MRI Systems Market Size& Industry Outlook

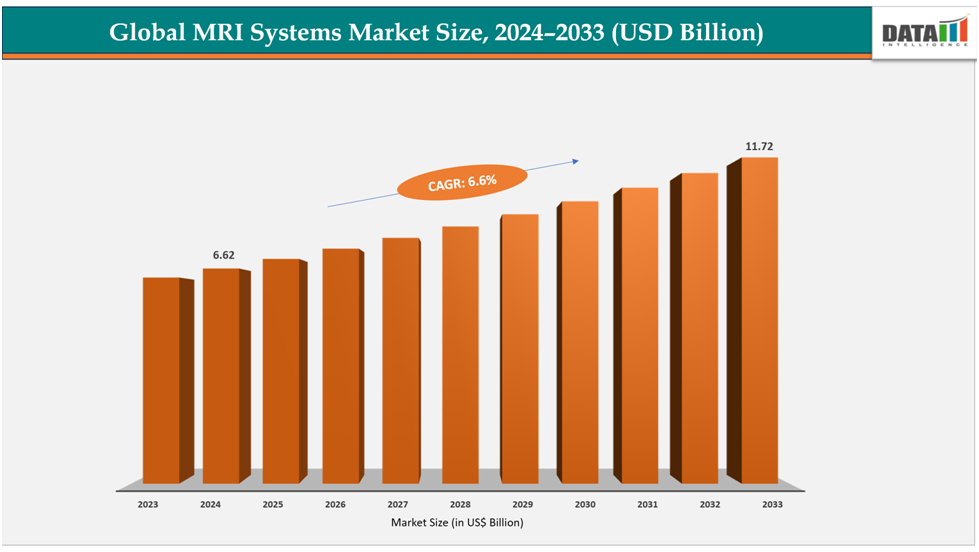

The global MRI systems market size reached US$ 6.24billion with rise of US$6.62billion in 2024 is expected to reach US$ 11.72billion by 2033, growing at a CAGR of 6.6%during the forecast period 2025-2033.The growing global burden of chronic and neurological diseases is prompting hospitals and diagnostic centers to increase their adoption of MRI systems. With its superior soft-tissue contrast and functional imaging capabilities, MRI is becoming essential for early detection and ongoing monitoring of conditions such as Alzheimer’s disease, multiple sclerosis, stroke and cancer. For example, in the U.S. over 6.9 million people aged 65 and older are living with Alzheimer’s in 2024, highlighting the need for accurate MRI-based diagnosis to track progression and access new therapies. This rising prevalence worldwide, particularly in Europe and aging Asian populations, is driving investment in higher-field and specialized MRI scanners like 3T and 7T to handle increasing diagnostic demand and improve patient outcomes.

Key Highlights

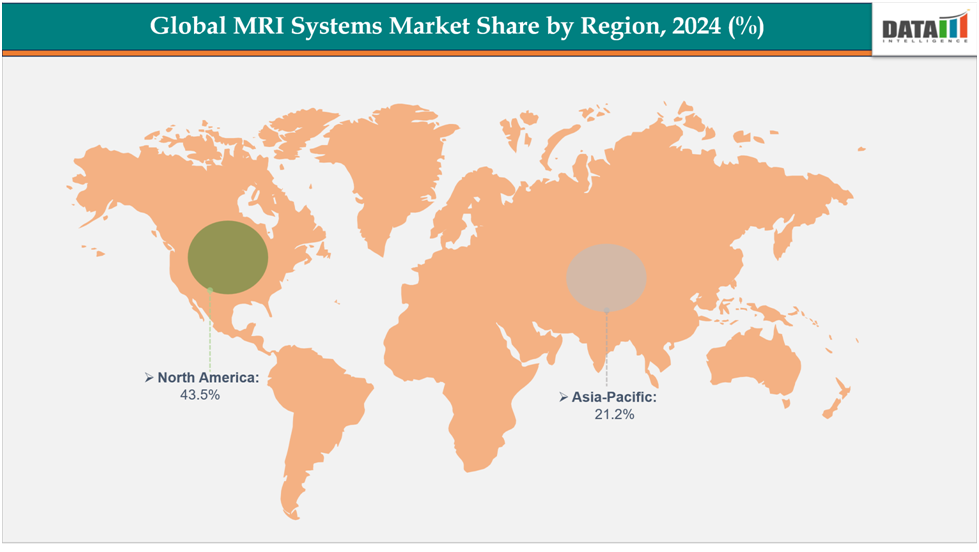

- North America dominates the MRI Systems market with the largest revenue share of 43.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of8.1% over the forecast period.

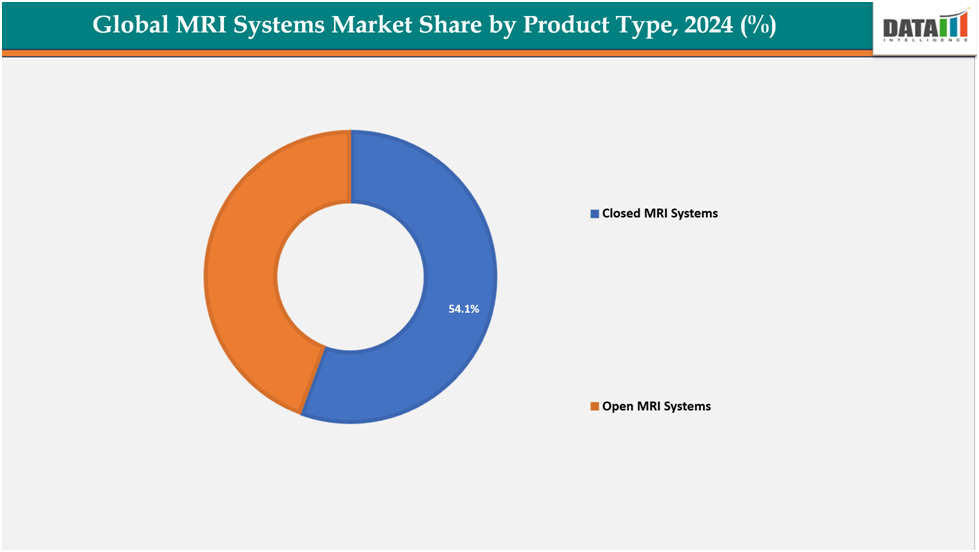

- Based on product type, closed MRI systems segmented the market with the largest revenue share of 54.1% in 2024.

- The major market players in the Siemens Healthiness, GE HealthCare, Philips Healthcare, Canon Medical Systems, Fujifilm Healthcare, United Imaging Healthcare, Mediso Ltd, IMRIS Imaging, Inc and among others.

Market Dynamics

Drivers:

Growing demand for early disease diagnosis is significantly driving the MRI systems market growth

The growing demand for early disease diagnosis plays a crucial role in driving the MRI systems market. As healthcare systems and patients increasingly prioritize detecting illnesses at an earlier stage, the need for imaging technologies that provide high-resolution, non-invasive, and detailed anatomical and functional information has surged. MRI systems are particularly suited to this demand because they can reveal subtle tissue changes and disease markers before symptoms fully develop, enabling timely interventions and better prognoses.

For instance, hospitals and imaging centers are installing advanced 3T and 7T MRI scanners to screen for small brain lesions in multiple sclerosis or early-stage tumors in oncology, which can significantly improve treatment planning and outcomes. This focus on early diagnosis directly boosts purchases of new MRI systems and upgrades of existing equipment worldwide.

Restraints:

High cost of MRI systems and installation are hampering the growth of the MRI systems market

The high cost of MRI systems and their installation remains a major hurdle for the market. A new 3-Tesla MRI scanner alone can cost about USD 1–3 million just for the equipment. On top of that, installation and facility modifications typically add another 20–30% to the total outlay, covering magnetic shielding, structural reinforcement to support the system’s weight, dedicated power supply and specialized cooling such as cryogenic systems for superconducting magnets. Annual maintenance, servicing and operational expenses including energy consumption, trained staff and contrast agents can further reach USD 70,000–150,000+ depending on system complexity. These steep upfront and recurring costs restrict adoption particularly among smaller hospitals and in developing regions with limited budgets.

For more details on this report – Request for Sample

Segment Analysis

The global MRI Systems market is segmented based on product type, strength, application, end user, and region.

Product Type:

The closed MRI systems from product type segment to dominate the MRI systems market with a 54.1% share in 2024

The closed MRI systems segment is driven primarily by its superior image quality, higher signal-to-noise ratio, and ability to perform advanced imaging protocols compared to open systems. These scanners typically have stronger magnets (1.5T and 3T), enabling faster scan times and clearer visualization of small anatomical structures. Hospitals and diagnostic centers prefer closed systems for high-volume settings and complex cases such as oncology or cardiovascular imaging. Growing demand for more accurate diagnostics, along with technological improvements in patient comfort (wider bores, noise reduction, and faster sequences), further boosts adoption of closed MRI systems worldwide.

For instance, in September 2024, Siemens Healthiness has introduced MAGNETOM Flow1, its first 1.5 T MRI platform with a closed helium circuit and no quench pipe, reducing the amount of liquid helium required for cooling to 0.7 litres using DryCool technology, saving costs and resources.

Application:

The neurological segment is estimated to have a 41.2% of the MRI systems market share in 2024

MRI’s non-invasive ability to detect minute changes in brain structure and function makes it indispensable for neurological applications. Rising prevalence of disorders such as Alzheimer’s disease, Parkinson’s disease, multiple sclerosis, and stroke is driving demand for advanced neuro-MRI. Increasing clinical trials for neurodegenerative conditions, expansion of functional MRI (fMRI) for mapping brain activity, and the growing use of high-field and ultra-high-field systems (3T and 7T) to improve diagnostic accuracy all strengthen this segment. As aging populations in North America, Europe, and Asia grow, healthcare systems are investing heavily in MRI capacity specifically to manage the surge in neurological cases.

For instance, in September 2025, Lilavati Hospital & Research Centre has launched the OMEGA 3T MRI, a new diagnostic imaging system with advanced technology and patient-centric features, marking the first installation of its kind in Mumbai. The system was inaugurated by permanent trustees, senior doctors, management, and hospital staff.

Geographical Analysis

North America dominates the global MRI systems market with a 43.5% in 2024

North America’s MRI market is propelled by a highly developed healthcare infrastructure, large numbers of accredited imaging centers and hospitals, and a strong focus on early and preventive diagnostics. The region shows rapid uptake of high-field (3T) and AI-enabled MRI systems for oncology, neurology and cardiology. In addition, favorable reimbursement frameworks and ongoing replacement of aging equipment encourage both public and private providers to invest in new scanners.

In the U.S., demand is heightened by a FDA approval, fast-growing elderly population and high prevalence of chronic and neurological conditions. Major research programs and clinical trials require advanced imaging capabilities, while both private insurers and Medicare increasingly cover high-end diagnostic procedures. The concentration of top MRI manufacturers and innovation hubs also accelerates the adoption of next-generation MRI technologies.

For instance, in June 2025, Hyperfine, Inc., a leading health technology company, has received FDA clearance for its Swoop system, the first FDA-cleared AI-powered portable MRI system for the brain. The new system, powered by Optive AI software, offers the highest level of image quality, functionality, and usability, revolutionizing brain imaging for clinicians and patients.

Europe is the second region after North America which is expected to dominate the global MRI systems market with a 34.5% in 2024

Europe benefits from universal or near-universal healthcare coverage and coordinated screening programs for cancer, cardiovascular and neurodegenerative diseases. EU funding for modernization of hospital equipment and a push toward low-helium or helium-free scanners make MRI upgrades attractive. Growing interest in cross-border healthcare and teleradiology is also creating demand for consistent, high-quality MRI images.

Germany stands out be fastest growing country in Europe due to its high per-capita MRI scanner density, strong medical technology manufacturing base and early adoption of high-performance systems. Robust reimbursement policies and a large academic hospital network mean new MRI features such as faster sequences, advanced neuroimaging and cardiac MRIare implemented quickly, keeping the country at the forefront of imaging practice.

For instance, in June 2024, A new field of research in dental diagnostics was moving toward integrating early detection of oral disease into routine dental examinations. Last year, Dentsply Sirona announced that it was collaborating with Germany-based medical technology company Siemens Healthiness to develop dental-dedicated magnetic resonance imaging (ddMRI) technology for dento-maxillofacial diagnostics.

The Asia Pacific region is the fastest-growing region in the global MRI systems market, with a CAGR of 8.1% in 2024

Across Asia-Pacific, rising healthcare expenditures, an expanding middle class and higher incidence of lifestyle-related diseases are fueling MRI purchases. Governments in China, India and Southeast Asia are funding diagnostic imaging infrastructure, while domestic vendors introduce more affordable systems to increase access in secondary cities and rural areas. Growing private hospital chains also see MRI as a differentiator for attracting patients.

Japan already has one of the world’s highest MRI scanner densities, and demand remains strong due to its aging population and emphasis on regular health check-ups. Government initiatives support the integration of advanced technologies such as AI-assisted image reconstruction and 3T/7T scanners.

Competitive Landscape

Top companies in the MRI systems market include Siemens Healthineers, GE HealthCare, Philips Healthcare, Canon Medical Systems, Fujifilm Healthcare, United Imaging Healthcare, Mediso Ltd, IMRIS Imaging, Incand among others.

GE Healthcare: GE HealthCare, a leading manufacturer of MRI systems, is a key player in the global market. Its SIGNA brand offers a range of systems, including 1.5T, 3T, and ultra-high-field 7T systems, as well as specialized solutions for cardiovascular, neurological, and pediatric imaging. The company is investing in faster gradient technology, AI-driven reconstruction software, and workflow tools to improve image quality and reduce scan times. It also develops energy-efficient systems and offers service packages to help hospitals manage costs.

Market Scope

| Metrics | Details | |

| CAGR | 6.6% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Closed MRI Systems, Open MRI Systems |

| Strength | <0.5T, 1.5T, 3T, >3T | |

| Application | Neurological, Musculoskeletal, Cardiovascular, Abdominal & Pelvic, Breast, Others | |

| End User | Hospitals, Imaging Centers, Ambulatory Surgical Centers | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global MRI systems market report delivers a detailed analysis with 62 key tables, more than 57visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here