Ruxolitinib Market Overview

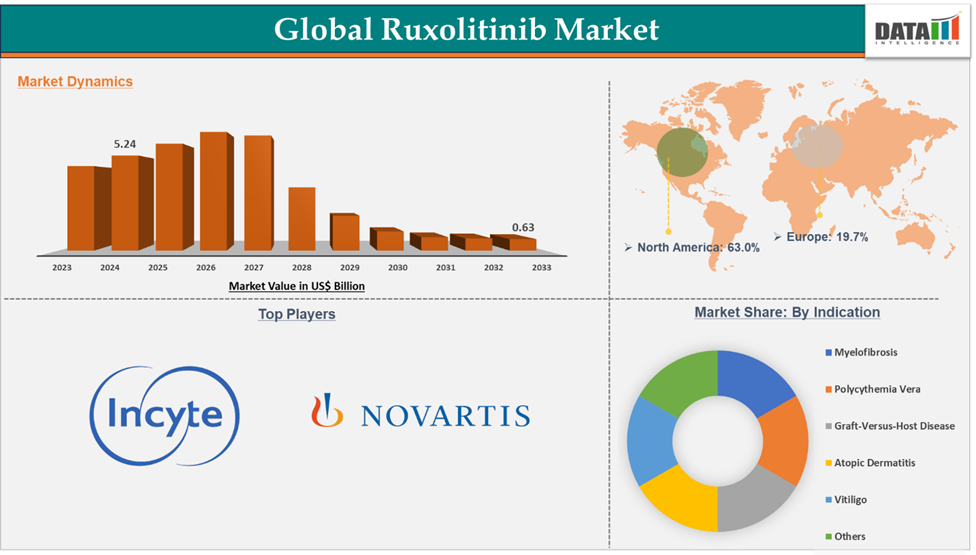

Ruxolitinib Market reached US$ 5.24 billion in 2024 and is expected to reach US$ 6.3 billion by 2027, growing at a CAGR of 3.8% during the forecast period 2025-2027.

Sales are expected to decline due to the loss of patent exclusivity and intense generic competition, with the market value projected to fall to $0.6 billion by 2033. The Ruxolitinib market is growing due to rising approvals in various geographies, increasing demand worldwide, and rising sales volumes. However, the high cost of ruxolitinib, patent expiration, and competition from generics can significantly hinder the market growth.

Executive Summary

For more details on this report – Request for Sample

Ruxolitinib Market Dynamics: Drivers & Restraints

The rising demand across the world and increasing sales volume are driving the market growth

Ruxolitinib is currently available under brand names such as Jakafi/Jakavi and Opzelura. Incyte Corporation sells Jakafi in the U.S. market and Opzelura in the U.S. and global markets, whereas Novartis AG holds development and commercialization rights for Jakavi in the world, excluding the United States. The market for Ruxolitinib is growing due to increasing demand across the world and consequently increasing sales volume.

For instance, in 2024, Incyte reported that the sales of Jakafi increased by 7.1% (198.4 million) in the U.S., from 2023 to 2024, mainly due to an increase in the prescription volume (142.3 million). Whereas the sales of Opzelura have increased by 33.5% (170.4 million) from 2023 to 2024, mainly due to an increase in volume sales (165.3 million).

Novartis AG has stated that the sales of Jakavi have significantly increased across the world due to strong demand in all indications. The company has reported sales of 1,936 million in 2024, with a growth of 11.2% from the previous year.

This growth in sales due to increasing prescription volumes across all indications drives the overall market in the forecast period.

Patent expiration and competition from generics may restrain the market growth

Patent expiration and the emergence of generics represent a significant restraint on the growth of the Ruxolitinib market. As the branded drug patents begin to expire, particularly in the U.S. and Europe, the generic manufacturers start making plans to enter the market. These generics pose a significant threat to existing branded products, and this is expected to drive down prices, reduce profit margins for originator companies like Incyte and Novartis, and significantly erode their market share.

Brand | US | EU | Japan |

Jakafi | 2028 | 2027 | 2028 |

Opzelura | 2028 | 2027 | 2028 |

Table: Patent Exclusivity Dates

While this will improve affordability and access for patients, it will also intensify market competition, especially in price-sensitive markets across Asia-Pacific, Latin America, and Middle East, and Africa.

Moreover, payers and healthcare systems are likely to favor lower-cost alternatives, particularly in publicly funded systems, further constraining revenue growth for the original product.

This shift could also limit incentives for further R&D investments in new indications or advanced formulations unless manufacturers find ways to differentiate.

Ruxolitinib Market Segment Analysis

The global Ruxolitinib market is segmented based on dose, route of administration, indication, and region.

Myelofibrosis in the indication segment accounted for 43.7% of the market share in 2024 in the global Ruxolitinib market.

Myelofibrosis (MF) is a rare form of blood cancer in which scar tissue builds up in the bone marrow, as a result, the production of new blood cells becomes deficient. Myelofibrosis is related to myeloproliferative disorders, a plethora of conditions affecting bone marrow and causing abnormal blood cell production.

There are two types of myelofibrosis, primary and secondary. Primary myelofibrosis is idiopathic, whereas secondary myelofibrosis occurs due to other types of bone marrow conditions such as polycythemia vera or thrombocythaemia. The exact cause of primary myelofibrosis is unknown, but certainly caused by mutations in the hematopoietic stem cells, which divide abnormally and form megakaryocytes in the bone marrow. These megakaryocytes build up in the bone marrow and trigger the cytokines, which cause inflammation and the buildup of fibrous tissue.

The treatment of myelofibrosis is focused on symptomatic relief, mostly as the majority of the patients slowly progress to severity and do not show symptoms in the beginning. The common treatment modalities are blood transfusions, targeted drug therapy, chemotherapy, surgery, bone marrow transplantation, palliative care, etc. Several targeted therapies have been approved in recent times, which are revolutionizing the myelofibrosis therapeutics. One such revolutionary drug is Ruxolitinib, sold under the brand names Jakafi/Jakavi. In 2011, it became the first drug approved for the treatment of myelofibrosis. A significant share of Ruxolitinib’s revenue is derived from its use in treating myelofibrosis (MF), where it has become the established standard of care globally. Since its approval, Ruxolitinib has maintained a strong market position by addressing a critical unmet need in MF treatment

Ruxolitinib Market Geographical Analysis

North America dominated the Ruxolitinib market with the highest share of 63.0% in 2024

In the region, Ruxolitinib is sold under two brands, which are notably Jakafi and Opzelura. In the United States, Jakafi is approved for the indications such as myelofibrosis, polycythemia vera, and graft-versus-host disease, while Opzelura is approved for use in atopic dermatitis and vitiligo. These two brands are sold by Incyte, a key player in the Ruxolitinib market.

Incyte holds commercialization rights for Jakafi in the U.S. and global rights for Opzelura. The company has reportedly generated sales of USD 2.7 billion in 2024, from the sales of Jakafi, and USD 508 million from the sales of Opzelura, which is combinedly 63% of the overall market size. This reflects the dominance of the North America region in the global Ruxolitinib market.

Moreover, the market is expected to see a lucrative growth driven by the rising prevalence of respective indications and expanding applications of Ruxolitinib.

For instance, in July 2022, the U.S. Food and Drug Administration (FDA) approved Opzelura for the treatment of patients above 12 years of age who are diagnosed with nonsegmental vitiligo. In October 2024, OPZELURA cream 1.5% was granted a Notice of Compliance by Health Canada for the topical treatment of both mild to moderate atopic dermatitis and nonsegmental vitiligo in patients 12 years of age and older.

At present, Incyte is evaluating the potential of Ruxolitinib for various indications such as pediatric Atopic dermatitis, prurigo nodularis, pediatric vitiligo, and hidradenitis suppurativa in clinical trials. If found safe and efficacious, the drug will be available first in the U.S. market for these expanded applications.

Hence, all these factors reflect the dominance of North America in the global Ruxolitinib market.

Ruxolitinib Market Major Players

The major players in the Ruxolitinib market are Incyte, Novartis AG

Ruxolitinib Market Key Development

In March 2025, Incyte announced the positive topline results from phase III trials evaluating the safety and efficacy of twice-daily ruxolitinib cream 1.5% (Opzelura), in adult patients (≥18 years) with prurigo nodularis (PN). The drug showed consistency with the anticipated safety and efficacy profile, and met its primary endpoints.

Market Scope

Metrics | Details | |

CAGR | 2025-2027: 3.8% 2028-2033: -29.0% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Dose | 5 mg, 10 mg, 15 mg, 20 mg, 25 mg and Others |

Route of Administration | Oral, Topical | |

Indication | Myelofibrosis, Polycythemia Vera, Graft-Versus-Host Disease, Atopic Dermatitis, Vitiligo, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |