Joint Pain Injection Market Size

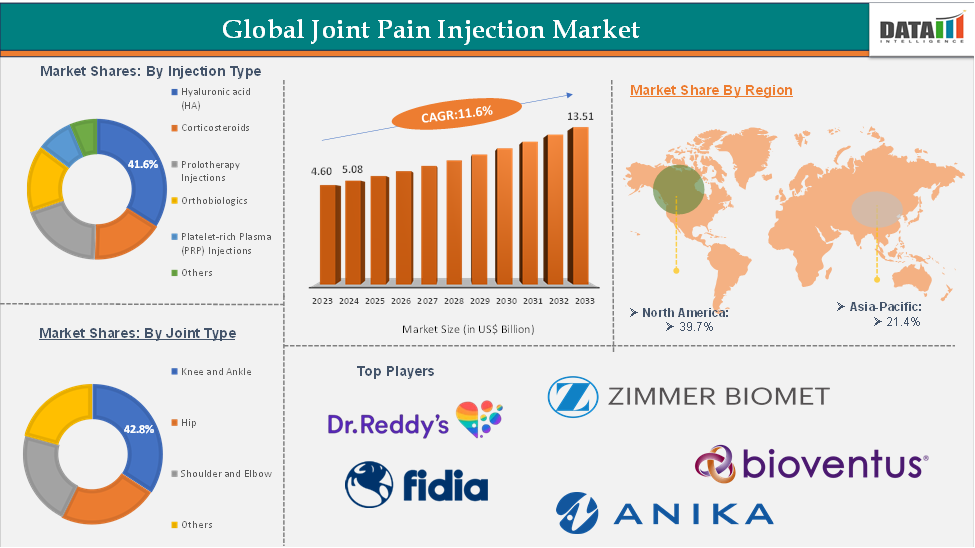

In 2023, the global joint pain injection market was valued at US$ 4.60 Billion. The global Joint Pain Injection market size reached US$ 5.08 Billion in 2024 and is expected to reach US$ 13.51 Billion by 2033, growing at a CAGR of 11.6% during the forecast period 2025-2033.

Global Joint Pain Injection Market Overview

The global market for joint pain injections is experiencing steady expansion, driven by rising cases of osteoarthritis (OA) and growing demand for minimally invasive, non-opioid alternatives to manage chronic musculoskeletal pain. As the global elderly population rises and sedentary lifestyles increase among younger demographics, joint degeneration and related disorders are becoming increasingly common. Intra-articular injection therapies are gaining traction as effective outpatient treatments with reduced recovery time. These therapies are now recognized not just for symptom relief, but also for their regenerative potential and ability to delay or reduce the need for surgical interventions.

A strong shift in patient and clinician preference away from long-term opioid usage and invasive joint replacement surgeries is contributing to the market’s sustained momentum. Increased healthcare awareness, improved insurance coverage, and a growing number of orthopedic specialists offering advanced injectable options are all contributing to expanding global adoption. Market players are increasingly investing in formulation innovations and aligning with a broader industry trend toward personalized, targeted pain management strategies.

In 2024, the U.S. Joint Pain Injection Market was valued at USD 1.51 billion and is expected to reach USD 4.02 billion by 2033. This growth is being powered by high OA prevalence, rising outpatient utilization of PRP and viscosupplementation therapies, and broadening insurance reimbursement policies. Advanced delivery devices and increasing clinical trials in regenerative medicine are further fueling innovation across North America.

The market in Japan, which has one of the oldest populations globally, is benefiting from widespread use of hyaluronic acid injections for knee OA and a national healthcare system that supports non-surgical interventions. Japan’s orthopedic community is also driving adoption of next-gen biologicals, while its patients increasingly seek outpatient solutions that allow continued mobility and avoid long hospital stays.

Global Joint Pain Injection Market Executive Summary

Global Joint Pain Injection Market Dynamics: Drivers & Restraints

Market Dynamics

Key Drivers: With the growing burden of osteoarthritis and other degenerative joint conditions, joint pain injections are becoming a core component of non-surgical pain management strategies.

