Global Quantum Warfare Market: Industry Outlook

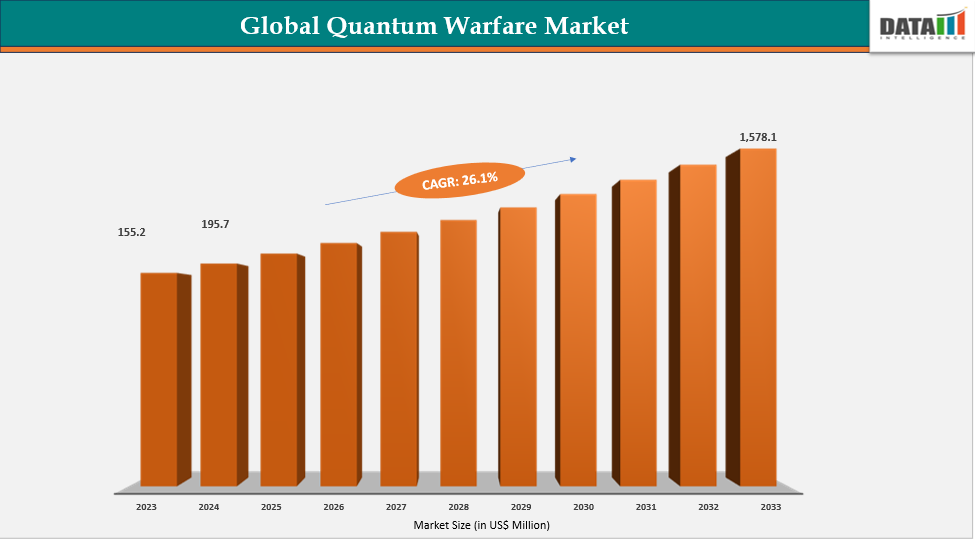

The global quantum warfare market reached US$ 155.2 million in 2023, with a rise to US$ 195.7 million in 2024, and is expected to reach US$ 1,578.1 million by 2033, growing at a CAGR of 26.1% during the forecast period 2025–2033. The global quantum warfare market is rapidly emerging at the intersection of defense modernization and next-generation quantum technologies, reshaping how militaries prepare for 21st-century conflicts. Quantum capabilities spanning cryptography, secure communications, sensing, navigation, and computing are increasingly recognized as critical to national security, with the potential to break conventional encryption, detect stealth assets, and ensure battlefield decision superiority.

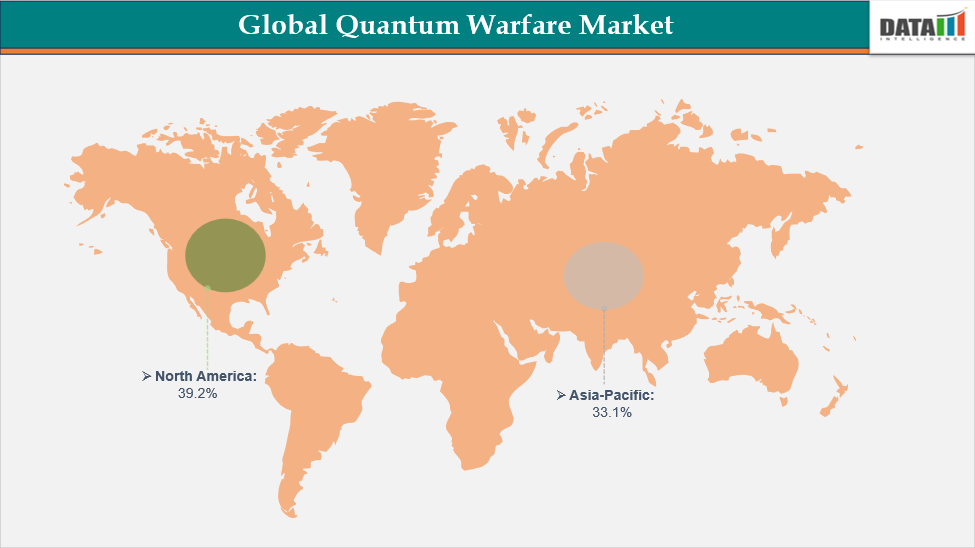

Regionally, North America currently leads with about 39.2% market share, owing to advanced R&D ecosystems, strong government funding, and defense contractor integration, while Asia-Pacific is projected to grow fastest, fueled by large-scale investments from China, Japan, and India. Europe also remains a key player, channeling funds through the EU’s Quantum Flagship and defense programs. In the US, defense innovation is particularly strong, the US Department of Defense invested over US$ 700 million in quantum information science between 2019 and 2023, and initiatives such as DARPA’s Quantum Apertures and Army Research Lab’s quantum networking programs underscore the urgency.

The demand for quantum warfare solutions is amplified by vulnerabilities in conventional systems and the urgency to safeguard military communications against quantum-enabled cyberattacks. For example, adversaries equipped with large-scale quantum computers could decrypt today’s military encryption within hours, posing a severe threat to critical infrastructure. This has accelerated the adoption of post-quantum cryptography and quantum key distribution (QKD) networks across defense forces. Airborne and space-based applications, such as satellite-enabled QKD are forecast to capture significant shares of future deployments.

Key Market Trends & Insights

- North America holds the largest market share, driven by the US and Canada’s accelerating quantum sensing initiatives for submarine detection and GPS-denied navigation, supported by DARPA and DoD programs, with the region’s defense R&D investment in quantum sciences reaching over US$ 844 million in 2023.

- Asia-Pacific is expected to show the highest growth as nations are prioritizing quantum satellite constellations for secure military communications, with China’s Micius satellite proving intercontinental QKD in 2017.

- Europe is focusing on an integrated quantum communication infrastructure for defense alliances, with projects such as the European Quantum Communication Infrastructure (EuroQCI), supported by Euro 90 million (US$ 105 million) in funding between 2021 and 2027.

Market Size & Forecast

- 2024 Market Size: US$ 195.7 million

- 2033 Projected Market Size: US$ 1,578.1 million

- CAGR (2025–2033): 26.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Market Dynamics

Driver: Quantum-Secured Communications Driving Defense Modernization

A major driver for the global quantum warfare market is the strategic push for quantum-secured communication networks to counter electronic warfare and cyber espionage. Defense agencies recognize that conventional satellite and radio communications are highly vulnerable to interception and disruption. Quantum Key Distribution (QKD) enables virtually unbreakable encryption by leveraging the principles of quantum mechanics.

In 2020, China’s PLA successfully demonstrated quantum-encrypted communication between ground stations and satellites over thousands of kilometers, showcasing strategic advantages in secure command-and-control. Europe followed with the EuroQCI project, integrating quantum encryption into its defense framework. These early implementations signal that military quantum communication is moving beyond research into operational systems.

US is advancing aggressively in this domain. The Department of Defense invested US$ 140 million in DARPA’s Quantum Network Challenge, seeking scalable battlefield-ready quantum networks. Such initiatives underscore how the need for tamper-proof, resilient communication in hostile environments is driving defense powers worldwide to accelerate investments in quantum-secured communication, making it one of the most compelling demand drivers in the quantum warfare market.

Nations are also forming cross-border collaborations to accelerate the deployment of quantum-secured communications. For instance, the US, U.K. and Australia under the AUKUS pact are exploring joint quantum technology applications for secure naval and aerospace operations. Meanwhile, Japan and South Korea have initiated defense quantum communication pilots in partnership with domestic telecom providers to safeguard military networks. These alliances reflect how quantum-encrypted systems are rapidly becoming a cornerstone of defense modernization, reinforcing the global momentum behind this transformative driver in the quantum warfare market.

