Overview

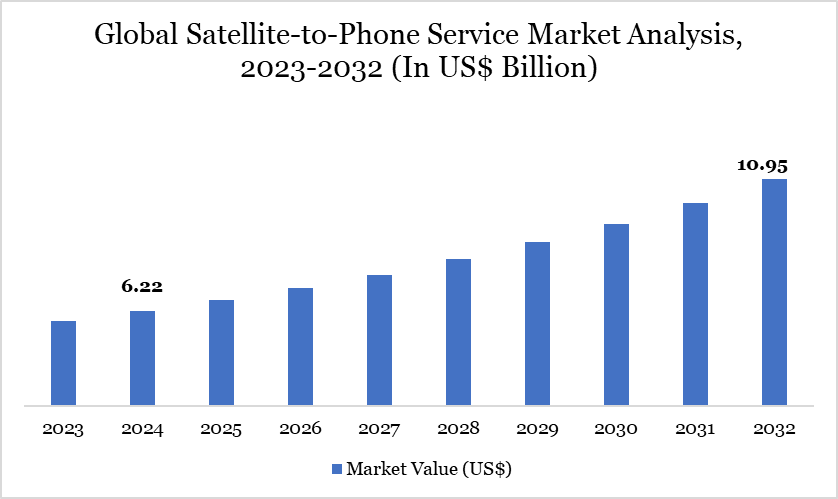

Global satellite-to-phone service market size reached US$ 6.22 billion in 2024 and is expected to reach US$ 10.95 billion by 2032, growing with a CAGR of 7.32% during the forecast period 2025-2032.

The Satellite-to-Phone Service industry is seeing a significant transformation due to the increasing demand for uninterrupted worldwide connectivity. Mobile Satellite Services (MSS) facilitate voice and data communication across terrestrial, maritime and aerial domains, proving essential in regions without adequate terrestrial infrastructure.

The market is seeing growth because to the rising adoption of smartphones, satellite-based IoT applications and the demand for dependable connectivity in underserved and remote areas. The amalgamation of terrestrial and non-terrestrial networks (NTN) is enabling a novel generation of Direct-to-Device (D2D) satellite communication solutions, with prominent companies such as Iridium, Globalstar and Inmarsat augmenting their services.

Significantly, the advancement of LEO satellite constellations is poised to transform the MSS ecosystem, especially in the direct-to-phone sector, anticipated to evolve into a billion-dollar business by 2027. Euroconsult forecasts that this sector may accommodate around 130 million average monthly users by 2032, highlighting the extensive long-term potential of the business.

Satellite-to-Phone Service Market Trend

A significant trend transforming the Satellite-to-Phone Service industry is the emergence of Direct-to-Device (D2D) connectivity and High-Throughput Satellite (HTS) technologies. These advancements eradicate reliance on terrestrial infrastructure, facilitating efficient satellite communication directly with consumer devices.

In November 2023, Viasat and Skylo Technologies inaugurated the world's inaugural global D2D network, integrating 3GPP Release 17 technology with geostationary L-band satellites, hence enabling applications in IoT, automotive and defense sectors. A notable development is the utilization of tiny, economical satellites in low Earth orbit, shown by SpaceX's Starlink constellation, which comprised nearly 5,500 satellites as of November 2023. This encompasses the initial six satellites equipped with direct-to-cell capabilities, which were launched in December 2023. Furthermore, MSS is progressively utilized in disaster-prone areas for emergency response, as shown by EM-DAT's report of 387 disasters in 2022 impacting 185 million individuals worldwide. The demand for robust, instantaneous communication solutions during such crises is driving innovation and acceptance across all sectors.

Market Scope

| Metrics | Details |

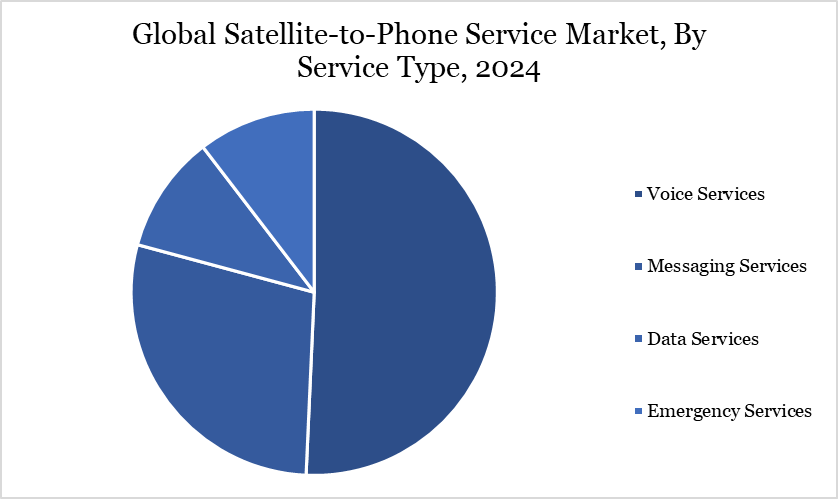

| By Service Type | Voice Services, Messaging Services, Data Services, Emergency Services |

| By Technology | Direct-to-Device (D2D) Communication, Relay-Based Communication |

| By Frequency Band | L-Band, S-Band, Ku-Band, Ka-Band, Others |

| By End-User | Consumer, Government & Defense, Maritime, Aviation, Energy & Utilities, Transportation & Logistics, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Dynamics

Increase in Demand for Military Communications on the Move (COTM)

The increasing need for Military Comms on the Move (COTM) solutions is a crucial catalyst for the Satellite-to-Phone Service market. Military operations in dynamic, remote or conflict-prone areas depend on resilient, real-time communication networks. Satellite-based COTM solutions guarantee continuous connectivity, even during transit or field operations.

In October 2023, Spectra Group collaborated with Inmarsat to assist Project Capstone 4, initiated by the Army Futures Command, utilizing the SlingShot system—an advancement that enhances tactical radio ranges over L-band satellite frequencies. This technology facilitates UHF and VHF radios to attain Beyond Line of Sight (BLOS) communication across extensive distances exceeding thousands of kilometers.

Temporary field configurations (Comms on the Pause or COTP) are recommended. As defense sectors worldwide enhance their dependence on digital warfare and real-time intelligence dissemination, the implementation of MSS for COTM becomes essential, fostering sustained market expansion across regions.

Request for Free Sample Click here

Elevated Capital and Operational Costs

A significant constraint hindering the expansion of the Satellite-to-Phone Service market is the substantial capital investment and continuous operational expenses related to satellite deployment and upkeep. A solitary GEO communication satellite, typically possessing a lifespan of 15 years, may incur costs of approximately US$ 300 million, whereas launch expenditures can surpass US$ 80 million. These expenses present considerable obstacles to entrance, particularly for emerging market participants.

Moreover, spectrum licensing costs and satellite maintenance contribute to the financial encumbrance. In metropolitan and developed areas with established 4G and 5G terrestrial networks, these costly MSS options encounter significant competition. Consequently, enterprises may be reluctant to engage in Managed Security Services unless their operations are situated in remote or strategically vital places. The financial obstacles, along with the presence of more affordable terrestrial alternatives, may hinder adoption in specific sectors unless cost-reducing advances gain broader prevalence.

global satellite-to-phone service market Segment Analysis

The global satellite-to-phone service market is segmented based on service type, technology, frequency band, end-user and region.

Surge in Demand for High-Speed, Remote Connectivity helps the growth of Data Services in the market

The data services sector occupies a leading position in the satellite-to-phone service market and is anticipated to experience the most rapid expansion throughout the forecast period. This category pertains to the conveyance of digital data, including internet connectivity, email, file transfers and other high-bandwidth applications, via satellite networks. With the global demand for satellite internet connectivity surging, data services are becoming crucial for ensuring dependable communications in regions where terrestrial infrastructure is inadequate or absent.

The expansion is predominantly driven by essential sectors such aviation, maritime, emergency response and oil and gas, all of which necessitate high-speed and high-capacity data transmission in remote and challenging environments. These services are essential for facilitating applications such as real-time monitoring, asset tracking and video surveillance. Furthermore, in urban and suburban areas with terrestrial networks, the demand for continuous and reliable data access is increasingly driving the development of satellite-based data services across several sectors.

Geographical Penetration

Increasing Digital Infrastructure Stimulates Market Expansion in Asia-Pacific

Asia-Pacific constitutes the most rapidly expanding segment of the Satellite-to-Phone Service market, propelled by digital transformation, the proliferation of smartphones and initiatives for 5G rollout. Regional governments are investing in fiber-optic and high-speed internet infrastructure, allowing MSS providers to address coverage deficiencies in remote and inaccessible regions.

Nations such as India are spearheading this transition. In July 2023, AST SpaceMobile partnered with Vodafone to launch space-based mobile services in India. In 2022, they successfully showcased 4G internet with download speeds above 10 Mbps and facilitated a phone connection from space with their BlueWalker 3 (BW3) test satellite. This illustrates how Asia-Pacific countries are surpassing conventional infrastructural constraints.

The integration of modern satellite systems with regional mobile network operators is anticipated to significantly enhance service coverage and dependability. With digital inclusion emerging as a regional goal, the adoption of MSS in the Asia-Pacific is expected to increase significantly.

Sustainability Analysis

The sustainability of the Satellite-to-Phone Service business is increasingly associated with resilience and disaster response capabilities. The sector enhances sustainability by providing resilient communication networks that operate effectively during severe weather conditions and natural disasters, situations where terrestrial infrastructure frequently falters.

In 2022, EM-DAT documented that more than 387 natural disasters impacted 185 million people, resulting in damages of US$ 223.8 billion. MSS guarantees that impacted communities and response teams may sustain essential communication channels, hence contributing significantly to effective disaster management and humanitarian assistance.

Moreover, satellite-based networks diminish the necessity for extensive terrestrial infrastructure, hence reducing land use effect and enabling deployment in ecologically sensitive regions. Innovations in compact, energy-efficient satellites and sustainable launch techniques are diminishing the environmental impact of satellite networks, aligning the market with overarching ESG objectives and long-term sustainable development strategies.

Competitive Landscape

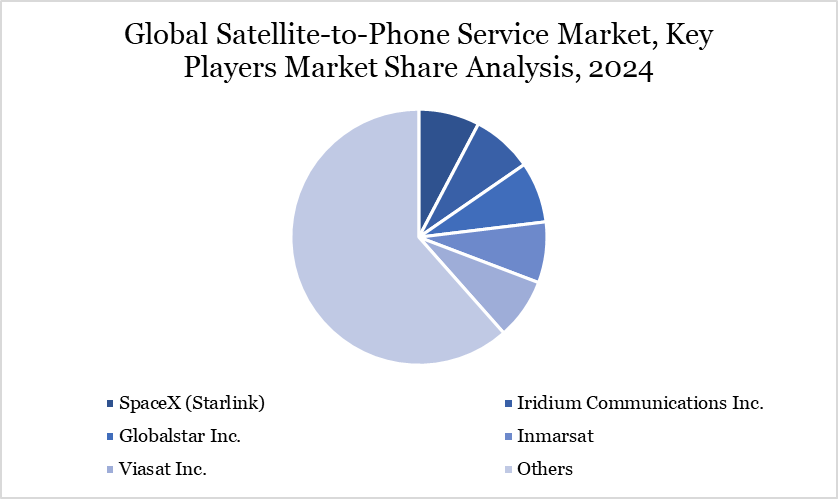

The major global players in the market include SpaceX (Starlink), Iridium Communications Inc., Globalstar Inc., Inmarsat, Viasat Inc., Skylo Technologies, AST SpaceMobile, Qualcomm Technologies, Inc., T-Mobile US, Inc. and Apple Inc.

Key Developments

- In March 2023, the Saudi Telecommunication Company signed an agreement with AST SpaceMobile, Inc., a U.S.-based satellite communications company, to create cutting-edge telecom solutions and satellite-based digital services to increase access to mobile services.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Suggestions for Related Report