Surgical Mesh Market Size

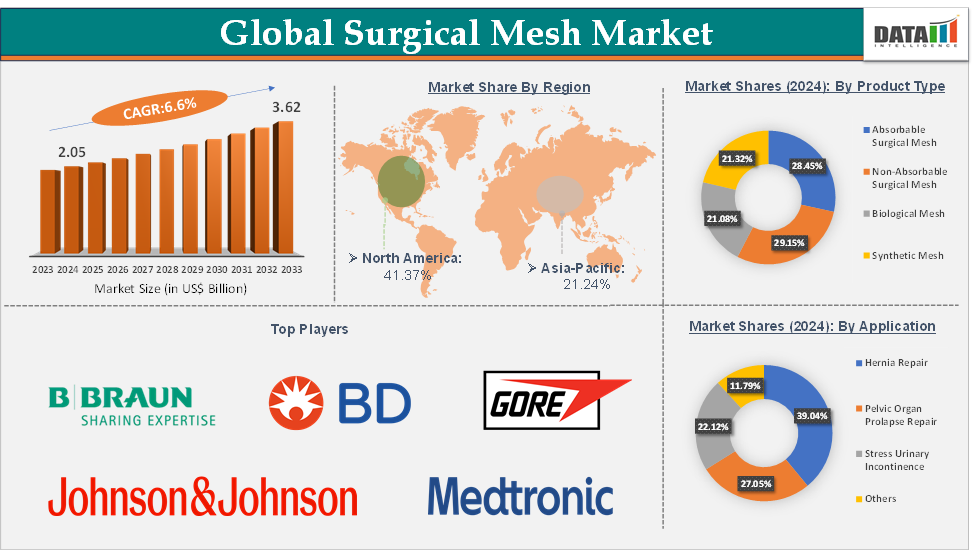

Surgical Mesh Market Size reached US$ 2.05 Billion in 2024 and is expected to reach US$ 3.62 Billion by 2033, growing at a CAGR of 6.6% during the forecast period 2025-2033.

Surgical Mesh Market Overview

Surgical meshes are medical devices used to provide additional support to weakened or damaged tissue. They are commonly employed in procedures such as hernia repair, pelvic organ prolapse, and reconstructive surgeries. The market encompasses various types of meshes, including synthetic, biologic, absorbable, and non-absorbable variants.

The surgical mesh market is poised for continued growth, fueled by technological innovations and the rising demand for effective surgical solutions. Companies that focus on developing cost-effective, biocompatible, and patient-centric mesh products are likely to gain a competitive edge. Additionally, strategic partnerships and investments in emerging markets will be crucial for sustained market expansion.

Executive Summary

For more details on this report – Request for Sample

Surgical Mesh Market Dynamics: Drivers & Restraints

The rising prevalence of hernias is significantly driving the surgical mesh market growth

The use of surgical mesh has become the standard of care for hernia repairs due to its effectiveness in reducing recurrence rates and improving patient outcomes. Traditional suture-based repairs had high recurrence (up to 15%), while mesh repairs have reduced that to less than 2%. Hernias are more prevalent in older adults, and with the global population aging, the number of patients needing hernia repair is increasing. This demographic trend is boosting demand for mesh implants.

The increased incidence of hernias, combined with proven clinical benefits of mesh, aging demographics, and the shift toward minimally invasive procedures, has led to a steady and growing demand for surgical mesh globally. More than 1 million abdominal wall hernia repairs are performed each year in the United States, with inguinal hernia repairs constituting nearly 770,000 of these cases. Approximately 90% of all inguinal hernia repairs are performed on males. This trend is expected to sustain and accelerate the market’s growth over the next decade.

Complications and safety concerns are hampering the surgical mesh market

Complications and safety concerns revolve around issues such as mesh migration, infection, erosion, chronic pain, and long-term health complications, all of which can lead to negative patient outcomes and increased healthcare costs. The growing number of adverse events and safety concerns surrounding surgical meshes has prompted regulatory scrutiny and legal challenges, which can slow the adoption of mesh products.

Mesh erosion happens when the mesh material fails or slides out of its initial place, becoming entrenched in adjacent tissues or organs. This can result in serious problems like infection, prolonged discomfort, and tissue damage. For instance, 5% to 20% of hernia operations result in mesh failure. According to a study in the British Medical Journal, the rate could be between 12% and 30%. These complications may require revision surgeries, which can increase both healthcare costs and patient morbidity.

Surgical Mesh Market, Segment Analysis

The global surgical mesh market is segmented based on product type, material type, application, end-user, and region.

The hernia repair from the application segment is expected to hold 39.04% of the market share in 2024 in the surgical mesh market

The hernia repair sector accounts for a significant percentage due to the long-standing usage of mesh in hernia repair surgeries and the improved results achieved by mesh-based treatments as compared to traditional non-mesh surgeries. Hernia repair surgery is the gold standard for strengthening the weak abdominal walls and avoiding hernia recurrence. As a result, market players are focused on the development of surgical mesh for hernia repair, which is further driving the segment growth.

For instance, in April 2025, BD (Becton, Dickinson and Company) announced 510(k) clearance from the U.S. Food and Drug Administration (FDA) and the commercial launch of Phasix ST Umbilical Hernia Patch, the first and only fully absorbable hernia patch on the market designed specifically for umbilical hernias. The combination of the unique features of the Ventralex ST Hernia Patch with the bioabsorbable nature of Phasix Mesh is a wonderful fusion of technology.

Additionally, in November 2024, Deep Blue Medical expanded its success of T-Line Hernia Mesh, a surgical product that helps prevent the recurrence of hernias after abdominal hernia repair surgery. Although the T-Line Mesh made its clinical debut just three years ago, it is already being used by about 45 clinical sites in the United States, and over 8,000 of the novel extensions and lockstitches of the mesh have been implanted to date with no adverse events.

The shift towards minimally invasive hernia repair surgeries, such as laparoscopic and robot-assisted surgery, has contributed to the dominance of the hernia repair segment. Surgical meshes are ideal for use in these procedures because they are lightweight, flexible, and can be easily inserted through small incisions. For instance, laparoscopic hernia repair is becoming the preferred technique for many surgeons due to its lower complication rates and quicker recovery. According to the Global Hernia Society, the laparoscopic approach accounts for about 60-70% of hernia surgeries in developed countries, driving the demand for surgical meshes tailored for these procedures.

Surgical Mesh Market Geographical Analysis

North America is expected to dominate the global surgical mesh market with a 41.37% share in 2024

North America, particularly the United States, has a high incidence of hernias due to factors such as an aging population, high obesity rates, and sedentary lifestyles. This has led to a large number of hernia repairs, most of which involve surgical mesh. For instance, according to Healthcare Cost and Utilization Project data and the US Food and Drug Administration, an estimated 611,000 ventral and 1 million inguinal hernia repairs are performed each year in the US.

North America has high levels of healthcare awareness and access, which leads to an increased number of surgeries involving surgical mesh. Patients are more likely to seek treatment for conditions like hernias, knowing that advanced treatments, such as mesh implants, are available. Thus, the market players are focusing on launching the surgical mesh with technological advancements.

For instance, in April 2024, TELA Bio commercially launched the OviTex Inguinal Hernia Repair (IHR) mesh in the US. The Pennsylvania-based firm has specifically designed the robotic-compatible OviTex IHR surgical mesh for use in laparoscopic and inguinal hernia repair. It comes in a three or four-layer anatomically shaped device or a three-layer rectangular device.

Asia-Pacific is growing at the fastest pace in the surgical mesh market, holding 21.24% of the market share

The rising rates of obesity in countries like Japan, China, and India, combined with an increasing number of abdominal hernia cases, are driving the demand for hernia repair surgeries. Obesity is a key risk factor for hernias, and with lifestyle changes, these conditions are becoming more prevalent in the Asia Pacific region, creating a significant market opportunity for surgical meshes.

For instance, according to the World Health Organization (WHO), the prevalence of obesity in Asia is rising rapidly. According to the Chinese BMI classification for overweight and obesity, 34.8% of the study population were overweight and 14.1% were obese. This growing rate of obesity significantly contributes to the increasing number of hernia cases and surgeries requiring mesh.

The Asia Pacific region has witnessed significant investments in healthcare infrastructure, particularly in countries like India, China, and South Korea, where hospitals, surgical centers, and medical device manufacturers are modernizing and expanding. This has made advanced surgical treatments, including mesh-based procedures, more accessible to the growing population.

For instance, in October 2024, Park Hospital, a multi-specialty healthcare provider performed a complex robotic-assisted surgery to save a 45-year-old man from a complicated diaphragmatic hernia. Robotic-assisted surgery allowed to safely reduce the herniated organs back into the abdominal cavity and repair the diaphragm with a large mesh, ensuring a stable closure. This increases the demand for surgical mesh in the region.

Surgical Mesh Market Top Companies

Top companies in the surgical mesh market include Johnson & Johnson, B. Braun SE, Medtronic plc, BD, CITEC, W. L. Gore & Associates, Inc., Medcity Surgicals, Dolphin Sutures, Herniamesh S.r.l., and Advin Health Care, among others.

Surgical Mesh Market Key Developments

In April 2025, BD (Becton, Dickinson and Company) launched industry-first bioabsorbable mesh designed for umbilical hernia repair with 510(k) clearance from the U.S. Food and Drug Administration (FDA) and the commercial launch of Phasix ST Umbilical Hernia Patch, the first and only fully absorbable hernia patch on the market designed specifically for umbilical hernias. The combination of the unique features of the Ventralex ST Hernia Patch with the bioabsorbable nature of Phasix Mesh is a wonderful fusion of technology.

In October 2024, Legal-Bay LLC, The Pre-settlement Funding Company, announced that there is finally some resolve on the horizon for hernia mesh litigants. Becton, Dickinson and Company, the parent company of BARD, has finally reached a settlement agreement on the thousands of lawsuits they've been battling for almost twenty years. The settlement will resolve cases in Rhode Island and the federal MDL in Ohio for plaintiffs who allege their hernia mesh devices were defective and caused physical injury.

In April 2024, TELA Bio commercially launched the OviTex Inguinal Hernia Repair (IHR) mesh in the US. The Pennsylvania-based firm has specifically designed the robotic-compatible OviTex IHR surgical mesh for use in laparoscopic and inguinal hernia repair. It comes in a three or four-layer anatomically shaped device or a three-layer rectangular device. The move is intended to meet the demand for more natural repair options in the more than 665,000 inguinal hernia procedures performed in the country every year.

Market Scope

Metrics | Details | |

CAGR | 6.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Absorbable Surgical Mesh, Non-Absorbable Surgical Mesh, Biological Mesh, Synthetic Mesh |

Material Type | Polypropylene, Polyester, Polytetrafluoroethylene (PTFE), Others | |

Application | Hernia Repair, Pelvic Organ Prolapse Repair, Stress Urinary Incontinence, Others | |

End-User | Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global surgical mesh market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 147 pages of expert insights, providing a complete view of the market landscape.