Overview

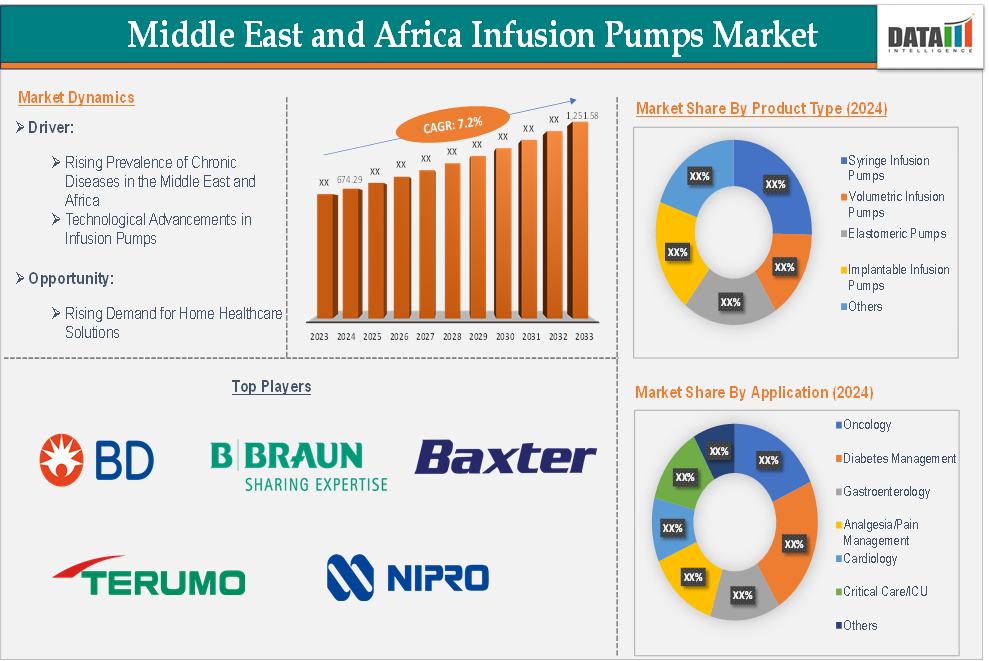

The Middle East and Africa Infusion Pumps market size reached US$ 769.17 million in 2024 and is expected to reach US$ 1,279.37 million by 2033, growing at a CAGR of 5.9% during the forecast period of 2025-2033.

An infusion pump is a medical device used to deliver fluids, medications, or nutrients into a patient's body in a controlled manner. These pumps are designed to administer a prescribed volume or dose of fluid over a specified period of time, allowing for accurate and consistent delivery of treatment.

They are commonly used in healthcare settings like hospitals, clinics, and home healthcare environments. Their versatility, safety features, and ability to improve patient outcomes make them indispensable in clinical settings, especially for managing chronic diseases, critical care, and pain management.

Executive Summary

Market Dynamics: Drivers & Restraints

The rising prevalence of chronic diseases in the Middle East and Africa is driving the Middle East and Africa infusion pumps market growth

Chronic conditions such as diabetes, cardiovascular diseases, cancer, and neurological disorders are increasingly common in the region, which in turn drives the demand for infusion pumps used in their treatment and management. For instance, the Middle East and North Africa (MENA) region has one of the highest diabetes prevalence rates globally. According to the International Diabetes Federation (IDF), around 73 million adults were living with diabetes in the MENA region in 2021, and this number is projected to rise to 135.7 million by 2045.

Insulin infusion pumps are critical in the management of diabetes, particularly for Type 1 diabetes patients who require continuous insulin delivery. As the number of diabetic patients rises, the demand for continuous glucose monitoring systems and insulin pumps increases as well.

Cancer incidence in the MEA region is also rising rapidly. In 2020, the World Health Organization (WHO) reported that 1.1 million new cancer cases were diagnosed in Africa alone, and this number is expected to grow as populations age and lifestyles change. Thus, infusion pumps are widely used in chemotherapy treatments for cancer patients, where precise and controlled drug delivery is crucial.

Limited healthcare budgets hamper the growth of the market

While the Middle East and Africa region is experiencing growth in its infusion pumps market, limited healthcare budgets in several countries are significantly hampering market growth. The region faces economic constraints, budget limitations in public healthcare, and reliance on external funding, which makes it challenging for hospitals and healthcare providers to invest in expensive medical equipment like infusion pumps.

Many countries in Sub-Saharan Africa, such as Ethiopia, Nigeria, and Kenya, face economic limitations that hinder the ability of governments to allocate significant funds for healthcare infrastructure, including advanced medical equipment like infusion pumps. The high cost of infusion pumps (including smart, volumetric, and syringe pumps) is a significant barrier, especially in lower-income countries. Infusion pumps, particularly advanced models with features like wireless connectivity and real-time monitoring, are expensive, and many healthcare systems cannot afford to make large-scale purchases.

For instance, according to the World Health Organization (WHO), healthcare spending in low- and middle-income countries (LMICs) is often below $100 per capita, compared to high-income countries, where spending exceeds $3,000 per capita. This disparity means many healthcare facilities in the MEA region struggle to purchase advanced devices like infusion pumps.

Segment Analysis

The Middle East and Africa infusion pumps market is segmented based on product type, technology, application, patient type, and end-user.

Product Type:

The syringe infusion pumps segment is expected to dominate the Middle East and Africa infusion pumps market with the highest market share

The syringe infusion pumps segment holds a dominant position in the Middle East and Africa (MEA) infusion pumps market due to their precision, compact size, and wide range of clinical applications. Syringe pumps are particularly effective in low-volume infusion therapy, which is essential in critical care units, pediatric care, and for delivering highly concentrated medications such as chemotherapy or anesthetics. They are preferred in settings where accuracy and safety are paramount, which contributes to their significant market share.

Syringe infusion pumps are specifically designed to deliver small volumes of fluids with high precision over extended periods. This makes them ideal for the administration of high-concentration drugs, chemotherapy agents, pediatric dosing, and anesthesia, where even minor dosing errors can have significant consequences.

For instance, in Saudi Arabia, oncology centers use syringe infusion pumps extensively to deliver chemotherapy agents to cancer patients, where precise dosage is critical. The King Faisal Specialist Hospital & Research Centre in Riyadh, a leading healthcare facility, frequently uses syringe pumps for cancer treatment.

Syringe infusion pumps are preferred in critical care units and pediatric care because they can deliver medications at a very low flow rate, which is crucial for newborns, premature infants, or elderly patients with special needs. The accuracy provided by syringe pumps helps reduce the risk of adverse reactions from incorrect drug dosing, which is especially vital for high-risk patients.

For instance, pediatric hospitals in Dubai and Abu Dhabi, such as the Al Jalila Children's Specialty Hospital, use syringe pumps extensively for pediatric pain management and the administration of fluids to infants. These pumps are designed to provide low-volume, continuous infusion while minimizing the risk of complications.

The rising prevalence of chronic diseases such as diabetes, cardiovascular diseases, and cancer across the MEA region has led to an increased need for infusion pumps in healthcare settings. Syringe infusion pumps are frequently used to administer insulin in diabetic patients, pain medication in cancer treatment, and fluids/medications in cardiac patients.

Competitive Landscape

The major Middle East and Africa players in the infusion pumps market include BD, B. Braun SE, Baxter International Inc., Fresenius Kabi AG, ICU Medical, Inc., Terumo Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Medtronic plc, F. Hoffmann-La Roche Ltd., Nipro, and others.

Scope

| Metrics | Details | |

| CAGR | 5.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Product Type | Syringe Infusion Pumps, Volumetric Infusion Pumps, Elastomeric Pumps, Implantable Infusion Pumps, and Others |

| Technology | Traditional Pumps, Smart Pumps, and Wearable Pumps | |

| Application | Oncology, Diabetes Management, Gastroenterology, Analgesia/Pain Management, Cardiology, Critical Care/ICU, and Others | |

| Patient Type | Adults, Pediatrics, and Geriatrics | |

| End-User | Hospitals, Specialty Clinics, Home Healthcare, and Others | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical Procedures and pharmaceuticals.

- Product Performance & Market Positioning: Analyze product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyze competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The Middle East and Africa infusion pumps market report delivers a detailed analysis with 45 key tables, more than 43 visually impactful figures, and 148 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.