Medical adhesives Market is segmented By Material Type (AcrylicAdhesive, Polyurethane, Cyanoacrylate, Epoxy, and Others), By Technology(Water-based, Solvent-based, Hot Melt and Others), By Application (Dental, Medical Device & Equipment, and Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2025-2033

Overview

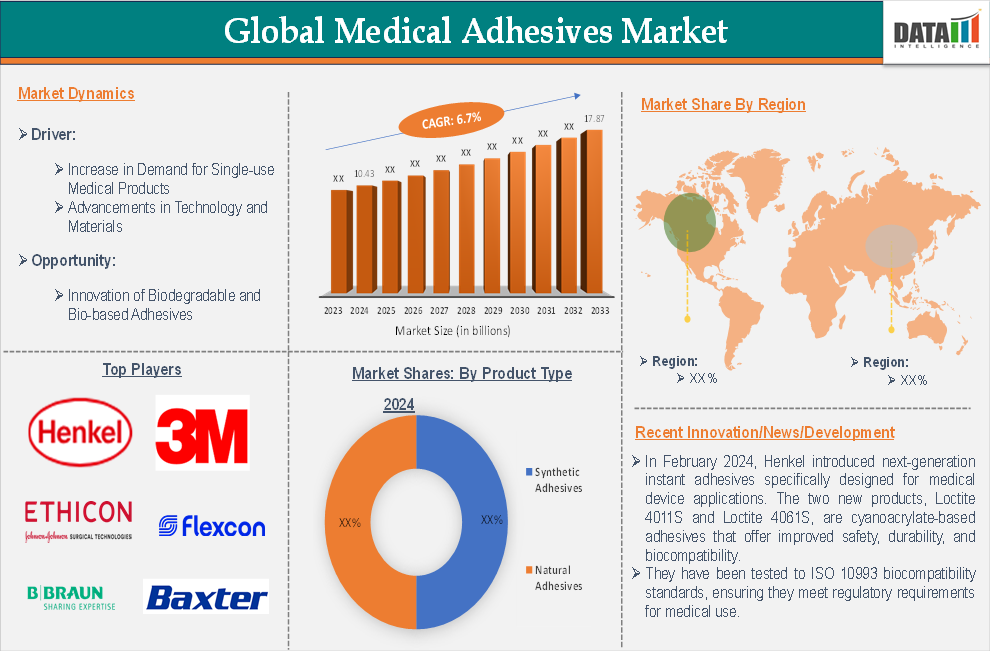

The global medical adhesives market reached US$ 10.43 billion in 2024 and is expected to reach US$ 17.83 billion by 2033, growing at a CAGR of 6.7 % during the forecast period of 2025-2033.

Medical adhesives are specialized substances used to bond biological tissues or secure medical devices to the body. They play an essential role in applications such as wound closure, surgical interventions, and the attachment of medical devices like bandages, electrodes, and transdermal patches. These adhesives are formulated to be biocompatible, safe, and effective, ensuring minimal risk of adverse reactions.

Medical adhesives are broadly classified into synthetic and biological formulations, catering to various surgical and medical device applications. Some adhesives are reusable, such as hot melt and pressure-sensitive adhesives, while others are disposable for single-use applications.

Executive Summary

Market Dynamics: Drivers & Restraints

Rising Demand for Disposable Medical Products

The rising demand for disposable medical products is expected to drive the growth of the medical adhesives market significantly. As healthcare facilities prioritize hygiene and safety, there has been a shift toward disposable products like wound dressings, bandages, surgical drapes, and diagnostic patches. These single-use products often rely on medical adhesives for secure application and patient comfort. The rising trend of minimizing cross-contamination and enhancing patient safety has made single-use medical products even more popular.

In response to the growing demand, manufacturers are increasing their production of high-performance adhesives designed for disposable products. For instance, in January 2023, H.B. Fuller launched Swift Melt 1515-I, its first bio-compatible product compliant in India, the Middle East, and Africa. The product is for medical tape applications to be used in stick-to-skin under unique climatic conditions, such as the high temperatures and humidity in the Indian sub-continent.

They focus on creating adhesives that ensure strong, reliable bonds while maintaining biocompatibility, ease of use, and skin-friendly properties. Thus, the growing need for disposable products is expected to expand the market as manufacturers expand their product lines. All these factors demand the global medical adhesives market.

Skin Sensitivity and Allergic Reactions

Skin sensitivity and allergic reactions are a significant challenge for the medical adhesives market as they can limit the use of adhesive products for certain patients. Many adhesives contain materials that, while effective in forming strong bonds, can cause irritation, rashes, or allergic reactions when applied to sensitive skin. This is especially problematic for individuals with existing skin conditions or those who need to use adhesives long-term, such as for wound care or medical devices.

In addition to causing discomfort and adverse effects, skin sensitivity and allergic reactions can also increase the risk of infections, especially in patients with compromised immune systems or those recovering from surgery. It can be particularly problematic in medical settings where precise, reliable wound care is essential. As a result, patients may experience discomfort or adverse effects, which can lead to discontinuing the product and lower patient adherence. Thus, the above factors could be limiting the global medical adhesives market's potential growth.

Segment Analysis

The global medical adhesives market is segmented based on product type, technology, application, and region.

Product Type:

The synthetic adhesives segment in product type is expected to dominate the global medical adhesives market with the highest market share

Synthetic adhesives play a crucial role in the global medical adhesives market, primarily due to their superior bonding strength, biocompatibility, and versatility. These adhesives are widely used in medical devices, wound closure, surgical applications, and transdermal drug delivery systems. The synthetic adhesives segment is driven by the rising adoption of medical devices and advanced wound care solutions. Compared to natural adhesives (such as fibrin or collagen-based adhesives), synthetic adhesives offer greater durability and flexibility, making them more suitable for long-term medical applications.

Increasing demand for minimally invasive surgical procedures, the need for faster healing solutions, and advancements in medical device technology. Their advantages include fast curing time, water resistance, and enhanced biocompatibility, making them ideal for modern healthcare needs.

For instance, in July 2023, DuPont launched the Liveo MG 7-9960 Soft Skin Adhesive, a next-generation, higher-adhesion, low-cyclics silicone soft skin adhesive (SSA) designed for advanced wound care dressings and medical devices. This new adhesive is engineered to provide longer wear time, gentle removal, and high repositionability, making it ideal for patients with fragile or sensitive skin, including children, the elderly, and those with skin conditions or open wounds. These factors have solidified the segment's position in the global medical adhesives market.

Geographical Analysis

North America is expected to hold a significant position in the global medical adhesives market with the highest market share

The region’s dominance is expected to be driven by a combination of advanced healthcare infrastructure, innovation, and a growing demand for more efficient and reliable medical solutions. Several of the world’s leading medical device manufacturing companies and product manufacturing companies are present in North America, which are consistently involved in introducing innovative products and setting new standards in the industry.

For instance, in February 2023, 3M unveiled a new medical adhesive designed to stick to the skin for up to 28 days, intended for use with various health monitors, sensors, and long-term wearables. This innovation, which doubles the previous standard wear time, highlights North America's leadership in developing patient-centric solutions. The focus on both performance and patient comfort continues to fuel the region’s dominance in the global medical adhesives market.

Additionally, the region is experiencing a high incidence of chronic diseases. For instance, according to the Centers for Disease Control and Prevention, in 2023, it was reported that about 38 million people had diabetes in the United States. Diabetes, a chronic condition that affects millions of people in the region, frequently requires specialized wound care solutions, including medical adhesives used in dressings and bandages. These adhesives not only help secure dressings to wounds but also ensure a sterile and comfortable environment, which is crucial for preventing infections and promoting faster healing.

Competitive Landscape

The major global players in the medical adhesives market include Ethicon (Johnson & Johnson), 3M, B. Braun Melsungen AG, Baxter International, Henkel, Avery Dennison Corporation, Bostik Ltd, Chemence Medical, Nitto Denko Corporation, and Flexcon Company, Inc., among others.

Key Developments

- In February 2024, Henkel introduced next-generation instant adhesives specifically designed for medical device applications. The two new products, Loctite 4011S and Loctite 4061S, are cyanoacrylate-based adhesives that offer improved safety, durability, and biocompatibility. They have been tested to ISO 10993 biocompatibility standards, ensuring they meet regulatory requirements for medical use.

Scope

| Metrics | Details | |

| CAGR | 6.7% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Synthetic Adhesives, Natural Adhesives |

| Technology | Water-Based, Solvent-Based, Solids, Hot Melt, and Others | |

| Application | Dental, Internal & External Medical Surgery, Medical Devices and Equipment, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials and product pipelines and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzed product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: This covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyze competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global medical adhesives market report delivers a detailed analysis with 62 key tables, more than 53 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.

Suggestions for Related Report

- Global Adhesive Equipment Market

- Global Adhesives and Sealants Market

- Global Cyanoacrylate Instant Adhesives Market

For more medical disposables-related reports, please click here