Smart Pumps Market Size

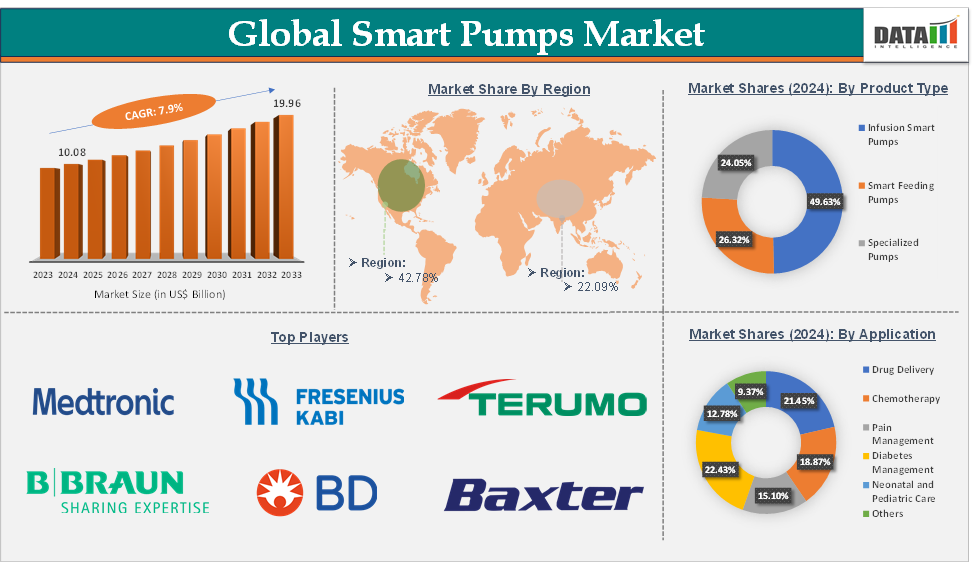

Smart Pumps Market Size reached US$ 10.08 Billion in 2024 and is expected to reach US$ 19.96 Billion by 2033, growing at a CAGR of 7.9% during the forecast period 2025-2033.

Smart Pumps Market Overview

The smart pump market in healthcare is expanding rapidly. This growth is fueled by increased demand for patient safety features like dose error reduction software and smart integration capabilities. For instance, the National Institute of Health stated that 89.5% of hospitals in the United States used smart pump technology according to a survey developed by the American Society of Health-System Pharmacists (ASHP). The utilization of smart pump technology varied by hospital bed size, with full implementation in hospitals with 600 beds and more.

Additionally, according to the study conducted by the National Institute of Health, using smart pump records, over 370,000 infusion starts for continuously infused medications used in neonates and infants hospitalized in a level IV NICU were evaluated. Smart pumps prevented 160 attempts to exceed the hard maximum limit for doses that were as high as 7–29 times the maximum dose and resulted in the reprogramming or cancellation of 2093 infusions after soft maximum alerts. Thus, the rising adoption of smart pumps is further accelerating the market growth.

Executive Summary

For more details on this report, Request for Sample

Smart Pumps Market Dynamics: Drivers & Restraints

Rising demand for home healthcare is significantly driving the smart pumps market growth

Rising demand for home healthcare is significantly driving the growth of the smart pumps market and is expected to drive the market over the forecast period by increasing the need for reliable, accurate, and remotely manageable medical devices that can be used outside of hospital settings. As the global population ages, there is a higher prevalence of chronic conditions such as diabetes, cardiovascular diseases, and kidney failure. These conditions often require long-term treatments such as insulin delivery, parenteral nutrition, and pain management through infusion pumps. Smart pumps, with their ability to provide accurate dosing and real-time monitoring, are ideal for home use.

According to the World Health Organization, about 830 million people worldwide have diabetes, the majority living in low- and middle-income countries. In addition, around 11% of cardiovascular deaths were caused by high blood glucose. This rising diabetes boosts the adoption of insulin pumps, thus, there is an increasing demand for smart pumps to use at home.

The trend toward patient-centric care and hospital-at-home programs is fueling the adoption of smart pumps. Healthcare providers are increasingly allowing patients to manage their treatments at home, reducing hospital visits and costs. For instance, patients receiving chemotherapy, home parenteral nutrition, or continuous insulin therapy can use smart pumps to safely administer their treatments while being monitored remotely by healthcare professionals.

For instance, almost $103 billion was spent on home health care in the United States, and that number will reach nearly $173 billion by 2026, according to an analysis from the Centers for Medicare & Medicaid Services (CMS) Office of the Actuary. This growth is driven by the push for outpatient care, increasing healthcare costs, and improvements in home-based medical devices.

Operational and user challenges are hampering the market growth

Despite their advanced features and significant benefits, these challenges hinder widespread adoption, particularly in complex healthcare environments like hospitals, clinics, and home settings. Smart pumps come with sophisticated features like dose error reduction software, remote monitoring, and integration with hospital systems. These features require a higher level of technical knowledge to operate effectively. For instance, pumps designed for drug delivery, such as those for chemotherapy or insulin, may have intricate settings that can overwhelm healthcare professionals without adequate training.

Additionally, in hospitals, some medical staff report a steep learning curve when it comes to handling smart pumps, especially when switching from traditional pumps. This increases the likelihood of human errors during the initial transition period, which can discourage facilities from fully adopting smart pump technologies.

Smart Pumps Market Segment Analysis

The global smart pumps market is segmented based on product type, connectivity, application, end-user, and region.

The infusion smart pumps from the product type segment are expected to hold 49.63% of the market share in 2024 in the smart pumps market

Infusion pumps are used extensively across various healthcare settings, including hospitals, clinics, and home care environments. These devices are essential for drug delivery, parenteral nutrition, chemotherapy, and insulin therapy, among other treatments. Infusion smart pumps incorporate advanced dose error reduction systems, wireless connectivity, dose safety software, and real-time monitoring, which enhances their safety and efficiency. These innovations help reduce medication errors, a significant concern in healthcare.

The major players in the market are developing advanced infusion smart pumps, which are further driving the segment growth. For instance, in April 2025, ICU Medical received FDA 510(k) clearance for several new additions to its infusion pump portfolio. The FDA cleared the Plum Solo precision IV pump, a single-channel complement to the dual-channel Plum Duo. ICU Medical also got the FDA’s green light for updated versions of its Plum Duo pump and LifeShield infusion safety software. With these advanced products, the segment is expected to grow in the coming years.

Smart Pumps Market Geographical Share

North America is expected to dominate the global smart pumps market with a 42.78% share in 2024

North America, especially the United States, is home to leading manufacturers of smart pumps, including Medtronic, Baxter International, and other emerging players, which are continuously innovating to develop advanced, user-friendly smart pumps. These innovations, such as wireless connectivity, real-time monitoring, and cloud-based data analytics, make these devices highly desirable in the healthcare industry.

For instance, in April 2024, Baxter International Inc. cleared the U.S. Food and Drug Administration (FDA) 510(k) clearance of its Novum IQ large volume infusion pump (LVP) with Dose IQ Safety Software. Adding LVP modality to the Novum IQ Infusion Platform, which includes Baxter’s syringe infusion pump (SYR) with Dose IQ Safety Software, powered by the IQ Enterprise Connectivity Suite, enables clinicians to utilize a single, integrated system across a variety of patient care settings. These continuous advancements by market players boost the adoption in the region, which is driving the North America market growth.

North America has a high prevalence of chronic diseases like diabetes, heart disease, and cancer, which require continuous medication administration via infusion pumps. This has fueled the demand for smart pumps, especially for insulin infusion pumps and chemotherapy drug delivery systems. For instance, according to the American Diabetes Association, 38.4 million Americans, or 11.6% of the population, have diabetes, many of whom rely on infusion pumps for insulin delivery. The growing patient population is a significant driver for the smart pumps market.

Smart Pumps Market Top Companies

Top companies in the smart pumps market include B. Braun Medical Inc., Medtronic plc, Fresenius Kabi USA, LLC, Terumo Corporation, Becton, Dickinson and Company, ICU Medical, Inc., Baxter International Inc., Insulet Corporation, BPL Medical Technologies, SINO MDT, and among others.

Market Scope

| Metrics | Details | |

| CAGR | 7.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Infusion Smart Pumps, Smart Feeding Pumps, and Specialized Pumps |

| Connectivity | Standalone Pumps and Connected Pumps | |

| Application | Drug Delivery, Chemotherapy, Pain Management, Diabetes Management, Neonatal and Pediatric Care, and Others | |

| End-User | Hospitals, Specialty Clinics, Ambulatory Surgical Centers, and Homecare Settings | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global smart pumps market report delivers a detailed analysis with 70 key tables, more than 65 visually impactful figures, and 158 pages of expert insights, providing a complete view of the market landscape.