Intrauterine Contraceptive Devices (IUD) Market Size

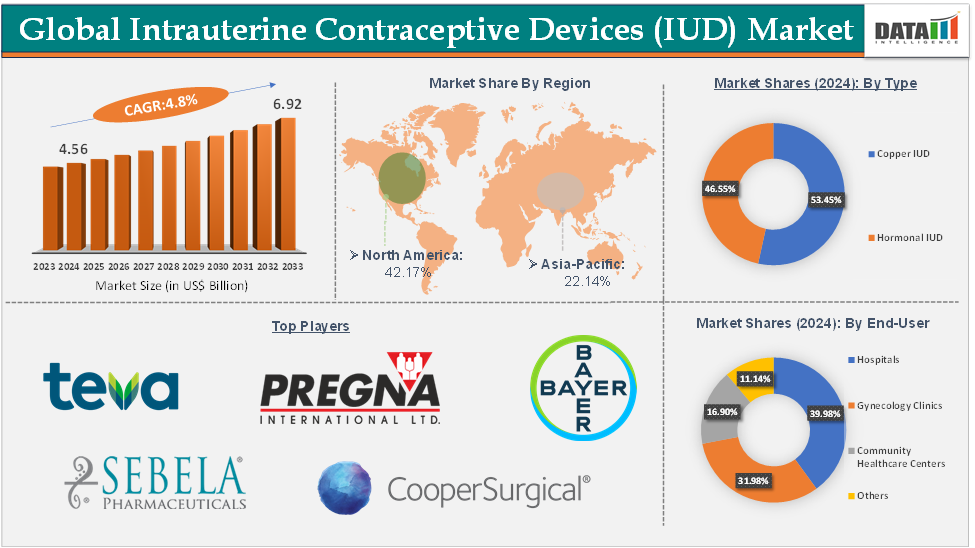

Intrauterine Contraceptive Devices (IUD) Market reached US$ 4.56 Billion in 2024 and is expected to reach US$ 6.92 Billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025-2033.

An intrauterine device is a small plastic T-shaped device used for birth control. It is inserted into the uterus where it stays to prevent pregnancy. Intrauterine devices prevent sperm from fertilizing an egg and prevent fertilized eggs from implanting in the uterus. The use of intrauterine devices is also being studied in the prevention and treatment of endometrial cancer and other conditions.

Intrauterine devices are one of the most effective forms of contraception available today, with rates of failure similar to various forms of sterilization. There are many benefits of IUDs, including efficacy, ease of use, reversible nature, and patient satisfaction, especially with time commitment for long-term use and cost. This activity reviews the indications, contraindications, risks, and benefits of intrauterine device placement and removal. This activity will also detail the role of the interprofessional team in providing patients who undergo intrauterine device placement and removal with the best possible care.

Executive Summary

For more details on this report - Request for Sample

Intrauterine Contraceptive Devices Market Dynamics: Drivers

Increasing adoption of IUDs is driving the growth of the intrauterine contraceptive devices market

The demand for the intrauterine contraceptive devices (IUDs) market is driven by multiple factors. The increase in awareness among people propels the market growth. Furthermore, the demand for the intrauterine contraceptive devices (IUDs) market will be fueled by technological advancements and government initiatives.

For instance, the United Nations reported that 161 million people worldwide use intrauterine devices (IUDs) as a form of contraception, making it one of the most common methods globally. In the United States, 20.4% of sexually experienced women have ever used an IUD, according to the CDC as of December 2023. In 2016, 14% of contraceptive users between the ages of 15 and 44 in the U.S. used an IUD, up from 2.4% in 2002. Women between the ages of 25 and 29 had the highest rates of IUD use at 19%, while those between 15 and 19 and 45 and 49 had the lowest rates at 5–6%.

Moreover, according to an article posted by the National Institute of Health, in July 2023, the use of the IUD contraceptive method varies widely. 18% in Eastern and southeastern Asia, and Northern Africa, while it is 27.8% in Tunisia and 36.1% in Egypt. Even though the use of modern contraceptive methods has nearly tripled, increasing from 14% to 41% between 2005 and 2019 among married women in Ethiopia, the contribution of an IUD to the method mix is negligible. The utilization of an IUD varies from 5.2% in Addis Ababa to 0.4% in the Gambella region to null in the Somali region of Ethiopia.

Restraints

Factors such as high costs associated with IUDs and side effects caused due to IUDs are expected to hamper the market. Women who use IUDs may experience side effects such as irregular menstrual cycle, increased period bleeding, and worsening of period cramps. In a few cases, it may lead to ectopic pregnancies and pelvic pain.

Intrauterine Contraceptive Devices Market Segment Analysis

The global intrauterine contraceptive devices market is segmented based on type, end-user, and region.

The copper IUD segment accounted for approximately 45.8% of the intrauterine contraceptive devices market share

The copper IUD segment is expected to hold the largest market share over the forecast period. In this segment, the development of government regulation, and rising funds for private manufacturers for research work would drive this market.

The non-hormonal copper IUD is a small plastic device with copper wire coiled (wrapped) around the frame. It is inserted into the uterus (womb) where the IUD constantly releases a small amount of copper. The copper IUDs are more than 99% effective at preventing pregnancy and can last for up to 5 – 10 years (depending on the type). A copper IUD can be used for contraception until menopause if inserted when one is 40 years of age or older.

For instance, in October 2023, Sebela Women's Health Inc., a part of Sebela Pharmaceuticals, announced additional positive data from the pivotal Phase 3 open-label study of the investigational Copper 175 mm2 intra-uterine device (IUD). The data presented at three recent women's health scientific congresses provide further support for the investigational, next-generation, hormone-free IUD as exhibited in its pivotal phase 3 trial. The hormone-free Copper 175 mm2 IUD has a flexible frame made of nitinol, a material that has superelastic properties and allows for the copper to be strategically placed near the Ostia of the fallopian tubes and the internal os of the cervix for proximal effect.

Intrauterine Contraceptive Devices Market Geographical Analysis

North America accounted for approximately 48.6% of the intrauterine contraceptive devices market share

The North America region is expected to hold the largest market share over the forecast period. The growing awareness among people in this region helps to propel the market. Additionally, the United States is known for the presence of major market players, which further accelerates the market growth by developing IUDs by gaining FDA approvals.

For instance, in February 2025, Sebela Women's Health Inc., a part of Sebela Pharmaceuticals, announced that the U.S. Food and Drug Administration (FDA) granted approval of MIUDELLA (copper intrauterine system) for the prevention of pregnancy in females of reproductive potential for up to three years. MIUDELLA is a next-generation, hormone-free, low-dose copper intrauterine device or IUD, the first to be approved by the FDA in the United States in over 40 years.

Market Segmentation

By Type

Hormonal IUD

Copper IUD

By End-User

Hospitals

Gynecology Clinics

Community Healthcare Centers

Others

By Region

North America

U.S.

Canada

Mexico

Europe

Germany

U.K.

France

Spain

Italy

Rest of Europe

South America

Brazil

Argentina

Rest of South America

Asia-Pacific

China

India

Japan

South Korea

Rest of Asia-Pacific

Middle East and Africa

Intrauterine Contraceptive Devices Market Major Players

The major global players in the global intrauterine contraceptive devices (IUD) market include Teva Pharmaceuticals, Bayer, Pregna, Sebela Pharmaceuticals, CooperSurgical, Inc., AbbVie, Eurogine, and SMB Corporation, among others.

Key Developments

In February 2025, Sebela Women's Health Inc., a part of Sebela Pharmaceuticals, announced that the U.S. Food and Drug Administration (FDA) granted approval of MIUDELLA (copper intrauterine system) for the prevention of pregnancy in females of reproductive potential for up to three years. MIUDELLA is a next-generation, hormone-free, low-dose copper intrauterine device or IUD, the first to be approved by the FDA in the United States in over 40 years.

In July 2024, 3Daughters, a clinical development company dedicated to advancing women’s healthcare, announced the successful completion of an oversubscribed seed financing round, raising $4.7 million. This round saw participation from existing investors including Thairm Bio, Argosy Foundation, Wexford Science and Technology, UMass Amherst, and new undisclosed investors.

In November 2023, Bayer and CrossBay Medical announced a development and licensing agreement to create a single-handed inserter for intrauterine systems (IUS), integrating CrossBay’s CrossGlide technology with Bayer’s hormonal IUD portfolio. The new inserter, using CrossGlide technology, aims to potentially improve the comfort of intrauterine placement, and might reduce discomfort during the insertion process. This could also shorten the procedure time required by healthcare professionals.

Key Scope

Metrics | Details |

CAGR | 4.8% |

Market Size | 2022-2033 |

Market Estimation Forecast Period | 2025-2033 |

Revenue Units | Value (US$ Bn) |

Segments Covered | Type and End-User |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa |

Largest Region | North America |

Fastest Growing Region | Asia-Pacific |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter's Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis, and Other key Insights. |

The global intrauterine contraceptive devices market report would provide approximately 51 tables, 54 figures, and 181 Pages.