SMN1 Gene Replacement Market is segmented By Type, By Product Type, By Age Group, By Route of Administration, By Sales Channel and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Market Overview

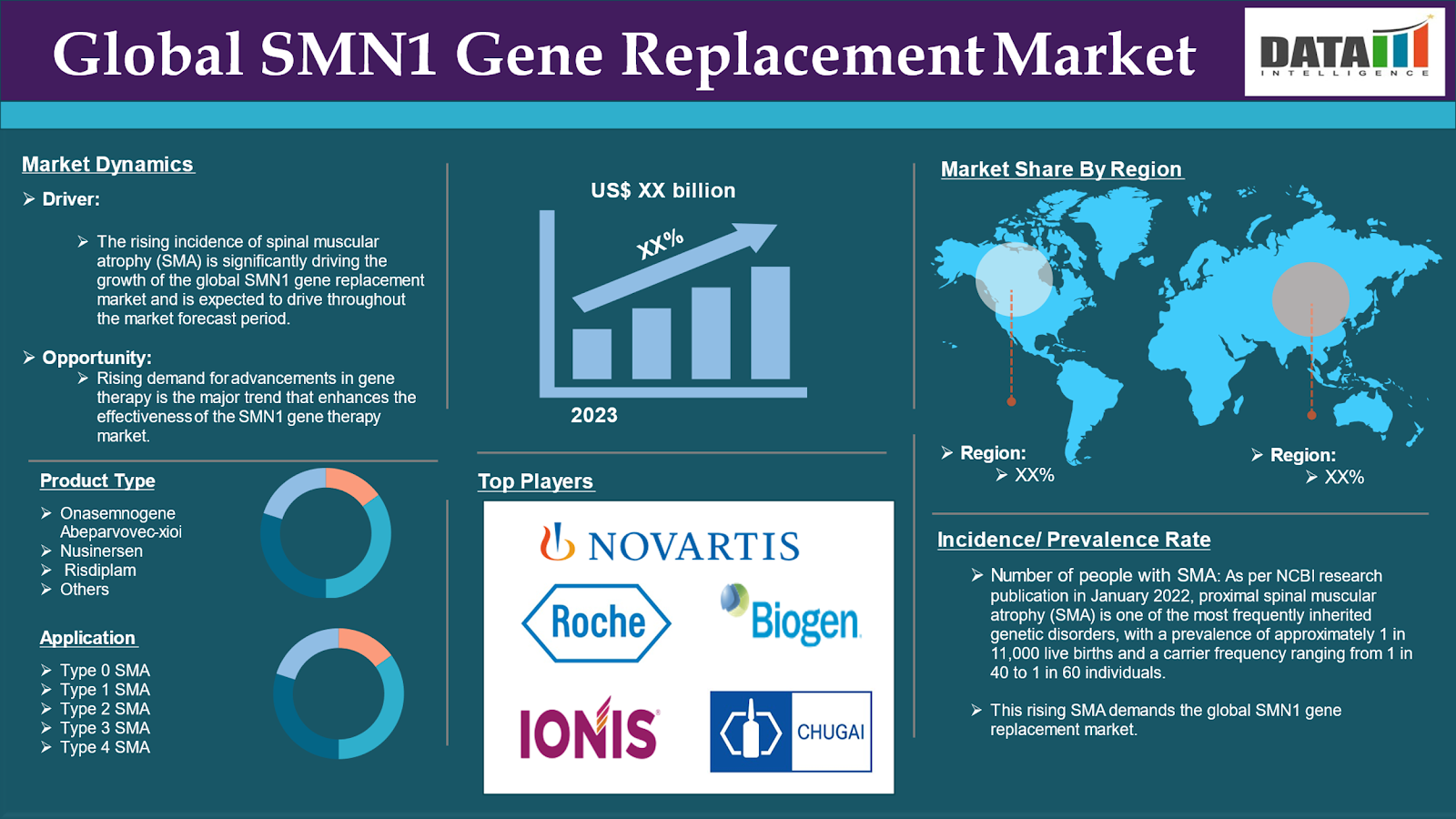

The global SMN1 gene replacement market reached US$ 1.21 billion in 2023 and is expected to reach US$ 1.76 billion by 2031, growing at a CAGR of 4.9% during the forecast period 2024-2031.

Spinal muscular atrophy (SMA) is a rare genetic neuromuscular disorder caused by loss-of-function mutations in the survival motor neuron-1 (SMN1) gene, which leads to a deficiency of the SMN protein. This deficiency is critical because the SMN protein is essential for the survival and function of motor neurons, which control muscle movements.

The severity of SMA symptoms is inversely related to the number of copies of the SMN2 gene, which, while similar to SMN1, produces significantly less functional SMN protein. SMA results from mutations in the SMN1 gene located on chromosome. The presence of one or more copies of the SMN2 gene can modify the severity of the disease; individuals with more copies of SMN2 generally have milder forms of SMA. These factors have driven the global SMN1 gene replacement market expansion.

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Rising incidence of spinal muscular atrophy (SMA)

The rising incidence of spinal muscular atrophy (SMA) is significantly driving the growth of the global SMN1 gene replacement market and is expected to drive throughout the market forecast period.

Spinal muscular atrophy (SMA) is a rare genetic neuromuscular disorder and a leading genetic cause of infant mortality. It is caused by the absence of a functional SMN1 gene, leading to the rapid and irreversible loss of motor neurons, which affects essential muscle functions such as breathing, swallowing, and basic movement. The severity of SMA varies across different types, which correspond to the number of copies of the backup SMN2 gene present.

As per NCBI research publication in January 2022, proximal spinal muscular atrophy (SMA) is one of the most frequently inherited genetic disorders, with a prevalence of approximately 1 in 11,000 live births and a carrier frequency ranging from 1 in 40 to 1 in 60 individuals. This rising SMA demands the global SMN1 gene replacement market.

The condition is primarily characterized by the degeneration of alpha motor neurons located in the anterior horn of the spinal cord. In its most severe form, SMA manifests before six months of age in infants, resulting in muscle weakness, loss of bulbar function, and other critical motor impairments. All these factors demand the global SMN1 gene replacement market.

Moreover, the rising demand for advancements in gene therapy contributes to the global SMN1 gene replacement market expansion.

High treatment costs

The high costs of treatments for spinal muscular atrophy (SMA) gene therapies present a significant barrier in the global SMN1 gene replacement market. These expenses not only impact individual patients but also have broader implications for healthcare systems and insurance providers.

According to an NCBI research publication in March 2023, Zolgensma (onasemnogene abeparvovec) and Nusinersen (Spinraza) are among the most expensive treatments available for spinal muscular atrophy (SMA), with estimated costs per dose of approximately $4.2 million for Zolgensma and around $6 million for Nusinersen over a patient's lifetime. Thus, the above factors could be limiting the global SMN1 gene replacement market's potential growth.

Market Segment Analysis

The global SMN1 gene replacement market is segmented based on type, product type, age group, route of administration, sales channel, and region.

Product Type:

Onasemnogene abeparvovec-xioi segment is expected to dominate the global SMN1 gene replacement market share

The onasemnogene abeparvovec-xioi segment holds a major portion of the global SMN1 gene replacement market share and is expected to continue to hold a significant portion of the global SMN1 gene replacement market share during the forecast period.

Zolgensma (onasemnogene abeparvovec) is the sole approved gene therapy for spinal muscular atrophy (SMA) that directly targets the genetic cause of the disease. It works by replacing the missing or non-functional SMN1 gene, aiming to halt disease progression through sustained expression of the SMN protein following a single intravenous infusion. Thus, the above factors could be driving the global SMN1 gene replacement market's potential growth.

Furthermore, key players in the industry more focus on the research & development and the rising number of clinical trials that would propel this segment in the SMN1 gene replacement market. As per Novartis data in March 2024, currently, Zolgensma has received approval in over 51 countries, and more than 3,700 patients have been treated globally, including those in clinical trials and managed access programs. Novartis remains committed to enhancing the lives of children affected by SMA and is actively exploring further applications of Zolgensma through an extensive clinical development program.

This includes investigating the potential of intrathecal administration of OAV101 for patients with later-onset forms of SMA. These factors have solidified the segment's position in the global SMN1 gene replacement market.

Nusinersen segment is the fastest-growing segment in the global SMN1 gene replacement market share

The nusinersen segment is the fastest-growing segment in the global SMN1 gene replacement market share and is expected to hold the market share over the forecast period.

SPINRAZA (nusinersen) is an antisense oligonucleotide (ASO) designed to address the underlying cause of motor neuron loss by continuously increasing the production of full-length survival motor neuron (SMN) protein in the body. It is administered directly into the central nervous system, where motor neurons are located, ensuring that treatment targets the origin of the disease.

