Overview

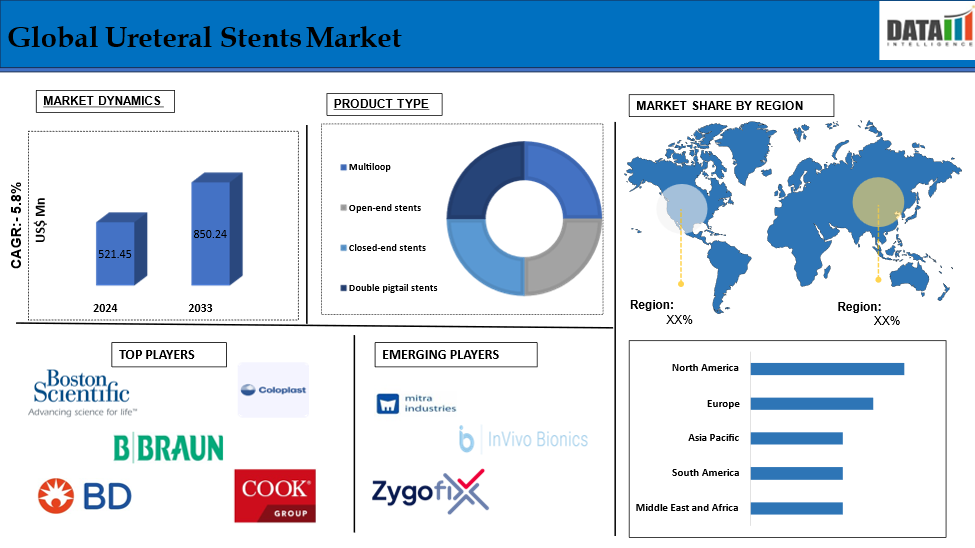

The Global Ureteral Stents Market reached US$ 521.45 Million in 2024 and is expected to reach US$ 850.24 Million by 2033, growing at a CAGR of 5.8% during the forecast period 2025-2033.

A ureteral stent is a thin, flexible tube placed in the ureter, which transfers urine from the kidneys to the bladder. Its major function is to prevent or treat obstructions that interfere with urine flow, which can be caused by a number of medical problems such as kidney stones, tumors, or strictures. Ureteral stents are designed to keep the ureter wide enough for urine to pass properly from the kidney to the bladder. They are frequently employed in situations where there is a blockage.

The increasing demand for ureteral stents is the driving factor that drives the market over the forecast period. This increase in demand can be linked to various interrelated causes, including the rising prevalence of urological problems, the increasing geriatric population, and advances in stent technology. All these factors together increase the demand for ureteral stents and it drives the market.

Executive Summary

Market Dynamics: Drivers & Restraints

Increasing demand for ureteral stents

The increasing demand for ureteral stents is expected to be a significant factor in the growth of the global ureteral stents market. The global ureteral stents market is poised for significant expansion, owing to the rising number of kidney-related disorders, increasing investments, and technological advancements. The rising incidence of kidney-related conditions has a substantial impact on the increasing demand for ureteral stents.

For instance, according to the National Institute of Health, chronic kidney disease is a progressive disorder that affects more than 10% of the world's population, or over 800 million people across the globe. Moreover, according to the National Kidney Foundation, over 2 million people worldwide are receiving treatment with dialysis or a kidney transplant to stay alive, however, this estimate may only represent 10% of people who actually need treatment for their survival. As these problems become increasingly common, the demand for effective treatments, such as ureteral stenting, has increased.

In recent times, many funds and investments have been made for research, development, and manufacture of ureteral stents. For instance, in November 2024, The Tamil Nadu government and Lubrizol, based in the United States, signed a Memorandum of Understanding (MoU). The partnership, which cost approximately INR 200 crore, generated high-quality medical tubing for key applications such as ureteral stents, neurovascular and cardiovascular treatments, intravenous catheters, hemodialysis tubes, and central venous catheters. The increased investments, increase the production volume of the ureteral stents to meet the increasing demand for ureteral stents and it drives the market.

High risk of complications post-stent removal

Factors such as the high risk of complications post-stent removal are expected to hamper the global ureteral stents market. Complications such as infection, hematuria, and acute pain can have a major impact on patient quality of life, increasing reluctance to use these devices. Irritative voiding symptoms, such as increased urine urgency, frequency, and discomfort, are one of the most prevalent consequences of stent removal. Furthermore, more serious complications such as urinary tract infections and prolonged bleeding may occur following removal, necessitating additional surgical treatments. Fear of these potential consequences can cause patients to become anxious, and urologists might become reluctant to suggest stenting as a first-line treatment option.

