Thermoplastic Tape Market Overview

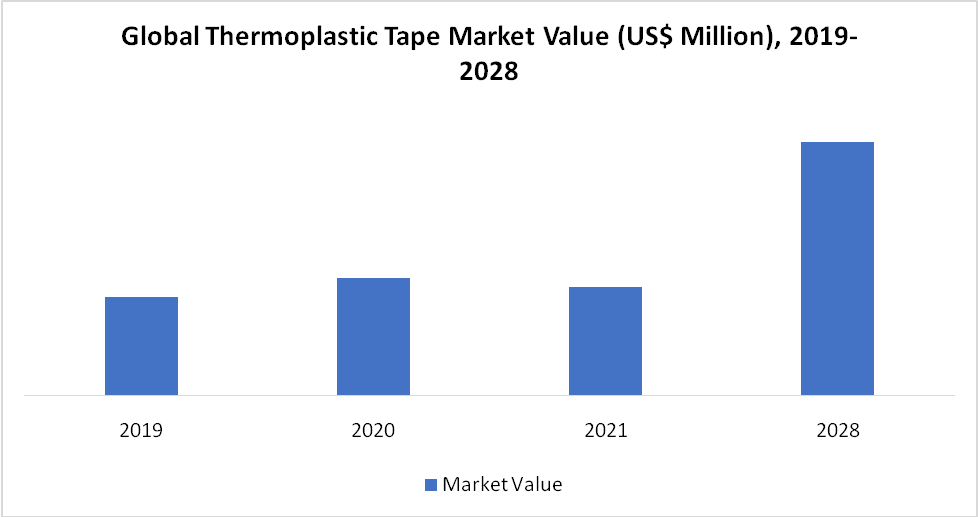

The Global "Thermoplastic Tape Market" is expected to reach at a CAGR of 15.9% during the forecast period (2024-2031).

Thermoplastic tape is a composite that combines fiber and plastic characteristics. The product is essentially a continuous roving that has been pre-impregnated with polymer plastic. At room temperature, such composites are quite flexible, but when heated and chilled, they stiffen. The reaction is triggered by the thermoplastic tape's plastic impregnation melting and forming a homogeneous liquid that, when cooled, forms polymer linkages, resulting in a hardened composite element. The tape features a variety of useful properties and abilities, including flexible placement before curing, high strength and rigidity after curing, ease of storage and application and high recyclability, which make it an excellent choice for Organo sheet layups in-situ applications.

Typically, PEEK and PEKK thermoplastic tapes have been made utilizing a solvent or water-based powder application procedure. Melt-extrusion techniques have recently been created, eliminating the need for a solvent or water-based powder, allowing a wider range of materials to be employed. Thermoplastic tapes with fiber volume fractions of 40–60% are typically produced using these processes. Stamp forming is the most prevalent method for making items out of thermoplastic tapes nowadays. Tapes are cut to a predetermined shape, stacked, heated, and pre-consolidated in this procedure. The preform is then put into a metal tool and pressed to solidify fully.

The thermoplastic composites are recyclable and they have processing advantages such a reduced cycle time, no volatile emissions, and a quick cycle time. Aluminum and steel are heavier than these materials. When heated above a certain temperature range, it softens, making the recycling process easier. Composites come in various shapes and sizes, including laminates, profiles, panels, and sheets, but component manufacturers prefer thermoplastic tape.

Market Summary

| Metrics | Details |

| Market CAGR | 15.9% |

| Segments Covered | By Material, By Thickness, By End-User, and By Region |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, and Other vital insights. |

| Fastest Growing Region | Asia Pacific |

| Largest Market Share | North America |

To Know More Insights - Download Sample

Thermoplastic Tape Market Dynamics

Even though thermoplastic composite materials are available in various forms, including panels, laminates, sheets, and profiles, component manufacturers still choose thermoplastic tape. Given the growing need for thermoplastic tape across various end-use sectors, manufacturers are eager to invest in various combinations and matrices of composites.

The lightweight feature of thermoplastic tapes is to drive the market.

Because of their lightweight qualities (50-70 per cent lighter than steel and 25-30 per cent lighter than aluminum), thermoplastic tapes are gaining interest in product manufacturing processes. The lightweight nature of thermoplastic tapes makes them ideal for both the launch vehicle and the payload in high-demand satellite applications. The material's low coefficient of thermal expansion assures dimensional stability when the satellite is thermally cycling.

Automobile manufacturers are focusing on thermoplastic unidirectional (UD) tapes in place of heavier metal alternatives as government regulations worldwide issue a clarion call for reducing carbon footprint in combination with increasing the production of electric vehicles (EV).

Exceptional mechanical properties to boost the market growth.

Continuous fiber-reinforced thermoplastic tapes with cohesive bonding and form-locking improve the stiffness and durability of car interiors and exteriors. The structural components in the automotive sector benefit from the strong bonding of UD carbon fibers with high-performance thermoplastic polyamide. Medical professionals also employ thermoplastic tapes because of their chemical inertness to human fluids and in vivo breakdown, preventing lipid exposure damage.

Onshore oil and gas applications benefit from thermoplastic tapes' chemical resilience, such as pumping acidic crude oil. Thermoplastic tapes can withstand extreme pressures and temperatures in subsea environments, both from the outside and inside, thanks to the liquids running through them.

Need for high processing temperature to hinder the market growth

The need for high processing temperatures while making thermoplastic tapes is a disadvantage, especially when using modern engineering polymers like PEEK and PEKK. These materials demand processing temperatures of up to 400°C, which adds to the processing equipment's design problems.

Furthermore, these high-grade engineering polymers are more expensive than epoxy thermosets of comparable quality. It is partly owing to decreased demand volume, but it is projected to alter when demand for thermoplastic materials rises.

COVID-19 Impact Analysis

The global effects of coronavirus illness 2019 (COVID-19) are already being felt and the Thermoplastic Tape market will be considerably impacted in 2020. The market for Thermoplastic Tape is rapidly approaching pre-COVID levels, with a high growth rate predicted over the future period, owing to the economic recovery in emerging countries. Because of the flexibility and advantages of thermoplastic tapes, companies have boosted R&D activities in numerous aircraft areas.

The COVID-19 epidemic has significantly impacted aerospace production, although this has not always been the case. Aerospace, space research, urban air mobility (UAM), and the military have all been working hard to develop the next generation of aircraft and composites, notably thermoplastic tapes, which have played a major role in many of these endeavors. Recently, there has been a hike in interest in thermoplastic tapes, notably for commercial aerospace and other high-performance applications.

Thermoplastic Tape Market Segment Analysis

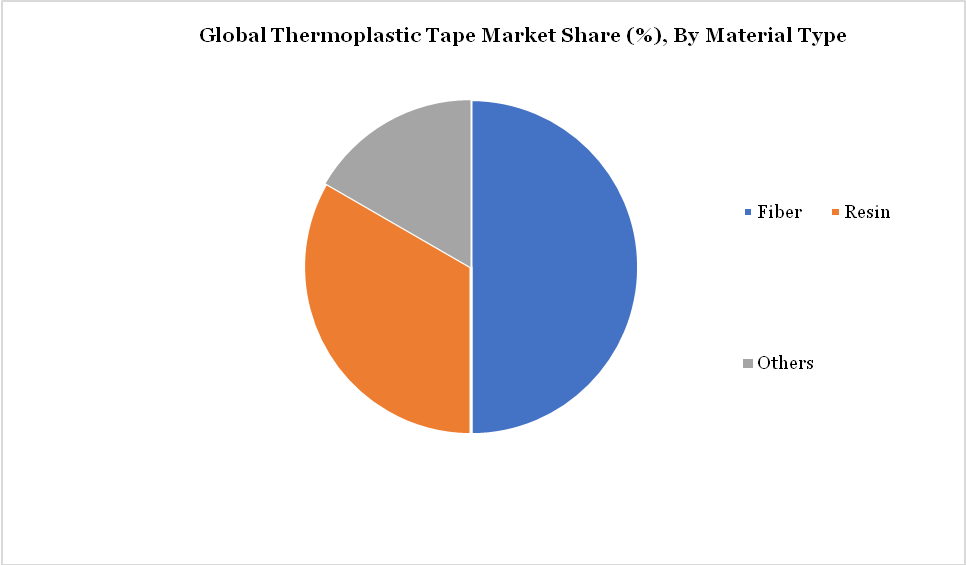

By material type, the thermoplastic tape market is classified into fiber, resin and others.

Fiber to hold the dominating position in the market

Pharmaceuticals and food and beverage packaging are also relying on hard plastics. The aerospace sector is expected to demand thermoplastic tapes comprised of carbon fiber-reinforced polymers (CFRP), which have a higher strength-to-weight ratio than glass and aramid competitors.

Despite its lesser strength than CRPF, thermoplastic tapes with glass-reinforced fiber are expected to gain significant momentum in construction. The ever-increasing demand for lightweight components in automotive and aerospace structures improves fuel efficiency by creating a gold mine in the thermoplastic tapes market.

Thermoplastic Tape Market Geographical Share

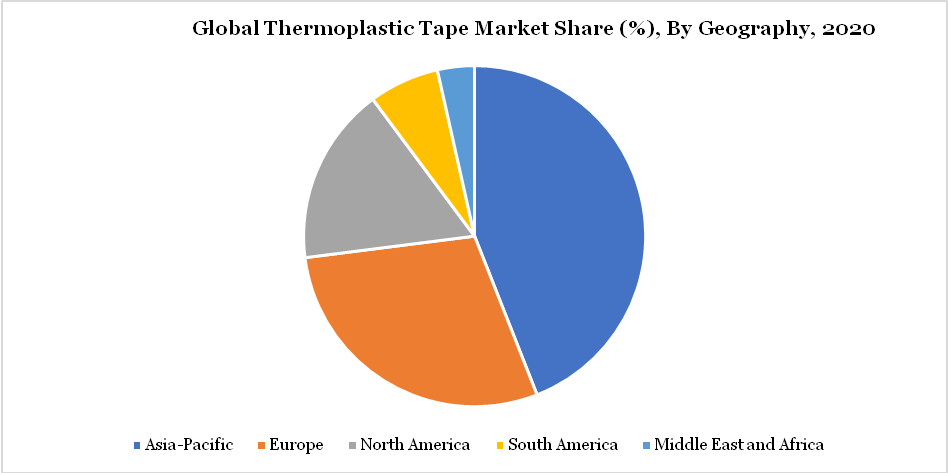

North America holds the largest market share global thermoplastic tape market.

Although North America dominates the worldwide thermoplastic tapes market, owing to the increased production of lightweight automobiles and aircraft. Legal action in the U.S. forces carmakers to fully electrify their vehicles, resulting in a surge in demand for lightweight automotive components. According to the US Department of Commerce, the automotive industry is one of the main markets for composite materials. In recent years, thermoplastic tape has gained much traction as a viable composite material that can be used to make complicated parts and components and improve the qualities of the final product, thanks to its high recyclability.

The rise in aviation traffic in emerging countries is prompting manufacturers to construct aircraft fleets with impact-resistant and weight-cutting components, which are catching the attention of thermoplastic tapes makers. Furthermore, oil and gas fittings makers are paying attention to the developing intra-country and inter-country onshore pipeline projects in the U.S. and Canada to meet the growing demand for oil and gas.

Thermoplastic Tape Companies and Competitive Landscape

Manufacturers in the market continue to strategically emphasize producing a thermoplastic tape with a higher fiber-to-resin content ratio. Several corporations are constructing new carbon fiber facilities to extend their global operations. They're also focusing on collaborating and forming joint ventures to develop their business. The manufacturer's preference determines the material's thermoplastic composite matrix and it has unlimited permutations that can be employed according to the uses and needs of the user.

The worldwide thermoplastic tape market is highly consolidated. Key players operating in the global market for Thermoplastic Tape include Supreme SA, Sabic Corporation, CompTape, Maru Hachi Corporation, Toray Industries, Evonik Industries AG, Alpha Packaging, Inc, Shanghai Topolo New Materials, C.L. Smith, Aaron Packaging Inc., Teijin Limited, and Mitsui Chemicals Inc.

Sabic Corporation

Overview: SABIC has demonstrated a remarkable ability to execute what others believed could not be done since its inception in 1976 by royal decree.SABIC, a public business situated in Riyadh, Saudi Arabia, is one of the leading petrochemicals manufacturers. Saudi Aramco owns 70% of the company's equity, with the remaining 30% being publicly listed on the Saudi stock exchange. The exponential expansion of SABIC has been nothing short of remarkable. The company operates in over 50 countries and employs over 32,000 outstanding people worldwide.

Product Portfolio: Petrochemicals, Agri-Nutrients and Specialties are three Strategic Business Units and Metals is a single entity (Hadeed).

Key Development: In 2018, SABIC introduced a new high-strength UDMAXTM thermoplastic composite tape for pipe and pressure vessel reinforcing 2018. The new glass-filled high-density polyethylene grade, which is commercially accessible worldwide, is designed for reinforcing industrial applications such as pipes and pressure vessels and provides unrivalled tensile strength. The innovative product features one of the highest glass content levels currently available in the industry and optimum thermoplastic resin impregnation.

The UDMAX GPE 46-70 tape is an alternative for metal and other traditional materials since it is extremely lightweight and strong. The UDMAX GPE 46-70 tape has a 70 per cent fiber by weight content, one of the highest available today due to SABIC's HPFIT, which allows the distribution and mixture of glass or carbon fibers with a thermoplastic matrix fast and precisely.

The product may considerably improve mechanical performance while lowering weight and helping to improve corrosion resistance in the most challenging situations by utilizing UDMAX tape to reinforce oil, gas, and water pipes, boilers, and storage tanks.

Why Purchase the Report?

- Visualize the composition of the thermoplastic tape segmentation by material, capacity, end-user, and region, highlighting the critical commercial assets and players.

- Identify commercial opportunities in thermoplastic tape by analyzing trends and co-development deals.

- Excel data sheet with thousands of data points of thermoplastic tape-level 4/5 segmentation.

- PDF report with the most relevant analysis cogently put together after exhaustive qualitative interviews and in-depth market study.

- Product mapping in excel for the key product of all major market players

The global thermoplastic tape report would provide access to an approx. 59market data table, 54 figures, and 180 pages.

Target Audience

- Service Providers/ Buyers

- Industry Investors/Investment Bankers

- Education & Research Institutes

- Research Professionals

- Emerging Companies

- Manufacturers