Furthermore, key players in the industry more focus on the research & development and the rising number of clinical trials that would propel this segment in the SMN1 gene replacement market. As per Biogen data in September 2024, SPINRAZA (nusinersen) is approved in over 71 countries for the treatment of spinal muscular atrophy (SMA) in infants, children, and adults. As a foundational therapy for SMA, more than 14,000 individuals have received SPINRAZA worldwide. Thus, the above factors could be driving the global SMN1 gene replacement market's potential growth.

The therapy has demonstrated sustained efficacy across various ages and SMA types, supported by a well-established safety profile from data on patients treated for up to 10 years. The clinical development program for nusinersen includes over 10 clinical studies, involving more than 460 participants from diverse patient populations, including two pivotal randomized controlled trials (ENDEAR and CHERISH). The ongoing NURTURE open-label extension study is assessing the long-term effects of SPINRAZA. These factors have solidified the segment's position in the global SMN1 gene replacement market.

Type

Type 1 SMA segment is expected to dominate the global SMN1 gene replacement market share

The type 1 SMA segment holds a major portion of the global SMN1 gene replacement market share and is expected to continue to hold a significant portion of the global SMN1 gene replacement market share during the forecast period.

Type 1 spinal muscular atrophy (SMA), also known as Werdnig-Hoffmann disease or infantile-onset SMA, is the most prevalent and severe form of this genetic disorder. It primarily affects infants, with symptoms typically appearing at birth or within the first six months of life.

Furthermore, key players in the industry more focus on the research & development and the rising number of clinical trials that would propel this segment in the SMN1 gene replacement market. According to Novartis AG, news in March 2024, the majority of patients with two copies of the SMN2 gene develop Type 1 SMA, the most prevalent form, accounting for about 60% of cases. Type 1 is particularly severe without treatment, over 90% of affected infants will either die or require permanent ventilation by the age of two. In contrast, more than 80% of patients with three copies of SMN2 develop Type 2 SMA, which represents around 30% of cases.

Untreated individuals with Type 2 typically cannot walk and will rely on a wheelchair; additionally, over 30% may not survive past age 25. Since motor neuron loss is irreversible, early diagnosis and prompt treatment including proactive supportive care are crucial to prevent further motor neuron degeneration and disease progression. These factors have solidified the segment's position in the global SMN1 gene replacement market.

Type 2 SMA segment is the fastest-growing segment in the global SMN1 gene replacement market share

The type 2 SMA segment is the fastest-growing segment in the global SMN1 gene replacement market share and is expected to hold the market share over the forecast period.

Type 2 spinal muscular atrophy (SMA) is classified as an intermediate form of the disease, characterized by specific onset and functional abilities in affected children. Symptoms of Type 2 SMA typically begin between 6 and 18 months of age. This delayed onset distinguishes it from Type 1 SMA, which manifests much earlier in infancy.

Children with Type 2 spinal muscular atrophy (SMA) experience weakness in the proximal muscles, which are those located closest to the center of the body, such as the hips and thighs. While they are often able to sit independently, they typically require assistance for mobility and may rely on wheelchairs as they grow older. The condition is marked by various symptoms, including muscle weakness, difficulties with respiratory function, and scoliosis resulting from muscle imbalances. As the disease progresses, patients may also face challenges with swallowing and breathing. Thus, the above factors could be driving the global SMN1 gene replacement market's potential growth.

Furthermore, key players in the industry more focus on the research & development and the rising number of clinical trials that would propel this segment in the SMN1 gene replacement market. For instance, as per NCBI research publication in March 2022, as an SMN2 pre-mRNA splicing modifier, risdiplam enhances the production of full-length SMN protein, which is crucial because its deficiency contributes to the pathophysiology of spinal muscular atrophy (SMA). In Phase 2/3 clinical trials, risdiplam demonstrated significant improvements in motor function among infants with SMA type 1, as well as in patients aged 2 to 25 years with SMA types 2 and 3.

These factors have solidified the segment's global position in the SMN1 gene replacement market.

Market Geographical Share

North America is expected to hold a significant position in the global SMN1 gene replacement market share

North America holds a substantial position in the global SMN1 gene replacement market and is expected to hold most of the market share.

The increasing prevalence of spinal muscular atrophy (SMA) in North America is leading to a higher demand for effective treatment options. As awareness of the condition grows, more patients are being diagnosed and receiving treatment, which in turn fuels SMN1 gene replacement market expansion.

The rising adoption of novel therapeutics is expected to drive the SMNI gene replacement market over the forecast period. Therapies for spinal muscular atrophy are designed to interfere with the cellular basis of the disease by modifying pre-mRNA splicing and enhancing the expression of the Survival Motor Neuron (SMN) protein, which is only expressed at low levels in this disorder. Novel therapeutics are developing based on this basis, so there is an increasing demand for novel therapies and there is an increasing adoption of these therapies which leads to better patient outcomes. Thus, the above factors could be driving the global SMN1 gene replacement market's potential growth in this region.

Furthermore, in this region, a major number of key players' presence, well-advanced healthcare infrastructure, government initiatives & regulatory support, technological advancements, & investments, and product launches would propel this SMN1 gene replacement market growth.

For instance, in December 2023, the lab of Yongchao C. Ma, Ph.D., at Stanley Manne Children's Research Institute at Ann & Robert H. Lurie Children's Hospital of Chicago uncovered a novel mechanism that leads to motor neuron degeneration in spinal muscular atrophy (SMA). This discovery offers a new target for treatment that overcomes important limitations of gene therapy and other current therapies for SMA. Thus, the above factors are consolidating the region's position as a dominant force in the global SMN1 gene replacement market.

Asia Pacific is growing at the fastest pace in the global SMN1 gene replacement market

Asia Pacific holds the fastest pace in the global SMN1 gene replacement market and is expected to hold most of the market share.

The increasing prevalence of spinal muscular atrophy (SMA) in the Asia-Pacific region is driving the demand for effective treatments. As awareness of SMA expands, more patients are being diagnosed and treated, which further contributes to SMN1 gene replacement market growth.

The region is facing a growing burden of chronic diseases, prompting increased investment in gene therapy development and heightening the need for innovative treatment options, particularly those targeting SMA. There has been a notable rise in the number of clinical trials yielding positive results for gene therapies in the Asia-Pacific area. This increase enhances confidence among healthcare providers and patients regarding these treatment options.

The emergence of numerous biotechnology companies specializing in gene therapy in countries such as China, Japan, and South Korea is fostering innovation and competition within the market. This influx of new players is expected to accelerate the development and availability of SMN1 gene replacement therapies. Thus, the above factors could be driving the global SMN1 gene replacement market's potential growth in this region.

Furthermore, key players in this region, government initiatives, research & developments, a supportive regulatory environment, and product launches drive this SMN1 gene replacement market growth. For instance, in September 2024, Chugai Pharmaceutical Co., Ltd. announced that the Ministry of Health, Labour and Welfare (MHLW) in Japan has approved “Evrysdi Dry Syrup 60 mg” (generic name: risdiplam) for two important updates. Firstly, it is now approved for an additional indication to treat pre-symptomatic spinal muscular atrophy (SMA) identified through genetic testing. Secondly, the approval includes a new dosage form suitable for patients under 2 months of age.

Thus, the above factors are consolidating the region's position as the fastest-growing force in the global SMN1 gene replacement market.

Market Competitive Landscape

The major global players in the SMN1 gene replacement market include Biogen., Novartis AG, F. Hoffmann-La Roche Ltd (Genentech), Ionis Pharmaceuticals, Inc., and Chugai Pharmaceutical Co., Ltd. among others.

Emerging Players

The emerging players in the global SMN1 gene replacement market include Cytokinetics, Inc. and Scholar Rock, Inc.

Metrics | Details | |

CAGR | XX% | |

Market Size Available for Years | 2022-2031 | |

Estimation Forecast Period | 2024-2031 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Type | Type 0 SMA, Type 1 SMA, Type 2 SMA, Type 3 SMA, Type 4 SMA |

Product Type | Onasemnogene Abeparvovec-xioi, Nusinersen, Risdiplam, Others | |

Age Group | Pediatric, Adults | |

Route of Administration | Oral, Intrathecal, Intravenous | |

Sales Channel | Distribution Channel, End-User | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Key Developments

In September 2024, Biogen announced positive topline results from the Phase 2/3 DEVOTE study, which investigated a higher dose regimen of Nusinersen (SPINRAZA) for treating spinal muscular atrophy (SMA) in treatment-naïve, symptomatic infants. This study is significant as it demonstrates the potential for an improved dosing strategy to enhance treatment outcomes for SMA patients.

Why Purchase the Report?

- To visualize the global SMN1 gene replacement market segmentation based on type, product type, age group, route of administration, sales channel, and region and understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of the SMN1 gene replacement market with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping is available in excel consisting of key products of all the major players.

The global SMN1 gene replacement market report would provide approximately 63 tables, 68 figures, and 184 pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies