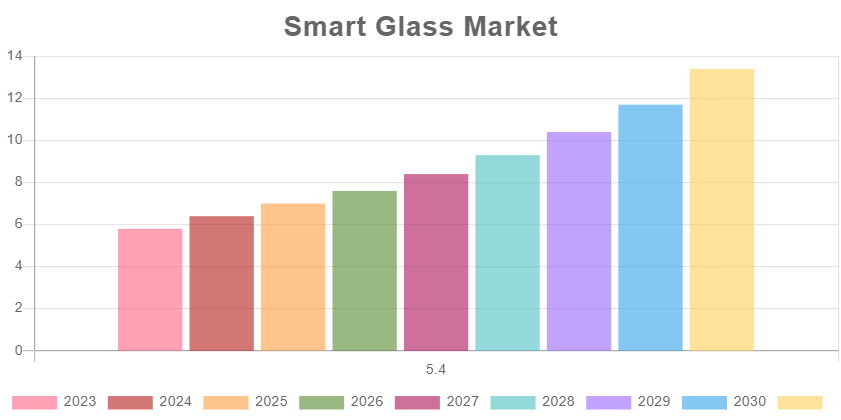

Smart Glass Market Size

Global Smart Glass Market reached US$5.8 billion in 2023 and is expected to reach US$ 13.4 billion by 2031, growing with a CAGR of 10.9% during the forecast period 2024-2031, according to DataM Intelligence report.

Smart glass is active and multipurpose, allowing a typically static material to come to life. Visible light, UV light, and infrared light can all be controlled using this method. Transparent materials (such as glass or polycarbonate) can transform from clear to shaded or completely opaque on command, making privacy glass possible.

Specialty glass known as "smart glass" reacts to heat, light, or voltage by altering its appearance and characteristics of light transmission. The rising use in a variety of applications, including architectural, automotive, aerospace, and marine, is what is fueling the market's expansion globally. The industry is mostly driven by two factors: design developments in most buildings for the installation of smart windows and technology innovations in switchable eyewear.

North America is among the growing regions in the global smart glass market, covering more than 1/3rd of the market. due to the region's businesses working together and the quick advancement of technology. Furthermore, the market is anticipated to increase as smart glasses become more and more popular among fitness enthusiasts and athletes in nations like the U.S. and Canada. For example, the Everysight Raptor and Solos Smart Glasses are made especially for runners, cyclists and triathletes since they enable them to perform to their best by showing real-time data like heart rate and average pace, among other things.

Market Scope

| Metrics | Details |

| CAGR | 10.9% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Technology, Mode of Control, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | Asia-Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more details on this report - Request for Sample

Market Dynamics

Increasing Use of Smart Glass in the Automotive Industry

The automobile sector is expanding rapidly. Higher investment and growing market confidence in the economy have driven sales of both light- and heavy-duty cars in recent years. The market for automotive smart glasses is influenced by many factors. The number of glasses that need to be replaced rises as more people drive and log more kilometers. Severe weather and poor driving conditions can also increase demand for vehicle glass replacement and repair.

However, consumers would rather put off fixing little windshield damage following a car trade-in, sale, or inspection. The market for smart glass for automotive applications is positively impacted in many nations by the production of new automobiles, the turnover of old cars and rules of vehicle inspections.

There were about 81.6 million automobiles made. The International Organization of Motor Vehicle Manufacturers (OICA) further broke down the total number of cars manufactured in 2022 by country. China, with 26.1 M automobiles, took first place, followed by US and Japan. The top 31 automakers included three African countries: South Africa, Morocco, and Egypt.

Increasing Focus on Energy-Efficiency

Smart glass technologies installed in energy-efficient buildings result in lower energy usage and thus lower operational costs for lighting, air conditioning, and heating. By optimizing daylighting, reducing solar heat gain, and enhancing thermal insulation, smart glass technology helps reduce reliance on artificial lighting and HVAC (heating, ventilation and air conditioning) systems.

The International Energy Agency reports that globally energy efficiency investments reached US$ 560 billion in 2022, up 16% from the previous year. Stricter energy-efficiency laws and construction requirements are being enforced by regulatory and governing organizations in some nations to cut carbon emissions and slow down global warming. The goals are achieved via smart glass technologies, such as electrochromic and thermochromic glass, which exploit sunshine, regulate solar heat gain, and reduce the need for artificial lighting and heating systems.

High Smart Glass Cost and Less Awareness

The smart glass was originally utilized in the 1980s, but the technology wasn't marketed until 2000. The smart glass business has seen several changes and developments in terms of technologies and applications. Due to major technological breakthroughs, smart glass costs 2 to 4 times more than ordinary windows and glass.

Thus, the most significant disadvantage of smart glass is its cost, which is extremely high despite its energy savings. If the price varies from manufacturer to manufacturer, expect to pay roughly US$100 per m2 for this specialist glazing. As a result, electrochromic glass is still very uncommon: it is mostly employed in professional and public settings (offices and museums).

In addition, while smart glass technology has been on the market for a decade, manufacturers have been able to get the required funding and support to begin mass production in the last few years. Manufacturers have realized economies of scale due to opening large-volume production plants, lowering costs. Thus, the cost of smart glass is expected to drop by 30–40% as the volume of production increases.

Lack of Awareness of the Long-Term Benefits of Smart Glass

The notion of smart glass has been marketed across many sectors with limited applications, resulting in little consumer comprehension of its unique advantages. With architects and industry players aware of the benefits of smart glass technology, the current phase of smart glass adoption and marketing will propel market expansion in application areas including automotive and architecture.

The technology has been gaining traction at a slow rate over the last two years because of a lack of knowledge. It is necessary, therefore, to educate end-users about its use as a technology that is future-focused, ecologically benign, and energy-efficient. Thus, the industry's expansion may be impeded by a lack of knowledge of the long-term advantages of smart glasses.

Market Segment Analysis

The global smart glass market is segmented based on technology, mode of control, application and region.

Low driving voltage, high UV/IV blocking and easy large-panel integration are set to drive electrochromic glass growth

The Pharmaceutical segment is among the growing regions in the global smart glass market covering more than 1/3rd of the market. Electrochromic glass may be colored and made opaque easily, adjusting to heat and transmitting light as needed. Low driving voltage, high UV and IV ray blocking ratio and ease of integration with large glass panels are likely to propel the electrochromic glass segment forward over the forecast period. Electrochromic glass is used in various applications, including educational facilities, commercial spaces, hospitals and retail outlets.

For instance, In April 2021, Bagmane Group, one of India's top build-to-suit real estate developers, picked SageGlass, the global leader in electrochromic glass, to create the world's largest smart glass installation. Rio Business Park, a 1.6 million square foot office complex in Bangalore, India, will get 200,000 square feet of SageGlass Harmony electrochromic glass, controls and software from SageGlass.

Market Geographical Share

Increasing Concern about Energy Use in Buildings, Particularly in the Business Sector, is driving up demand for Smart Glass in North America

North America has been a dominant force in the global smart glass market. Smart glass is quickly becoming one of the most popular building materials in North American. One of the primary reasons for its growing popularity is its versatile building material that architects may employ for various functions.

Because of its aesthetic appeal, smart glass has become an increasingly common feature in commercial design. For example, despite sun glare issues, Spirit Lake Casino and Resort, a fine dining restaurant in North Dakota, used smart glass to provide (visitors) with beautiful views of the natural surroundings. The system also saves money for the restaurant by lowering the cooling demand of the air conditioning during hot days.

Furthermore, the increased concern about energy use in buildings, particularly in the business sector, is driving up demand for smart glass. As per the Department of Energy (DOE) 2015 report, buildings account for 40% of overall energy use and 70% of electricity consumption in U.S. Windows are widely regarded as one of the least energy-efficient building components. According to the California Energy Commission, they account for over 40% of total energy use in cooling, heating and lighting (natural light blocked by shades must be replaced by artificial light). The reasons mentioned above are projected to impact smart glass demand in the region.

Smart glass windows have emerged as an appealing offering to consumers in the building sector as building rules across U.S. drive demand for greener designs. As a result of these trends, the smart glass market in the region is predicted to grow.

Furthermore, the government sector has been implementing technology in the region. For instance, smart glass was used in remodeling the Government Services Administration Headquarters in U.S. Smart glass helps keep building occupants comfortable while reducing energy use for cooling and heating. Smart glass has the great potential to reduce the building's cooling load by up to 20% and its HVAC requirements by up to 30%. The glass demonstrates the GSA's commitment to incorporating more green technologies into its rebuilt facilities.

COVID-19 Impact Analysis

COVID-19 has significantly impacted the global smart glass industry's growth. Depending on how the virus spreads in different parts of the world, global smart glass sales for important applications such as architecture and automotive are projected to drop by 10–15% this fiscal year.

Some of the reasons impeding the growth of the smart glass market include a decrease in the number of new construction projects and the temporary shutdown of manufacturing facilities. On the other hand, short-term supply chain interruptions are projected to impact market growth in key regions.

Furthermore, COVID-19 has significantly impacted the global automotive sector, closing several manufacturing locations globally. Automobile sales fell about% globally in the second quarter of 2020, notably in Europe, affecting overall smart glass demand. Furthermore, trade prohibitions across national and international borders and other trade restrictions have harmed the globally supply chain of the glass sector, resulting in fewer sales activities.

Russia-Ukraine War Impact Analysis

The prolonged hostilities between Russia and Ukraine have had a substantial impact on the world market for smart glasses, mostly due to supply chain interruptions and changes in the cost of raw materials. Both nations are important providers of essential components and raw materials, such as certain rare earth metals and specialty glass substrates, needed in the production of smart glasses.

The war has caused supply volatility for key resources, which has boosted costs and caused delays for producers globally. The acquisition of these vital resources has also become more difficult due to trade restrictions and sanctions against Russia, which haves exacerbated supply chain problems and increased manufacturing prices and lead times.

Market Segmentation

By Technology

- Electrochromic

- Polymer Dispersed Liquid Crystal (PDLC)

- Thermochromic

- Suspended Particle Devices (SPD)

- Photochromic

- Others

By Mode of Control

- Switches

- Dimmer

- Remote

- Others

By Application

- Architectural

- Commercial

- Educational Buildings

- Corporate

- Healthcare

- Lab Facilities

- Retail

- Transportation

- Automotive

- Aircraft

- Marine

- Consumer Electronics

- Power Generation

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On October 31, 2023, Guardian Industries Holdings, LLC introduced SunGuard SNX 70+, a triple silver-coated glass featuring a visible light transmission of 68% and a solar heat gain coefficient of 0.28 when applied to Guardian UltraClear low-iron glass. Engineered to ensure a uniform neutral reflected color, this glass maintains its aesthetic appeal whether observed directly or from an angled perspective.

- On August 11, 2023, Gauzy Ltd. partnered with Kolbe, a producer of top-tier windows and doors to launch a complete switchable privacy glass solution for the residential sector, enabling homeowners to effortlessly merge customized living spaces with cutting-edge integrated technology. The solution incorporates Premium Polymer Dispersed Liquid Crystal (PDLC) films, which are laminated between dual glass panes providing an innovative and adaptable privacy feature for residential applications.

- On May 11, 2022, AGC, Inc. developed a Low-E coating-based light-control panoramic roof, which will be incorporated in Toyota Motor Corporation’s LEXUS RZ. The Low-E glass with high solar control and heat insulation characteristics will provide a comfortable cabin temperature and an open cabin environment. Its ability to eliminate sunshade provides a lighter body.

Major Global Players

The major global players in the market include Saint-Gobain, AGC Inc., Nippon Sheet Glass Co., Ltd, Gentex Corporation, AGP Group, Smartglass International, Innovative Glass Corp, SPD Control Systems Corporation, Corning Incorporated and Guardian Industries Holdings.

Why Purchase the Report?

- To visualize the global smart glass market segmentation based on technology, mode of control, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of smart glass market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global smart glass market report would provide approximately 62 tables, 58 figures and 180 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies