Thrombocytopenia Management Market Size& Industry Outlook

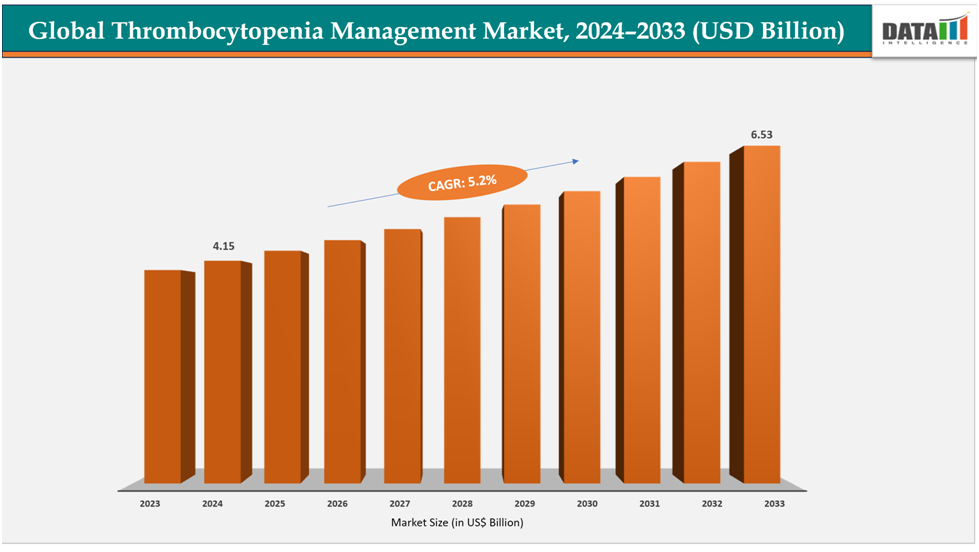

The global thrombocytopenia management market size was US$4.15Billion in 2024 and is expected to reach US$6.53Billion by 2033, growing at a CAGR of5.2%during the forecast period 2025-2033.

Innovations in pipelines are driving rapid growth in the market for thrombocytopenia management. A variety of new therapies are currently under development. Thrombopoietin receptor agonists (TPO-RAs) are demonstrating enhanced effectiveness. Monoclonal antibodies focus on specific pathways to achieve improved patient outcomes. Advancements in enzyme replacement therapies are being made for rare types of thrombocytopenia. Oral medications and subcutaneous injections provide greater convenience for patients. The number of clinical trials is increasing world wide.For instance, in August 2025, Novartis announced that its Phase III VAYHIT2 trial of ianalumab plus eltrombopag in ITP patients met the primary endpoint, demonstrating a statistically significant improvement in time to treatment failure and prolonged maintenance of safe platelet levels compared to placebo plus eltrombopag.

Key Highlights

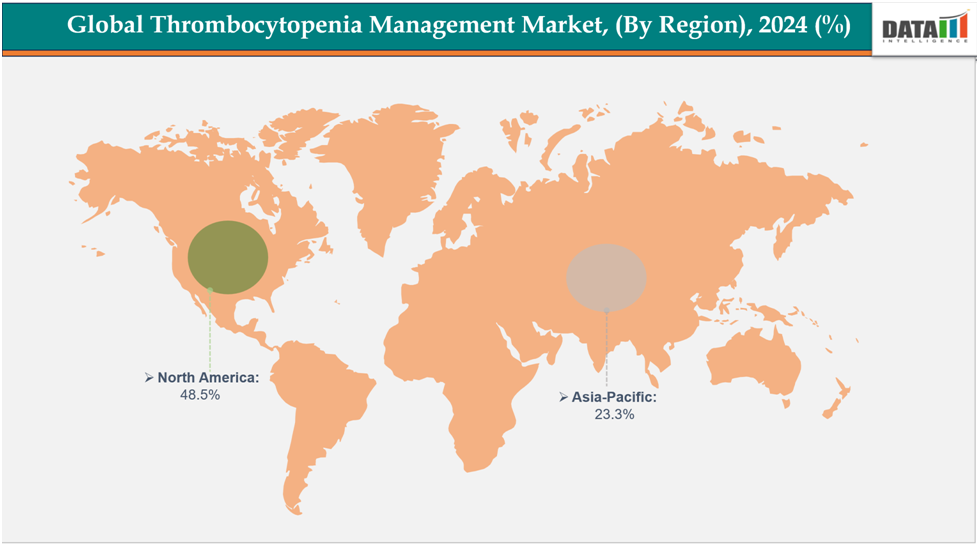

- North America is dominating the global thrombocytopenia management market with the largest revenue share of 48.5% in 2024.

- The Asia Pacific region is the fastest-growing region in the global thrombocytopenia management market, with a CAGR of 7.7% in 2024.

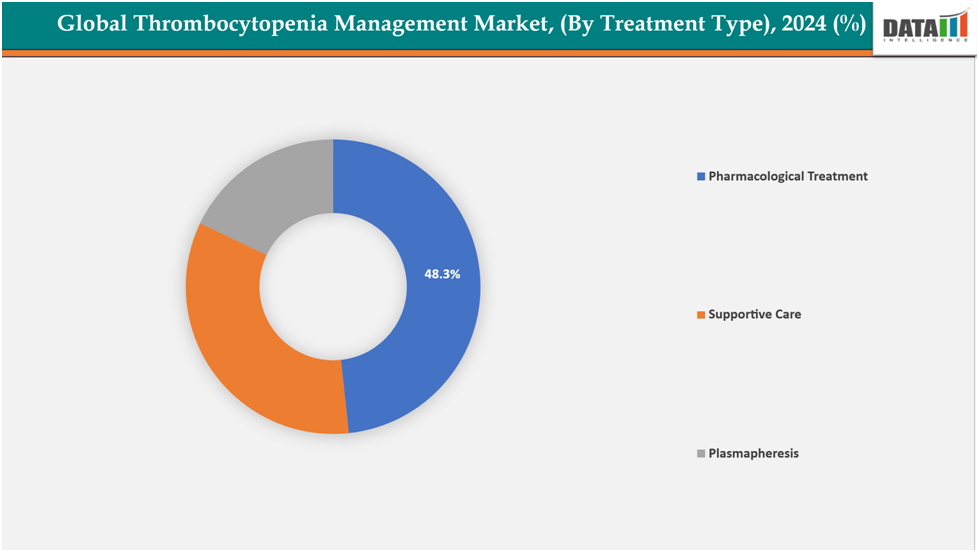

- The pharmacological treatments segment is dominating the thrombocytopenia management market with a 48.3% share in 2024

- The idiopathic thrombocytopenic purpura segment is dominating the thrombocytopenia management market with a 40.2% share in 2024

- Top companies in the thrombocytopenia management market include Novartis, Teva Pharmaceuticals USA, Inc., Amgen Inc., Rigel Pharmaceuticals, Inc., Sobi, Inc., Sanofi, Pfizer Inc., Genentech USA, Inc., Shionogi Inc., and Takeda Pharmaceuticals U.S.A., Inc., among others.

Market Dynamics

Drivers:

Advancements in treatment options and diagnostics are accelerating the growth of the thrombocytopenia management market

Improved patient outcomes have been driven by the availability of new therapeutic options. Medications like thrombopoietin (TPO) receptor agonists effectively enhance platelet production. Enzyme replacement therapies and monoclonal antibodies target underlying causes, reducing the reliance on splenectomy and steroid treatments.

For instance, in November 2023, Takeda announced that the U.S. FDA approved ADZYNMA (recombinant ADAMTS13) for prophylactic and on-demand treatment of adult and pediatric patients with congenital thrombotic thrombocytopenic purpura (cTTP), marking it as the first FDA-approved enzyme replacement therapy for this rare disorder.

Furthermore, enhanced safety profiles have encouraged wider adoption of therapies. Advances in diagnostics have improved both accuracy and speed. Point-of-care platelet monitoring enables early detection, while molecular testing accurately identifies disease subtypes. Early diagnosis allows timely intervention, making individualized treatment approaches increasingly feasible.

The high cost of advanced therapies is expected to hamper the growth of the thrombocytopenia management market

A key challenge to the growth of the thrombocytopenia management market is the high cost of treatment. Advanced therapies, including recombinant enzymes, monoclonal antibodies, and TPO receptor agonists, are expensive. Many patients, especially in developing countries, face affordability issues, compounded by limited insurance coverage and restrictive reimbursement policies.

Moreover, high treatment costs can lead to therapy delays or discontinuation. Budget constraints may make hospitals and clinics reluctant to use expensive medications, reducing adoption rates and limiting overall market penetration.

For more details on this report, see Request for Sample

Thrombocytopenia Management Market, Segmentation Analysis

The global thrombocytopenia management market is segmented based on treatment type, disease type, distribution channel, and region

By Treatment Type:

The pharmacological treatments segment is dominating the thrombocytopenia management market with a 48.3% share in 2024

The market is primarily driven by the pharmacological treatments segment, which includes therapies targeting platelet production and immune-mediated platelet destruction. These medications provide faster, more effective management of ITP and other thrombocytopenias. Injectable and oral options enhance patient adherence and convenience, while reducing the need for invasive procedures such as plasma exchange or splenectomy.

Furthermore, market dominance is maintained by excellent efficacy, enhanced safety profiles, and growing approvals worldwide. Pharmacotherapy innovation keeps driving segment expansion. For instance, in July 2025, the US FDA approved Sanofi’s Wayrilz (rilzabrutinib) as the first BTK inhibitor for adults with persistent or chronic ITP. The approval followed the pivotal LUNA 3 Phase 3 study, which demonstrated sustained platelet responses and symptom improvement.

By Disease Type:

The idiopathic thrombocytopenic purpura segment is dominating the thrombocytopenia management market with a 40.2% share in 2024

The thrombocytopenia management market is dominated by the Idiopathic Thrombocytopenic Purpura (ITP) segment, the most common autoimmune disorder causing low platelet counts. Affecting both adults and children globally, its high prevalence drives consistent demand for treatment. For example, PDSA estimates around 50,000 people in the U.S. currently have ITP. Persistent and chronic cases require long-term care. First-line therapies, such as corticosteroids, are widely used, while second-line treatments including monoclonal antibodies and TPO receptor agonists enhance efficacy and broaden market adoption.

Moreover, new drug approvals enhance therapeutic options. For instance, in July 2025, Kissei Pharmaceutical’s licensing partner, JW Pharmaceutical, launched the SYK inhibitor TAVALISSE (fostamatinib disodium hexahydrate) in South Korea for the treatment of thrombocytopenia in adult patients with chronic idiopathic thrombocytopenic purpura (ITP), marking a significant advancement in ITP therapy.

Geographical Analysis

North America is dominating the global thrombocytopenia management market with 48.5% in 2024

The market for managing thrombocytopenia is dominated by North America due to the region's high incidence of ITP and other platelet diseases, sophisticated healthcare system, and mature market. Advantageous reimbursement practices, as well as the quick uptake of new treatments and cutting-edge diagnostic tools, boost growth.

In the United States, the market for thrombocytopenia management has grown as a result of novel medication formulations, recent FDA approvals, and better patient care brought about by improved disease management techniques and cutting-edge therapies. For instance, in July 2025, Sobi North America announced that the FDA approved Doptelet (avatrombopag) for treating thrombocytopenia in pediatric patients aged one year and older with persistent or chronic ITP, including a new oral granule formulation, Doptelet Sprinkle, for children under six.

Europe is the second region after North America ,which is expected to dominate the global thrombocytopenia management market with34.5% in 2024

The thrombocytopenia management market in Europe has expanded due to recent EU and EMA approvals, new product launches, ongoing clinical research, strategic collaborations, and technological advancements. These developments have enhanced treatment accessibility, broadened therapeutic options, and accelerated the adoption of innovative formulations within the region’s advanced healthcare systems.

Owing to the factors like the recent EU and EMA approvals and new product launches. For instance, in October 2025, the CHMP issued a positive opinion recommending the EU approval of Sanofi’s Wayrilz (rilzabrutinib) for adult patients with immune thrombocytopenia (ITP) who were refractory to other treatments. The final regulatory decision was anticipated in the following months.

The Asia-Pacific region is the fastest-growing region in the global thrombocytopenia management market, with a CAGR of 7.7% in 2024

The Asia-Pacific market for thrombocytopenia management is expanding rapidly due to factors like the increased incidence of platelet abnormalities, greater public awareness of the condition, advancements in healthcare facilities, and encouraging government programs. Growth is further fueled by the adoption of cutting-edge therapies and creative treatment alternatives in nations like China, Japan, South Korea, and India.

Japan’s thrombocytopenia management market expanded steadily, with PMDA and Japan’s Ministry of Health, Labor and Welfare (MHLW)approvals, new product launches, ongoing clinical research, and enhanced treatment options improving patient access and therapeutic outcomes. For instance, in March 2024, Japan’s MHLW approved VYVGART (efgartigimod alfa) for intravenous use in adults with primary immune thrombocytopenia (ITP), as announced by argenx SE, marking a significant advancement in ITP treatment in Japan.

Market Competitive Landscape

Top companies in the thrombocytopenia management market include Novartis, Teva Pharmaceuticals USA, Inc., Amgen Inc., Rigel Pharmaceuticals, Inc., Sobi, Inc., Sanofi, Pfizer Inc., Genentech USA, Inc., Shionogi Inc., and Takeda Pharmaceuticals U.S.A., Inc., among others.

Novartis: Novartis is a global healthcare company actively involved in the thrombocytopenia management market, focusing on developing innovative therapies for platelet disorders, including immune thrombocytopenia (ITP). Leveraging advanced research, robust clinical trials, and novel formulations, Novartis aims to improve patient outcomes, expand treatment options, and enhance accessibility, reinforcing its strategic presence in both established and emerging thrombocytopenia markets worldwide.

Key Developments:

- In August 2025, Asahi Kasei Pharma announced that Doptelet Tablet 20 mg (avatrombopag maleate), for which it held exclusive distribution rights in Japan from Sobi Japan, was approved for the additional indication of persistent and chronic immune thrombocytopenia (ITP), expanding its therapeutic use.

- In August 2024, Takeda announced that the European Commission approved ADZYNMA (recombinant ADAMTS13) for treating ADAMTS13 deficiency in children and adults with congenital thrombotic thrombocytopenic purpura (cTTP), making it the first and only enzyme replacement therapy in the EU for this condition.

- In June 2024, Ethypharm entered into an agreement with Mitsubishi Tanabe Pharma Corporation to acquire the selective antithrombin agent Argatroban monohydrate (Argatra, Arganova, Novastan, Exembol) in Europe, expanding its portfolio in anticoagulant and thrombocytopenia-related therapies.

Thrombocytopenia Management Market Scope

| Metrics | Details | |

| CAGR | 5.2% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Treatment Type | Pharmacological Treatment, Supportive Care, Plasmapheresis |

| By Disease Type | Idiopathic Thrombocytopenic Purpura, Thrombotic Thrombocytopenic Purpura, Drug‑induced Thrombocytopenia, Others | |

| By Distribution Channel | Hospital Pharmacies, Retail Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global thrombocytopenia management market report delivers a detailed analysis with 62 key tables, more than 52visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here