Market Size

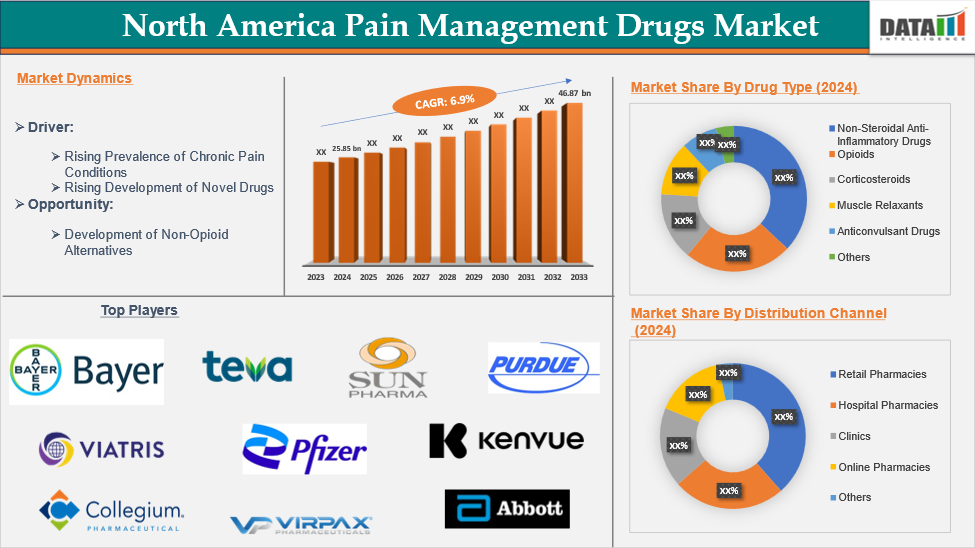

The North America pain management market reached US$ 25.85 billion in 2024 and is expected to reach US$ 46.87 billion by 2033, growing at a CAGR of 6.9% during the forecast period 2025-2033.

Pain management drugs, also called analgesics, are medications aimed at alleviating pain. These are classified into several categories, which majorly include non-steroidal anti-inflammatory drugs (NSAIDs), opioids, corticosteroids, muscle relaxants, anticonvulsants, etc.

NSAIDs are commonly used for mild to moderate pain and help reduce inflammation. Opioid analgesics, including morphine and oxycodone, are stronger medications prescribed for moderate to severe pain. They act by binding to specific receptors in the brain to block pain perception. Anticonvulsants, antidepressants, are effective for managing nerve pain and chronic pain syndromes..

Executive Summary

For more details on this report, Request for Sample

Market Dynamics: Drivers & Restraints

Rising Prevalence of Chronic Pain Conditions

Pain medications find their major applications in chronic and painful conditions such as osteoarthritis, back pain, neuropathic pain, fibromyalgia, and cancer-related pain. As conditions like arthritis, back pain, fibromyalgia, and neuropathy become more widespread, there is an increased demand for effective pain relief medications. For instance, according to the report published by the Centers for Disease Control and Prevention in 2024, it stated that in 2022, the age-adjusted prevalence of diagnosed arthritis among adults was 18.9%. Arthritis is more common in women (21.5%) than in men (16.1%). The prevalence of arthritis also increased with age, ranging from 3.6% in adults aged 18–34 to 53.9% in those aged 75 and older.

This increased demand has led to greater use of both traditional pain management drugs, such as opioids and NSAIDs (non-steroidal anti-inflammatory drugs), and newer, more targeted therapies like biologics, nerve blockers, and non-opioid analgesics.

Moreover, with the aging population in North America, which is more susceptible to chronic pain, the need for long-term pain management is growing. This demographic shift, along with heightened awareness of chronic pain, is driving healthcare providers to seek out innovative and diverse treatment options, contributing to the expansion of the pain management drugs market. Additionally, as patients and healthcare systems move away from opioid-based treatments due to concerns over addiction and side effects, there is a growing market for alternative therapies, including non-opioid painkillers and cannabinoid-based medications. Thus, the rising prevalence of chronic pain conditions is significantly driving the growth of the pain management drugs market in North America.

Competition from Alternative Pain Management Treatments

Competition from alternative pain management treatments is expected to pose a challenge to the growth of the pain management drugs market. As more patients seek non-pharmacological options, there is a growing shift away from traditional drug treatments. Some of the alternative pain management treatment approaches that are gaining traction over pharmacological options include acupuncture, hypnosis, massage, mindfulness meditation, music-based interventions, spinal manipulation, tai chi, qigong, and yoga are gaining traction. This can affect the overall market growth as individuals are more individuals are seeking drug-free treatments with rising awareness about health.

As these alternatives gain popularity, they are expected to limit the demand for traditional pain management drugs, making it essential for pharmaceutical companies to innovate and adapt to meet changing patient preferences and remain competitive in the market. Other alternative therapies, such as massage, chiropractic therapies, therapeutic touch, certain herbal therapies, and dietary approaches, are also expected to gain demand in the coming years.

Market Segment Analysis

The North America pain management market is segmented based on the drug type, indication, mode of prescription, and distribution channel.

Non-steroidal anti-inflammatory drugs in the drug type segment is expected to dominate the pain management market

Nonsteroidal anti-inflammatory drugs (NSAIDs) are widely used for pain relief, particularly for mild to moderate pain and inflammation. This category includes medications such as acetaminophen, aspirin, ibuprofen, naproxen, diclofenac, and celecoxib. These drugs play a crucial role in managing pain associated with musculoskeletal conditions, arthritis, post-surgical recovery, and migraines. NSAIDs cater to a wide range of pain conditions

Several major pharmaceutical companies are operating in the NSAIDs segment. For instance, in December 2024, Hikma Pharmaceuticals PLC (Hikma), a global pharmaceutical company, introduced Indomethacin Suppositories in a 50mg dose to the US market. This marks Hikma as the second generic version available, further expanding the company's portfolio and providing doctors and patients in the US with more treatment options. Their effectiveness and the increasing launches and their availability are expected to drive the segment growth.

Market Players

The market players in the pain management market are Bayer AG, Kenvue, Teva Pharmaceuticals Industries Ltd.., Viatris Inc., Pfizer Inc., Purdue Pharmaceuticals L.P., Abbott, Collegium Pharmaceutical, Inc., Sun Pharmaceutical Industries Ltd., AND Virpax Pharmaceuticals, among others.

| Metrics | Details | |

| CAGR | 6.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Drug Type | Non-Steroidal Anti-Inflammatory Drugs, Opioids, Corticosteroids, Muscle Relaxants, Anticonvulsant Drugs, Others | |

| Indication | Arthritis Pain, Back Pain, Surgery Pain, Headaches & Migraine, Injury Pain, Cancer Pain, Fibromyalgia, Muscle Spasms, Menstrual Pain, Neuropathic Pain, Others | |

| Segments Covered | Mode of Prescription | Prescription-Based, Over-the-Counter |

| Distribution Channel | Retail Pharmacies, Hospital Pharmacies, Clinics, Online Pharmacies, Others | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, and product pipelines, and forecasts upcoming pharmaceutical advancements.

- Type Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient Type delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The North America pain management market report would provide approximately 45 tables, 46 figures, and 180 pages.

Target Audience 2024

- Manufacturers: Pharmaceutical, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.