Global Heparin Market: Industry Outlook

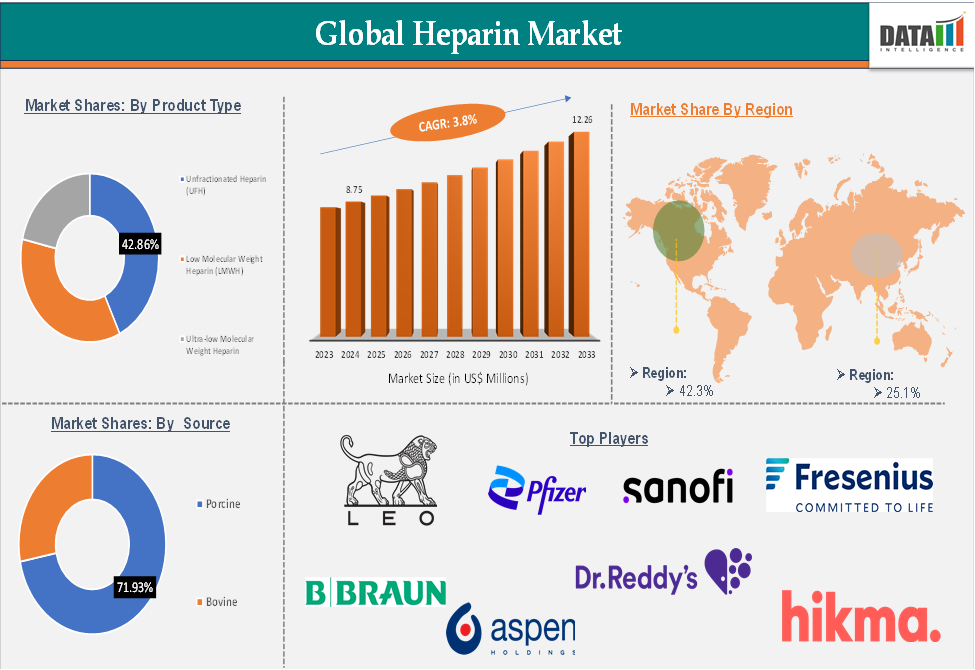

The global heparin market reached US$ 8.75 Billion in 2024 and is expected to reach US$ 12.26 Billion by 2033, growing at a CAGR of 3.8% during the forecast period 2025-2033.

The global heparin market is experiencing steady growth due to the increasing prevalence of cardiovascular diseases, increased surgical procedures, and a growing elderly population. Heparin is crucial in managing conditions like deep vein thrombosis, pulmonary embolism, dialysis, and cardiac surgeries. Technological advancements and increased awareness of thrombosis prevention are driving market expansion.

North America dominates the market due to advanced healthcare infrastructure, high disease burden, and major pharmaceutical players. The Asia-Pacific region is expected to experience the fastest growth due to improved healthcare access, a growing population, and the government's focus on public health initiatives. Despite challenges like raw material dependency and regulatory constraints, the global heparin market is poised for consistent growth.

Global Heparin Market: Market Infographics

Global Heparin Market Dynamics: Drivers & Restraints

Rising incidence of cardiovascular and thromboembolic disorders is driving the market growth

The global heparin market is growing due to the increasing prevalence of cardiovascular and thromboembolic disorders like deep vein thrombosis, pulmonary embolism, and atrial fibrillation. With aging populations in developed countries and sedentary lifestyles in emerging economies, cardiovascular diseases remain the leading cause of death globally, claiming 17.9 million lives each year. Factors like obesity, diabetes, and hypertension, which are key risk factors for blood clots, are also increasing the need for anticoagulant therapies.

For instance, according to the Centers for Disease Control and Prevention, venous thromboembolism (VTE), a blood clot, affects up to 900,000 US people annually, with high risk during hospitalization, cancer treatment, and pregnancy. An estimated 60,000-100,000 Americans die from VTE each year, and many suffer long-term complications.

Heparin, particularly low molecular weight heparin (LMWH), is widely used for preventing and treating venous thromboembolism and other clot-related complications in hospital and surgical settings. Its increasing adoption in emergency care, intensive care units, and oncology underscores its essential role in modern clinical practice.

Risk of adverse effects and bleeding complications restrain the market growth

The global heparin market faces significant challenges due to the risk of severe adverse effects, particularly heparin-induced thrombocytopenia (HIT) and bleeding complications. HIT is an immune-mediated condition that increases thrombotic risk, potentially leading to life-threatening complications. The narrow therapeutic window of unfractionated heparin requires rigorous monitoring through activated partial thromboplastin time (aPTT), which can be resource-intensive and inconvenient in healthcare settings. Accidental overdose or improper dosing can lead to internal hemorrhages and fatal bleeding, especially in elderly or renal-compromised patients.

