Indonesia Flexible Packaging Market Size

Indonesia Flexible Packaging Market reached USD 4.1 billion in 2022 and is expected to reach USD 5.9 billion by 2030, growing with a CAGR of 4.8% during the forecast period 2023-2030. During the forecast period, rapid urbanization coupled with growing population will propel the growth of the Indonesia flexible packaging market.

The growing share of young urban people leads to increasing demand for packaged goods, thus driving demand for flexible packaging from various industries.

Growing concerns over plastic pollution are likely to increase demand for alternative flexible packaging solutions. In June 2023, the Indonesian government announced plans to completely eliminate the usage of various single-use plastics by 2029. It will create opportunities for paper and cellulose-based flexible packaging solutions.

Market Scope

| Metrics | Details |

| CAGR | 4.8% |

| Size Available for Years | 2021-2030 |

| Forecast Period | 2023-2030 |

| Data Availability | Value (US$) |

| Segments Covered | Material, Product, Technology, End-User and Region |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Equipment Type Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more details on this report – Request for Sample

Indonesia Flexible Packaging Market Dynamics

Increased Demand for Plastic-Based Flexible Packaging Products

The plastic-based flexible packaging segment accounts for a major share of the flexible packaging market in Indonesia. It will continue to dominate the market during the forecast period because of the increased popularity of plastic-based flexible packaging products among industrial buyers and consumers. Plastic packaging is increasingly replacing metal and glass packaging (especially for food products), increasing the demand for flexible plastic packaging products and solutions. Plastic is the favoured material for flexible packaging as it is highly versatile and can be converted into several shapes and sizes.

Furthermore, there have been many technological innovations, which has led to an increase in number of new products offered by vendors to suit the varied needs of their customers. Manufacturers are looking for high-performance packaging solutions that can also help ensure that manufacturing costs remain low. Packaged food and beverage companies demand highly cost-efficient and visually appealing packaging solutions. Such demands have compelled vendors to use new technologies to innovate their product offerings.

Expansion of the E-Commerce Industry

The Indonesia e-commerce industry has undergone significant growth in recent years. According to recent data, more 62% of Indonesians have purchased products or services online in 2022, with more than 38% of Indonesians undertaking online purchases with regular frequency. The expansion of the Indonesian e-commerce industry presents new growth opportunities for the flexible packaging industry.

E-commerce relies on efficient and reliable delivery systems to ensure products reach customers in good condition. Flexible packaging is lightweight and take up less space compared to traditional rigid packaging. It helps e-commerce operators to reducing shipping costs. Furthermore, using flexible packaging allows e-commerce companies to adjust to seasonal nature of consumer demand, since flexible packaging does not require long lead times for production.

Infrastructure Challenges

Indonesia is a vast archipelago having five major islands and numerous minor islands. Indonesia’s geography necessitates an extensive distribution network to reach consumers across these islands. Limited number of roadways, ports and airports make it challenging to efficiently transport raw materials to manufacturing facilities and finished products to retail outlets. It leads to delays and increased costs, affecting the competitiveness of flexible packaging products.

Many regions of Indonesia have poorly maintained infrastructure, where manufacturing facilities frequently encounter power outages and unreliable utilities. Poor infrastructure can lead to a significant increase in production costs, thus eroding the competitiveness of many flexible packaging manufacturers based in these regions.

Indonesia Flexible Packaging Market Segment Analysis

The Indonesia flexible packaging market is segmented based on material, product, technology, end-user and region.

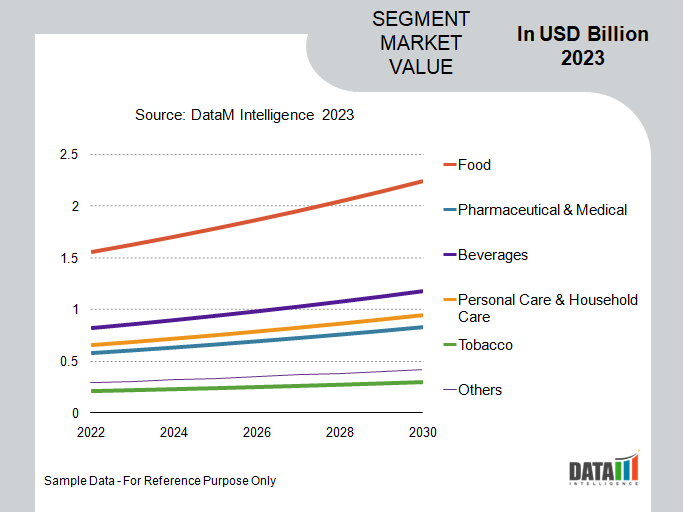

The Food Industry is Among the Largest Utilizers of Flexible Packaging in Indonesia

Food and beverage packaging make up almost 70% of the Indonesian packaging market. The packaging sector is predicted to increase in parallel with the ever-increasing demand and growth in food consumption. Flexible food packaging is considered a more cost-effective kind of food packaging, accounting for more than a third of the packaging used in the food business. The industry utilizes various types of packaging, including bags, pouches, tubes, shrink films, sleeves and carded packaging.

The food industry has long been regarded as one of Indonesia's most important economic foundations. In 2021, investment flows were USD 2.21 billion (IDR 33.2 trillion), accounting for 9.4% of total domestic and 4.5% of total foreign direct investment. In recent years, following increased demand in the food and beverage sector, the packaging industry has reaped major benefits from shifting consumption habits in Indonesia, with customers seeking processed and packaged food in appealing and hygienic packaging.

Various companies have been expanding their presence in the country by expanding the food industry. For instance, in 2021, Vishakha Polyfab completed a significant flexible packaging expansion in Indonesia. The Indonesian plant commenced operations in January 2021 and is capable of producing 13,500 tons of packaging material annually.

Indonesia Flexible Packaging Companies

The major players include Amcor plc, Innopack, Berry Indonesia Inc., PT. INDONESIA TOPPAN PRINTING, Plasindo Lestari, PT. Primajaya Eratama, PT. Tunas Alfin Tbk, ePac Flexible Packaging, PT Artec Package Indonesia, PT Dinakara Putra, Flexo Plate Digital, Mondi Group, Sealed Air Corporation, Sonoco Products Company, PT Inkote Indonesia and PT Argha Karya Prima Industry.

COVID-19 Impact on Market

The COVID-19 pandemic led to major shifts in consumer dynamics, resulting in changing demand patterns for various packaged goods. The pandemic led to a surge in demand for essential items like food and hygiene products, whereas other industries experienced a decline in demand. Flexible packaging manufacturers had to quickly adapt to changing dynamics over the course of the pandemic.

The pandemic caused disruptions in the supply chain due to government-imposed measures such as lockdowns, travel restrictions and a resulting labor shortage. Flexible packaging manufacturers faced various challenges including difficulty in raw material procurement and transportation, leading to delays in production and fulfillment of orders.

Russia- Ukraine War Impact Analysis

The ongoing conflict between Russia and Ukraine have created instability in various markets. Although not directly impacted by the conflict, sanctions on Russia led to an increase in crude oil prices, thus driving up prices for feedstock chemicals required for manufacturing flexible plastic packaging. Many Indonesian manufacturers incurred high production costs and reduced profit margins on account of increase in raw material prices.

Furthermore, global volatility has also led to an increase in the prices of various essential food items, many of which are imported by Indonesia. A general rise in packaged food items has led to reduced consumer spending thus affecting demand for flexible packaging from the food industry over the short and medium term.

By Material

- Paper

- Aluminium

- Cellulosic

- Polymer

By Product

- Pouches & Packets

- Wraps

- Bags

- Barrier Laminates

- Others

By Technology

- Traditional Flexible Packaging

- Sustainable Flexible Packaging

By End-User

- Food

- Pharmaceutical & Medical

- Beverages

- Personal Care & Household Care

- Tobacco

- Others

Key Developments

- In November 2022, CMA CGM, a French multinational logistics company, announced an initiative in Indonesia to recycle and reuse paper and plastic-based flexible packaging.

- In August 2022, ePac, a U.S.-based company specializing in flexible packaging solutions, announced its expansion in Southeast Asia, with a new production plant in Indonesia slated for opening in mid 2023.

- In January 2023, it was announced that various Indonesian scientific institutions were investigating the use of seaweed in designing flexible packaging solutions as an alternative to plastic-based packaging.

Why Purchase the Report?

- To visualize the Indonesia flexible packaging market segmentation based on material, product, technology, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of Indonesia flexible packaging market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The Indonesia flexible packaging market report would provide approximately 53 tables, 41 figures and 165 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies