Market Size

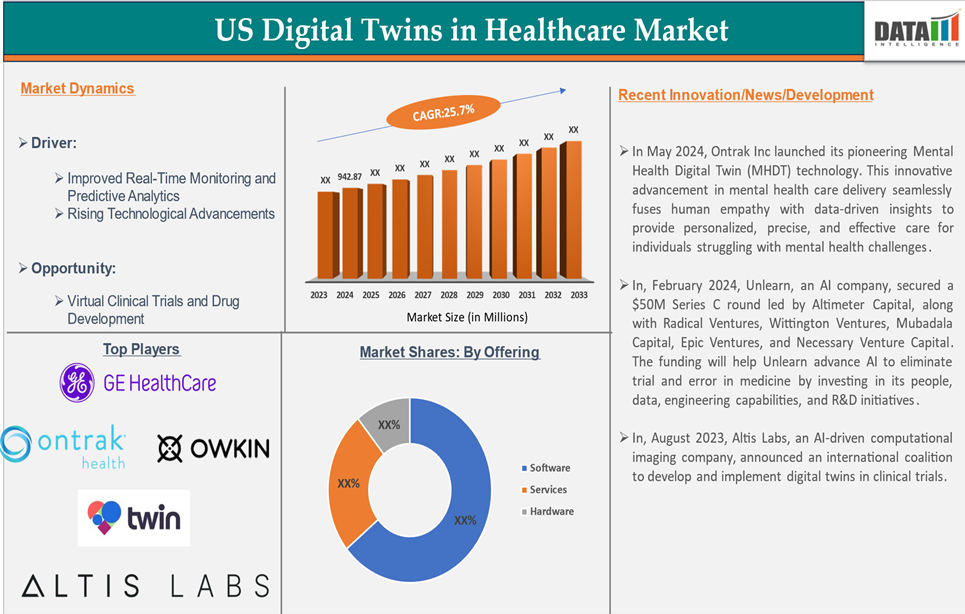

The U.S. digital twins in the healthcare market reached US$ 942.87 million in 2024 and is expected to reach US$ 7,184.78 million by 2033, growing at a CAGR of 25.7% during the forecast period 2025-2033.

A digital twin in healthcare refers to a virtual model or replica of a physical entity, such as a patient, medical device, healthcare facility, or even an entire healthcare system. It is a digital representation that uses real-time data, advanced simulation, machine learning, and artificial intelligence (AI) to mirror the physical object or system in the digital world. These models enable healthcare professionals to monitor, analyze, and predict the behavior or condition of the physical entity they represent, thereby improving decision-making, patient care, and operational efficiency.

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Improved Real-Time Monitoring and Predictive Analytics

Digital twins enable continuous monitoring of patient health using data from various devices, including wearables, sensors, and medical equipment. This real-time data feeds into virtual models of patients, allowing healthcare professionals to monitor conditions and respond instantly to any changes in the patient’s health. Predictive analytics within these models can forecast deteriorations or health events, allowing for earlier interventions.

Predictive analytics embedded in digital twins can simulate how diseases progress in patients, offering insights into how they might respond to various treatments. This allows healthcare providers to make more accurate predictions about disease outcomes, enabling better care planning and treatment personalization.

According to the World Health Organization (WHO), cancer is expected to be responsible for over 16 million deaths by 2040. Digital twin technology could significantly reduce these numbers by allowing for early detection and better-targeted treatments, leading to improved survival rates. Predictive modeling in oncology could help identify high-risk patients and intervene before the disease progresses to an advanced stage.

Digital twins allow for continuous monitoring of chronic patients' conditions and can predict potential complications or flare-ups, which enables doctors to adjust treatments accordingly and manage these diseases effectively.

Regulatory and Compliance Challenges

The regulatory landscape governing healthcare data is intricate and differs across regions and countries. In the U.S., healthcare providers must comply with HIPAA (Health Insurance Portability and Accountability Act), which governs how personal health information is managed. In the European Union, GDPR (General Data Protection Regulation) imposes strict rules on data privacy and consent. For digital twins to be deployed, these regulations must be understood and adhered to at all times, which can significantly delay implementation.

The complexity and regional variation of regulatory requirements can create delays in bringing digital twin solutions to market. Healthcare providers and technology developers must navigate different rules and protocols, which can increase the time and cost required to implement these technologies effectively.

Market Segment Analysis

The U.S. digital twins in the healthcare market are segmented based on offering, application, technology, and end-user.

Offering:

The software from the offering segment is expected to dominate the digital twin in the healthcare market with the highest market share

Digital Twin software is a set of tools and platforms used to create, manage, and utilize virtual replicas, offering simulation, analysis, and monitoring capabilities.

The growth of software segment is attributed by several factors such as advancements in artificial intelligence (AI) and machine learning (ML), software for real-time simulation, predictive analytics, and personalized treatment plan generation. Increased demand for remote patient monitoring and telemedicine is also creating demand for software-driven digital twin solutions integrating wearable devices with electronic health records (EHRs) to generate digital twins.

Moreover, Investment in healthcare and government initiatives to improve the digital health infrastructure is accelerating the adoption of digital twin software across hospitals, research institutions, and pharmaceutical companies.

Major US Players

The major U.S players in the digital twin in the healthcare market include Twin Health, GE Healthcare, Owkin, Inc., Ontrak Health, Decision Lab Ltd, and Altis Labs, Inc. among others.

Key Developments

- In May 2024, Ontrak Inc. launched its pioneering Mental Health Digital Twin (MHDT) technology. This innovative advancement in mental health care delivery seamlessly fuses human empathy with data-driven insights to provide personalized, precise, and effective care for individuals struggling with mental health challenges.

- In February 2024, Unlearn, an AI company, secured a $50M Series C round led by Altimeter Capital, along with Radical Ventures, Wittington Ventures, Mubadala Capital, Epic Ventures, and Necessary Venture Capital. The funding will help Unlearn advance AI to eliminate trial and error in medicine by investing in its people, data, engineering capabilities, and R&D initiatives.

- In August 2023, Altis Labs, an AI-driven computational imaging company, announced an international coalition to develop and implement digital twins in clinical trials.

Market Scope

| Metrics | Details | |

| CAGR | 25.7% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Offering | Software, Services, Hardware |

| Application | Treatment Planning, Drug Discovery and Development Diagnostics, Patient Monitoring, Healthcare Facility Management, Others | |

| Technology | Virtual Reality (VR), Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Augmented Reality (AR), Others | |

| End-User | Hospitals and Clinics, Pharmaceutical and Biotechnology Companies, Academic and Research Institutes | |

Why Purchase the Report?

- Technological Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The U.S. Digital Twin in healthcare market report delivers a detailed analysis with 70 key tables, more than 65 visually impactful figures and 159 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Application & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.