Next Generation Antibody Therapeutics Market Size

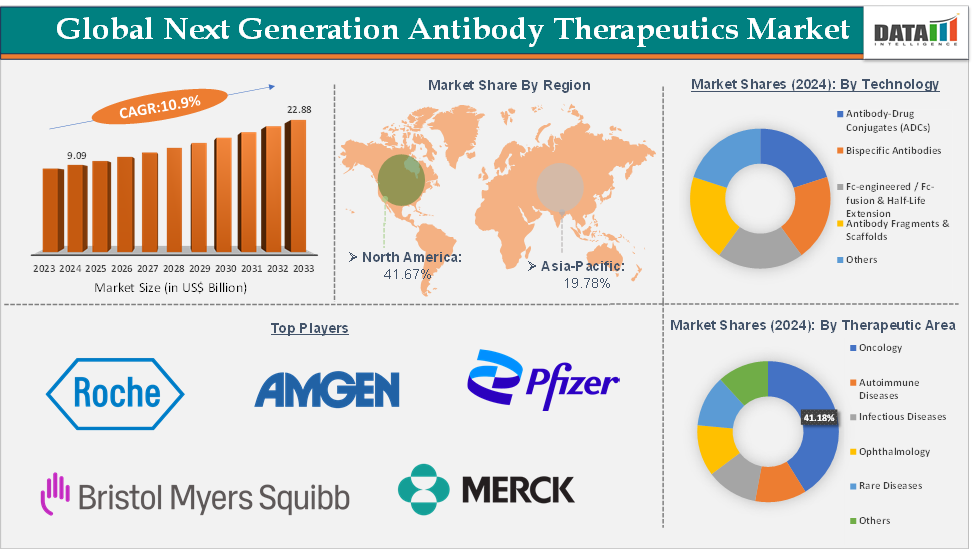

The global next generation antibody therapeutics market size reached US$ 9.09 Billion in 2024 from US$ 8.28 Billion in 2023 and is expected to reach US$ 22.88 Billion by 2033, growing at a CAGR of 10.9% during the forecast period 2025-2033.

Overview

The next-generation antibody therapeutics market is driven by rising cancer prevalence, technological advances, and strong clinical pipelines. A notable trend is the shift toward subcutaneous delivery, improving patient convenience and reducing hospital load. The market is evolving rapidly, propelled by advanced modalities like ADCs, bispecific/multispecific constructs, Fc-engineered antibodies, and antibody-mimetic scaffolds, which enable enhanced specificity, dual-target engagement, and improved safety profiles. Key challenges include high development costs, complex manufacturing, and stringent regulatory oversight.

Executive Summary

Dynamics

Drivers:

Investments, partnerships, and strategic deals are significantly driving the next generation antibody therapeutics market growth

Investments, partnerships, and strategic deals are playing a pivotal role in accelerating the growth of the next-generation antibody therapeutics market by pooling resources, sharing risks, and enabling faster innovation. The development of advanced modalities like antibody-drug conjugates (ADCs), bispecifics, and engineered Fc antibodies requires significant R&D funding and specialized know-how, which is increasingly achieved through collaborations between biotech innovators and large pharmaceutical companies.

For instance, in March 2025, Callio Therapeutics announced its launch with the closing of a $187.0 million Series A financing round. This financing was led by Frazier Life Sciences with significant participation from Jeito Capital alongside other life sciences investors, including Novo Holdings A/S, Omega Funds, ClavystBio, Platanus, Norwest, Pureos Bioventures, SEEDS Capital and EDBI. The company intends to use the proceeds from the Series A financing to achieve clinical proof-of-concept for its HER2-targeted dual-payload ADC and a second undisclosed ADC program.

Restraints:

Immunogenicity & safety concerns are hampering the growth of the next generation antibody therapeutics market

Immunogenicity and safety concerns remain significant hurdles hampering the growth of the next-generation antibody therapeutics market, as even advanced engineered antibodies can trigger unintended immune responses. Despite humanization and Fc-engineering efforts, some patients develop anti-drug antibodies (ADAs) that neutralize therapeutic effects or alter drug pharmacokinetics, leading to reduced efficacy or treatment discontinuation.

For instance, certain bispecific antibodies like blinatumomab have been associated with severe cytokine release syndrome (CRS) and neurotoxicity, requiring careful dose titration and hospital monitoring. Similarly, antibody-drug conjugates such as trastuzumab emtansine (Kadcyla) can cause off-target toxicities due to premature payload release. These risks increase regulatory scrutiny, with agencies demanding more extensive safety data and post-marketing surveillance, which can delay approvals and raise development costs.

Safety concerns also complicate patient recruitment in clinical trials, particularly for rare diseases where small sample sizes magnify adverse event risks. Moreover, market uptake can be hindered by physician hesitation in prescribing newer constructs without long-term safety profiles. Collectively, these immunogenicity and safety challenges slow market penetration and increase attrition rates, forcing developers to invest heavily in preclinical predictive models, biomarker-based patient selection, and safer linker-payload technologies to mitigate risks.

For more details on this report – Request for Sample

Segmentation Analysis

The global next generation antibody therapeutics market is segmented based on technology, therapeutic area, end-user, and region.

The oncology segment from the therapeutic area is dominating the next generation antibody therapeutics market with a 41.18% share in 2024

Next-gen formats such as antibody-drug conjugates (ADCs), bispecific antibodies, and checkpoint inhibitor-based combinations offer targeted mechanisms that can deliver potent cytotoxic payloads or redirect immune cells with high precision, minimizing damage to healthy tissue. For instance, in July 2025, Zymeworks Inc. announced that the U.S. Food and Drug Administration (FDA) cleared the investigational new drug (IND) application for ZW251, a novel glypican-3 (GPC3)-targeted ADC incorporating the company’s proprietary topoisomerase 1 inhibitor (TOPO1i) payload, ZD06519, for the treatment of hepatocellular carcinoma (HCC).

With multiple blockbuster antibodies already approved and hundreds in oncology-focused pipelines, pharma leaders like Roche, Pfizer, Bio-Thera Solutions, AstraZeneca, and Merck continue to prioritize oncology as the primary growth engine for next-generation antibody therapeutics. For instance, in June 2025, Bio-Thera Solutions Inc. announced that dosing had begun in a phase 3 clinical study for BAT8006, an antibody drug conjugate targeting folate receptor α for the treatment of platinum-resistant ovarian cancer. The phase 3, randomized, open-label, parallel-group clinical trial of BAT8006 is designed to assess the efficacy of BAT8006 versus the investigator's choice of single-agent chemotherapy in patients with platinum-resistant high-grade serous epithelial ovarian, primary peritoneal, or fallopian tube cancer.

Geographical Share Analysis

North America is expected to dominate the global next generation antibody therapeutics market with a 41.69% in 2024

North America dominates the global next-generation antibody therapeutics market due to its strong biotechnology ecosystem, advanced healthcare infrastructure, and high adoption of innovative biologics. The region, particularly the United States, hosts many of the world’s leading pharmaceutical and biotech companies, such as Pfizer, Amgen and Bio-Thera Solutions, which are actively developing next-gen modalities like antibody-drug conjugates (ADCs), bispecific antibodies, and Fc-engineered therapeutics.

The U.S. Food and Drug Administration (FDA) provides supportive regulatory frameworks, including Breakthrough Therapy and Orphan Drug designations, accelerating approvals for high-potential oncology and rare disease antibodies illustrated by the rapid clearance. For instance, in July 2025, Sutro Biopharma, Inc. announced that it entered into a collaboration with the U.S. Food and Drug Administration (FDA) to develop reference materials to improve regulatory standards and enhance analytical methods for ADC drug development. The collaboration will leverage Sutro’s cell-free XpressCF technology to precisely engineer ADCs with predefined attributes, as well as the FDA’s cutting-edge analytical capabilities to fully characterize these materials.

Competitive Landscape

Top companies in the next generation antibody therapeutics market include F. Hoffmann-La Roche Ltd, Amgen Inc., Bristol-Myers Squibb Company, Pfizer Inc., AstraZeneca, Merck & Co., Inc., Biogen, ADC Therapeutics SA and Genmab A/S, among others.

Report Scope

Metrics | Details | |

CAGR | 10.9% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Technology | Antibody-Drug Conjugates (ADCs), Bispecific Antibodies, Fc-engineered / Fc-fusion & Half-Life Extension, Antibody Fragments & Scaffolds and Others |

Therapeutic Area | Oncology, Autoimmune & Inflammatory Diseases, Infectious Diseases, Ophthalmology, Rare Diseases and Others | |

End-User | Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Academic and Research Institutes and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global next generation antibody therapeutics market report delivers a detailed analysis with 59 key tables, more than 58 visually impactful figures, and 167 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more Biotechnology-related reports, please click here