These injections, ranging from corticosteroids and hyaluronic acid to platelet-rich plasma (PRP), are gaining traction due to their fast-acting relief, minimally invasive nature, and potential to delay or avoid joint replacement surgeries. The rise in aging populations globally, coupled with increased rates of obesity and sedentary lifestyles, is accelerating the demand. For instance, according to the CDC, approximately 1 in 5 U.S. adults is affected by some form of arthritis. Among the more than 100 known types, osteoarthritis (OA) is the most prevalent, impacting around 32.5 million adults across the United States.

Particularly in orthopedic clinics and outpatient care centers, injections are preferred for their ability to target localized pain without systemic drug exposure.

Hyaluronic acid injections, for example, are now considered a first-line treatment for moderate osteoarthritis in many regions due to their extended duration of relief compared to oral medications.

Restraints:

Limited long-term efficacy is hampering the growth of the Joint Pain Injection market

Inconsistent long-term efficacy of joint injections continues to limit market expansion in broader patient groups.

Most commonly used treatments, such as corticosteroids or Visco supplementation, provide only temporary relief, often requiring repeat procedures. This not only increases cumulative healthcare costs but also raises concerns about cartilage deterioration and side effects with repeated usage.

Furthermore, the limited insurance coverage for some emerging biologics, like PRP or stem cell injections, creates a financial barrier for both providers and patients, restricting wider adoption across general orthopedic and primary care settings.

Opportunities:

Emerging biologic injections are expected to create a lucrative opportunity for the growth of the Joint Pain Injection market

The emergence of biologic and regenerative injections presents new growth horizons for joint pain injection therapy.

Advanced treatments such as PRP, stem cell therapies, and orthobiologics are gaining attention for their regenerative potential, offering not just symptom relief but also biological repair of damaged tissues. These modalities are being increasingly adopted by sports medicine practitioners and orthopedic specialists to treat early-stage joint degeneration, especially among younger and more active patients.

The growing consumer preference for non-opioid, personalized therapies is also fueling investment and innovation in this space, with biotech companies exploring novel formulations and delivery systems.

For more details on this report – Request for Sample

Global Joint Pain Injection Market, Segment Analysis

The global joint pain injection market is segmented based on injection type, joint type, cause, distribution channel, and region.

By Injection Type

The hyaluronic acid (HA) segment in the joint pain injection was valued at US$ 1.64 Billion in 2024

Hyaluronic Acid Injections accounted for the largest revenue share in 2024, representing 32.4% of the global joint pain injection market. The widespread use of HA in treating knee osteoarthritis, especially under FDA-approved brands such as Synvisc, Monovisc, and Euflexxa, has driven adoption across orthopedic and sports clinics.

Patients and physicians favor HA due to its longer pain relief window and fewer side effects compared to corticosteroids. Hyaluronic acid (HA) injections currently dominate the joint pain injection market due to their widespread clinical use, regulatory approval, and proven efficacy in managing osteoarthritis, particularly of the knee.

Platelet-Rich Plasma (PRP) Injections:

Platelet-Rich Plasma (PRP) injections are projected to grow fast from 2025 to 2033. As a key player in the biologics space, PRP is gaining ground among younger patients and athletes seeking regenerative solutions. Clinics offering sports medicine and advanced orthopedics are pioneering the use of PRP for early intervention, helping the segment expand rapidly.

By Distribution Channel

Hospital Pharmacies led the distribution segment with the largest revenue share in 2024 due to their proximity to treatment facilities and integration with prescription workflows.

Online Pharmacies and Specialty Drug Distributors are growing at a robust pace, offering convenience for providers and direct-to-clinic deliveries.

Global Joint Pain Injection Market, Geographical Analysis

North America was valued at US$ 2.01 Billion in 2024 with a significant portion in the global joint pain injection market

North America dominated the joint pain injection market in 2024, accounting for over 39.70% of global revenue. This leadership is driven by advanced healthcare infrastructure, high awareness of joint pain therapies, and favorable reimbursement policies, particularly for HA and corticosteroid injections. The U.S. leads the region, supported by a large elderly population, increasing sports injuries, and a strong presence of key players such as Zimmer Biomet, Anika Therapeutics, and Bioventus. Additionally, the rapid integration of biologics into orthopedic care pathways is positioning North America as the innovation hub for joint injection therapies.

Ongoing clinical research and high awareness among both physicians and patients further solidify North America’s leadership in the joint pain injection market. These real-time factors together are driving the region’s dominance in the global joint pain injection market.

Asia-Pacific is growing at the fastest pace in the joint pain injection market, holding 21.4% of the market share

Asia-Pacific is expected to be the fastest-growing region from 2025 to 2033. Rapid aging in countries like Japan, China, and South Korea, combined with increased healthcare investments and growing patient awareness, is accelerating adoption. The region is also seeing growing interest in regenerative medicine, particularly PRP and stem cell therapies, driven by supportive regulatory frameworks and government-backed medical innovation hubs.

China is leading this regional surge with expanded orthopedic services and an increase in clinical adoption of both traditional and biologic joint injection products.

Europe

Europe holds a strong share in the joint pain injection market, backed by public healthcare access, aging demographics, and wide physician adoption of HA and corticosteroid injections. Countries like Germany and France are increasingly exploring biologics for orthopedic use, supported by clinical research institutions and collaborations with biotech firms.

Germany stands out as the regional leader due to its strong orthopedic network, regulatory clarity, and advanced manufacturing ecosystem for HA-based products.

Middle East & Africa / South America

Both regions are witnessing steady adoption driven by urbanization, increased orthopedic diagnoses, and expanding private healthcare sectors. The UAE and Brazil, in particular, are investing in smart clinics and sports medicine centers that are incorporating advanced injection therapies for joint pain management.

Global Joint Pain Injection Market Competitive Landscape

Top companies in the joint pain injection market include Bioventus, Anika Therapeutics Inc., Zimmer Biomet, Dr. Reddy’s Laboratories Ltd., and Fidia Farmaceutici S.p.A., among others.

Global Joint Pain Injection Market Key Developments

In September 2024, Sun Pharmaceutical Industries Limited and Moebius Medical Limited announced that the U.S. Food and Drug Administration (FDA) had granted Fast Track designation (FTD) to MM-II (Large Liposomes of DPPC and DMPC) for the treatment of osteoarthritis knee pain. Planning for confirmatory Phase 3 clinical trials for MMII is underway.

Global Joint Pain Injection Market Scope

Metrics | Details | |

CAGR | 11.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Injection Type | Hyaluronic acid (HA), Corticosteroids, Prolotherapy Injections, Orthobiologics, Platelet-rich Plasma (PRP) Injections, Others |

Joint Type | Knee and Ankle, Hip, Shoulder, Elbow, Others | |

Cause | Osteoarthritis, Rheumatoid arthritis, Fibromyalgia, Others | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

Regions Covered | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Australia, Rest of Asia Pacific), South America (Brazil, Argentina, Rest of Latin America) and Middle East & Africa | |

Companies Covered | Bioventus, Anika Therapeutics Inc., Zimmer Biomet, Dr. Reddy’s Laboratories Ltd., Fidia Farmaceutici S.p.A. | |

DMI Insights on Calciphylaxis Treatment Market

DMI recommends that companies concentrate on high-growth biologics, such as PRP and orthobiologics, rather than conventional corticosteroids, which are ineffective in the long term. In 2024, North America will comprise 39.7% of the market. Businesses should incorporate additional biologics into their portfolios that are targeted at ambulatory and sports medicine clinics due to the robust reimbursement support. Japan and China are optimal investment destinations for the foreseeable future due to the geriatric populations and the increasing prevalence of non-surgical OA therapies. In order to distinguish oneself, it will be necessary to allocate funds toward innovative service delivery methods, payer engagement, and outcome-focused research. Access and profit margins can be further enhanced through online and specialized distribution.

The global joint pain injection market report delivers a detailed analysis with 50+ key tables, more than 60+ visually impactful figures, and 178 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here