Segment Analysis

The Global Ureteral Stents Market is segmented based on Product Type, Material, Application, End-User, And Region.

Double pigtail stents segment is expected to dominate the global ureteral stents market share

The double pigtail stents segment is anticipated to dominate the global ureteral stents market owing to their unique design, featuring coiled ends and technological advancements.

These stents are distinguished by their unique shape, which includes coiled ends that assist anchor the stent within the urinary tract, successfully avoiding migration and ensuring solid placement. This design not only reduces the risk of issues associated with stent displacement but also allows for better compliance with the anatomical structure of the urinary system, thereby improving patient comfort during use. This unique shape of the stent makes it user-friendly for the patients and increases the demand for the double pigtail stents making this the most dominating segment in the global ureteral stents market.

Recent technological advancements and launches have boosted the acceptance of double pigtail stents. For instance, in December 2024, The RELIEF ureteral stent was approved as the first and only stent for the prevention of vesicoureteral reflux, which is a major source of patient discomfort. Technological improvements and recent launches such as RELIEF ureteral stents have aided the development of minimally invasive insertion techniques for double pigtail stents. These procedures not only improve the simplicity of implantation but also minimize recuperation time for patients, increasing their acceptance in medical facilities and making them the most dominating segment in the global ureteral stents market.

Geographical Analysis

North America is expected to hold a significant position in the global ureteral stents market share

North America is expected to hold a significant portion of the global ureteral stents market. North America will likely account for a significant share of the global ureteral stents market, owing to its rising number of kidney-related disorders, increasing healthcare investments, advanced healthcare infrastructure, and technological advancements. One of the primary drivers of this demand in North America is the single number of kidney-related disorders.

For instance, according to the American Kidney Fund, more than 35.5 million Americans suffer from kidney disease. An estimated 808,000 Americans suffer from kidney failure. More than 557,000 Americans are on dialysis. Kidney disease is spreading at an alarming rate. It currently affects more than one in every seven (14% of American adults). In 2021, more than 135,000 Americans were diagnosed with kidney failure. Nine out of 10 individuals with renal disease were unaware of their status, and one-third of those with severely impaired kidney function were also unaware. Due to the increasing number of kidney-related disorders, the need for ureteral stents is increasing which helps ensure proper flow of urine through the ureter, this increases the demand for ureteral stents and drives the market in North America.

Asia Pacific is growing at the fastest pace in the global ureteral stents market

The Asia Pacific region is emerging as the fastest-growing market for ureteral stents, owing to a rising prevalence of urological disorders, increasing healthcare investments, and technological advancements. The increasing number of kidney-related disorders and renal replacement therapies are the primary reasons for the upsurge and growth of the market in the Asia Pacific region. For instance, the estimated prevalence of CKD is 800 per million people (pmp), while the incidence of end-stage renal disease (ESRD) is 150-200 pmp. Diabetic nephropathy is the leading cause of chronic kidney disease in population-based research. In India, nearly 18,000-20,000 patients (10% of new ESRD cases) receive renal replacement therapy, with over 172 transplant centers, the majority of which are privately run and located in South India. Each year, nearly 3,500 transplants are performed, with approximately 700 cadaver donors. Due to the increasing number of kidney-related disorders, the improper flow of urine is increasing which increases the demand for the ureteral stents market in the Asia Pacific region.

Competitive Landscape

The major global players in the global ureteral stents market include Boston Scientific Corporation, B. Braun Holding GmbH & Co. KG, Cook Group Incorporated, Coloplast Ltd., BD, Medline Industries, Inc., Allium Medical Solutions Ltd, Pnn Medical A/S, Teleflex Incorporated, Olympus Corporation among others.

Emerging Players

Mitra Industries, InVivo Bionics, and ZygoFix among others

| Metrics | Details | |

| CAGR | 5.8% | |

| Market Size Available for Years | 2018-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Product Type | Multiloop, Open-end stents, Closed-end stents, Double pigtail stents |

| Material | Metal stents, Silicone stents, Hybrid stents, Polyurethane stents, Others | |

| Application | Kidney stones, Kidney transplantation, Tumors, Urinary incontinence, Others | |

| End-User | Hospitals and Clinics, Ambulatory Surgical Centers, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global ureteral stents market report delivers a detailed analysis with 70+ key tables, more than 60 visually impactful figures, and 250 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.