In-Flight Connectivity Market Overview

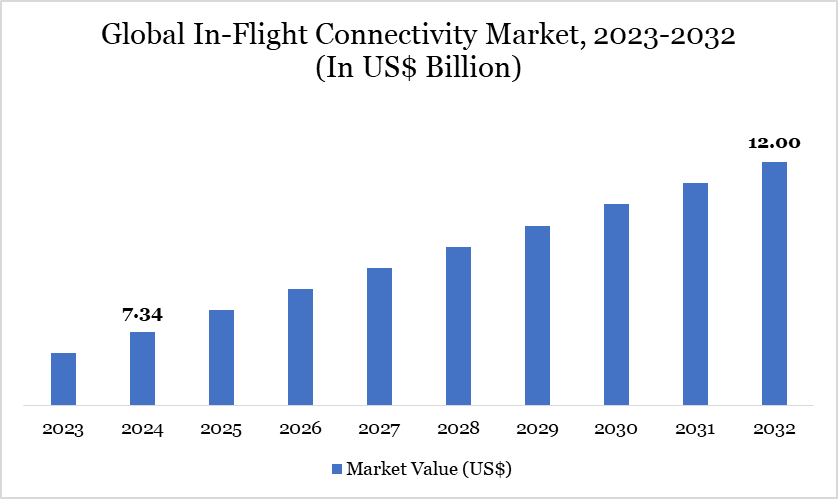

In-Flight Connectivity Market reached US$7.34 billion in 2024 and is expected to reach US$12.00 billion by 2032, growing at a CAGR of 6.34% during the forecast period 2025-2032.

The global in-flight connectivity market is evolving as airlines adopt technology to enhance efficiency and sustainability. For instance, Aeromexico’s partnership with Panasonic Avionics illustrates how connectivity can reduce waste through just-in-time sales, optimizing inventory and supporting environmental goals. This innovation not only improves passenger experiences but also helps airlines minimize their ecological footprint, marking a shift toward greener practices in aviation.

Innovative solutions like AirFi’s LEO technology, which cuts drag by 4%, and Intelsat’s lightweight ESA antenna, which offers high-speed connectivity without moving parts, are driving this evolution. The advancements highlight that in-flight connectivity extends beyond entertainment; it is essential for promoting sustainable practices within the aviation industry. With a growing emphasis on passenger experience, airlines are likely to invest heavily in technology to enhance Wi-Fi and entertainment options.

In-Flight Connectivity Market Trend

A key trend in the in-flight connectivity (IFC) market is the rise of strategic partnerships between airlines, satellite providers, and technology firms. For instance, the partnership between United Airlines and SpaceX in September 2024. This collaboration aims to equip United's fleet with Starlink, offering free high-speed internet access to passengers. By setting a new standard for connectivity, especially on challenging routes, this initiative underscores North America's technological leadership and innovation in enhancing the passenger experience.

For more details on this report – Request for Sample

Market Scope

Metrics | Details |

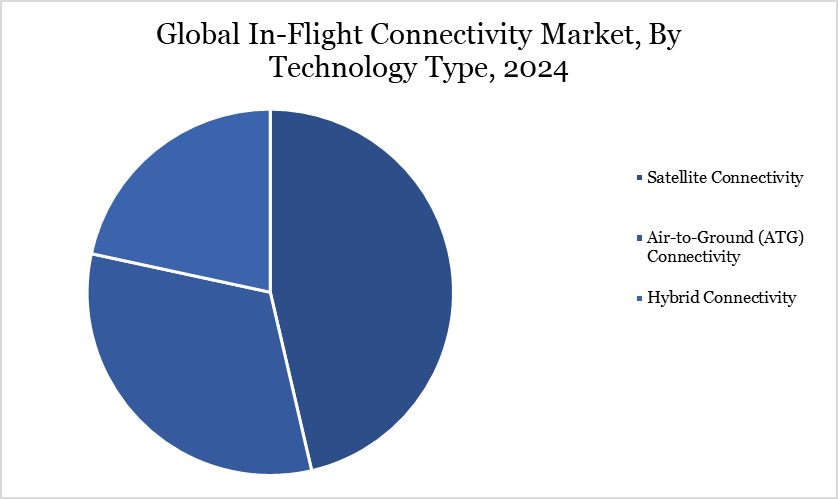

By Technology Type | Satellite Connectivity, Air-to-Ground (ATG) Connectivity, Hybrid Connectivity |

By Service Model | Free Wi-Fi, Paid Wi-Fi, Freemium Model |

By Connectivity | High-Speed Connectivity, Standard Connectivity, Low-Bandwidth Connectivity |

By Aircraft Type | Narrow-Body Aircraft, Wide-Body Aircraft, Regional Aircraft |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

In-Flight Connectivity Market Dynamics

Growing Demand from Passengers for In-Flight Connectivity

Increasing passenger demand for connectivity is a significant driver of the In-Flight Connectivity (IFC) market. As passengers become more accustomed to seamless connectivity in their everyday lives, they expect the same experience during flights The willingness of passengers to pay for Wi-Fi services or access to digital content creates new revenue streams for airlines, making IFC a lucrative market. As the demand for digital services and connectivity increases globally, airlines are prioritizing the installation of advanced connectivity solutions to provide better service and meet the evolving needs of passengers.

For instance, Air India has become the first airline in India to offer in-flight Wi-Fi connectivity on domestic flights in January 2025, available on Airbus A350, Boeing 787-9, and select Airbus A321neo aircraft. Passengers can browse, work, or stay connected with loved ones for free on devices like laptops, tablets, and smartphones. This service follows a successful pilot program on international routes, including flights to New York, London, Paris, and Singapore.

High Infrastructure Costs

High infrastructure costs pose a significant challenge for the global in-flight connectivity market. Airlines face substantial investments in satellite systems and onboard Wi-Fi technology, which can be prohibitively expensive, especially for smaller carriers. This financial barrier limits their ability to offer competitive connectivity options, creating a disparity in service quality between budget and premium airlines.

Moreover, the ongoing maintenance and upgrades required for in-flight connectivity systems add to the financial strain. As passenger expectations for faster and more reliable service continue to rise, airlines must invest continuously in technology advancements. This ongoing cost burden can deter many airlines from enhancing their connectivity offerings, ultimately stunting market growth.

In-Flight Connectivity Market Segment Analysis

The global in-flight connectivity market is segmented based on technology type, service model, connectivity, aircraft type, and region.

Greater Coverage And Reliability of Satellite Connectivity

The global in-flight connectivity market is segmented based on technology type into satellite connectivity, air-to-ground connectivity and hybrid connectivity. Satellite connectivity has emerged as a leading force in in-flight internet services, offering unmatched global coverage and reliability. Unlike air-to-ground systems, which are constrained by terrestrial infrastructure, satellite systems provide consistent internet access across vast distances, including oceans and remote areas.

Innovative developments are driving the segment dominance. For instance, in May 2024, SES introduced its SES Open Orbits Inflight Connectivity Network. By partnering with regional satellite network operators, SES is creating a fully interoperable Ka-band platform that integrates geostationary (GEO) and medium earth orbit (MEO) satellite networks. This initiative highlights the aviation industry's increasing reliance on satellite technology to meet passenger demands for reliable internet service.

In-Flight Connectivity Market Geographical Share

Larger Air Travel Market in North America

North America dominates the global in-flight connectivity market due to a combination of high demand, technological advancements and a favorable regulatory environment. US features a large and affluent air travel market where passengers increasingly expect Wi-Fi and connectivity as standard amenities.

US airlines saw a 4.5% increase in traffic in August 2024, with 86.8 million passengers carried, according to the Bureau of Transportation Statistics. Domestic flights accounted for 74.8 million passengers, while 12 million flew internationally. The data shows a 0.6% rise in seasonally adjusted enplanements compared to July, although down 1.2% from the record high set in June 2024. Passenger numbers were also significantly higher than in August 2023, with a 13.2% increase over two years ago and a 29.6% jump from three years ago.

The surge in passenger volume underscores a significant rebound in air travel, which is expected to drive heightened demand for in-flight connectivity services. This demand drives airlines to prioritize these services, investing in innovative technologies like satellite-based systems and air-to-ground networks that enhance reliability and quality.

Technological Advancement Analysis

Technological advancements in the In-Flight Connectivity (IFC) market are rapidly enhancing the quality, speed, and reliability of onboard internet. The shift from traditional GEO satellites to LEO and MEO constellations enables low-latency, high-speed broadband even on remote flight paths. Innovations in antenna systems such as electronically steered antennas (ESA)—allow better signal acquisition and seamless handover between satellites. Integration with cloud platforms and 5G networks is improving real-time data management and reducing operational delays.

In April 2025, Viasat, Inc., a global leader in satellite communications, has unveiled its next-generation in-flight connectivity solution, Viasat Amara, aimed at transforming the onboard passenger experience. Amara features smart multi-orbit networking, advanced hardware, and a suite of digital tools tailored for real-time, scalable performance. The solution enables airlines to offer differentiated, future-proof connectivity with flexible business models and guaranteed service quality. Viasat positions Amara as more than just fast Wi-Fi it's a strategic platform for enhancing brand, loyalty, and revenue growth.

In-Flight Connectivity Market Major Players

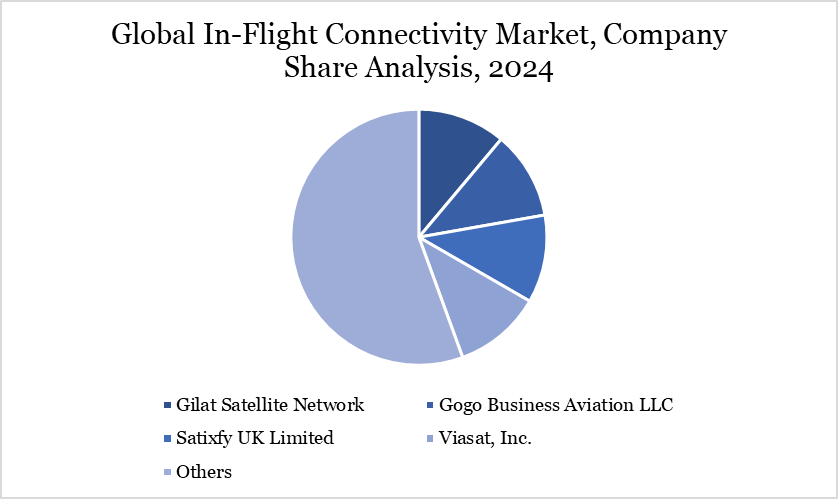

The major global players in the market include Gilat Satellite Network, Gogo Business Aviation LLC, Satixfy UK Limited, Viasat, Inc., Hughes Network Systems, LLC, SES S.A., Deutsche Telekom AG, Thales S.A., EUTELSAT COMMUNICATIONS SA and Iridium Communications Inc.

Key Developments

In October 2024, Qatar Airways launched the world’s first Boeing 777 equipped with Starlink, providing free, high-speed, low-latency internet on flights. The airline plans to equip its entire Boeing 777 fleet by 2025, enhancing passenger connectivity and experience.

In September 2024, Air France announced it will launch free ultra-high-speed Wi-Fi on all its aircraft starting in 2025, providing a ground-like experience. Passengers can access the service through their Flying Blue accounts, with connectivity powered by Starlink’s satellite network for fast and reliable internet.

In May 2024, Intelsat launched its 2Ku inflight connectivity service on Condor Airlines' new Airbus A320neo and A321neo aircraft. The factory-installed system provides streaming-quality connectivity and will be available on all 43 planes, with deliveries scheduled through 2028.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies