Uveitis Treatment Market Size& Industry Outlook

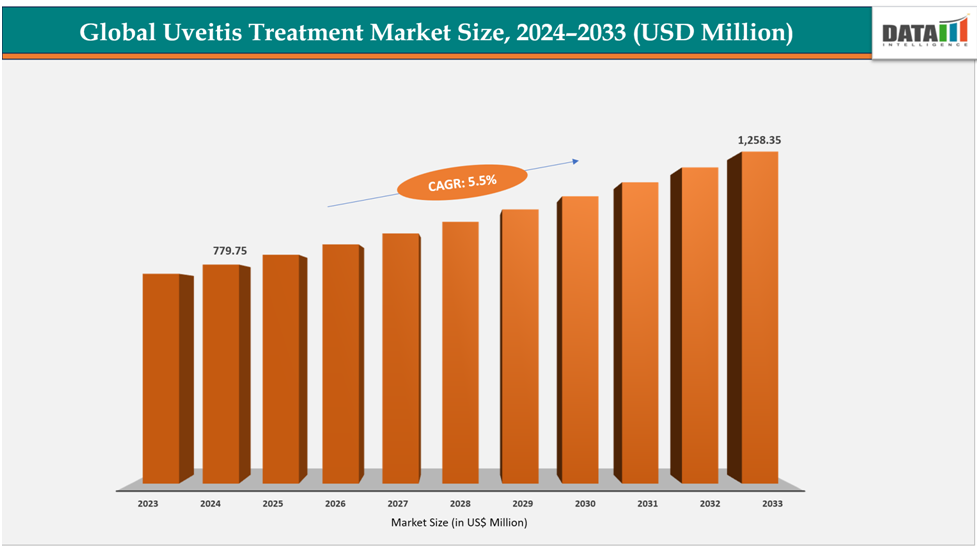

The global uveitis treatment market size reached US$ 742.09million with rise of US$779.75million in 2024 is expected to reach US$ 1,258.35million by 2033, growing at a CAGR of 5.5%during the forecast period 2025-2033.

One of major growing factor in this market is increasing awareness and early diagnosis of ocular disorders. For instance, a 2024 study published in Ophthalmology highlighted that the implementation of widespread screening programs and the use of advanced imaging techniques, such as optical coherence tomography (OCT), led to earlier detection of uveitis in high-risk populations. Early diagnosis allows for timely intervention, reducing the risk of vision loss and improving treatment outcomes. This heightened awareness among healthcare providers and patients is accelerating the adoption of available therapies, thereby supporting market expansion.

Key Highlights

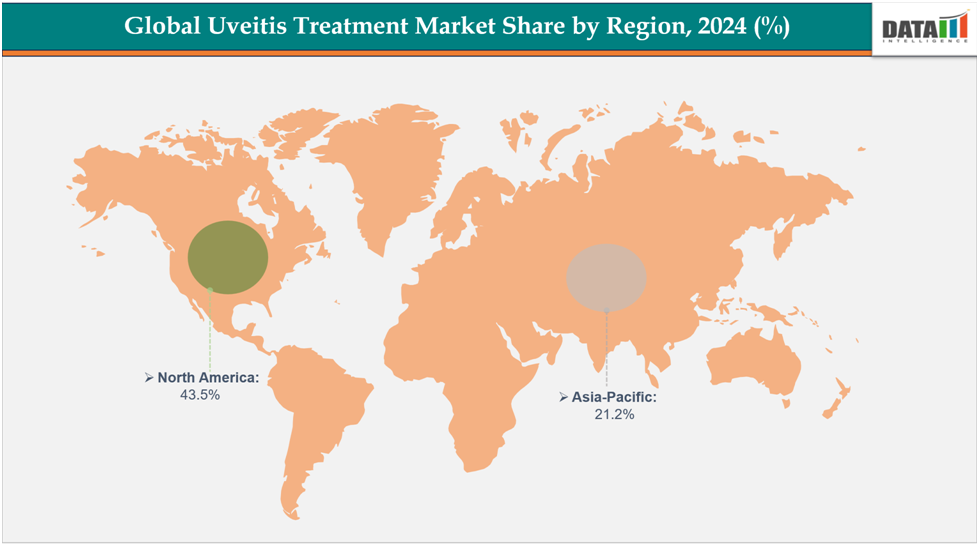

North America dominates the uveitis treatment market with the largest revenue share of 43.5% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of8.1% over the forecast period.

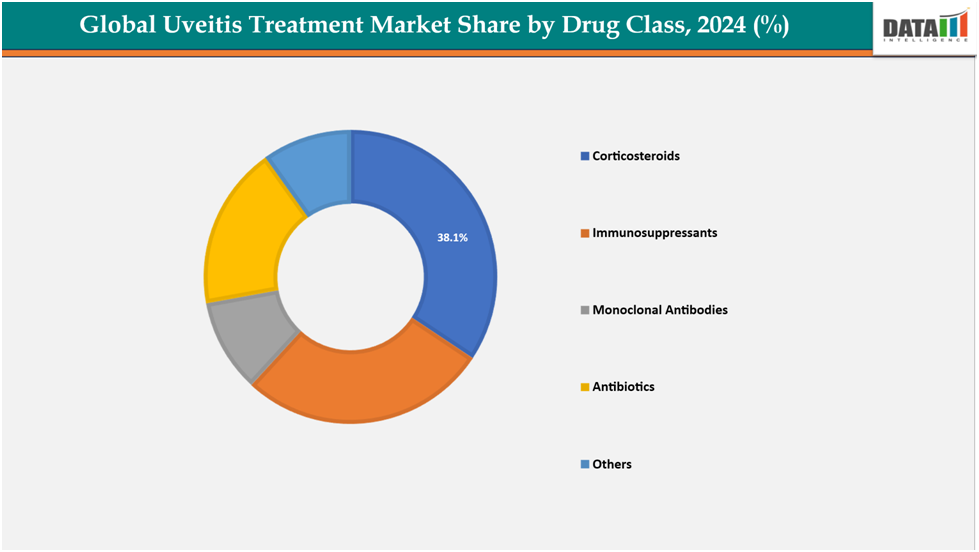

Based on drug class, corticosteroids segmented the market with the largest revenue share of 38.1% in 2024.

The major market players in the AbbVie Inc, Bausch Health Companies / Bausch + Lomb, EyePoint Pharmaceuticals, Inc, Santen Pharmaceutical Co., Ltd, Alimera Sciences, Ocular Therapeutix, Inc, Ophthotech Corporation and among others.

Market Dynamics

Drivers: The rising prevalence of autoimmune and inflammatory disorders is significantly driving the uveitis treatment market growth

The rising prevalence of autoimmune and inflammatory disorders is significantly influencing the global uveitis treatment market. Uveitis, an intraocular inflammatory condition, is often associated with systemic autoimmune diseases such as rheumatoid arthritis, lupus, and Crohn's disease. These conditions can lead to non-infectious uveitis, which is more challenging to treat and often requires long-term management strategies.

These trends underscore the critical role that the rising prevalence of autoimmune and inflammatory disorders plays in shaping the uveitis treatment landscape, driving both market growth and the development of more specialized therapeutic options.

For instance, NCBI estimates indicate that the global incidence and prevalence of autoimmune diseases are rising annually by approximately 19.1% and 12.5%, respectively.

Restraints: Limited access to treatments in developing regionsare hampering the growth of the Uveitis Treatment market

Limited access to advanced uveitis treatments in developing regions remains a significant challenge for the global market. In many low- and middle-income countries, patients face barriers such as high treatment costs, inadequate healthcare infrastructure, and a shortage of trained specialists. These limitations restrict timely diagnosis and access to innovative therapies, including biologics and targeted immunosuppressants, resulting in suboptimal disease management and poorer patient outcomes. Consequently, this disparity hampers overall market growth and underscores the need for improved healthcare accessibility and affordability in these regions.

For more details on this report – Request for Sample

Segmentation Analysis

The global uveitis treatment market is segmented based on uveitis type, drug class, route of administration, distribution channel, and region.

Drug Class:

The corticosteroids from drug class segment to dominate the uveitis treatment market with a 38.1% share in 2024

The corticosteroids segment plays a pivotal role in the uveitis treatment market, serving as the first-line therapy for reducing inflammation and preventing vision loss. available in topical, periocular, and intravitreal forms, corticosteroids help manage both anterior and posterior uveitis. intravitreal implants like Retisert and Yutiq provide sustained drug delivery, minimizing the need for frequent administration. the segment benefits from strong clinical efficacy, well-established usage, and wide availability, making it a major contributor to market growth globally.

For instance, A study published in Ocular Immunology and Inflammation 2025, evaluated 1,475 patients across multiple uveitis clinics in the U.S., comparing the efficacy of corticosteroids alone, corticosteroids combined with conventional immunosuppressants (methotrexate, mycophenolate mofetil, azathioprine, leflunomide), and corticosteroids in combination with biologic therapies (TNF inhibitors such as adalimumab and infliximab). The results demonstrated that patients receiving corticosteroids alongside immunosuppressants or biologics experienced faster and more sustained resolution of inflammation compared to corticosteroid monotherapy.

Route of Administration:

The oral segment is estimated to have a 54.1% of the uveitis treatment market share in 2024

The oral segment, primarily comprising immunosuppressants such as methotrexate, cyclosporine, and mycophenolate, addresses moderate to severe cases of non-infectious uveitis. oral therapies offer systemic immunomodulation, benefiting patients with multi-site inflammation or refractory disease. this segment is gaining traction due to increasing adoption of biologics in combination with oral immunosuppressants, expanded clinical guidelines, and growing awareness among physicians, driving its share in the overall uveitis treatment market.

Geographical Analysis

North America dominates the global uveitis treatment market with a 43.5% in 2024

The North American uveitis treatment market is fueled by robust healthcare infrastructure, high awareness, ongoing clinical trials and advanced therapies. Early biologics and intravitreal implants adoption, with major players like AbbVie, Bausch Health, and Eye Point Pharmaceuticals, and favorable reimbursement policies accelerate market expansion. For instance, in September 2024, Priovant Therapeutics has enrolled the first patients in the CLARITY Phase 3 study for brepocitinib in non-anterior non-infectious uveitis. The FDA has granted Brepocitinib Fast Track Designation for NIU, a process designed to expedite the development and review of drugs for serious conditions.

The US market for biologics, particularly Adalimumab, is driven by a large patient population, high prevalence of autoimmune and inflammatory disorders, robust clinical trial activity, insurance coverage, innovative corticosteroid implants, strong regulatory support, and investment in ophthalmology research.

Europe is the second region after North America which is expected to dominate the global uveitis treatment market with a 34.5% in 2024

Europe's market for ocular immunotherapy is growing due to increasing ocular inflammation disorders and acceptance of corticosteroid implants and biologic therapies. Collaboration between governments, academic centers, and pharmaceutical companies enhances innovation. Reimbursement policies in Germany and France provide wider patient access, while a well-established ophthalmology network strengthens treatment adoption. The UK market is driven by NHS support, a strong network of specialist eye clinics, clinical research programs, patient-centric initiatives, and participation in multinational trials.

For instance, in May 2025, A study by researchers from the University of Bristol in England has published guidelines for uveitis detection and treatment, highlighting the development of improved treatment options for patients with the inflammatory eye disease.

The Asia Pacific region is the fastest-growing region in the global uveitis treatment market ,with a CAGR of 8.1% in 2024

The Asia Pacific market is driven by a rising burden of ocular infections, increasing awareness of eye health, and expanding access to biologics and steroid implants. Rapid healthcare infrastructure development, global investments, and a growing middle-class population drive market adoption.

In Japan, with high healthcare standards, strong government support, and early adoption of innovative ophthalmic drugs, is also fostering regional growth in the uveitis treatment segment.

For instance, Uveitis is a major ophthalmic concern in Japan, with 200 cases per 100,000 individuals, accounting for 3.2% of all new ophthalmic disease cases in 2024.This significant patient pool encourages adoption of advanced therapies such as biologics and corticosteroid implants, driving growth in the uveitis treatment market.

Competitive Landscape

Top companies in the uveitis treatment market include AbbVie Inc, Bausch Health Companies / Bausch + Lomb, Eye Point Pharmaceuticals, Inc, Santen Pharmaceutical Co., Ltd, Alimera Sciences, Ocular Therapeutix, Inc, Ophthotech Corporation

AbbVie Inc: AbbVie Inc is a leading player in the global uveitis treatment market, known for its flagship biologic Humira (Adalimumab), which is one of the few monoclonal antibodies approved for non-infectious intermediate, posterior, and panuveitis. The company's targeted therapy reduces long-term corticosteroid use, strengthening its position as a market leader in immunology and ophthalmology. AbbVie leverages its clinical data, patient access programs, and global commercial reach to drive the adoption of biologic therapies for uveitis.

Key Developments:

In March 2025, ANI Pharmaceuticals has received FDA approval for an expanded label for Iluvien, which includes treatment for chronic non-infectious uveitis affecting the posterior segment of the eye (NIU-PS). This expansion, along with a stronger partnership with Seigfried, aims to improve supply security and access for patients in need.

Market Scope

Metrics | Details | |

CAGR | 5.5% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Uveitis Type | Anterior, Intermediate, Posterior, Panuveitis |

Drug Class | Corticosteroids, Immunosuppressants, Monoclonal Antibodies, Antibiotics, Others | |

Route of Administration | Oral, Intravenous | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global uveitis treatment market report delivers a detailed analysis with 62 key tables, more than 57visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here