For more details on this report, Request for Sample

Global Heparin Market Segment Analysis

The global heparin market is segmented based on product type, source, route of administration, application, end user, and region.

Product Type:

The unfractionated heparin (UFH) segment of the product type is expected to hold 42.8% in the heparin market

Unfractionated Heparin (UFH) is a fast-acting anticoagulant made up of polysaccharide chains with varying molecular weights. It enhances antithrombin III activity, preventing blood clot formation and extension. UFH is commonly used in clinical settings for venous thromboembolism treatment, dialysis, and surgical procedures requiring anticoagulation. Due to its short half-life and reversibility with protamine sulfate, UFH is particularly beneficial in emergency surgeries or critical care units where rapid anticoagulation reversal is needed.

Unfractionated Heparin (UFH) is a popular anticoagulant due to its fast onset of action, ability to adjust dosage through activated partial thromboplastin time (aPTT), and safety advantage in high-risk procedures. Despite the increasing use of low molecular weight heparins (LMWHs), UFH remains a strong choice in intensive care units, emergency departments, and perioperative management due to its clinical efficacy, cost-effectiveness, and flexibility in dosing.

Global Heparin Market - Geographical Analysis

North America dominated the global heparin market with the highest share of 42.3% in 2024

The heparin market in North America is fueled by factors such as high prevalence of cardiovascular diseases, cancer, obesity, and chronic conditions, advanced healthcare infrastructure, and strong diagnostic capabilities. The growing geriatric population and frequent use of heparin in procedures like dialysis and cardiac surgeries further fuel its demand. Major pharmaceutical manufacturers, robust regulatory frameworks, and comprehensive insurance coverage further strengthen the growth potential of the heparin market in North America.

For instance, in June 2023, Techdow USA, a leading generic injectables company, launched its generic Enoxaparin Sodium (Preservative Free) Prefilled Syringes in various strengths. The drug is a therapeutic equivalent for Lovenox (Preservative Free) from Sanofi-Aventis US LLC. The U.S. Food and Drug Administration granted Techdow USA final approval for the product. Enoxaparin, a low molecular weight heparin, is an anticoagulant that prevents thrombosis, a blood clot that restricts blood flow.

Asia-Pacific region in the global heparin market is expected to grow with the highest CAGR of 18.5% in the forecast period of 2025 to 2033

The Asia-Pacific heparin market is experiencing significant growth due to rapid healthcare infrastructure development, increasing healthcare expenditure, and a focus on improving access to essential medicines. The aging population, particularly in China and Japan, is experiencing a rise in cardiovascular diseases, diabetes, and cancer, which often require anticoagulant therapy.

The increasing number of surgical procedures, kidney dialysis cases, and hospital admissions in densely populated countries like India and Southeast Asia is also contributing to heparin demand. Government initiatives to improve public health systems and the affordability of critical care drugs are also driving market growth.

For instance, in September 2024, Sysmex Corporation launched the HISCL HIT IgG Assay Kit for measuring IgG antibodies against platelet factor 4 and heparin complexes in Japan. The kit is for Automated Blood Coagulation Analyzers CN-6500/CN-3500, which incorporate HISCL-Series technology. It achieves high sensitivity and specificity for serological testing for heparin-induced thrombocytopenia, reducing false positives and enhancing testing efficiency. This kit is designed to speed up the diagnosis of HIT and reduce false positives.

Global Heparin Market- Key Players

The major global players in the heparin market include Pfizer Inc., Sanofi SA, Leo Pharma A/S, Fresenius SE & Co. KGaA, B. Braun Melsungen AG, Aspen Pharmacare Holdings Limited, Dr. Reddy's Laboratories Ltd, and Hikma Pharmaceuticals PLC, among others.

Industry Trends

- In February 2024, B. Braun Medical Inc. launched its new Heparin Sodium 2,000 units in 0.9% Sodium Chloride Injection, 1,000 mL, as part of its Heparin premixed bag portfolio. This addition aims to meet the diverse needs of healthcare facilities and patients for high-alert medication. The Heparin portfolio is manufactured using EXCEL IV Containers, ensuring patient and environmental safety. The product is manufactured and distributed by B. Braun's Irvine, CA facility.

Scope

| Metrics | Details | |

| CAGR | 3.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Unfractionated Heparin (UFH), Low Molecular Weight Heparin (LMWH), Ultra-low Molecular Weight Heparin |

| Source | Porcine, Bovine | |

| Route of Administration | Intravenous, Subcutaneous | |

| Application | Deep Vein Thrombosis, Atrial Fibrillation, Renal Impairment Coronary Artery Disease, Others | |

| End User | Hospitals & Clinics, Ambulatory Surgical Centers, Research & Academic Institutions | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |