Probiotics in Poultry Feed Market Overview

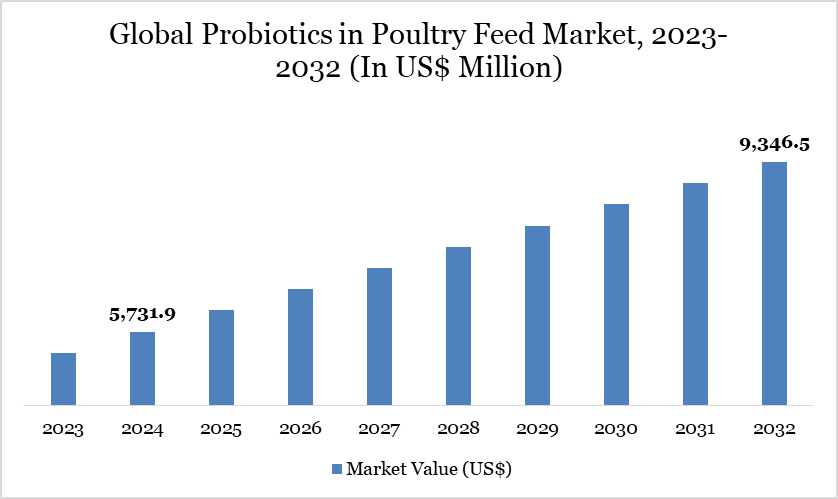

Probiotics in Poultry Feed Market reached US$5,731.9 million in 2024 and is expected to reach US$9,346.5 million by 2032, growing at a CAGR of 6.4% during the forecast period 2025-2032.

The global probiotics in poultry feed market is witnessing robust growth, driven by the rising demand for antibiotic-free poultry products and growing consumer awareness of food safety and animal health. Probiotics are increasingly adopted as natural alternatives to antibiotic growth promoters, particularly due to global regulations aimed at curbing antibiotic resistance.

Asia-Pacific is emerging as the fastest-growing market, supported by expanding poultry production, increasing investment in sustainable farming practices, and favorable government policies. North America and Europe continue to hold significant market shares due to stringent animal welfare standards and a strong preference for clean-label meat products.

For instance, Asia accounted for 41.4% of global chicken meat growth and 74.1% of global egg production increase from 2012–2022. This surge in output is driving the adoption of probiotics to support feed efficiency, health, and performance at scale.

Probiotics in Poultry Feed Market Trend

Technological advancements such as encapsulation and solid-state fermentation are enhancing the stability and bioavailability of probiotics in poultry feed. These methods protect beneficial microbes during processing and ensure effective delivery to the gut. As a result, poultry producers benefit from improved digestion, immunity, and overall feed efficiency. Such innovations support the shift toward sustainable, antibiotic-free nutrition solutions.

For instance, in December 2024, a new Bacillus-based probiotic was developed by the Arkansas Agricultural Experiment Station and Kent Nutrition Group. Designed for poultry and swine, it improves gut health and weight-gain efficiency. The innovation also allows for higher inclusion of soybean meal, leading to feed cost savings. This showcases how targeted strain development drives both performance and profitability.

For more details on this report - Request for Sample

Market Scope

| Metrics | Details |

| By Poultry Type | Broilers, Layers, Breeders and Others |

| By Form | Dry, Liquid and Encapsulated |

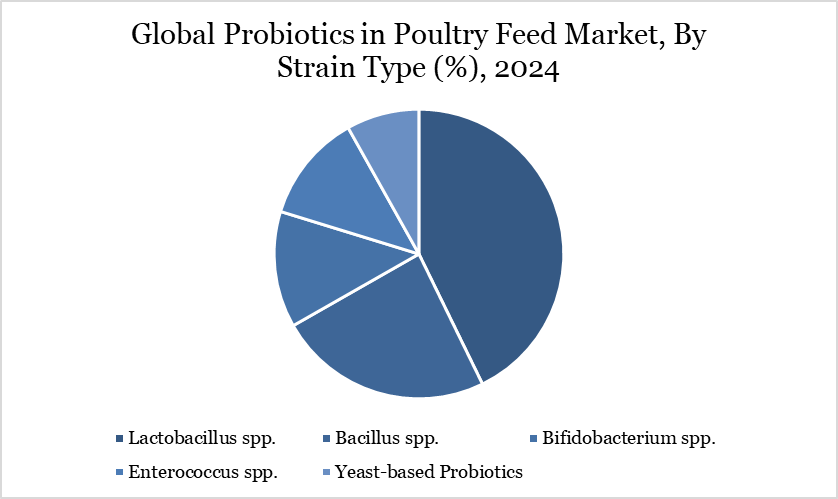

| By Strain Type | Lactobacillus spp., Bacillus spp., Bifidobacterium spp., Enterococcus spp. And Yeast-based Probiotics |

| By Application Method | In-feed Probiotics, Water-soluble Probiotics, Multi-strain and Synbiotic Solutions and Farm-Specific Formulations |

| By Function | Growth Promotion, Digestive Health, Immune Enhancement, Stress Management and Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Probiotics in Poultry Feed Market Dynamics

Rising Demand for Antibiotic-Free and Organic Poultry Products

The global poultry industry is transforming rising consumer health concerns, regulatory reforms, and the global threat of antimicrobial resistance (AMR) prompt a shift away from antibiotics in animal production. As a result, probiotics are gaining traction as a natural and effective alternative to support gut health, disease prevention, and performance in antibiotic-free systems.

Growing awareness of food safety, animal welfare, and antibiotic resistance is reshaping consumer preferences toward antibiotic-free (ABF), organic, and free-range poultry. Major foodservice brands and retailers are responding with clean-label commitments, further pushing demand for ABF production. Probiotics are increasingly viewed as a key enabler of this transition, helping maintain gut health and disease resistance in flocks without antibiotics.

Antibiotic resistance is projected to cause 10 million deaths annually by 2050, surpassing cancer as a leading global killer. In response, governments worldwide, including the EU, the US, and Asian nations, have implemented stricter regulations to reduce antibiotic usage in livestock. Countries like Denmark have pioneered traceability frameworks to track on-farm antibiotic use, prompting similar initiatives globally.

Feed manufacturers and integrators are increasingly investing in functional feed solutions. Probiotics, such as Amlan’s Varium, are gaining traction as they improve nutrient absorption, enhance immune response, and reduce pathogen load, ensuring profitability under ABF systems. In Southeast Asia, many broiler producers are actively working to eliminate antibiotic growth promoters while maintaining performance.

Higher Cost Compared to Traditional Additives

Probiotics require advanced production techniques, specialized strains, and stringent quality control measures, which increase manufacturing expenses. These factors make probiotic products less accessible to cost-conscious poultry producers, particularly in emerging markets.

Additionally, the need for cold-chain logistics and tailored formulations adds to distribution and handling costs. While the long-term benefits of probiotics are well recognized, the initial investment poses a barrier for widespread adoption. This price sensitivity often leads producers to prioritize lower-cost alternatives, slowing market penetration in regions with tight feed margins.

Probiotics in Poultry Feed Market Segment Analysis

The global probiotics in poultry feed market is segmented based on poultry type, form, strain type, application method, function and region.

Rising Adoption of Bacillus-Based Probiotics Driving Growth in Poultry Feed Market

Bacillus species, notably Bacillus subtilis and Bacillus amyloliquefaciens, are preferred in poultry feed formulations due to their spore-forming capability, which ensures robust survival through feed processing and gastrointestinal transit. This resilience provides a clear edge over non-spore-forming probiotics like lactic acid bacteria.

The growing regulatory restrictions on antibiotic growth promoters (AGPs) across Asia-Pacific markets have propelled Bacillus-based probiotics as effective, safe substitutes. These probiotics enhance poultry health and immune function while addressing the global challenge of antibiotic resistance.

Bacillus spores’ heat tolerance makes them especially suitable for pelleted feed systems common in tropical countries such as India, Vietnam, and Indonesia. This characteristic supports their widespread adoption in large-scale commercial poultry operations within the region.

Scientific studies validate that strains like B. subtilis KB41 and B. amyloliquefaciens KB54 contribute to improved growth rates, optimized gut health, and enhanced immune responses in broiler chickens, leading to better feed conversion and overall flock productivity.

The probiotic B. subtilis DSM 29784 produces key metabolites including pantothenate, niacin, and hypoxanthine that play a significant role in modulating inflammatory pathways, strengthening intestinal barriers, and positively shaping gut microbiota, thereby promoting poultry resilience and performance.

The Asia-Pacific region, led by China, India, and Southeast Asia, is witnessing increased demand for Bacillus probiotics, driven by expanding poultry production and rising consumer preference for antibiotic-free products. Both domestic and international players are investing in strain innovation and feed integration to capture this growth.

Probiotics in Poultry Feed Market Geographical Share

Probiotic Surge in Asia-Pacific Poultry Feed

The Asia-Pacific poultry probiotics market is poised for strong growth, driven by rising meat and egg consumption, health-focused nutrition models, and expanding modern poultry farming practices.

In the Asia-Pacific market, China is a rapidly growing segment, driven by the country’s massive poultry industry and the increasing need for efficient, healthy, and sustainable animal production.

China is the world’s top chicken consumer, with consumption reaching 24,436 kilotons in 2022, as per World Population Review. This is fueled by population growth, urbanization, higher income levels, and a shift in consumer preferences toward poultry meat, especially after the African Swine Fever outbreak reduced pork supply.

The market for probiotics in poultry feed is further propelled by ongoing investments in commercial poultry farming, advances in broiler genetics, and heightened consumer awareness of the health benefits of poultry products. Together, these factors foster a dynamic environment where innovative feed solutions like probiotics play a central role in supporting China’s massive and expanding poultry sector.

Additionally, major players in the country and their key initiatives that will propel this market growth. For instance, in May 2025, Evonik introduced its poultry probiotic Ecobiol to the Chinese market during the China Feed Industry Expo, achieving a major milestone as the product received its first-ever registration as a feed-grade Bacillus subtilis probiotic in mainland China. This approval means that Ecobiol, which harnesses the benefits of Bacillus subtilis to enhance poultry gut health and performance, can now be legally used in animal feed across China.

Sustainability Analysis

The global poultry industry remains a critical contributor to food security and livelihoods. As the global population continues to rise, so does the demand for safe, sustainable poultry products. This growing demand, coupled with increasing concerns over antimicrobial resistance and regulatory pressures to reduce or eliminate the use of antibiotic growth promoters (AGPs), is driving the industry to seek natural and cost-effective alternatives.

Prebiotics, probiotics, and postbiotics are emerging as viable substitutes for AGPs, offering a sustainable pathway to enhance poultry health, growth performance, and feed efficiency. These bio-based additives function through various mechanisms, including competitive exclusion and inhibition of pathogens, modulation of gut microbiota, stimulation of immune responses, enhancement of nutrient digestibility, and improvement of intestinal morphology.

Their adoption is being accelerated by rising consumer demand for antibiotic-free and clean-label poultry products. Although some physiological benefits are still being explored, the demonstrated improvements in bird health and productivity position these alternatives as strategic solutions for the future of poultry production. Widespread acceptance and implementation of these functional feed additives can support a more sustainable, safe, and economically viable poultry industry globally.

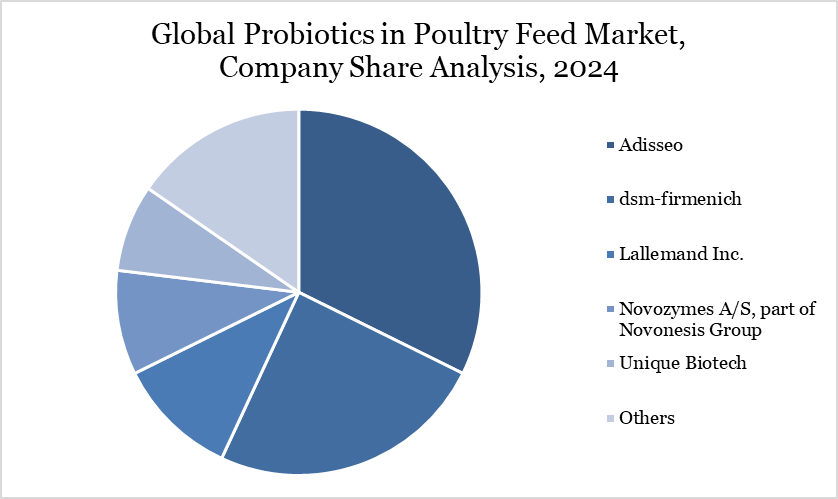

Probiotics in Poultry Feed Market Major Players

The major global players in the market include Adisseo, DSM-Firmenich, Lallemand Inc., Novozymes A/S, part of Novonesis Group, Unique Biotech, Evonik, Novus International, Inc., Vetline and Anfotal Nutritions Private Limited.

Key Developments

In May 2025, Evonik introduced its poultry probiotic Ecobiol to the Chinese market during the China Feed Industry Expo, achieving a major milestone as the product received its first-ever registration as a feed-grade Bacillus subtilis probiotic in mainland China. This approval means that Ecobiol, which harnesses the benefits of Bacillus subtilis to enhance poultry gut health and performance, can now be legally used in animal feed across China.

In January 2025, Evonik introduced Ecobiol Soluble Plus to the Indian market, a water-soluble probiotic aimed at enhancing poultry gut health and productivity. It contains Bacillus amyloliquefaciens CECT 5940, known for improving nutrient absorption and combating pathogens. Tailored for tropical climates, it helps poultry overcome heat stress and intestinal challenges. The product was officially launched at the 16th Poultry India Expo in Hyderabad.

In September 2023, Chr. Hansen India launched GalliPro Fit, a next-gen three-strain probiotic for poultry health and nutrition. Introduced in Hyderabad on August 21, it enhances performance, food safety, and reduces pathogen risks, promising to boost profitability in the Indian poultry sector.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies