Market Size

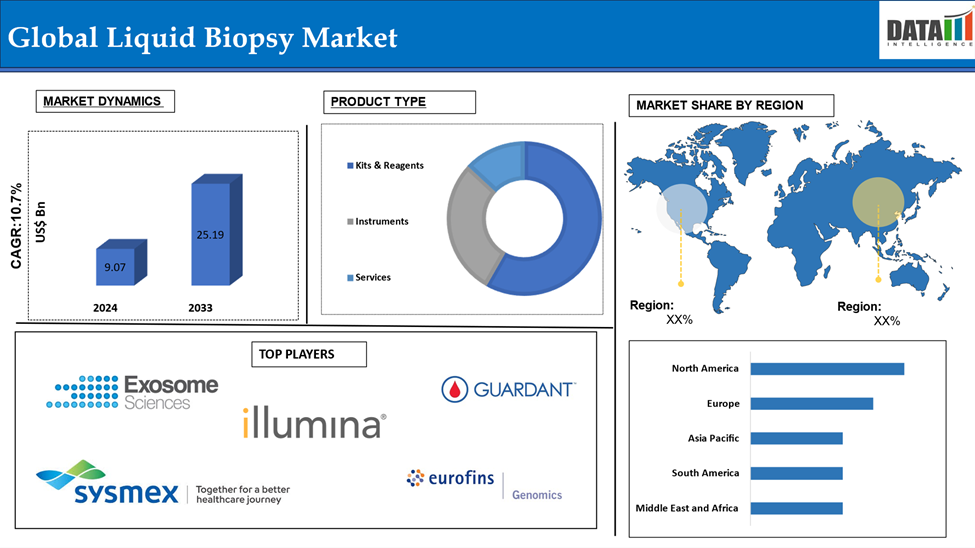

Global Liquid Biopsy Market reached US$ 9.07 billion in 2024 and is expected to reach US$ 25.19 billion by 2033, growing at a CAGR of 10.7% during the forecast period 2025-2033.

Liquid biopsy is a minimally invasive test that detects cellular or molecular biomarkers in body fluids like blood, urine, semen, or saliva, providing diagnostic, prognostic, or predictive disease information. Moreover, Liquid biopsy is utilized in clinical settings for early cancer detection, tumor staging and monitoring of localized cancer patients, predicting metastatic progression in advanced cancer patients, and monitoring treatment efficacy, although screening remains challenging.

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Rising Prevalence of Cancer

The liquid biopsy market is gaining demand due to the rising global cancer burden, which necessitates early detection and real-time monitoring for improved patient outcomes. Traditional methods are invasive and time-consuming, making liquid biopsy a non-invasive alternative. It allows for the detection of circulating tumor DNA, CTCs, and other biomarkers from blood samples, facilitating early diagnosis, treatment monitoring, and personalized therapy selection. For instance, the American Cancer Society (ACS) has revealed cancer statistics for 2025, estimating that more than 2 million new occurrences of cancer will be diagnosed in the United States this year, with over 600,000 people dying from cancer.

Researchers predict that in 2025, there will be 2,041,910 new cancer diagnoses in the United States, which equates to almost 5600 new cases every day. The figure comprises 1,053,250 cancer cases in males and 988,660 in women.

Standardization and Regulatory Challenges

One of the main things about retaining the global liquid biopsy market is the lack of standards and strict rules from regulators. Liquid biopsy technologies use complicated testing methods, and test results can be inconsistent when screening methods are changed. There aren't any generally agreed upon rules for validating tests, handling samples, and figuring out what the results mean, which makes it hard for broad adoption.

Also, regulatory bodies like the FDA and EMA need a lot of clinical support for liquid biopsy tests, which makes the approval process take longer. These problems make it take longer for new goods to reach the market and make it harder for smaller businesses to bring new liquid biopsy options to market.

Market Segment Analysis

The global liquid biopsy market is segmented based on product type, circulating biomarker, application, technology, end user and region.

Product Type:

Kits and reagents in product type segment is expected to dominate with highest market share

Kits and reagents play a crucial role in liquid biopsy, a minimally invasive test that analyzes body fluids, such as blood, to detect circulating tumor cells(CTCs), cell-free DNA (cfDNA), and extracellular vesicles (EVs). These components are essential for the extraction, purification, and analysis of the target molecules. Extraction kits, these kits are designed to isolate specific molecules, such as cfDNA, from bodily fluids.

Owing to the various factors like, novel product launches, increasing demand for this segment and other facotrs help the kits and reagents segment is expected to grow during the forecast period. For instance, in February 2024, Twist Bioscience Corporation, a company enabling customers to succeed through its offering of high-quality synthetic DNA using its silicon platform, launched the cfDNA Library Preparation Kit to enable liquid biopsy research.

Moreover, in October 2024, QIAGEN has announced significant updates to its sample technologies solutions for non-invasive liquid biopsy applications, aimed at research and clinical applications in oncology, prenatal care, and organ transplantation.

Market Geographical Analysis

North America is expected to hold a significant position in the Liquid Biopsy market

North America holds a substantial position in the liquid biopsy market and is expected to hold most of the market due to novel tests innovations, advanced healthcare infrastructure, high cancer prevalence, and investment in precision medicine. For instance, in July 2024, Guardant Health, Inc., a leading precision oncology company, announced the launch of a major upgrade to its market-leading Guardant360 liquid biopsy test. The new enhanced test evaluates biomarkers in 739 genes in total, which is 10 times more cancer biomarkers than the previous version of Guardant360 evaluated. The test can also identify an extensive array of emerging biomarkers to precisely characterize cancer and can quantify disease burden at much higher sensitivity.

Moreover, the rising incidence of cancer in the U.S. and Canada drives demand for early, non-invasive diagnostic solutions. FDA regulatory support and increased cancer research funding accelerate the development of liquid biopsy technologies. Leading biotechnology and pharmaceutical companies and collaborations in biomarker research and clinical trials further strengthen North America's market growth.

Major Global Players

The major global players in the liquid biopsy market include Exosome Sciences Inc., Illumina, Inc., Guardant Health, Thermo Fisher Scientific Inc., NeoGenomics Laboratories, Qiagen, BioChain Institute Inc., Sysmex Europe SE, Eurofins Genomics, and Goffin Molecular Technologies among others.

Key Developments

- In February 2025, SOPHiA GENETICS, a leader in AI healthcare technology and data-driven medicine, has achieved a milestone in the global adoption of its cancer testing applications MSK-ACCESS powered with SOPHiA DDM and MSK-IMPACT powered with SOPHiA DDM. 37 prominent institutions, including top researchers and opinion leaders, have already adopted the Liquid Biopsy and Solid Tumor applications.

- In October 2024, GeneCentric Therapeutics has launched its EXpressCTSM liquid biopsy platform, allowing tissue RNA expression and epigenomics to be realized in liquid biopsy. The platform expands the application of the company's RNA-based gene expression signatures and diagnostic tests to cell-free DNA (cfDNA) liquid biopsy samples, including blood and urine.

| Metrics | Details | |

| CAGR | 10.7% | |

| Market Size Available for Years | 2018-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Volume (Units) | ||

| Segments Covered | Product Type | Kits & Reagents, Instruments, Services |

| Circulating Biomarker | Circulating Tumor Cells, Circulating Tumor DNA (ctDNA), Cell-free DNA (cfDNA), Extracellular Vesicles | |

| Application | Cancer Applications, Non-Cancer Applications | |

| Technology | Multi-gene-parallel Analysis (NGS), Single Gene Analysis (PCR Microarrays) | |

| End User | Hospitals and Physician Laboratories, Research Centers, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Technological Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Product Type & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.

The global liquid biopsy market report delivers a detailed analysis with 61 key tables, more than 59 visually impactful figures, and 220 pages of expert insights, providing a complete view of the market landscape.