Single-Use Medical Devices Market Size

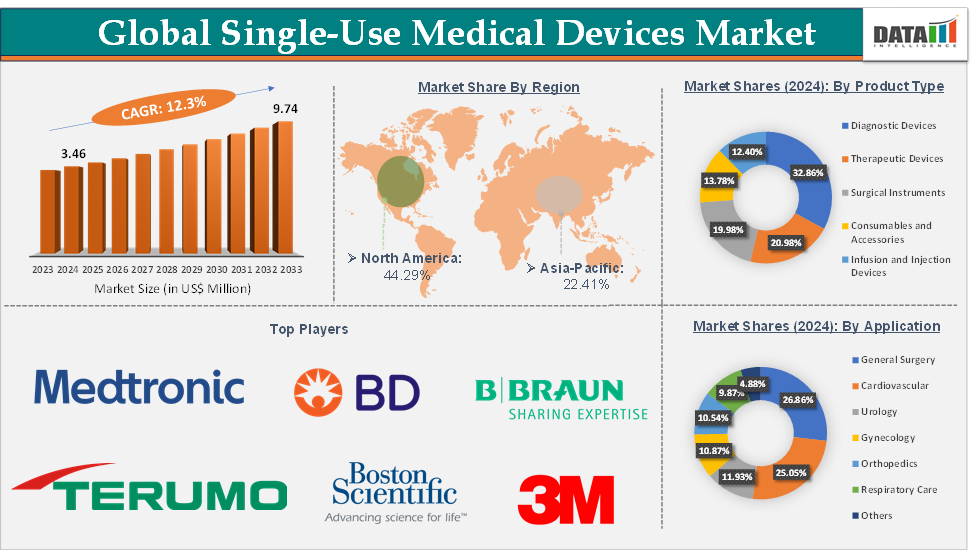

Single-Use Medical Devices Market Size reached US$ 3.46 Billion in 2024 and is expected to reach US$ 9.74 Billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025-2033.

Single-Use Medical Devices Market Overview

The global single-use medical devices market is experiencing robust growth, driven by heightened concerns over infection control, rising surgical procedures, the shift toward value-based healthcare, and increasing demand for home-based and ambulatory care services. Single-use devices designed for one-time use to ensure sterility and prevent cross-contamination are gaining prominence across various medical specialties and healthcare settings. Companies that prioritize innovation, cost-efficiency, regulatory compliance, and sustainability will be best positioned to lead in this evolving landscape.

Executive Summary

For more details on this report – Request for Sample

Single-Use Medical Devices Market Dynamics: Drivers & Restraints

Integration with smart health technologies is significantly driving the single-use medical devices market growth

The integration of smart health technologies with single-use medical devices is transforming the market by enhancing clinical outcomes, reducing hospital-acquired infections, and enabling remote monitoring, all while preserving the convenience and sterility of disposables. This convergence is not just a tech trend, it's a major differentiator driving new product development, adoption, and investment.

Glucose monitoring patches, ECG stickers, and blood pressure patches with embedded microelectronics. For instance, Abbott’s FreeStyle Libre, a single-use, wearable glucose sensor for diabetics, provides real-time blood sugar data through a smartphone. Enables continuous monitoring and reduces the need for hospital visits. Prefilled syringes and auto-injectors with NFC/Bluetooth for dose tracking. For instance, Becton Dickinson’s BD Smart Connected Care Platform uses sensor-equipped single-use injection devices that track medication administration. These improve adherence, reduce errors, and support clinical decision-making.

The integration of smart technology is redefining what single-use means, no longer just simple, sterile, and disposable, but also intelligent, connected, and data-driven. This trend is unlocking new use cases, driving premium pricing, and reshaping the competitive landscape of the single-use medical devices market.

Disposable waste is hampering the growth of the single-use medical devices market

While single-use medical devices offer critical advantages such as infection control, convenience, and cost-efficiency, they also generate significant volumes of medical waste, raising environmental, regulatory, and reputational challenges. This disposable waste issue is now a serious restraint on market growth, especially in regions focused on sustainability and healthcare decarbonization.

Most single-use medical devices are made from non-biodegradable plastics and mixed materials (e.g., PVC, polypropylene), which are difficult or impossible to recycle. For instance, a single hospital can generate tons of disposable PPE and device waste monthly, much of it ending up in landfills or being incinerated. Growing public and institutional pressure (especially in Europe and North America) is pushing hospitals to reduce waste, creating barriers to the adoption of single-use items unless they are eco-friendly.

Medical waste disposal (especially hazardous/infectious waste) is expensive and highly regulated. For instance, in the U.S., disposal of regulated medical waste can cost up to 10–20x more than regular waste handling. Healthcare providers in cost-sensitive markets are increasingly evaluating reusables or limiting the use of disposables to essential cases only.

Single-Use Medical Devices Market Segment Analysis

The global single-use medical devices market is segmented based on product type, application, end-user, and region.

The diagnostic devices from the product type segment are expected to hold 32.86% of the market share in 2024 in the single-use medical devices market

The diagnostic devices segment holds a dominant position in the single-use medical devices market due to its widespread clinical usage, regulatory preference for disposability, and the growing demand for fast, accurate, and safe diagnostic tools, especially in infectious disease management and decentralized care settings. The development of various single-use diagnostic devices by major market players is boosting the segment’s growth.

For instance, in October 2024, Inspira Technologies OXY B.H.N. Ltd. announced the development of a new disposable kit for the perfusion market. The innovative disposable kit is being developed as a single-use product designed to identify and alert users to changes in the performance of the disposable during operation and treatment. The unique design and features of the disposable are expected to provide a smart, compatible, and adjustable experience for medical teams.

Additionally, in May 2024, Laborie Medical Technologies Corp. introduced the Solar Compact System and Solar Anorectal Manometry Catheter, the first disposable HRAM catheter on the market. These devices significantly advance diagnostic capabilities for defecatory disorders and pelvic-floor dysfunction associated with constipation and fecal incontinence by measuring static and dynamic pressures in the lower gastrointestinal tract.

Single-Use Medical Devices Market Geographical Analysis

North America is expected to dominate the global single-use medical devices market with a 44.29% share in 2024

Health expenditures per person in the U.S. were $13,432 in 2023, which was over $3,700 more than any other high-income nation, which supports rapid adoption of disposables to optimize patient throughput and safety. For instance, major hospital systems (e.g., Mayo Clinic, Cleveland Clinic) stock large volumes of single-use endoscopes and surgical kits to minimize turnover time and HAI risk.

Medicare, Medicaid, and private insurers in the U.S. reimburse hospitals and clinics for disposables, including single-use diagnostic cartridges and infusion sets, making cost less of a barrier. For instance, Hospitals receive bundled payments that cover single-use cardiac catheterization kits, encouraging cath-lab procedures with disposable packs.

Moreover, the presence of major market players in North America, especially in the United States developing single-use medical devices, which is further driving the market growth in the region. For instance, in May 2024, Olympus this week announced it launched the DVM-B2 Digital Video Monitor for single-use endoscopes. The DVM-B2 is designed as an all-in-one video processor and monitor for use with single-use endoscopes for bronchoscopy and ENT, including the H-SteriScope Single-use Flexible Bronchoscopes and the E-SteriScope Single-use Flexible Rhinolaryngoscopes.

Single-Use Medical Devices Market Top Companies

Top companies in the single-use medical devices market include Medtronic, BD, B. Braun SE, Terumo Corporation, Smith+Nephew, Boston Scientific Corporation, 3M, Abbott, NIPRO, Cardinal Health, among others.

Market Scope

Metrics | Details | |

CAGR | 12.3% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Diagnostic Devices, Therapeutic Devices, Surgical Instruments, Consumables and Accessories, and Infusion and Injection Devices |

Application | General Surgery, Cardiovascular, Urology, Gynecology, Orthopedics, Respiratory Care, and Others | |

End-User | Hospitals, Ambulatory Surgical Centers, Clinics, Home Healthcare, Diagnostic Centers and Labs, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global single-use medical devices market report delivers a detailed analysis with 69 key tables, more than 73 visually impactful figures, and 157 pages of expert insights, providing a complete view of the market landscape.