Restraint: High Cost and Technical Complexity

A key restraint for the quantum warfare market is the extremely high cost and technical complexity of developing and deploying quantum technologies. Building stable quantum systems requires cryogenic cooling, advanced error correction, and specialized infrastructure, which limit scalability and accessibility. For instance, setting up a quantum communication network can cost hundreds of millions of dollars, restricting adoption to only the largest defense budgets. Moreover, the shortage of skilled quantum engineers and scientists slows progress, particularly in developing regions. These barriers hinder rapid commercialization and delay widespread military integration, restraining the overall growth of the quantum warfare market.

For more details on this report, Request for Sample

Global Quantum Warfare Market Segment Analysis

The global quantum warfare market is segmented based on deployment, application, end-user and region.

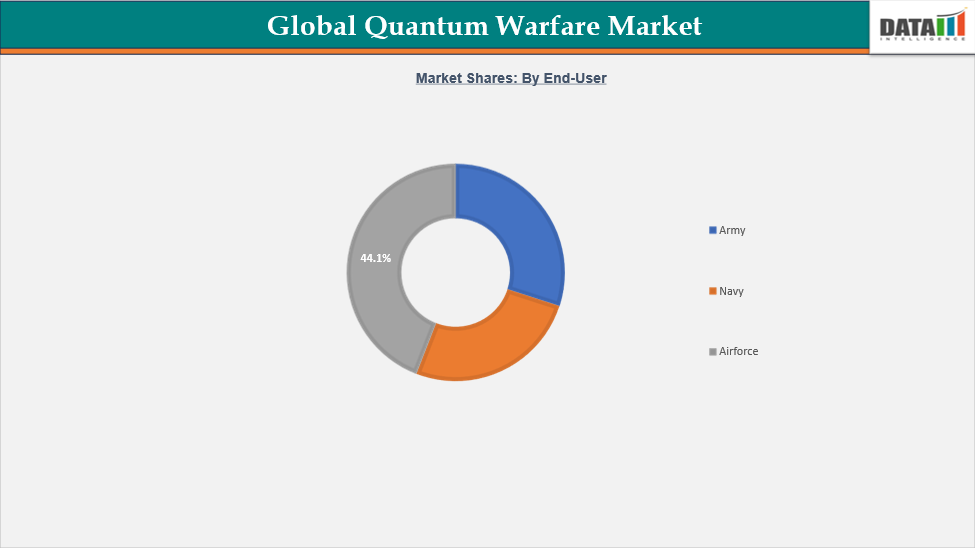

End-User: The air force segment is estimated to have 44.1% of the quantum warfare market share.

The air force segment of the quantum warfare market is emerging as one of the most critical domains due to the growing need for secure communication, advanced navigation, and enhanced sensing in aerial missions. Air forces globally are investing in quantum technologies to maintain air superiority in highly contested environments. Quantum-enabled systems can provide stealth detection, interference-proof navigation, and encrypted command-and-control for fighter jets and drones.

In 2022, the US Air Force Research Laboratory (AFRL) launched projects using quantum clocks and sensors to enhance aircraft navigation in GPS-denied zones. The Royal Australian Air Force partnered with Airbus to test quantum accelerometers, which promise more precise flight control in degraded environments. These investments highlight how different nations view air platforms as primary beneficiaries of quantum breakthroughs.

The operational impact is also evident in multinational collaborations. NATO allies are working on quantum-secured air-to-air and air-to-ground data links to ensure resilience against cyber and electronic warfare attacks. With aerial platforms often exposed to the highest risks in combat, air forces are prioritizing early adoption of quantum technologies to safeguard mission-critical operations. As a result, the Air Force segment is expected to retain a dominant position in the quantum warfare market, driving innovation and procurement in the coming decade.

Geographical Analysis

The North America quantum warfare market was valued at 39.2% market share in 2024

North America holds a dominant position in the quantum warfare market, driven by strong government funding, advanced defense contractors, and robust R&D ecosystems. The US and Canada are accelerating investments to secure technological leadership against near-peer adversaries such as China and Russia. The region’s leadership stems from early adoption of quantum communication, sensing, and computing for military applications.

The US Navy is actively testing quantum sensors for submarine detection in partnership with MIT Lincoln Laboratory, while the Canadian Department of National Defence invested CAD 40 million (US$ 28.9 million) in quantum radar development to strengthen Arctic surveillance. These projects showcase the region’s focus on both terrestrial and maritime applications of quantum warfare.

North America also benefits from strong public-private partnerships. Companies such as IBM, Honeywell, Rigetti, and IonQ are collaborating with defense agencies to develop deployable quantum systems. A notable case is Lockheed Martin’s contract with D-Wave, which explores quantum computing for optimizing logistics and mission simulations. Meanwhile, DARPA’s Quantum Apertures program seeks to revolutionize airborne sensing capabilities, aiming for early field trials within this decade.

With these concentrated efforts, North America is not only setting global standards but also creating operational quantum defense systems. As military quantum budgets continue to rise, the region is expected to retain its leadership and remain the largest revenue contributor to the global quantum warfare market through 2035.

The Asia-Pacific quantum warfare market was valued at 33.1% market share in 2024

The Asia-Pacific region is emerging as the fastest-growing hub for the quantum warfare market, propelled by rising defense budgets, geopolitical tensions, and ambitious national quantum programs. Countries such as China, India, Japan, South Korea, and Australia are investing heavily to strengthen their military quantum capabilities. This growth reflects the urgency to gain technological superiority in contested zones such as the South China Sea and the Indo-Pacific corridor.

China is at the forefront, expanding beyond its early satellite QKD experiments into large-scale defense deployments. Based on its demonstrated capability with the Jinan network and its national strategy of Military-Civil Fusion, China is assessed to be actively constructing and expanding quantum-secured ground networks for the PLA, supported by significant state investment that totals in the billions of dollars across its entire quantum enterprise.

Japan is also advancing rapidly, with the Japan Ministry of Defense funding quantum sensing research worth more than US$50 million to improve GPS-independent navigation for fighter jets. Meanwhile, India launched defense-focused quantum encryption projects under its National Quantum Mission (US$ 730 million), reinforcing its air and naval command systems. South Korea is equally active in collaborative research, where it allocated US$ 60 million in 2023 for military-grade quantum communications.

These programs reflect a regional pattern of strong government backing, close defense-industry partnerships, and a focus on operational readiness. With increasing cross-border collaborations and sustained funding, the Asia-Pacific is set to transform into the largest contributor to growth in the global quantum warfare market by 2032, challenging North America’s dominance. This makes the region a pivotal arena for quantum defense innovation and deployment in the coming decade.

Competitive Landscape

The global quantum warfare market features several prominent players, including Northrop Grumman Corporation, Lockheed Martin Corporation, RTX Corporation, BAE Systems plc, Thales Group, L3Harris Technologies, Inc., International Business Machines Corporation, Google LLC, IonQ, Inc. and Quantinuum, among others.

International Business Machines Corporation: International Business Machines Corporation (IBM) is a leading player in the quantum warfare market, leveraging its advanced quantum computing platforms and defense partnerships. Through its IBM Quantum program, the company offers over 20 quantum systems accessible via the cloud, supporting applications in secure communications, cryptography, and defense simulations. IBM collaborates with US defense agencies and aerospace firms to develop post-quantum cryptography and quantum algorithms for mission planning. Its roadmap toward 1,000+ qubit processors by 2025 positions it as a critical technology enabler. By combining hardware, software, and R&D expertise, IBM strengthens military readiness in the quantum warfare landscape.

Market Scope

| Metrics | Details | |

| CAGR | 26.1% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Deployment | On-premises and Cloud Based |

| Application | Intelligence, Surveillance, and Reconnaissance (ISR), Precision Navigation and Timing, Target Acquisition & Guidance, Communications, Electronic Warfare (EW), Cyber Warfare and Others | |

| End-User | Army, Navy and Airforce | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global quantum warfare market report delivers a detailed analysis with 62 key tables, more than 55 visually impactful figures, and 239 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more related reports, please click here