through virtual care.

For instance, in April 2025, ATA Action, the American Telemedicine Association's advocacy arm, launched the Virtual Foodcare Coalition, a group dedicated to creating policies that integrate virtual care with food and nutritional support to enhance health, prevent disease, and manage chronic conditions.

Restraint: Data security and privacy concerns

The virtual care market faces challenges due to data security and patient privacy concerns. Healthcare providers are at risk of cyberattacks, data breaches, and unauthorized access. Compliance with HIPAA and GDPR laws also poses challenges. These issues can hinder adoption rates and reduce patient trust, especially in regions with an underdeveloped cybersecurity infrastructure.

Virtual Care Market Segment Analysis

The global virtual care market is segmented based on component, mode of delivery, end user, , and region.

Component:

The services segment of the component is expected to hold 54.1% of the virtual care market

The global virtual care market's services segment offers various services like teleconsultation, patient monitoring, mental health services, chronic disease management, and specialist second opinions. These solutions are provided through virtual platforms that connect patients and healthcare professionals via video calls, messaging, and app-based interfaces. The services segment focuses on clinical interaction, diagnosis, treatment, and ongoing patient support, forming the core of the virtual healthcare experience.

The services segment is gaining momentum due to rising patient demand for convenient, on-demand healthcare access, the increasing burden of chronic diseases, physician shortages, and the integration of AI and data analytics in service delivery. The COVID-19 pandemic has normalized virtual consultations and encouraged long-term investments in virtual care infrastructure and service delivery, resulting in a more efficient and personalized healthcare experience.

For instance, in March 2025, AvaSure, a leader in acute virtual care, launched its Virtual Care Assistant, a solution developed using Oracle Cloud Infrastructure and NVIDIA to enhance patient care, streamline clinical workflows, and improve operational efficiency in hospitals and healthcare systems.

Virtual Care Market Geographical Analysis

North America dominated the global Virtual Care market with the highest share of 41.3% in 2024

North America, particularly the US, dominates the global virtual care market due to its advanced healthcare infrastructure, widespread digital health adoption, and supportive regulatory environment. Government initiatives like Medicare and Medicaid's telehealth reimbursement policies have boosted adoption. The region's high healthcare IT integration, strong innovation investment, tech-savvy population, and growing demand for remote chronic disease management further drive market growth.

For instance, in April 2025, DocNow, a leading provider of EHR solutions for post-acute care, launched DocNow Telehealth, a secure, Zoom-powered virtual care platform designed for providers in Skilled Nursing Facilities, Long-Term Care, and Home Health settings. The platform enables providers to conduct virtual visits directly within the DocNow EHR environment, reducing administrative burden and streamlining care.

Asia-Pacific region in the global virtual care market is expected to grow with the highest CAGR of 18.3% in the forecast period of 2025 to 2033

The Asia Pacific region is experiencing rapid growth in the virtual care market due to internet penetration, smartphone usage, and increasing healthcare demands. Countries like China, India, and Japan are investing in digital health infrastructure to improve accessibility, especially in rural areas. The COVID-19 pandemic has accelerated the adoption of telehealth platforms, and governments are recognizing the long-term benefits of virtual care. The growing middle class and awareness of digital health solutions are also driving the market's expansion.

For instance, in March 2025, Ping An Health, a health technology unit of Chinese insurance firm Ping An, introduced a generative AI-powered chatbot on its mobile health app, Ping An Xin Yi. The feature offers round-the-clock, on-demand AI-assisted health consultations, simplified interpretation of medical reports and laboratory results, and personalized medication reminders.

Virtual Care Market Key Players

The major global players in the virtual care market include Teladoc Health Inc., Oracle Corporation, Sword Health Inc., PlushCare, Transcarent, MDLIVE, Medocity Inc., and CVS Health, among others.

Industry Key Developments

In April 2025, Fabric, a leader in care delivery, launched major updates to its Virtual Care platform, including a subscription-based care model that offers convenience and continuity to traditional healthcare organizations. These enhancements enable health systems, payers, employers, and digital health companies to offer personalized, concierge care at scale, expand access, build patient loyalty, and stand out in a competitive market.

Market Scope

Metrics | Details | |

CAGR | 13.2% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Component | Services, Solutions |

Mode of Delivery | Audio, Video, Messaging | |

End User | Homecare, Hospitals, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |